The Indian stock market experienced a significant downturn on February 28, 2025, with major indices and sectors reflecting widespread declines. This comprehensive report delves into sector-wise performance, highlights notable dividend-yielding stocks, examines trading volumes, identifies stocks hitting upper and lower circuits, and concludes with key insights.

Market Overview

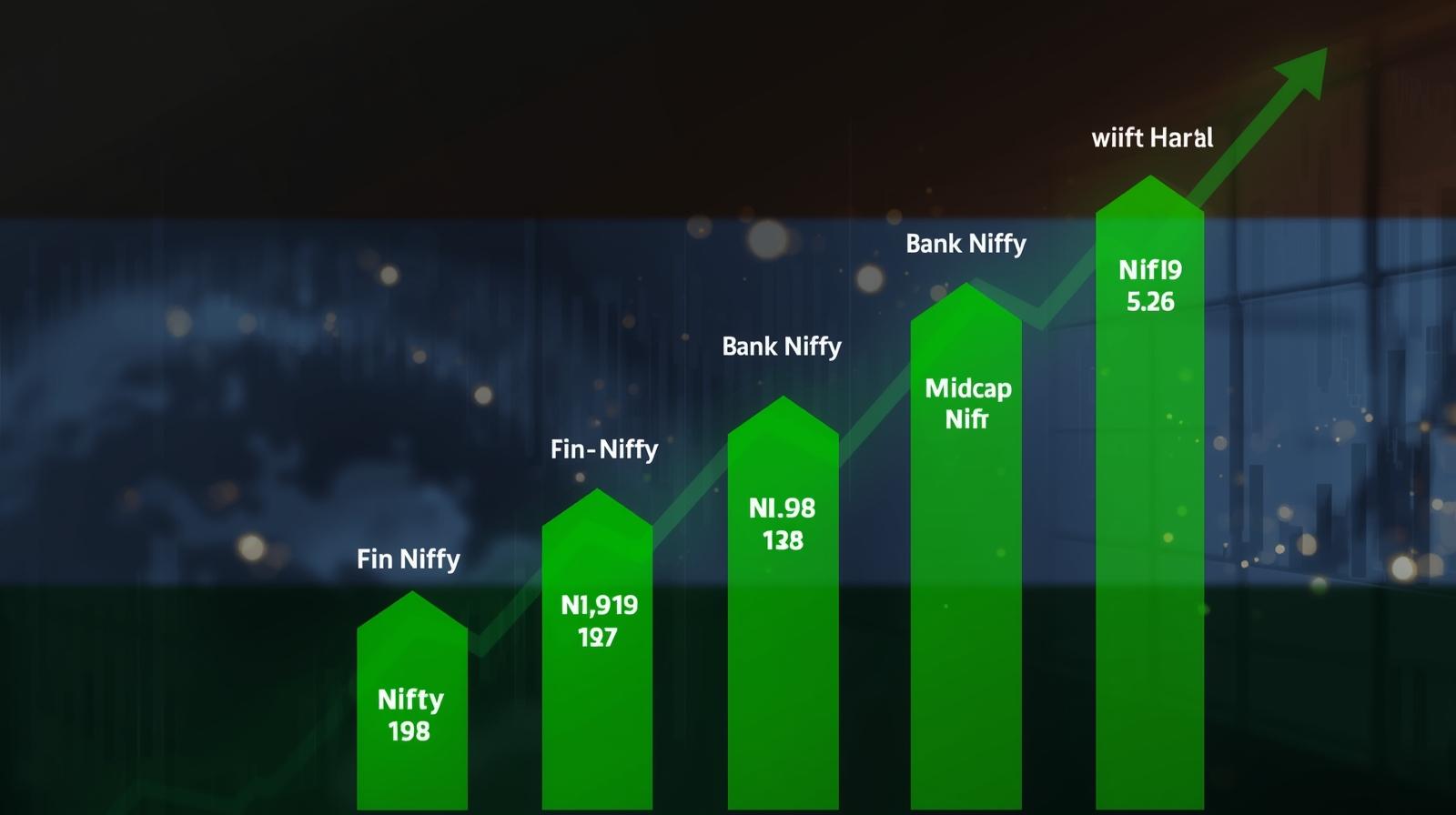

On February 28, 2025, the Indian stock market faced a substantial decline, with the Nifty 50 and BSE Sensex both falling by 1.2%. This downturn was primarily driven by escalating concerns over a potential global trade war and a slowing U.S. economy. The announcement of impending tariffs by the U.S. government exacerbated these fears, leading to a broad-based sell-off across various sectors.

Sector-Wise Performance Red

-

Information Technology (IT) Sector

The IT sector witnessed notable declines, influenced by rising U.S. jobless claims and inflation concerns. HCL Technologies Ltd. shares fell by 3.45% to ₹1,574.95, outperforming some competitors like Tata Consultancy Services Ltd., which saw a 3.58% drop, and Wipro Ltd., which declined by 5.72%.

-

Automobile Sector Red

The automobile sector faced significant pressure, with Maruti Suzuki India Ltd. shares dropping by 3.55% to ₹11,945.00. This performance was weaker compared to peers such as Ashok Leyland Ltd., which fell by 5.54%, and Eicher Motors Ltd., which declined by 3.26%.

-

Energy Sector

The energy sector experienced mixed results. Reliance Industries Ltd. shares decreased by 0.62% to ₹1,199.60, outperforming competitors like Gujarat State Petronet Ltd., which fell by 2.44%, and GAIL (India) Ltd., which declined by 2.09%. NTPC Ltd. shares dropped by 1.52% to ₹310.95, yet still outperformed the broader market.

-

Financial Sector

The financial sector was adversely affected by the overall market sentiment. Major banking stocks experienced declines, contributing to the downward trend in the sector.

Dividend-Yielding Stocks

Investors often seek dividend-paying stocks for steady income, especially during volatile market conditions. As of February 2025, notable high dividend-yielding stocks in India include:

-

Taparia Tools: Dividend yield of 456.62%.

-

VST Industries: Dividend yield of 48.15%.

-

Xchanging Solutions: Dividend yield of 32.02%.

-

Bharat Petroleum Corporation Limited (BPCL): Dividend yield of 10.30%.

-

Chennai Petroleum Corporation: Dividend yield of 9.21%.

These companies have demonstrated a consistent track record of dividend payments, making them attractive to income-focused investors.

Trading Volumes and Circuit Breakers

Analyzing trading volumes provides insights into market liquidity and investor interest. On February 28, 2025, Reliance Industries recorded a trading volume of 437,472 shares, below its 50-day average of 584,543 shares. Maruti Suzuki’s trading volume stood at 12,480 shares, also below its 50-day average of 14,280 shares. NTPC saw a trading volume of 512,412 shares, surpassing its 50-day average of 444,703 shares.

Circuit breakers are regulatory measures to curb excessive volatility by halting trading if a stock’s price moves beyond predetermined thresholds. Specific data on stocks hitting upper or lower circuits on February 28, 2025, is not available in the provided sources.

High-Price Stocks

High-price stocks often represent companies with substantial market capitalization and investor confidence. As of February 2025, some of the high-price stocks in the Indian market include:

-

MRF Limited: Trading at significant price levels, reflecting its dominance in the tire manufacturing industry.

-

Honeywell Automation India Limited: Known for its high share price, indicative of its strong position in the automation sector.

-

Shree Cement Limited: A leading cement producer with a substantial share price, reflecting its market leadership.

Conclusion

The Indian stock market’s decline on February 28, 2025, underscores the impact of global economic uncertainties on domestic equities. Sector-wise analysis reveals that while all sectors faced challenges, the extent varied, with the IT and automobile sectors experiencing more pronounced declines. Dividend-yielding stocks continue to offer potential income opportunities for investors amidst market volatility. Monitoring trading volumes and understanding circuit breaker mechanisms remain crucial for navigating such turbulent market conditions.

Note: This report is based on data available up to February 28, 2025. Investors are advised to conduct thorough research or consult financial advisors before making investment decisions.