Module 1 – Introduction to Stock Market

Learning Outcome: Understand the roles and influence of Retail Investors, FIIs, DIIs, HNIs, Mutual Funds, Brokers, and Market Makers.

Key Takeaway: Every participant in the stock market, whether small or institutional, plays a crucial role in shaping market trends and influencing stock prices.

Recap: Lesson 4: IPOs and the Primary Market.

In Lesson 4, we explored how companies raise capital through Initial Public Offerings (IPOs) in the primary market. You learned how investors can participate in IPOs, the process of listing shares, and the difference between primary and secondary markets. This foundation is crucial before diving into market participants, because knowing who invests in the market helps you understand trends and price movements.

Introduction to Market Participants

The stock market is a dynamic ecosystem where numerous participants interact, creating liquidity and defining price trends. Understanding market participants is critical for anyone aspiring to be a knowledgeable investor. From a small retail investor buying a few shares to a large institutional player investing millions, each participant has a distinct role, risk appetite, and influence on market movements.

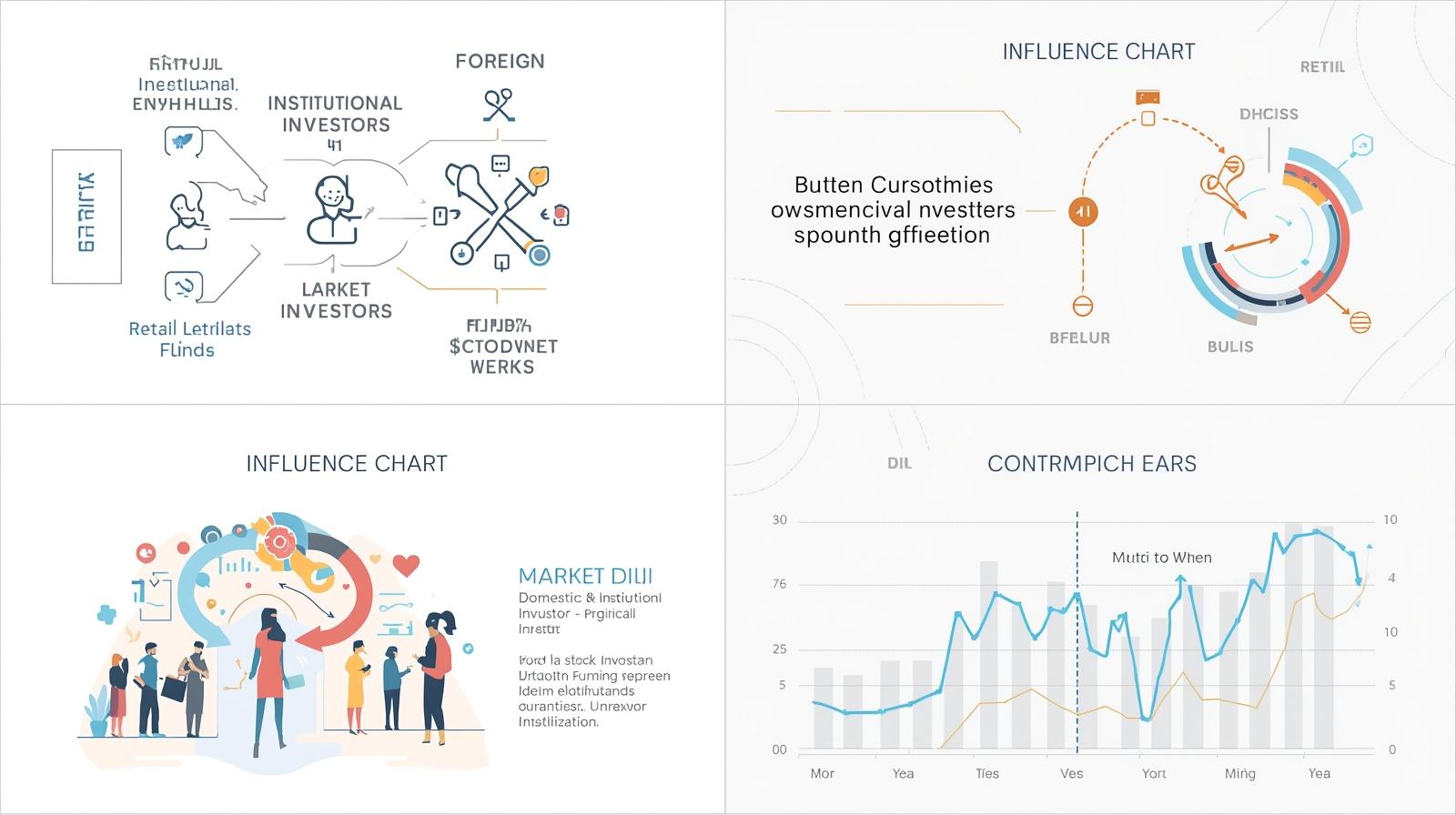

Types of Market Participants

Market participants can broadly be categorized into the following types:

1. Retail Investors

Retail investors are individual investors who buy and sell securities for personal accounts. They are the backbone of the market, providing essential liquidity. Their decisions are often influenced by personal financial goals, news, social media trends, and market sentiment.

Key Characteristics:

- Invest smaller amounts compared to institutional investors.

- Usually have a longer-term perspective but can also trade short-term.

- Influence is visible in small-cap and mid-cap stocks where volumes are lower.

Impact on Market:

Retail investors often follow trends. For example, a sudden surge in buying due to positive news can push a stock up, while panic selling during negative events can accelerate declines.

2. Foreign Institutional Investors (FIIs)

FIIs are investment firms or funds from foreign countries that invest in a country’s stock market. In India, FIIs are crucial as they bring foreign capital, affecting liquidity and price movements.

Key Characteristics:

- Manage large capital, often in billions of dollars.

- Invest in equities, bonds, and derivatives.

- Decisions are influenced by global economic trends, currency fluctuations, and geopolitical events.

Impact on Market:

FIIs can create strong market momentum. A heavy inflow often leads to a bullish market, while large outflows can trigger corrections. For example, during global crises, FIIs withdrawing funds can cause sharp market dips.

3. Domestic Institutional Investors (DIIs)

DIIs include mutual funds, insurance companies, banks, and pension funds that invest in the stock market within their home country. They act as a stabilizing force, often countering the volatility created by FIIs.

Key Characteristics:

- Invest large sums with long-term strategies.

- Typically buy fundamentally strong stocks.

- Less influenced by short-term market noise.

Impact on Market:

DIIs can help moderate market swings. For instance, if FIIs sell during a global downturn, DIIs often step in to buy, preventing excessive market crashes.

4. High Net-Worth Individuals (HNIs)

HNIs are individual investors with significant capital to invest. They often invest in high-value stocks, private placements, or venture opportunities.

Key Characteristics:

- Can influence stock prices in illiquid markets.

- Often have access to privileged research and investment opportunities.

- Tend to diversify across sectors and asset classes.

Impact on Market:

HNIs provide liquidity and can create market trends in smaller segments, particularly in IPOs or private placements.

5. Mutual Funds

Mutual funds pool money from multiple investors to invest in diversified portfolios of stocks, bonds, and other assets.

Key Characteristics:

- Professional fund managers make investment decisions.

- Offer diversification to small investors who may lack capital or expertise.

- Include Equity Funds, Debt Funds, Hybrid Funds, and Index Funds.

Impact on Market:

Mutual funds can create sector-specific trends. For instance, large inflows into technology-focused equity funds can drive tech stock prices up.

6. Brokers and Market Makers

Brokers act as intermediaries between buyers and sellers, facilitating transactions in exchange for a commission or fee. Market makers provide liquidity by continuously quoting buy and sell prices for stocks.

Course Details:

Lesson-1: How Does the Stock Market Work? The Secret Engine of the Stock Market – Explained Simply

Lesson-2: How Does the Stock Market Work? The Secret Engine of the Stock Market – Explained Simply

Lesson-3: Types of Financial Markets Explained with Real-Life Examples (Stock Market Course)

Lesson-4: Stock Market Course – Lesson 4: IPOs and the Primary Market

Lesson-5: Stock Market Course – Lesson 5: Market Participants-I

Key Characteristics:

- Brokers execute trades for clients and provide research advice.

- Market makers ensure smooth trading and prevent excessive volatility.

Impact on Market:

Without brokers and market makers, trading would be slow and inefficient. Their role is vital for maintaining price stability and liquidity in the market.

How Each Participant Influences Market Trends

Market trends are shaped by the interplay of various participants:

- Retail Investor Sentiment: Often reacts to news, resulting in short-term market swings.

- FII Inflows and Outflows: Can create bullish or bearish momentum.

- DII Strategies: Stabilize the market during volatile periods.

- HNIs & Mutual Funds: Influence specific sectors or stocks.

- Brokers & Market Makers: Ensure smooth execution and liquidity, indirectly shaping market behavior.

Example:

During the Indian IT boom, FIIs invested heavily in IT stocks, DIIs followed with mutual fund inflows, and retail investors joined the rally. This coordinated activity pushed stock prices up, creating a bullish market trend.

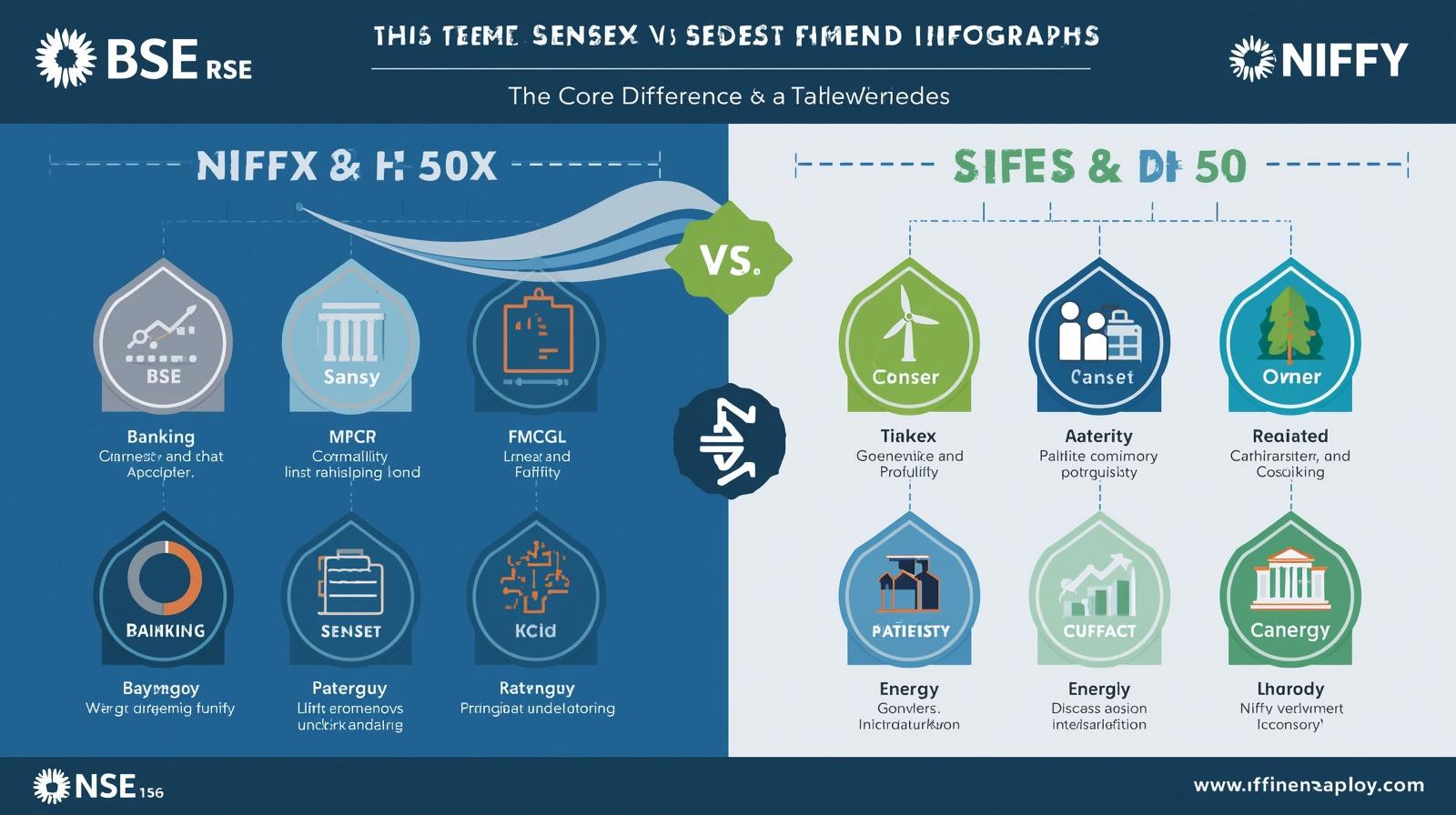

Market Dynamics: FII vs DII Movements

FIIs and DIIs often have opposing effects:

- Bull Market: FIIs buying + DII support = strong upward momentum.

- Bear Market: FIIs selling + DII interventions = moderated correction.

Understanding these movements helps investors make informed decisions, anticipate trend reversals, and manage risk.

Investor Psychology & Trend Formation

Market psychology plays a crucial role in trend formation:

- Herd Behavior: Retail investors often follow the crowd, amplifying trends.

- Fear & Greed: Drives panic selling or irrational buying.

- Contrarian Opportunities: Smart investors may profit when the majority panic.

By understanding the psychology of different participants, an investor can identify opportunities and avoid common pitfalls.

Case Studies: Indian Market Examples

- FII Inflows in 2021: FIIs invested heavily in large-cap Indian equities, driving markets to record highs. DIIs followed cautiously, stabilizing mid-cap corrections.

- Mutual Fund Retail Growth: Increased mutual fund participation by retail investors in 2022 helped sustain market momentum during periods of FII outflows.

- IPO Trends: HNIs and retail investors often create initial price surges in IPOs before DIIs step in for long-term stability.

-

The Tariff Tussle: Decoding the Legal Challenge to Executive Trade Power

Supreme Court| Tariffs| Trade War 2026| Donald Trump| IEEPA| Section 301| US Economy| Import Duties| Constitutional Law| Reciprocal Trade Act…

-

The 2025-26 Market Journey: From All-Time Highs to the “Retail Trap” Panic

Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks|…

-

Indian Stock Market Update Feb 20: Nifty Reclaims 25,550, Sensex Jumps 316 Pts Amid Global Cues

Indian Stock Market Update Feb 20| Nifty 50 today| Sensex closing| Top gainers and losers Market Snapshot: The Bulls Fight…

Summary & Key Takeaways

- The stock market consists of multiple participants: Retail Investors, FIIs, DIIs, HNIs, Mutual Funds, Brokers, and Market Makers.

- Each participant has a distinct role, risk appetite, and influence on market trends.

- Understanding participant behavior helps investors make informed decisions, anticipate trends, and manage risks.

- FII and DII movements are particularly important for market stability and predicting bullish or bearish trends.

Quiz / Activity

- Name three major types of institutional investors in the stock market.

- How do FIIs influence Indian stock market trends?

- What is the main role of brokers and market makers?

- Give an example of how retail investor sentiment can move stock prices.

- Why is understanding participant psychology important for investors?

Course Introduction

🌟 Coming Up in Lesson 6

👉 “Lesson 6 Preview: Types of Orders and How Trading Works

In the next lesson, you will learn:

- Different types of stock market orders (market, limit, stop-loss)

- How trades are executed on NSE and BSE

- Understanding order books, settlement, and trading strategies

Mark your calendar – Lesson 4 is on the way with exciting insights on IPOs.🚀

Open Demat Account

by Mirae Asset (m,Stock)

-

The Tariff Tussle: Decoding the Legal Challenge to Executive Trade Power

Supreme Court| Tariffs| Trade War 2026| Donald Trump| IEEPA| Section 301| US Economy| Import Duties| Constitutional Law| Reciprocal Trade Act…

-

The 2025-26 Market Journey: From All-Time Highs to the “Retail Trap” Panic

Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks|…

-

Indian Stock Market Update Feb 20: Nifty Reclaims 25,550, Sensex Jumps 316 Pts Amid Global Cues

Indian Stock Market Update Feb 20| Nifty 50 today| Sensex closing| Top gainers and losers Market Snapshot: The Bulls Fight…

-

Indian Stock Market Today: Bulls Charge Ahead as Sensex and Nifty Rally on Banking & IT Strength

# Indian Stock Market Today: Sensex and Nifty Close Higher Amid Broad-Based Buying ## Indian Stock Market Report – Updated…

-

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown Trending Keywords: YouTube down, YouTube…

-

Global Market Update 2026: Equities, Commodities, and Indian Rupee Outlook

Comprehensive 2026 global market update covering equities, commodities, bond markets, US Dollar trends, and detailed Indian Rupee outlook with investment themes and risks.