Zen Technologies Q2 FY26, Indian defense stocks, Anti-drone technology

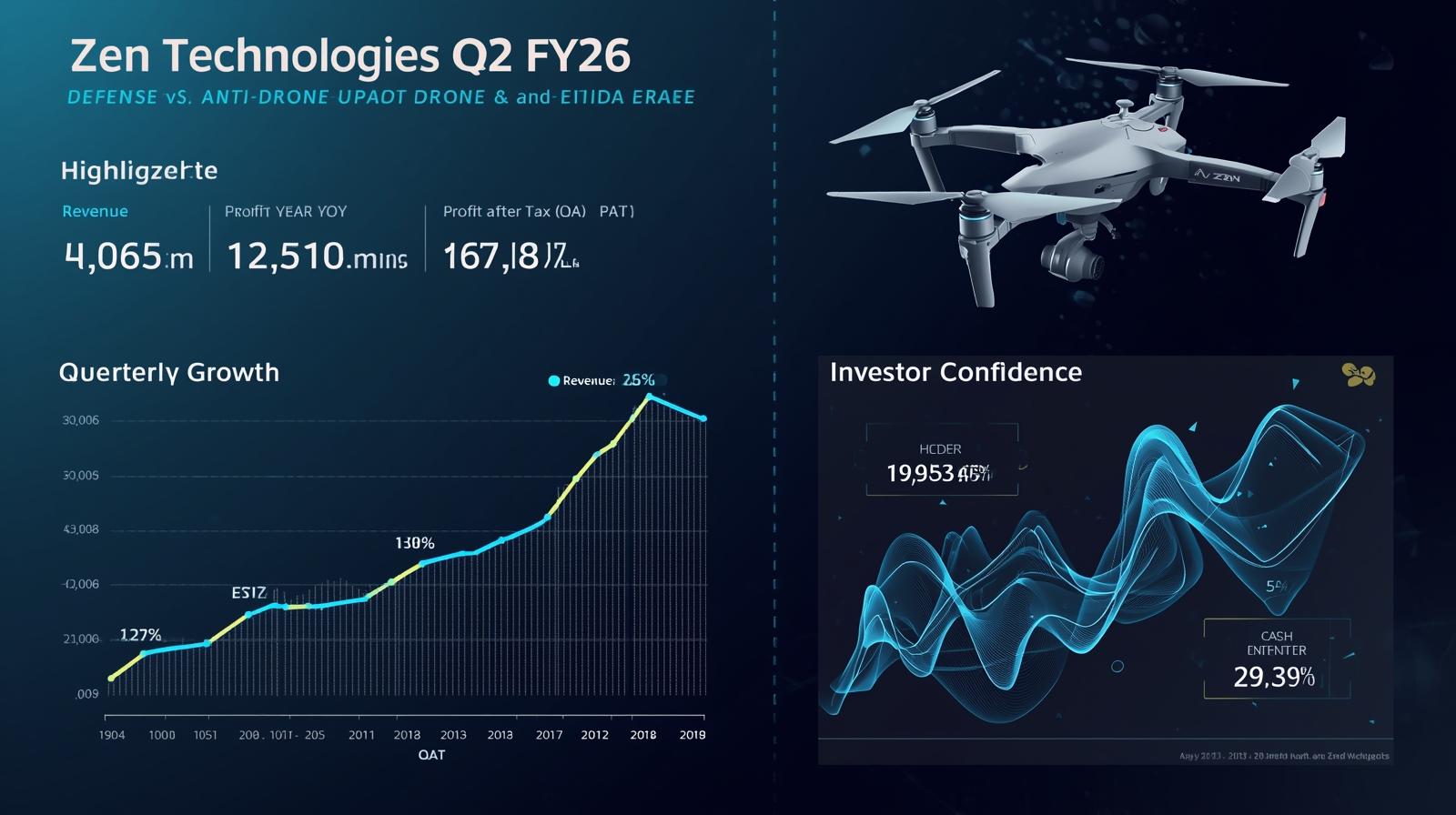

📊 Financial Highlights (Q2 FY26)

Consolidated Results:

- Revenue from Operations: ₹173.57 crore

- Operating EBITDA: ₹65.54 crore

- Net Profit After Tax (PAT): ₹59.40 crore

- EBITDA Margin: 37.3%

- EPS: ₹6.61

Standalone Results:

- Revenue from Operations: ₹124.65 crore

- Operating EBITDA: ₹42.10 crore

- Net Profit After Tax (PAT): ₹46.16 crore

- EBITDA Margin: 33.73%

- EPS: ₹5.13

Note: Figures are unaudited.

📉 Year-on-Year Performance

- Revenue decreased 28.23% YoY (₹241.84 crore → ₹173.57 crore)

- PAT decreased 5.06% YoY (₹62.67 crore → ₹59.40 crore)

Reason: Procedural delays in order finalizations impacted revenue recognition.

📈 Quarter-on-Quarter Performance

- Revenue improved 9.70% QoQ (₹158.22 crore → ₹173.57 crore)

- PAT increased 23.37% QoQ (₹48.23 crore → ₹59.40 crore)

Indicates recovery trajectory despite procedural delays.

💼 Operational Insights

- Strong operational EBITDA margins show efficient cost management.

- Liquidity position exceeds ₹1,100 crore, ensuring capacity for strategic investments.

- Subsidiaries ARIPL and UTS continue contributing to consolidated performance.

- Government anti-drone orders and defense training solutions drive long-term growth.

🔮 Outlook

Zen Technologies expects temporary headwinds in FY26 to subside. Focus remains on:

- Innovation in defense technology

- Expansion of anti-drone solutions

- Leveraging India’s defense modernization programs

Analyst view: The company’s robust liquidity and growing order book support future revenue stability.

Today Post:

- Lesson 6: What is a Share? | Basics of Stock Market Course

- Gold Rate Today Crash!: Complete Market Update & Investment Insights

- Infosys Dividend Announcement – Interim Dividend of ₹23 Per Share for Q2 FY2025-26

- Quality Power Electrical Equipments Limited Announces HR GM Resignation of Senior Management Personnel

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

The Tariff Tussle: Decoding the Legal Challenge to Executive Trade Power

Supreme Court| Tariffs| Trade War 2026| Donald Trump| IEEPA| Section 301| US Economy| Import Duties| Constitutional Law| Reciprocal Trade Act…

-

The 2025-26 Market Journey: From All-Time Highs to the “Retail Trap” Panic

Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks|…

-

Indian Stock Market Update Feb 20: Nifty Reclaims 25,550, Sensex Jumps 316 Pts Amid Global Cues

Indian Stock Market Update Feb 20| Nifty 50 today| Sensex closing| Top gainers and losers Market Snapshot: The Bulls Fight…

-

Indian Stock Market Today: Bulls Charge Ahead as Sensex and Nifty Rally on Banking & IT Strength

# Indian Stock Market Today: Sensex and Nifty Close Higher Amid Broad-Based Buying ## Indian Stock Market Report – Updated…

-

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown Trending Keywords: YouTube down, YouTube…

-

Global Market Update 2026: Equities, Commodities, and Indian Rupee Outlook

Comprehensive 2026 global market update covering equities, commodities, bond markets, US Dollar trends, and detailed Indian Rupee outlook with investment themes and risks.