Types Of Stocks | Large Cap Stocks | Mid Cap Stocks | Small Cap Stocks | Penny Stocks | Difference Between Large Mid And Small Cap | Stock Market Basics | Stock Types Explained | Indian Stock Categories | Market Capitalization India | Stock Investing For Beginners | Stock Market Course | Investing Education India | Risk And Reward In Stocks

🌇 The City of Stocks

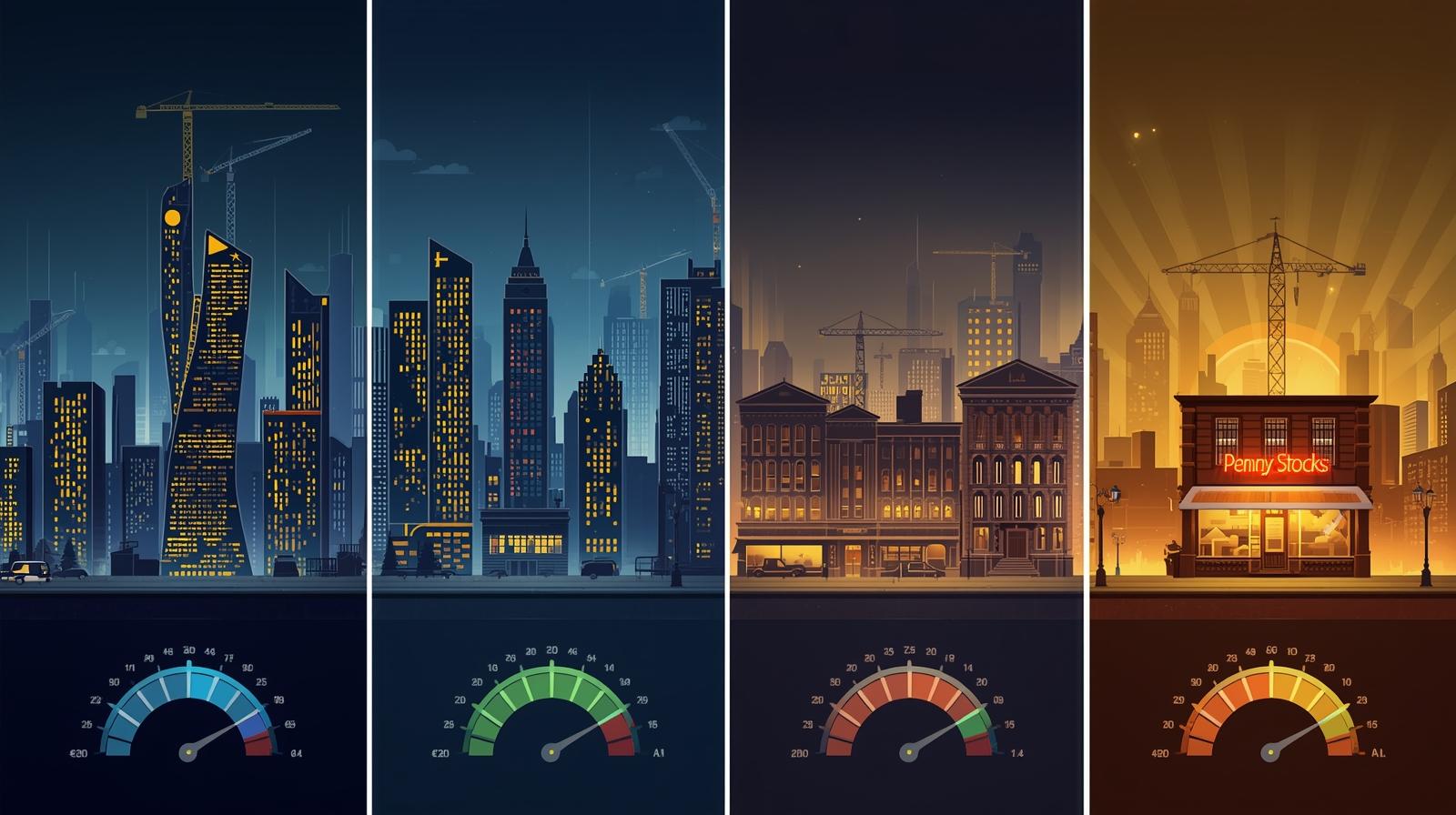

Imagine the stock market as a city — filled with skyscrapers, growing towers, busy streets, and glittering kiosks.

Each part of this city represents a different type of stock.

Some offer security and strength, while others whisper promises of explosive growth.

Let’s walk through this financial city and meet its four iconic residents.

🏢 1. The Skyscrapers — Large-Cap Stocks

These are the market giants, the names everyone recognizes — Reliance Industries, Infosys, HDFC Bank, ITC.

They’re the pillars of stability, moving with confidence and paying consistent dividends.

Large-cap stocks are favored by long-term investors who value safety, liquidity, and steady returns.

They rarely give shocks — but they also rarely give adrenaline.

Traits:

- Market cap above ₹50,000 crore

- Strong fundamentals and wide investor trust

- Consistent dividends and less volatility

Risk Level: ⭐⭐ Low

Best For: Safe, long-term investors

Analogy:

They’re the skyscrapers that define the skyline — slow to rise, steady to stay.

🏗️ 2. The High-Risers — Mid-Cap Stocks

Mid-caps are the growth engines of the market. They’ve already proven themselves but still have room to expand.

When the market rallies, these stocks often outperform the giants, giving impressive returns.

However, mid-caps are more sensitive to market mood swings. They reward confidence but punish panic.

Traits:

- Market cap between ₹10,000–₹50,000 crore

- Strong growth potential and sector leadership possibilities

- Moderate risk and solid performance in bull markets

Risk Level: ⭐⭐⭐ Medium

Best For: Investors who seek growth with moderate risk

Analogy:

Mid-caps are towers under construction — ambitious, rising, and occasionally unstable.

You May visit this too:

- Hindustan Unilever Declares ₹19 Interim Dividend; Record Date 7 Nov 2025

- Petronet LNG Declares ₹7 Interim Dividend for FY 2025-26 — Record Date Set for November 14

- IIFL Capital Services Q2 FY26 Investor Presentation Highlights and Financial Performance

- Infosys Buyback 2025: Record Date, Price ₹1800, ₹18,000 Crore Offer Details

- 45 Weeks. 45 Lessons. From Basics to Advanced – Master Stock Market Investing in Less than 1 Year.

🏪 3. The Street Hustlers — Small-Cap Stocks

These are the dreamers of the stock world. They may be small today, but their ambitions are limitless.

Small-cap companies often work in niche markets, with innovative ideas and bold management.

They can deliver multi-bagger returns — but also face high volatility and limited liquidity.

Traits:

- Market cap below ₹10,000 crore

- High growth potential, but low stability

- Often under-researched — potential hidden gems

Risk Level: ⭐⭐⭐⭐ High

Best For: Aggressive investors chasing long-term rewards

Analogy:

They’re the energetic street entrepreneurs — full of promise, but walking a tightrope.

🎲 4. The Lottery Booth — Penny Stocks

Welcome to the most unpredictable part of the city — the penny stock lane.

They’re flashy, cheap, and full of stories. Some become legends; most vanish quietly.

Investing here is like buying a lottery ticket — exciting, but dangerous if misunderstood.

Traits:

- Usually priced under ₹10 per share

- Thinly traded, low transparency

- Driven more by speculation than fundamentals

Risk Level: ⭐⭐⭐⭐⭐ Very High

Best For: Expert traders with high risk appetite

Analogy:

They’re the neon-lit kiosks of the market — bright, bold, and risky to enter.

🧠 The Balance of Risk and Reward

Every investor must decide how much risk they can handle.

A balanced portfolio is like a city map — it includes skyscrapers for safety, mid-caps for momentum, and a few hustlers for thrill.

Never let the penny street dominate your skyline.

| Category | Market Cap (₹ Cr) | Risk | Reward | Best For |

|---|---|---|---|---|

| Large-Cap | 50,000+ | ⭐⭐ | Moderate | Safe Investors |

| Mid-Cap | 10,000–50,000 | ⭐⭐⭐ | High | Balanced Investors |

| Small-Cap | Below 10,000 | ⭐⭐⭐⭐ | Very High | Aggressive Investors |

| Penny | Below 1,000 | ⭐⭐⭐⭐⭐ | Extreme | Speculators Only |

🧭 Final Insight

“A wise investor knows that growth without risk is a myth — but risk without research is a disaster.”

Your journey through this market city depends on your personality.

Some prefer skyscrapers and peace; others thrive in chaos and challenge.

There’s no right or wrong — only alignment between who you are and what you invest in.

Types Of Stocks | Large Cap Stocks | Mid Cap Stocks | Small Cap Stocks | Penny Stocks | Difference Between Large Mid And Small Cap | Stock Market Basics | Stock Types Explained | Indian Stock Categories | Market Capitalization India | Stock Investing For Beginners | Stock Market Course | Investing Education India | Risk And Reward In Stocks

Course Introduction

🌟 Coming Up in Lesson 9

✅ Corporate Actions

✅ Learning Outcome: Understanding Bonus issues, Stock Splits, and Rights Issues

✅ Key Takeaway: Corporate actions influence stock prices and investor behavior

You Can visit:

Open Demat Account

by Mirae Asset (m,Stock)

-

The Tariff Tussle: Decoding the Legal Challenge to Executive Trade Power

Supreme Court| Tariffs| Trade War 2026| Donald Trump| IEEPA| Section 301| US Economy| Import Duties| Constitutional Law| Reciprocal Trade Act…

-

The 2025-26 Market Journey: From All-Time Highs to the “Retail Trap” Panic

Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks|…

-

Indian Stock Market Update Feb 20: Nifty Reclaims 25,550, Sensex Jumps 316 Pts Amid Global Cues

Indian Stock Market Update Feb 20| Nifty 50 today| Sensex closing| Top gainers and losers Market Snapshot: The Bulls Fight…

-

Indian Stock Market Today: Bulls Charge Ahead as Sensex and Nifty Rally on Banking & IT Strength

# Indian Stock Market Today: Sensex and Nifty Close Higher Amid Broad-Based Buying ## Indian Stock Market Report – Updated…

-

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown Trending Keywords: YouTube down, YouTube…

-

Global Market Update 2026: Equities, Commodities, and Indian Rupee Outlook

Comprehensive 2026 global market update covering equities, commodities, bond markets, US Dollar trends, and detailed Indian Rupee outlook with investment themes and risks.