The SME IPO of Shreeji Global FMCG Ltd., a fast-growing player in the Indian FMCG and spice manufacturing segment, is opening for public subscription on November 4, 2025. The issue has already drawn interest in market circles thanks to its robust revenue growth, brand recognition, and expansion focus.

This detailed report covers everything investors need to know — from company background, financial performance, valuation metrics, to risk factors and listing outlook — along with an expert verdict on whether this IPO deserves a place in your portfolio.

📅 IPO Schedule & Key Details

| Particular | Details |

|---|---|

| IPO Type | SME IPO (Book-Built Issue) |

| Exchange | NSE SME Platform |

| Issue Size | ₹85 crore (Fresh issue only) |

| Price Band | ₹120 – ₹125 per share |

| Face Value | ₹10 per share |

| Lot Size | 1,000 shares per lot |

| Minimum Investment (Retail) | ₹1,25,000 |

| IPO Opens | November 4, 2025 |

| IPO Closes | November 7, 2025 |

| Allotment Date | November 10, 2025 |

| Refunds / Credit to Demat | November 11, 2025 |

| Listing Date | November 12, 2025 |

🧾 Company Overview

Shreeji Global FMCG Ltd. operates in the food processing and spice manufacturing segment, catering to both domestic and export markets. The company’s product portfolio includes:

- Whole and ground spices (turmeric, chili, cumin, coriander, etc.)

- Pulses, grains, and flours (wheat, rice, atta, besan)

- Blended and packaged food ingredients marketed under its flagship brand “SHETHJI.”

With manufacturing units located in Rajkot and Morbi (Gujarat), Shreeji Global is positioned in one of India’s fastest-growing FMCG belts, benefiting from robust agricultural supply chains.

The company has steadily diversified into value-added spice products and packaged consumer food items, leveraging rising domestic demand and export opportunities.

📈 Financial Performance Snapshot

| Financial Year | Revenue (₹ Cr) | PAT (₹ Cr) | PAT Margin (%) | ROE (%) |

|---|---|---|---|---|

| FY2023 | 588.99 | 5.47 | 0.93 | 24.7 |

| FY2024 | 650.85 | 12.15 | 1.87 | 51.7 |

Key takeaways:

- Revenue growth of ~10.5% YoY demonstrates steady scaling capacity.

- Profit after tax more than doubled, indicating operational efficiency improvements.

- PAT margins remain modest at 1.9%, typical for agri-based FMCG players.

- ROE above 50% is strong but must be viewed alongside leverage (Debt/Equity ~1.03).

Overall, the company shows consistent top-line growth and improving profitability — a positive sign for investors looking at mid-term expansion stories in FMCG.

⚙️ Use of IPO Proceeds

According to the prospectus, the ₹85 crore raised will be used for:

- Capital expenditure: Expansion of existing facilities and purchase of new machinery.

- Solar energy installations: To reduce long-term power costs and carbon footprint.

- Working capital requirements: To support inventory and receivable cycles.

- General corporate purposes: Including branding, marketing, and logistics enhancement.

This capital deployment plan indicates the management’s intention to strengthen production efficiency and build sustainable cost advantages — crucial in the highly competitive FMCG market.

💰 Valuation Analysis

🔹 Earnings & Valuation Multiples

| Parameter | Value |

|---|---|

| EPS (FY25) | ₹21.32 |

| NAV per Share | ₹51.86 |

| P/E Ratio | ~5.86x (at ₹125) |

| P/B Ratio | ~2.41x |

| Debt/Equity | 1.03x |

| PAT Margin | 1.87% |

🔹 Interpretation

- The P/E ratio of ~5.9x appears attractive compared to large FMCG peers (many trade between 30x–60x earnings).

- However, this low multiple partly reflects SME-listing and liquidity risks, and the thin profit margins of the business.

- P/NAV of 2.4x with a high ROE (51%) suggests investors are paying a reasonable premium for growth potential.

- Margins remain tight; sustained profit scaling will be the key to long-term value creation.

In simple terms, the IPO seems reasonably priced, not expensive — but investors must weigh valuation attractiveness against business volatility.

🧮 Comparison with Peers (Indicative)

| Company | Type | P/E | PAT Margin (%) | ROE (%) | Remarks |

|---|---|---|---|---|---|

| Everest Food Products | Mainboard | 40x | 12.5 | 34 | Established, high margins |

| MDH Ltd. | Unlisted (Comparable) | ~35x | 10–12 | 25 | Brand dominance |

| Shreeji Global FMCG | SME IPO | 5.9x | 1.9 | 51.7 | Growth stage, low margin |

👉 The table shows Shreeji Global’s valuation is far lower than leading spice brands — offering room for re-rating if profitability sustains and brand recognition improves post-listing.

📊 Balance Sheet Strength

The company’s financial structure appears moderate in terms of leverage.

- Debt/Equity ratio ~1.03x suggests controlled debt but still notable for an SME.

- Working capital cycle is relatively stretched due to raw material inventory and receivables typical in the FMCG chain.

- Post-IPO infusion should ease liquidity constraints and fund expansion without over-reliance on borrowings.

🧠 Management & Strategy Insights

The promoters of Shreeji Global FMCG have long experience in agri-processing, spice trade, and packaged consumer products. The strategy ahead includes:

- Expanding domestic retail presence under the “SHETHJI” brand.

- Enhancing export capacity for high-margin spice blends.

- Building solar and energy-efficient manufacturing lines for long-term cost competitiveness.

- Upgrading packaging and R&D to cater to evolving consumer preferences.

The management’s operational background and planned modernization could translate into meaningful growth over 3–5 years, provided execution remains strong.

⚠️ Key Risks & Concerns

While the IPO numbers appear attractive, retail investors must carefully consider the following:

- Low Liquidity Risk (SME platform)

- NSE SME stocks often face limited trading volumes and wide bid-ask spreads.

- Exiting early or in bulk may be difficult.

- Thin Profit Margins

- Despite rising revenues, PAT margins remain below 2%.

- Any raw-material cost inflation could compress profits sharply.

- Regulatory & Quality Risk

- Spices and food items are subject to FSSAI norms and international safety standards.

- The sector recently saw contamination controversies (e.g., MDH & Everest), which highlight brand risk.

- Debt Load & Working Capital Dependency

- The company operates on moderate leverage; poor cash conversion can strain finances.

- Valuation Trap Possibility

- While P/E looks low, it could reflect market discount for size, liquidity, and scale limitations rather than undervaluation.

💹 Market Sentiment & GMP Trends

According to early market trackers, the Grey Market Premium (GMP) for Shreeji Global FMCG IPO has started appearing in the ₹25–₹35 range, indicating moderate subscription interest among SME investors.

If sustained, this could translate into a 20–30% listing gain, although SME GMPs can fluctuate sharply close to the listing date.

🔍 Listing Scenario Forecasts

| Scenario | Expected Listing Price | Gain / Loss | Probability |

|---|---|---|---|

| Bull Case | ₹150–₹160 | +20% to +30% | Medium |

| Base Case | ₹125–₹135 | 0% to +8% | High |

| Bear Case | ₹110–₹115 | −8% to −12% | Medium |

The most likely outcome points to a flat to modestly positive listing, given the current GMP and market mood. Sustained post-listing performance will depend on margin expansion and quarterly delivery.

🧭 Expert Verdict – Should You Apply?

| Investor Type | Recommendation | Rationale |

|---|---|---|

| Conservative Investors | ❌ Avoid | SME listing risk, low margin profile |

| Balanced Investors | ⚠️ Apply for Min Lot | Attractive valuation, but hold medium-term |

| Aggressive / Listing Gains Seekers | ✅ Apply | Low P/E, positive GMP, potential 20–30% listing pop |

👉 In summary, Shreeji Global FMCG Ltd. presents a reasonably priced SME IPO backed by revenue growth and brand expansion, but investors should treat it as a high-risk, moderate-reward opportunity.

Those with a 1–2 year horizon and comfort with SME volatility may consider applying for limited exposure.

📊 Final Pros & Cons Summary

| Pros | Cons |

|---|---|

| Attractive valuation (P/E ~5.9x) | SME liquidity & volatility risk |

| Strong revenue growth trend | Thin PAT margin (~2%) |

| High ROE (51%) indicates capital efficiency | Moderate debt (D/E ~1.0x) |

| Focused expansion and energy efficiency plans | Brand visibility still developing |

| Growing FMCG demand base | Execution risk in scaling up production |

🪙 Overall Rating: ⭐ 6.5 / 10

✅ Reasonably priced, growth potential exists

⚠️ SME risk & low margins keep it speculative

💡 Apply only with high-risk appetite or for listing-gain strategy

🧩 Investor Takeaway

The Shreeji Global FMCG IPO stands at the crossroads of India’s booming FMCG growth and SME capital expansion. Its business fundamentals are sound, management appears focused, and valuation seems conservative.

However, success will depend on sustaining profitability and expanding margins beyond the raw trading model. Investors must remember — a low P/E is not always a guarantee of undervaluation. Liquidity constraints and execution challenges remain real risks.

Hence, for diversified portfolios, this IPO may serve as a high-beta FMCG bet rather than a long-term core holding.

Subscription:

| Investor | 04 Nov 2025 | 06 Nov 2025 | 07 Nov 2025 |

|---|---|---|---|

| Anchor | 1 | 1 | 1 |

| QIB | 0.00 | 0.49 | 1.64 |

| Non-Institutional | 0.67 | 1.65 | 5.06 |

| BNII | 0.81 | 1.31 | 6.16 |

| SNII | 0.39 | 1.82 | 2.85 |

| Retail | 0.42 | 1.00 | 2.91 |

| Total | 0.42 | 1.09 | 3.27 |

GMP Trend:

| Date | GMP |

|---|---|

| 04 Nov 2025 | ₹0.00(0.00%) |

| 06 Nov 2025 | ₹0.00(0.00%) |

| 07 Nov 2025 | ₹0.00(0.00%) |

It should be noted that IPO GMP is subject to extreme volatility, so an investment decision based solely on Patel Retail IPO GMP will prove risky. Therefore, before to investing, consider all factors and make the right investment decision whether to invest in Patel Retail IPO or not.

How to Check IPO Allotment Status:

MUFG Intime

To check IPO allotment status, follow the steps below:

- Click on the below allotment status check button.

- Select Company Name.

- Enter your PAN Number, Application Number or DP Client ID (Anyone).

- Click on Search.

NSE Website

To check IPO allotment status, follow the steps below:

- Click on the below allotment status check button.

- Select Company Name.

- Enter your PAN Number, Application Number or DP Client ID (Anyone).

- Click on Search.

BSE Webiste

To check IPO allotment status, follow the steps below:

- Click on the below allotment status check button.

- Select Company Name.

- Enter your PAN Number, Application Number or DP Client ID (Anyone).

- Click on Search.

-

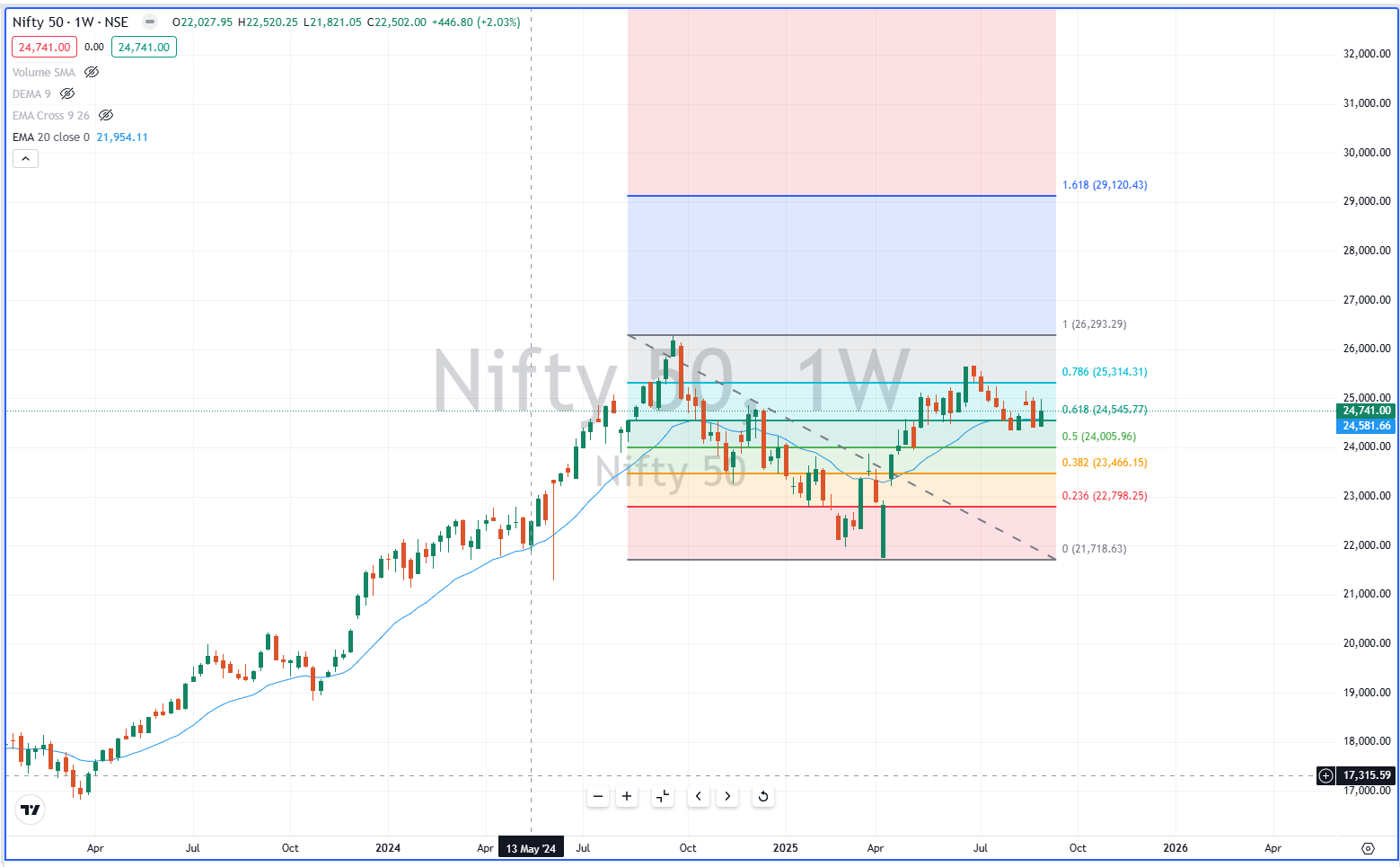

Market Snapshot: Bulls Return on Global Cues & Trade Deal Optimism

Indian Stock Market| Nifty 50| Sensex| Bank Nifty| Axis Bank| India-EU FTA| Stock Market News| Market Wrap| Jan 27 2026…

-

India-EU FTA 2026: The “Mother of All Deals” Sealed – In-Depth Analysis

India EU FTA 2026| India EU Trade Deal| Tariff cuts India EU| CBAM India EU agreement| India EU Services Trade…

-

Hindustan Zinc OFS Review 2026: Vedanta to Offload ₹4,500 Cr Stake

Hindustan Zinc OFS Review| Vedanta Limited| HINDZINC| Stock Market News| Dividend Stocks| Silver Rally| Zinc Prices| Offer For Sale| High…

-

Weekly Market Intelligence: 10 Stocks to Watch

Top 10 Stocks| Top 10 Stocks to Watch| Market Analysis As the Indian markets navigate a period of heightened volatility…

-

Lesson 19 – KEY RATIOS |Deep Dive into PE, PB, ROE & DE

Key Ratios| Stock Market Basics| PE Ratio| PB Ratio| ROE| Debt Equity Ratio| Fundamental Analysis| Investing for Beginners Introduction| Part-1/3…

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

Market Snapshot: Bulls Return on Global Cues & Trade Deal Optimism

Indian Stock Market| Nifty 50| Sensex| Bank Nifty| Axis Bank| India-EU FTA| Stock Market News| Market Wrap| Jan 27 2026…

-

India-EU FTA 2026: The “Mother of All Deals” Sealed – In-Depth Analysis

India EU FTA 2026| India EU Trade Deal| Tariff cuts India EU| CBAM India EU agreement| India EU Services Trade…

-

Hindustan Zinc OFS Review 2026: Vedanta to Offload ₹4,500 Cr Stake

Hindustan Zinc OFS Review| Vedanta Limited| HINDZINC| Stock Market News| Dividend Stocks| Silver Rally| Zinc Prices| Offer For Sale| High…

-

Weekly Market Intelligence: 10 Stocks to Watch

Top 10 Stocks| Top 10 Stocks to Watch| Market Analysis As the Indian markets navigate a period of heightened volatility…

-

Lesson 19 – KEY RATIOS |Deep Dive into PE, PB, ROE & DE

Key Ratios| Stock Market Basics| PE Ratio| PB Ratio| ROE| Debt Equity Ratio| Fundamental Analysis| Investing for Beginners Introduction| Part-1/3…