As we head into Tuesday’s trading session on June 3, 2025, markets appear to be at a crucial juncture. Short-term technicals from the 15-minute charts of the Nifty 50, Bank Nifty, and Sensex are signaling potential volatility, with well-defined support and resistance zones guiding near-term sentiment.

With global cues mixed and FII-DII flows fluctuating, Indian indices are likely to witness sharp moves — especially around key technical levels. Let’s break down the setup.

🔹 Nifty 50 – Chart Outlook

The Nifty 50 index is hovering near a decisive range, with buyers defending the 24650–24465 zone, while sellers are active around 24800 and 24973. This tight band suggests a volatility squeeze, and a breakout or breakdown could occur in tomorrow’s session.

🔻 Key Supports:

-

24650 – First line of defense; a break may attract quick selling.

-

24550 – Acts as a minor support in case of intraday dip.

-

24465 – Critical level; a sustained breach could trigger downside momentum.

🔺 Key Resistances:

-

24800 – Immediate hurdle; breakout may lead to short-covering.

-

24973 – Upper ceiling; clearing this may invite bullish momentum and test 25100 levels.

📌 Trading Strategy for Nifty:

-

Bullish Bias above 24800: Watch for breakouts toward 24973 and potentially 25100.

-

Bearish Bias below 24550: Could lead to quick declines toward 24465 and even 24380.

-

Range-bound Setup: If Nifty stays between 24650–24800 for the first hour, scalping strategies might work best.

🎯 Tip for intraday traders: Use VWAP and 20-EMA to confirm entry after a level is tested. Avoid chasing the move without confirmation.

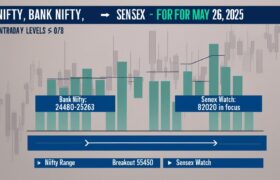

🔹 Bank Nifty – Chart Outlook

Bank Nifty is trading in a tight consolidation channel with support emerging around 55680 and 55480, while resistance stands at 55875 and 56098. The banking index may play a key role in broader market direction tomorrow, especially as it tends to lead during high-beta moves.

🔻 Key Supports:

-

55680 – Immediate support; buying interest likely to emerge here.

-

55480 – Break below this could lead to a 150–200 point slide.

🔺 Key Resistances:

-

55875 – A level to watch closely on opening; breakout can add momentum.

-

56000 – Psychological barrier.

-

56098 – A convincing breach above this could target 56350.

📌 Trading Strategy for Bank Nifty:

-

Long above 55875 with tight stop-loss: Targets 56000–56100.

-

Short below 55480: Targets 55250 and potentially 55000.

-

Neutral view if price remains between 55680–55875 with low volume.

💡 Pro tip: Watch HDFC Bank and ICICI Bank as sentiment leaders. A breakout in either may validate the broader trend in Bank Nifty.

🔹 Sensex – Chart Outlook

Sensex, often seen as a slower mover compared to Nifty and Bank Nifty, is showing signs of direction-setting behavior. On the 15-minute chart, support rests between 81100 and 80650, while resistance stands tall around 81450–81600.

🔻 Key Supports:

-

81100 – Strong demand zone; bulls likely to defend this on dips.

-

80650 – Last swing low; if breached, momentum could flip bearish.

🔺 Key Resistances:

-

81303 – Immediate overhead supply zone.

-

81450 – Crucial barrier; a breakout may see the index push toward 81600.

-

81600 – Final hurdle before fresh highs.

📌 Trading Strategy for Sensex:

-

Bullish move above 81450 can lead to 81600+ levels.

-

Bearish setup below 81100 toward 80800.

-

Intraday traders may watch for divergence with Nifty to spot reversals early.

🔮 Overall Market Sentiment for June 3, 2025

Markets are likely to open cautiously after Monday’s indecisive action. The 15-minute charts suggest tight ranges, but any breach of key support/resistance levels could trigger rapid intraday moves. Here’s the broader sentiment outlook:

-

📉 Bearish if Nifty breaks below 24465

-

📈 Bullish only above 24973 with volume

-

🧭 Sideways action likely if indices remain within highlighted bands in the first hour

🗣️ Volatility Alert: Watch for mid-day breakouts — 12:15 PM to 1:00 PM often sees trend continuation or reversal.

📌 Key Takeaways for Traders

-

🟢 Trade with confirmation, not anticipation.

-

📉 Protect capital in narrow ranges — use trailing SLs aggressively.

-

🧠 Avoid overtrading if price remains trapped between multiple zones.

-

🔔 Keep an eye on US Futures and SGX Nifty before the open.

Get a detailed 15-minute chart analysis of Nifty, Bank Nifty, and Sensex for June 3, 2025. Identify key support and resistance levels, trading strategies, and market outlook for intraday success.

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.