The Indian stock market indices continued their upward trajectory on July 15, 2025, with all major benchmarks closing in green. From NIFTY to Midcap Nifty, positive sentiment was observed as domestic buying strengthened and global cues remained stable.

Market Opening to Close: Bulls in Command as Midcaps Lead the Rally

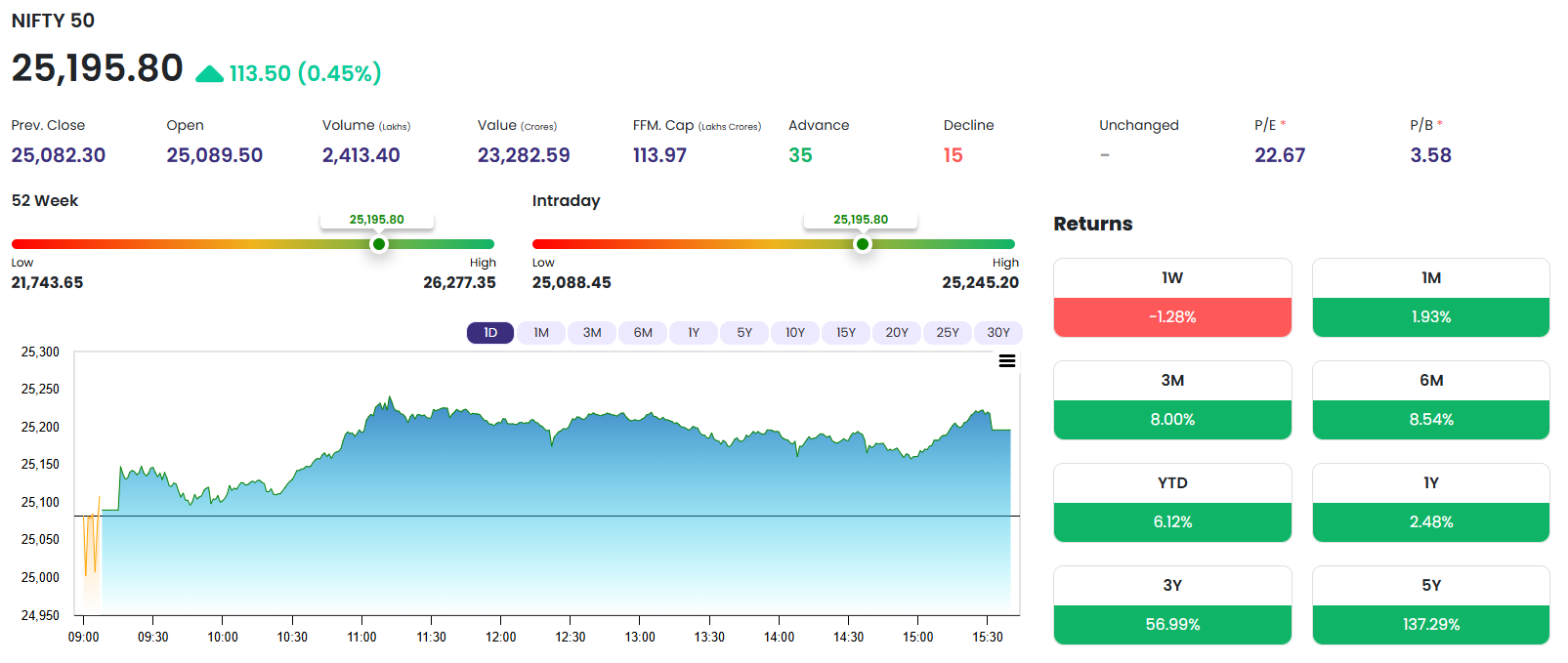

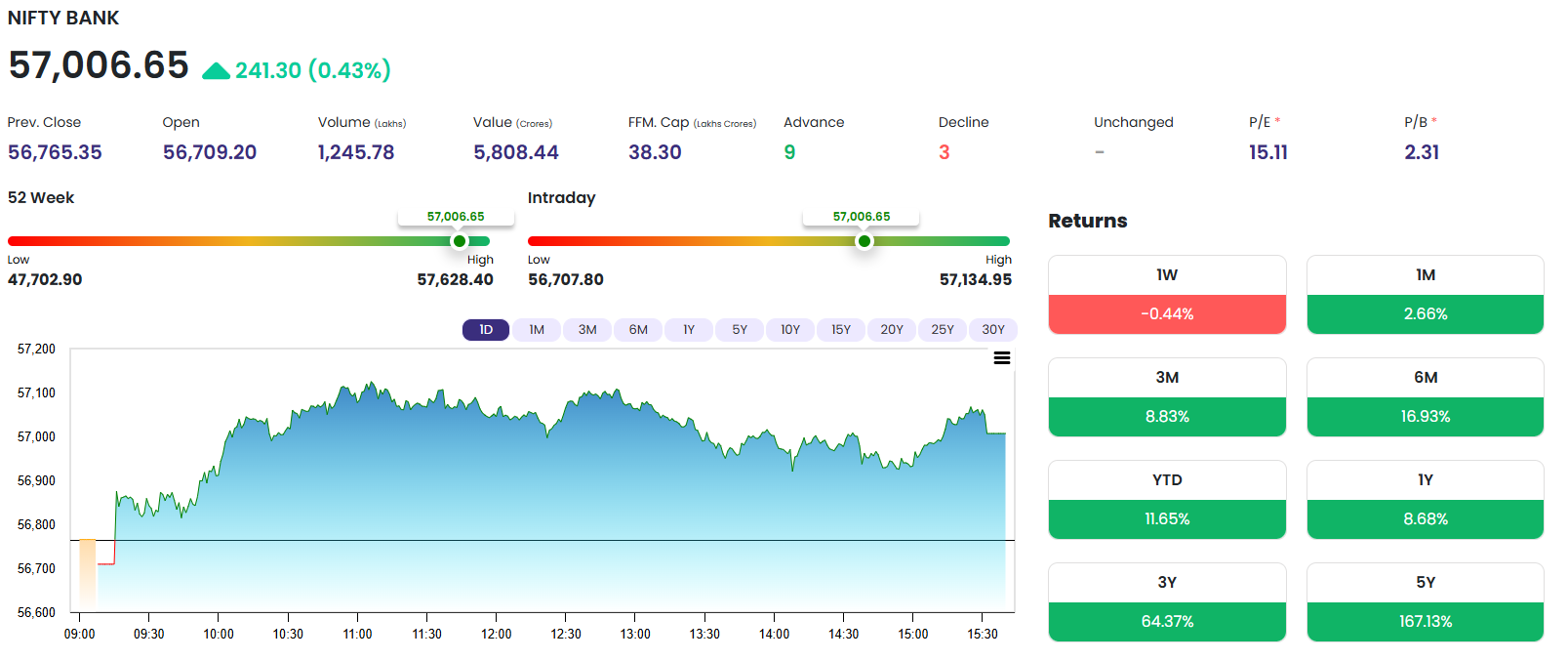

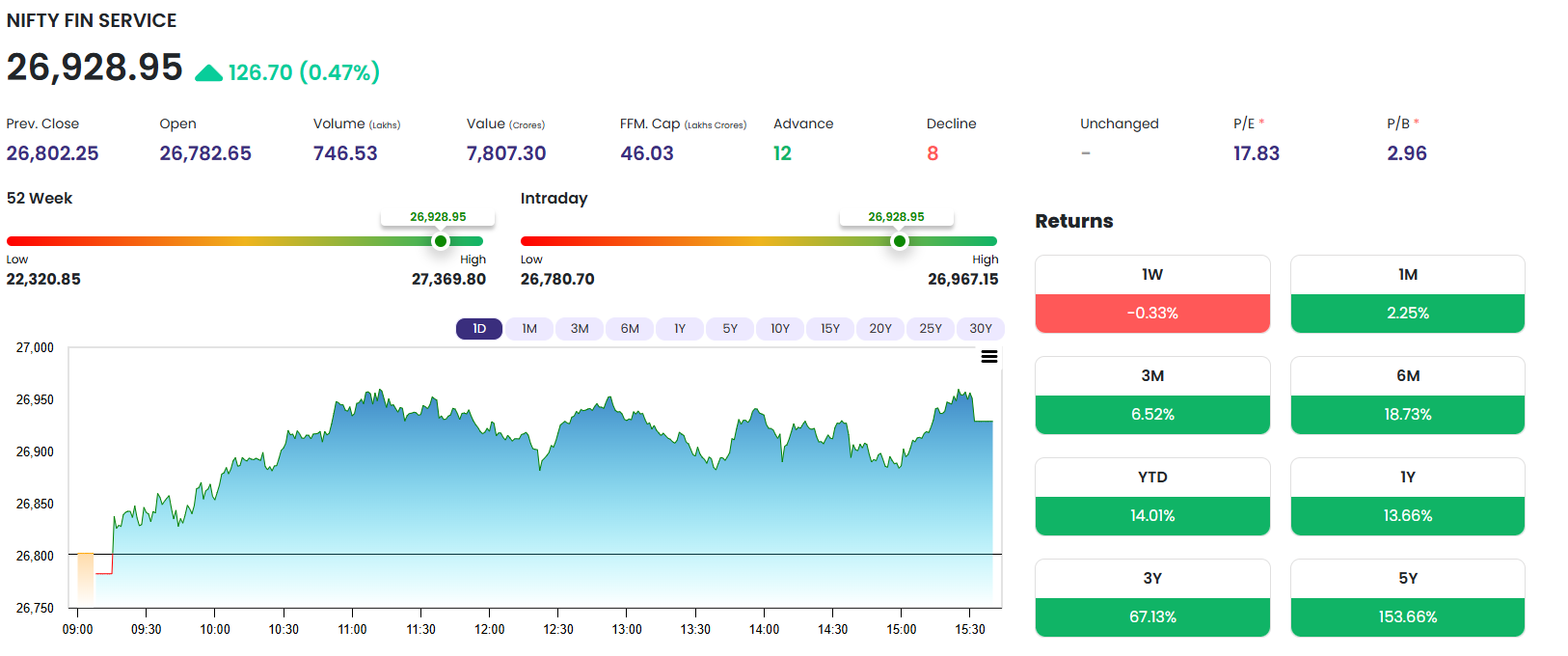

The Indian stock market opened on a positive note on July 15, 2025, tracking stable global cues and encouraging domestic signals. With investors showing renewed confidence, the broader markets surged ahead, led by strong participation in midcap and financial indices. The benchmark NIFTY 50 opened above the 25,000 mark, maintaining momentum throughout the session and closing at 25,195.80, up by 113.50 points or 0.45%. Bank Nifty and Fin Nifty also followed suit with healthy gains, reflecting strong investor interest in banking and financial sectors. Notably, the Midcap Nifty stole the spotlight with a 1.31% gain, suggesting a broad-based rally and strong undercurrent in mid- and small-cap stocks. The day’s performance indicated a risk-on sentiment, as traders and investors placed bets on quality mid-tier companies with better-than-expected Q1 earnings visibility.

The market breadth remained solidly positive, with buying seen across sectors such as Auto, Capital Goods, FMCG, and Financial Services. Despite global uncertainties like geopolitical concerns and interest rate expectations from the US Fed, the Indian market demonstrated strong resilience and liquidity-driven optimism. Institutional investors appeared active, and domestic retail participation stayed robust, especially in the cash segment of the broader markets. Technical charts also showed strength with key indices forming bullish candles, suggesting potential upside continuation in the coming sessions. With the NIFTY closing above a key psychological level and the Bank Nifty holding firm above 57,000, traders are now eyeing fresh breakouts in the near term. The improved volumes and closing near intraday highs signal that bulls continue to have the upper hand, positioning Indian equity markets favorably as the week progresses.

🔹 NIFTY (NSE Nifty 50 Index)

-

Current Price: ₹25,195.80

-

Change: +113.50 points (+0.45%)

-

Open: ₹25,089.50

-

High / Low: ₹25,245.20 / ₹25,088.45

-

Previous Close: ₹25,082.30

✅ Market View: NIFTY witnessed a solid day with a strong gap-up opening and closed above the 25,100 mark, supported by sectors like IT, FMCG, and Auto. The index respected support near 25,080 and saw a breakout toward intraday highs.

🔹 BANK NIFTY

-

Current Price: ₹57,006.65

-

Change: +241.30 points (+0.43%)

-

Open: ₹56,709.20

-

High / Low: ₹57,134.95 / ₹56,707.80

-

Previous Close: ₹56,765.35

✅ Banking Boost: Bank Nifty remained resilient with large private sector banks like HDFC Bank and ICICI Bank contributing positively. With a narrow range and strong close, the banking sector showed strength and readiness for a potential breakout in upcoming sessions.

🔹 FIN NIFTY (Nifty Financial Services)

-

Current Price: ₹26,928.95

-

Change: +126.70 points (+0.47%)

-

Open: ₹26,782.65

-

High / Low: ₹26,967.15 / ₹26,780.70

-

Previous Close: ₹26,802.25

✅ Financials Holding Strong: The FIN NIFTY index saw moderate buying with key NBFCs and insurance stocks aiding gains. The index is forming a base around 26,800, indicating investor confidence in financial stocks.

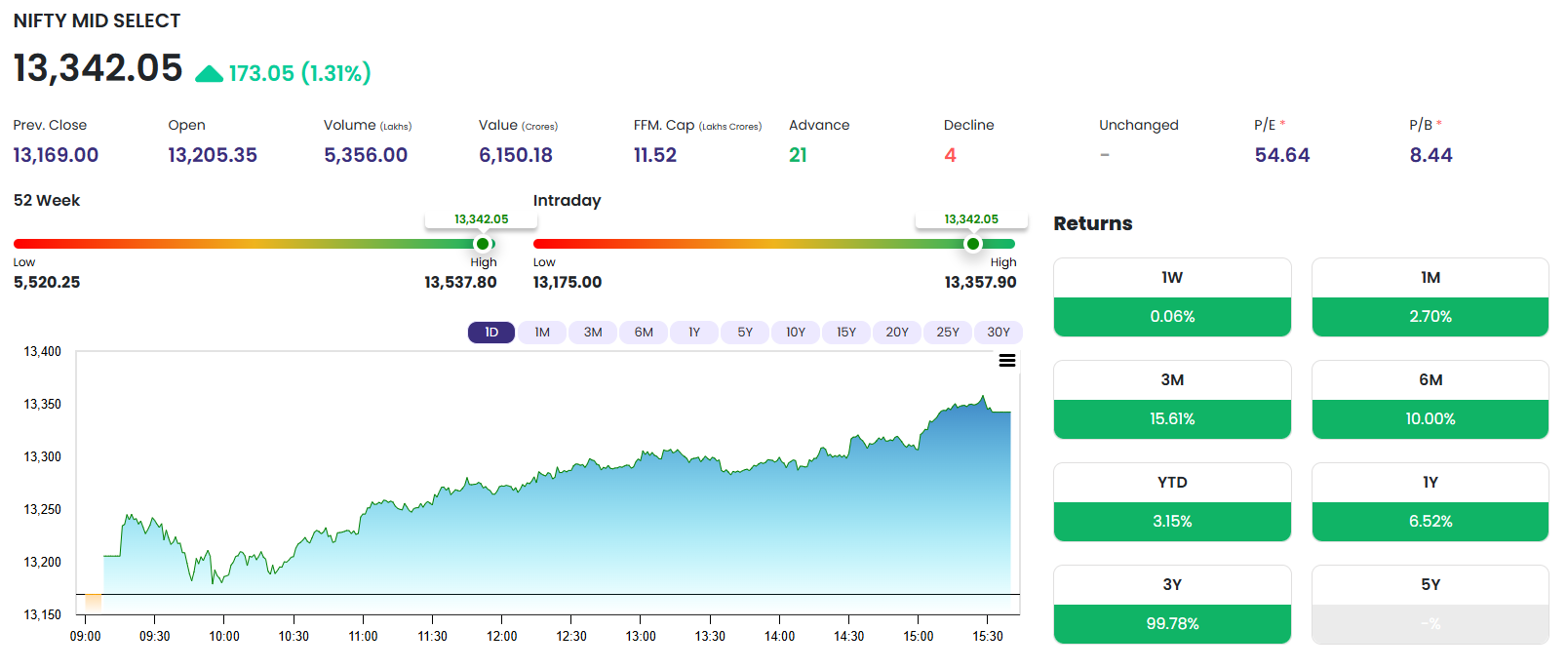

🔹 MIDCAP NIFTY

-

Current Price: ₹13,342.05

-

Change: +173.05 points (+1.31%)

-

Open: ₹13,205.35

-

High / Low: ₹13,357.90 / ₹13,175.00

-

Previous Close: ₹13,169.00

📈 Outperformer of the Day: Midcap Nifty emerged as the top gainer among the indices with a stellar 1.31% jump. Broader market participation, driven by midcap pharma, capital goods, and chemicals, signaled risk-on sentiment in the market. Stocks like Cummins India, Bharat Forge, and L&T Finance saw impressive traction.

📌 Market Summary & Technical Outlook

-

All indices ended the day in green.

-

Midcap stocks saw renewed buying interest.

-

Nifty is showing signs of strength, with immediate resistance at 25,250 and support at 25,000.

-

Bank Nifty’s narrow range breakout possibility in the next few sessions could set the tone for financials.

📈 Key Takeaways

✔️ Broader market participation reflects healthy bullish sentiment.

✔️ Midcap index outperformed, suggesting investor interest is spreading beyond large caps.

✔️ Nifty and Bank Nifty remain comfortably above short-term moving averages, indicating trend continuation.

✔️ No signs of overbought fatigue yet — volumes remain supportive.

📣 Expert Quote of the Day:

“Midcaps are back in focus with stronger hands coming in. If this trend holds, we could see the broader market scale new highs in the short term.”

– Market Analyst, Mumbai-based brokerage

Note: This is the Testing Real data may be differ for above

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.