Introduction: Supreme Industries Back in Momentum

In a market where quality, consistency, and cash-rich businesses attract long-term capital, Supreme Industries Ltd (NSE: SUPREMEIND) is once again making headlines. With over 80 years of legacy, Supreme Industries is India’s largest plastic processor, and its recent stock trend is reviving strong interest from institutional and retail participants alike.

After a 24% monthly rally, a key technical breakout, and robust long-term fundamentals, Supreme Industries is setting up for a potential re-rating in FY26 — despite a softer start in Q1. Let’s dive into what’s making this stock trend and what investors should know.

🏢 About the Company: Supreme Scale & Innovation

Founded in 1942, Supreme Industries operates 30+ manufacturing facilities across India and handles over 640,000 MT of polymers annually, making it an undisputed leader in plastic processing. Its eight business segments cater to end-to-end industrial, retail, and infrastructure requirements:

- Plastic piping systems (CPVC, UPVC, HDPE)

- Industrial molded products

- Performance films

- Protective packaging

- Furniture and material handling

- Cross-laminated films

- Composite LPG cylinders

- Bath fittings

Its flagship “Supreme” brand is widely recognized across India’s construction, plumbing, packaging, and storage solutions markets.

📊 Q1 FY26 Performance: Soft Start, But No Panic

Supreme Industries posted muted Q1 FY26 numbers due to seasonal weakness and margin contraction.

| Metric | Q1 FY26 | Q1 FY25 | QoQ Change |

|---|---|---|---|

| Revenue | ₹2,626 Cr | ₹2,656 Cr | ↓ 13.6% |

| EBITDA | ₹371 Cr | ₹467 Cr | ↓ 20.5% |

| PAT | ₹177 Cr | ₹236 Cr | ↓ 25% |

Margins compressed due to fluctuating raw material prices and subdued industrial demand in June. But with zero debt, strong reserves, and strategic inventory adjustments, the company remains fundamentally secure.

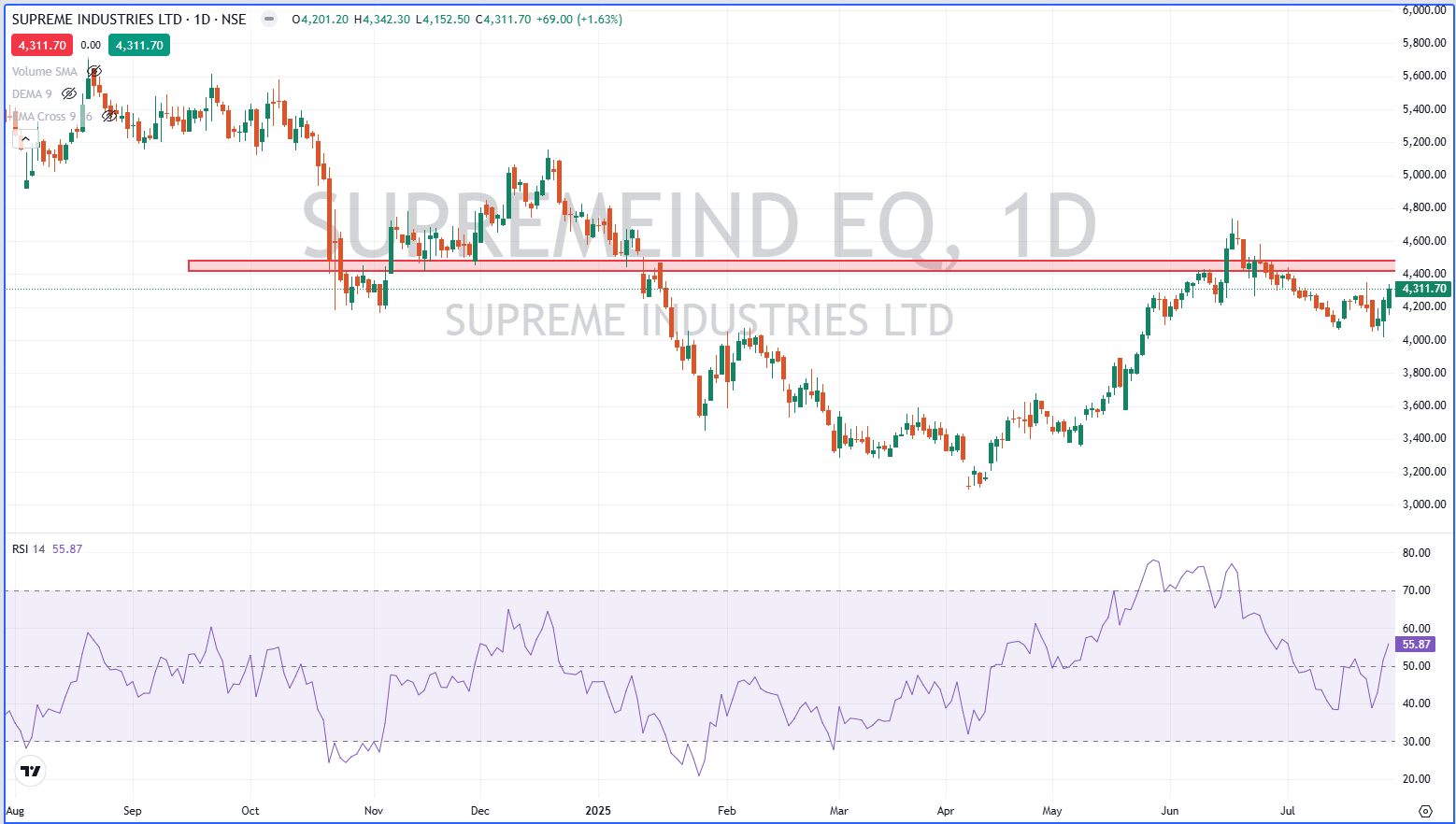

📈 Supreme Industries Share Price: Technical Levels

As of July 25, 2025, Supreme Industries closed at ₹4315.00, up +1.63% for the day. The scrip has rallied over 24% in one month, bouncing back from a recent low of ₹3,480.

🔹 Key Levels:

- 52-Week High: ₹5,724

- 52-Week Low: ₹3,020

- Support Zone: ₹4,050 – ₹4,150

- Resistance: ₹4,420 / ₹4,580

- MACD: Bullish crossover above signal line

📉 Technical Note:

In May 2025, the stock broke out from an inverse head-and-shoulders pattern on the weekly chart, indicating a major long-term reversal. It’s currently consolidating near short-term resistance, awaiting a breakout.

🧠 Analyst Opinions & Institutional Confidence

Brokerages such as HDFC Securities and SMC Global have reaffirmed a Buy/Add stance on Supreme, citing:

- Healthy demand outlook in housing & infra

- Robust return ratios (ROE ~17%, ROCE ~22%)

- Strong cash generation and capex discipline

Shareholding (June 2025):

- Promoters: 48.9% (zero pledged)

- FIIs: 22%

- DIIs: 14.5% (MFs ~9%)

- Retail/Public: 14.6%

Despite a minor dip in FII holdings, mutual fund participation has steadily risen, indicating domestic institutional support.

💰 Dividend Policy: Steady Returns to Shareholders

Supreme Industries maintains a consistent dividend payout history:

- Final Dividend FY25: ₹24/share (paid June 2025)

- Interim Dividend: ₹10/share (October 2024)

- Dividend Yield: ~0.8%

- Payout Ratio: 39%

This aligns with its cash-rich, zero-debt model, favoring long-term investors who seek regular income with capital appreciation.

📈 Financial Snapshot – FY25 (Full Year)

- Total Revenue: ₹10,446 Cr

- EBITDA: ₹1,432 Cr

- Net Profit: ₹896 Cr

- EPS: ₹70.6

- Debt: ₹0 (Debt-free)

- Cash & Reserves: ₹2,800+ Cr

Its financial muscle gives it room for both growth and resilience, even when market cycles turn adverse.

🔄 Growth Drivers Going Ahead

1. Housing & Infra Boom:

With PMAY urban & rural rollouts, metro projects, and Jal Jeevan Mission—plastic piping demand is expected to rise through FY26-FY27.

2. Export Push:

Supreme is increasing export shipments of cross-laminated films, molded crates, and composite cylinders to Africa, Gulf, and Southeast Asia.

3. Cost Optimization:

In-house resin compounding, backward integration in molding, and multi-location manufacturing helps them beat freight and input costs.

4. New Product Pipelines:

Composite LPG cylinders and specialized packaging films are being tested across new verticals with higher margins.

🧠 Retail Traders’ Takeaway

If you’re a retail investor wondering whether to ride this trend — here’s what works in Supreme Industries’ favor:

- ✅ Debt-free & dividend-paying

- ✅ Technical breakout confirms trend

- ✅ Undervalued on PEG despite high P/E (~60x)

- ✅ Backed by institutions & growing sectors (housing, infra)

Short-term players may look for pullbacks to ₹4,150–₹4,200 zones, while long-term investors can hold with a ₹5,000+ target in view for FY26–27.

✍️ Final Word

Supreme Industries stands tall as an example of a well-managed, zero-debt industrial major navigating cyclical headwinds with precision. While Q1 FY26 earnings reflected temporary softness, the stock’s technical breakout, clean balance sheet, and expansion roadmap indicate that Supreme may just be preparing for its next big leap.

📌 Retail investors should keep this on their radar — it’s a classic case of quality at reasonable price amidst market noise.

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.