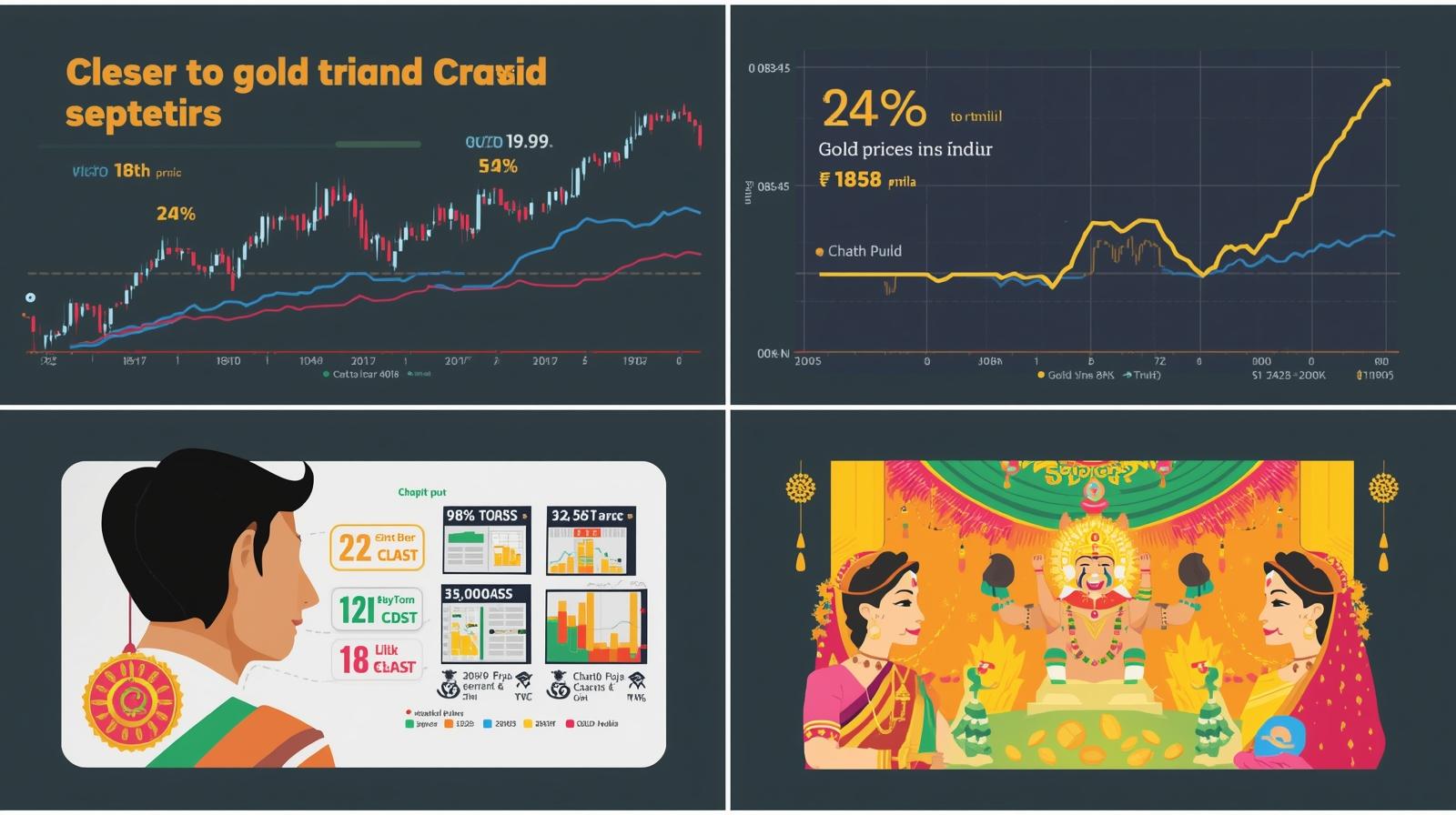

The gold market in India experienced a sharp fall recently, what is it gold price crash? marking one of the steepest declines in recent years. Investors saw a gold price crash today, causing panic among short-term traders and gold enthusiasts. In this report, we analyze why gold prices fell, current rates for 24K, 22K, and 18K gold, and provide actionable insights for investors.

📉 Why Gold Prices Crashed Today

Several factors contributed to the recent gold price decline:

- Profit Booking by Investors – After a prolonged rally, many investors cashed in on gains.

- Stronger US Dollar – A rising dollar reduced gold’s appeal as an investment.

- Geopolitical Stability – Easing global tensions lowered safe-haven demand for gold.

- US Federal Reserve Rate Speculations – Anticipation of a rate cut affected gold prices negatively.

On October 23, 2025, gold prices dropped over 6%, marking the worst single-day fall since 2013.

📈 Partial Recovery on October 25, 2025

Gold prices rebounded slightly due to festival demand and global market stabilization:

| Gold Type | Price per Gram | Price per 10 Grams |

|---|---|---|

| 24K | ₹12,562 | ₹1,25,620 |

| 22K | ₹11,515 | ₹1,15,150 |

| 18K | ₹9,422 | ₹94,220 |

Demand surged during Chhath Puja, helping gold recover from last week’s sharp decline.

Current Gold Market Update (October 26, 2025)

- 24K Gold: ₹12,562 per gram

- 22K Gold: ₹11,515 per gram

- 18K Gold: ₹9,422 per gram

Market analysts suggest short-term volatility is expected, influenced by global economic indicators, US monetary policy, and festival season demand.

🔍 Gold Investment Insights

If you’re considering investing in gold:

- Physical Gold: Ensure purity and secure storage.

- Gold ETFs: Provides liquidity and easy trading.

- Sovereign Gold Bonds (SGBs): Offer interest but were discontinued after 2024.

Experts recommend consulting a financial advisor before investing, especially during volatile market periods.

💡 Key Takeaways

- Gold rate today saw a sharp crash but is partially recovering.

- 24K, 22K, 18K gold prices are still higher than last year’s average.

- Profit booking, dollar strength, and geopolitical stability were major reasons for the fall.

- Festival demand is likely to support prices in the short term.

- Investors should balance risk and opportunity before making new purchases.

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)