✨ Market Overview

On today’s session, the Nifty indices showcased a mixed bag performance, with broader indices like Midcap, Smallcap, Auto, Pharma, Healthcare, and Media providing support, while heavyweight indices like Bank Nifty, Nifty 100, Nifty Next 50, PSU Banks, Metals, and Realty dragged the overall sentiment into cautious territory.

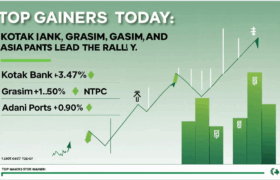

📈 India’s stock market indices opened the day on a cautious note and closed with mixed trends as traders balanced global cues, sector rotation, and profit-booking pressures. The headline index Nifty 50 slipped slightly by 0.19% to settle at 25,405.30, reflecting mild consolidation after recent highs. Banking indices, including Bank Nifty and Fin Nifty, were notable drags as both private and PSU bank stocks faced selling amid uncertain global bond yields and profit booking after a strong run. On the flip side, the broader market showed resilience with the Midcap and Smallcap indices trading in green, indicating sustained investor interest in mid-sized and small-cap counters. The Nifty Pharma and Healthcare indices were standout performers, supported by defensive buying as investors sought stability amidst volatility. The Auto index also gained smartly, driven by positive demand outlook and early signs of festive season momentum. Media stocks surprised on the upside, emerging as the day’s top sectoral gainer. However, metals, commodities, PSU banks, and realty stocks weighed on sentiment due to weakness in underlying commodity prices and profit booking in high-beta names. Overall, the market breadth remained positive, hinting that investors are gradually shifting towards selective value picks in mid and small-cap segments. As Nifty remains in consolidation mode near lifetime highs, traders and retail investors are closely watching sectoral rotation trends to spot the next leadership pocket. Global market cues, crude oil price trends, and monsoon updates will be crucial triggers for the market’s short-term direction.

🔍 Key Index Highlights

✅ NIFTY 50

-

Current: 25,405.30 🔻 -0.19%

-

Opened at 25,505.10, touched 25,587.50, low at 25,384.35

-

Slight decline amid profit booking & global cues

-

Current: 56,791.95 🔻 -0.36%

-

Weakness in major private & PSU banks pulled the index lower

-

Current: 26,734.90 🔻 -0.47%

-

Financial stocks underperformed tracking the banking trend

-

Current: 13,462.55 🔼 +0.16%

-

Midcaps remained resilient with selective buying in mid-sized stocks

-

Current: 9,198.70 🔼 +0.42%

-

Outperformed as investors shifted focus towards value picks

-

Current: 43,960.55 🔼 +0.78%

-

Strong buying in healthcare & pharma boosted sentiment

-

Current: 24,004.95 🔼 +0.44%

-

Auto index surged amid improving demand outlook

-

Current: 1,750.15 🔼 +1.45%

-

Biggest gainer on the back of positive momentum in select media stocks

-

Current: 9,623.45 🔻 -0.78%

-

Metals corrected amid commodity price softness

-

Current: 7,129.90 🔻 -0.89%

-

Heavy selling pressure seen in PSU banking counters

-

Current: 963.15 🔻 -0.71%

-

Realty index faced profit-booking after recent rally

📌 Sector-wise Snapshot

✔️ Gainers:

-

🏥 Healthcare (+0.78%)

-

🎬 Media (+1.45%)

-

🚗 Auto (+0.44%)

-

💊 Pharma (+0.42%)

-

📈 Smallcap 50 (+0.42%)

-

🏢 Midcap indices modestly green

✔️ Losers:

-

🏦 PSU Banks (-0.89%)

-

⚙️ Metals (-0.78%)

-

🏘️ Realty (-0.71%)

-

📊 Nifty Next 50 (-0.54%)

-

🏦 Private Banks (-0.46%)

📈 What Does This Mean for Traders & Investors?

🔹 Large-caps saw mild selling amid global risk-off.

🔹 Midcap & Smallcap stocks attracted rotational buying—sign of domestic investor confidence.

🔹 Defensive sectors like Pharma & Healthcare gained on safe-haven demand.

🔹 Banking & Metals stocks faced pressure, signaling cautious approach by FIIs.

🔹 Auto stocks outperformed due to strong sales momentum & festive season outlook.

🔹 PSU Banks remained under selling pressure—traders cautious post recent run-up.

💡 Market Sentiment & Short-term Outlook

📌 Nifty’s minor dip indicates consolidation near all-time highs.

📌 Sustained buying in Midcaps & Smallcaps is positive for broad market health.

📌 Watch for global cues, commodity trends, and monsoon updates.

📌 Sector rotation visible—traders should adopt stock-specific strategies.

🗝️ Current Key Data (Snapshot)

| Index | LTP | Change (%) | Day’s High | Day’s Low |

|---|---|---|---|---|

| NIFTY 50 | 25,405.30 | -0.19% | 25,587.50 | 25,384.35 |

| BANK NIFTY | 56,791.95 | -0.36% | 57,193.25 | 56,764.10 |

| MIDCAP 100 | 59,683.25 | +0.03% | 59,955.50 | 59,613.55 |

| SMALLCAP 100 | 19,027.05 | +0.26% | 19,080.90 | 18,960.10 |

| NIFTY HEALTHCARE | 43,960.55 | +0.78% | 44,010.60 | 43,638.15 |

| NIFTY METAL | 9,623.45 | -0.78% | 9,786.15 | 9,610.90 |

📣 Pro Tip for Traders

💬 “Don’t follow the crowd blindly—sector rotation is the key to outperformance. Keep an eye on Midcaps, Pharma, and Auto for near-term opportunities while being cautious in PSU Banks & Metals.”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.