| Particular | Details |

|---|---|

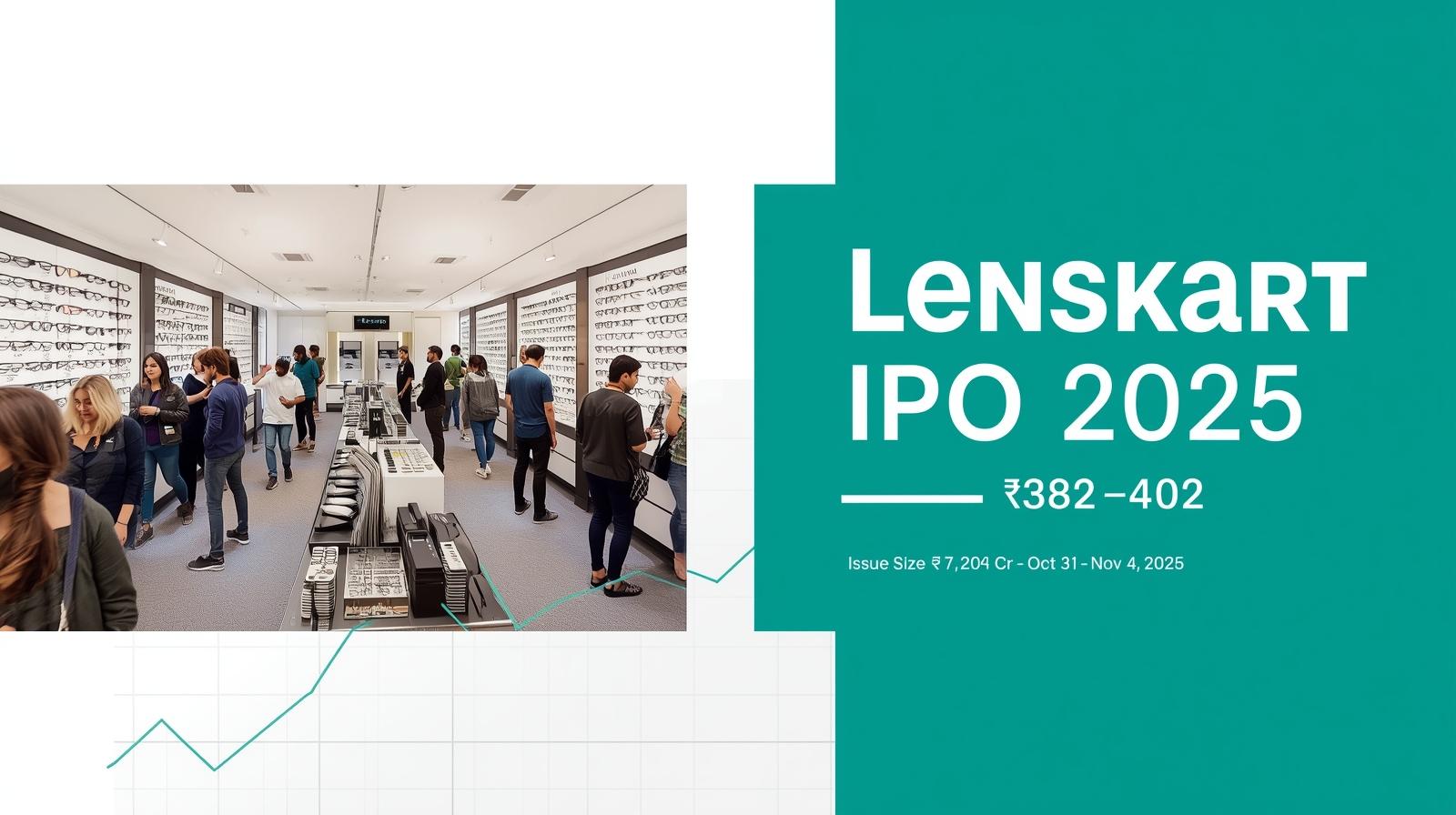

| Price Band | ₹382 – ₹402 per share |

| Total Issue Size | ₹7,278 crore (approx.) |

| Fresh Issue | ₹2,150 crore |

| Offer for Sale (OFS) | ₹5,128 crore |

| Lot Size | 37 shares per lot (minimum) |

| IPO Dates | Oct 31 – Nov 4, 2025 |

| Anchor Book | Oct 30, 2025 |

| Allotment Date | Nov 6, 2025 |

| Listing Date (Tentative) | Nov 10, 2025 |

| Lead Managers | Kotak Mahindra Capital, Morgan Stanley India, Avendus, Citigroup India, Axis Capital, Intensive Fiscal |

| Registrar | MUFG Intime India Pvt. Ltd. |

About Lenskart Solutions Ltd.

Founded in 2010 by Peyush Bansal, Lenskart has transformed from a digital eyewear startup into one of India’s most recognized omnichannel brands. With more than 2,000 stores in India and over 650 stores overseas, Lenskart operates across India, the Middle East, Singapore, and other global markets.

The company’s mission is to make eyewear affordable and accessible through a combination of technology-driven retail, vertically integrated manufacturing, and customer-centric experience. The brand’s success lies in its hybrid model — online convenience paired with offline service through physical stores and home eye-test services.

Why This IPO Is Significant

The Lenskart IPO marks one of India’s largest consumer-tech listings in 2025. It showcases how a digital-first brand has scaled into a profitable retail powerhouse.

The company aims to raise around ₹7,278 crore through a combination of:

- Fresh issue of ₹2,150 crore, to fund expansion and working capital, and

- Offer for Sale (OFS) of ₹5,128 crore, by existing shareholders including the founders and early investors such as SoftBank, Temasek, and Kedaara Capital.

This mix signals a major liquidity event for early backers while providing capital for continued growth.

Financial Performance (FY22–FY25)

Consolidated Income Statement Summary (₹ in crore)

| Financial Year | FY22 | FY23 | FY24 | FY25 |

|---|---|---|---|---|

| Revenue from Operations | 1,502 | 3,788 | 5,427.7 | 6,652.5 |

| EBITDA | (loss) | 404 | 560 (approx.) | 850 (est.) |

| Net Profit / (Loss) | (loss) | (64) | (10) | 297.3 |

Growth Overview

- Revenue has grown over 4× from FY22 to FY25.

- The company achieved its first consolidated profit in FY25, marking a major turnaround.

- Margins improved steadily due to operational efficiency, higher average order value, and better product mix.

Lenskart’s growth is driven by aggressive offline expansion, digital sales through its app and website, and increasing international presence.

Use of IPO Proceeds

The fresh issue of ₹2,150 crore will be utilized for:

- Store expansion across Tier-II and Tier-III cities.

- Investment in technology and supply chain infrastructure.

- Repayment of borrowings and general corporate purposes.

This focus on technology and distribution aligns with Lenskart’s strategy to strengthen its omnichannel dominance.

Promoter & Shareholding Structure

- Founders: Peyush Bansal and Neha Bansal.

- Key Investors (pre-IPO): SoftBank, Temasek, Kedaara Capital, Falcon Edge, and others.

- Founders and investors will partly divest through the OFS, signaling partial profit-taking while retaining long-term stakes.

Valuation & Peer Comparison

At the upper price band of ₹402, the implied market capitalization is around ₹69,500 crore ($7.9 billion).

In terms of revenue scale and brand recall, Lenskart competes indirectly with:

- Titan Eye+ (Titan Company)

- GKB Opticals

- Specsmakers

While Titan’s eyewear division is profitable, Lenskart’s growth pace and technology-led model give it an edge in scalability — though at a premium valuation multiple.

Key Strengths

✅ Strong Omnichannel Presence: Seamless integration of online and offline sales.

✅ Brand Loyalty: Lenskart has become a household name among millennials and Gen-Z consumers.

✅ Technology Leadership: AI-based lens fitting, 3D try-on, and digital prescription storage.

✅ Backward Integration: In-house lens manufacturing and global sourcing reduce dependency on vendors.

✅ Global Expansion: Strong performance in UAE, Singapore, and Saudi Arabia with ongoing expansion in Southeast Asia.

Risks & Concerns

⚠️ Large OFS Portion: Heavy promoter and investor selling could cause selling pressure post listing.

⚠️ Valuation Premium: Market expectations are high; any slowdown in growth may impact valuation.

⚠️ Operational Challenges: Managing over 2,000 stores and supply chain efficiency across regions.

⚠️ Competition: From Titan Eye+, local opticians, and emerging D2C eyewear startups.

⚠️ Global Expansion Risks: Currency fluctuations and regulatory hurdles in new markets.

Market Reception

The IPO has generated strong interest from institutional and retail investors, with early grey market signals indicating a healthy premium. Analysts anticipate robust participation from mutual funds and FPIs given Lenskart’s profitability and brand power.

However, market experts also highlight that listing gains could be limited due to the large OFS component.

How to Apply for the IPO

- Application Mode: ASBA through bank net banking, UPI-based broker platform, or direct application via online brokers.

- Lot Size: 37 shares per lot (minimum).

- Retail Investor Limit: 10% of total issue reserved for retail investors.

- Allotment Basis: Proportionate allocation depending on subscription levels.

- Listing Exchanges: NSE and BSE (expected).

Lenskart at a Glance

| Parameter | Details |

|---|---|

| Founded | 2010 |

| Headquarters | Gurugram, India |

| Business Model | Omnichannel eyewear retail |

| Products | Eyeglasses, contact lenses, sunglasses, accessories |

| Stores | 2,067 in India, 656 international |

| Employees | Over 8,000 |

| CEO | Peyush Bansal |

Analyst Outlook

Lenskart’s IPO is seen as a symbol of maturing Indian consumer-tech. The company’s transition from high-growth losses to sustainable profitability makes it appealing to investors looking for long-term growth in organized retail.

That said, investors must note that the company’s success depends on its ability to:

- Sustain profitability while expanding internationally.

- Maintain customer loyalty in an increasingly competitive eyewear market.

- Manage costs and operational complexity across 2,000+ locations.

Investor View — Balanced Take

- For long-term investors: Lenskart offers exposure to a high-growth consumer sector with global ambitions and strong brand equity.

- For short-term traders: Listing gains are possible but may be capped due to a large OFS and high valuation multiples.

- For conservative investors: Wait for quarterly results post-listing to confirm profit consistency before entering.

Retail Investor Checklist — “Should You Apply?”

1️⃣ Confirm IPO Details

- Price band ₹382–₹402

- Lot size 37 shares

- Retail portion 10%

2️⃣ Self-Check

- Are you comfortable holding for 12–24 months?

- Do you understand IPO risk vs. valuation premium?

3️⃣ Evaluate Fundamentals

- Revenue growth 4× in 3 years

- FY25 turned profitable (PAT ₹297 crore)

- High gross margins through backward integration

4️⃣ Risk Summary

- Large OFS by promoters

- High valuation vs peers

- Competitive landscape expanding rapidly

5️⃣ Investment Decision

- Short-term listing play: Moderate risk; gains possible if sentiment strong.

- Medium-term investor (1–3 years): Good opportunity if valuations stabilize post listing.

- Long-term investor (3+ years): Attractive business model, potential multibagger if profitability sustains.

Bottom Line

The Lenskart IPO is a milestone in India’s retail and consumer-tech evolution.

It combines:

- Strong fundamentals,

- Rapid revenue growth, and

- A powerful brand identity.

At the same time, it carries valuation risks and post-listing supply pressure due to the large OFS.

Investors seeking growth with calculated risk can consider participation, while conservative investors may choose to watch the listing and enter later at fair valuations.

Subscription:

| Date | Anchor | QIB | NII | BNII(>10l) | SNII(<10L) | Retail | EMPY | Total |

|---|---|---|---|---|---|---|---|---|

| Day-1 | 1 | 1.42 | 0.41 | 0.30 | 0.63 | 1.32 | 1.10 | 1.13 |

| Day-2 | 1 | 1.64 | 1.89 | 1.64 | 2.38 | 3.35 | 2.62 | 2.02 |

| Day-3 | 1 | 40.36 | 18.23 | 21.81 | 11.06 | 7.56 | 4.96 | 28.27 |

GMP Trend:

| Date | GMP |

|---|---|

| 31 Oct 2025 | ₹95.00(23.63%) |

| 03 Nov 2025 | ₹59.00(14.68%) |

| 04 Nov 2025 | ₹44.00(10.95%) |

It should be noted that IPO GMP is subject to extreme volatility, so an investment decision based solely on Patel Retail IPO GMP will prove risky. Therefore, before to investing, consider all factors and make the right investment decision whether to invest in Patel Retail IPO or not.

How to Check IPO Allotment Status:

MUFG Intime

To check IPO allotment status, follow the steps below:

- Click on the below allotment status check button.

- Select Company Name.

- Enter your PAN Number, Application Number or DP Client ID (Anyone).

- Click on Search.

NSE Website

To check IPO allotment status, follow the steps below:

- Click on the below allotment status check button.

- Select Company Name.

- Enter your PAN Number, Application Number or DP Client ID (Anyone).

- Click on Search.

BSE Webiste

To check IPO allotment status, follow the steps below:

- Click on the below allotment status check button.

- Select Company Name.

- Enter your PAN Number, Application Number or DP Client ID (Anyone).

- Click on Search.

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

Market Snapshot: Bulls Return on Global Cues & Trade Deal Optimism

Indian Stock Market| Nifty 50| Sensex| Bank Nifty| Axis Bank| India-EU FTA| Stock Market News| Market Wrap| Jan 27 2026…

-

India-EU FTA 2026: The “Mother of All Deals” Sealed – In-Depth Analysis

India EU FTA 2026| India EU Trade Deal| Tariff cuts India EU| CBAM India EU agreement| India EU Services Trade…

-

Hindustan Zinc OFS Review 2026: Vedanta to Offload ₹4,500 Cr Stake

Hindustan Zinc OFS Review| Vedanta Limited| HINDZINC| Stock Market News| Dividend Stocks| Silver Rally| Zinc Prices| Offer For Sale| High…

-

Weekly Market Intelligence: 10 Stocks to Watch

Top 10 Stocks| Top 10 Stocks to Watch| Market Analysis As the Indian markets navigate a period of heightened volatility…

-

Lesson 19 – KEY RATIOS |Deep Dive into PE, PB, ROE & DE

Key Ratios| Stock Market Basics| PE Ratio| PB Ratio| ROE| Debt Equity Ratio| Fundamental Analysis| Investing for Beginners Introduction| Part-1/3…