Company Overview: Game Changers Texfab Ltd.

Game Changers Texfab Ltd. is an emerging player in India’s technical and specialty textile sector, engaged in the trading and processing of a wide range of fabrics — including technical, coated, and fashion fabrics used in garments, furnishings, and outdoor materials.

The company follows an asset-light business model, outsourcing much of its manufacturing to partner units, while focusing on design, quality control, and marketing. This approach allows flexibility and better capital management — a crucial advantage in a competitive textile environment.

With the Indian textile industry expected to touch USD 350 billion by 2030, the company aims to strengthen its presence across domestic and export markets.

💰 IPO Details

| Particular | Details |

|---|---|

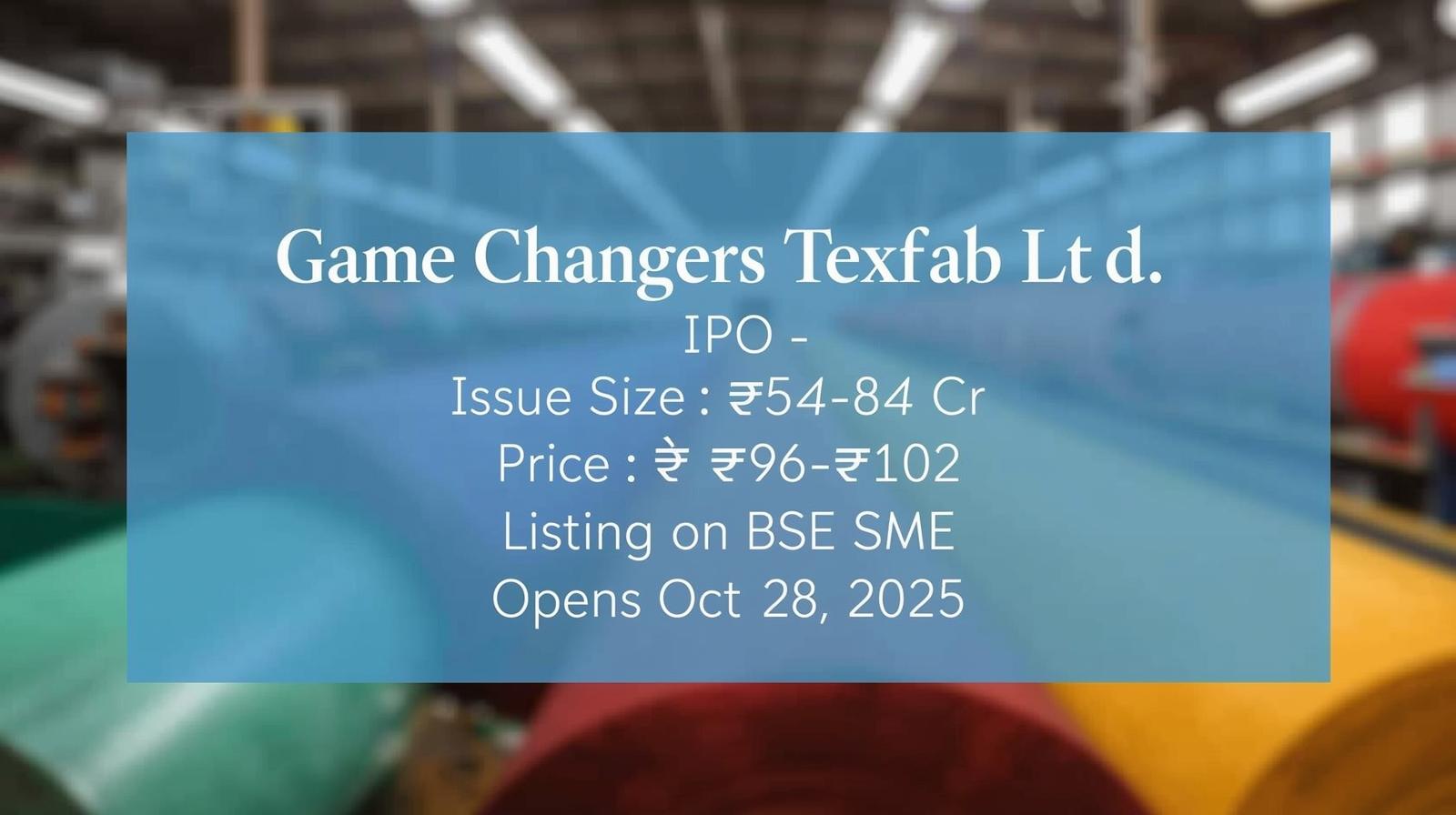

| Issue Type | Book-Built Issue (SME IPO) |

| Issue Size | ₹54.84 crore |

| Face Value | ₹10 per share |

| Price Band | ₹96 to ₹102 per share |

| Market Lot | 1,200 shares |

| Minimum Investment (Retail) | ₹1,22,400 per lot (approx.) |

| Issue Opens | 28 October 2025 |

| Issue Closes | 30 October 2025 |

| Basis of Allotment | 31 October 2025 |

| Credit of Shares / Refunds | 3 November 2025 |

| Listing Date | 4 November 2025 |

| Exchange | BSE SME |

| Lead Manager | Corpwis Advisors Pvt. Ltd. |

| Registrar | Skyline Financial Services Pvt. Ltd. |

📊 Financial Performance Snapshot

| Financial Year | Revenue (₹ Cr) | Profit After Tax (₹ Cr) | EPS (₹) |

|---|---|---|---|

| FY2023 | 97.86 | 4.21 | 6.85 |

| FY2024 | 115.59 | 6.12 | 9.64 |

| FY2025 (Est.) | 124.75 | 7.45 | 10.31 |

Highlights:

- Revenue grew by ~18% YoY in FY2024.

- PAT margin improved due to cost optimization and product mix changes.

- Return on Net Worth (RoNW) stood near 24%, which is strong for an SME textile player.

- Debt-to-equity ratio remains under 0.5, indicating healthy financial leverage.

🎯 IPO Objectives

The company plans to utilize the IPO proceeds for:

- Working Capital Requirements – to support increased production and trading scale.

- Capital Expenditure – for technology enhancement and production automation.

- General Corporate Purposes – brand expansion, marketing, and distribution improvement.

- Potential Strategic Acquisitions – in allied textile verticals to boost capacity and margins.

📈 Subscription Status

On the final day of the issue:

- Overall Subscription: 1.17x

- Retail Category: 1.18x

- NII (HNI) Category: 1.48x

- QIB Category: 1.01x

This moderate oversubscription suggests steady but cautious investor interest — typical for quality SME listings with niche potential.

⚙️ Industry Outlook

India’s textile sector is witnessing a revival post-pandemic, with strong export demand and rising domestic consumption. Technical textiles, a segment where Game Changers operates, is expected to grow at a CAGR of 12–14% over the next five years due to demand from infrastructure, automotive, and medical sectors.

However, challenges such as fluctuating raw material costs, import competition, and dependency on external suppliers remain key risks.

🧩 Strengths

- Asset-light business model supports scalability.

- Steady revenue and profit growth.

- Diversified product portfolio catering to multiple textile segments.

- Experienced management with industry expertise.

- Strategic use of proceeds toward working capital and expansion.

⚠️ Risks & Weaknesses

- SME listing may lead to low post-listing liquidity.

- Exposure to volatile fabric prices and global demand swings.

- Limited operating history as a listed entity.

- High retail investment per lot may deter small investors.

💹 Valuation Check

At the upper price band of ₹102 and FY2024 EPS of ₹9.64, the P/E ratio stands around 10.6x, which is reasonable compared to peers like Monte Carlo (P/E ~15x) and Sangam India (P/E ~13x).

This suggests that the IPO is fairly valued given its growth trajectory, though it carries the usual SME risk premium.

📊 Peer Comparison

| Company | P/E Ratio | FY24 PAT Margin | Segment |

|---|---|---|---|

| Game Changers Texfab Ltd. | 10.6x | 5.3% | Technical / Specialty Textiles |

| Sangam India Ltd. | 13.2x | 6.5% | Textiles & Yarn |

| Monte Carlo Fashions | 15.4x | 8.1% | Apparel / Fabrics |

| Ruby Mills Ltd. | 12.7x | 5.8% | Fabrics / Technical Textiles |

💬 Analyst View

Game Changers Texfab’s IPO offers a balanced mix of growth potential and valuation comfort. While it may not see explosive listing gains due to its SME nature, the company’s improving margins, strong RoNW, and capital-light model make it a fair medium-term bet for investors seeking exposure to the textile growth story.

Listing gains expectation: Moderate (5–10%)

Long-term outlook: Positive if execution and scale-up continue as planned.

🧭 Final Verdict

| Category | Verdict |

|---|---|

| Valuation | ✅ Fairly Priced |

| Financial Growth | ✅ Strong |

| Risk Level | ⚠️ Moderate |

| Listing Potential | ⚙️ Stable-to-Positive |

| Long-term Potential | 👍 Promising for patient investors |

Recommendation: “Apply with a medium-term horizon” — investors comfortable with SME volatility may consider partial exposure.

📆 Key Dates at a Glance

| Event | Date |

|---|---|

| IPO Opens | 28 October 2025 |

| IPO Closes | 30 October 2025 |

| Allotment | 31 October 2025 |

| Refund / Credit | 3 November 2025 |

| Listing | 4 November 2025 |

Subscription:

| Investor | 27 Oct 2025 | 28 Nov 2025 | 30 Nov 2025 |

|---|---|---|---|

| Anchor | 1 | 1 | 1 |

| QIB | 00 | 0.06 | 1.01 |

| Non-Institutional | 0.40 | 0.43 | 1.48 |

| BNII | 0.57 | 0.26 | 1.46 |

| SNII | 0.08 | 0.76 | 1.52 |

| Retail | 0.40 | 0.66 | 1.18 |

| Total | 0.24 | 0.38 | 1.17 |

GMP Trend:

| Date | GMP |

|---|---|

| 27 Oct 2025 | ₹0.00(0.00%) |

| 28 Nov 2025 | ₹0.00(0.00%) |

| 29 Nov 2025 | ₹0.00(0.00%) |

It should be noted that IPO GMP is subject to extreme volatility, so an investment decision based solely on Patel Retail IPO GMP will prove risky. Therefore, before to investing, consider all factors and make the right investment decision whether to invest in Patel Retail IPO or not.

How to Check IPO Allotment Status:

Skyline Fin. Ser. Ltd

To check IPO allotment status, follow the steps below:

- Click on the below allotment status check button.

- Select Company Name.

- Enter your PAN Number, Application Number or DP Client ID (Anyone).

- Click on Search.

NSE Website

To check IPO allotment status, follow the steps below:

- Click on the below allotment status check button.

- Select Company Name.

- Enter your PAN Number, Application Number or DP Client ID (Anyone).

- Click on Search.

BSE Webiste

To check IPO allotment status, follow the steps below:

- Click on the below allotment status check button.

- Select Company Name.

- Enter your PAN Number, Application Number or DP Client ID (Anyone).

- Click on Search.

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

Market Snapshot: Bulls Return on Global Cues & Trade Deal Optimism

Indian Stock Market| Nifty 50| Sensex| Bank Nifty| Axis Bank| India-EU FTA| Stock Market News| Market Wrap| Jan 27 2026…

-

India-EU FTA 2026: The “Mother of All Deals” Sealed – In-Depth Analysis

India EU FTA 2026| India EU Trade Deal| Tariff cuts India EU| CBAM India EU agreement| India EU Services Trade…

-

Hindustan Zinc OFS Review 2026: Vedanta to Offload ₹4,500 Cr Stake

Hindustan Zinc OFS Review| Vedanta Limited| HINDZINC| Stock Market News| Dividend Stocks| Silver Rally| Zinc Prices| Offer For Sale| High…

-

Weekly Market Intelligence: 10 Stocks to Watch

Top 10 Stocks| Top 10 Stocks to Watch| Market Analysis As the Indian markets navigate a period of heightened volatility…

-

Lesson 19 – KEY RATIOS |Deep Dive into PE, PB, ROE & DE

Key Ratios| Stock Market Basics| PE Ratio| PB Ratio| ROE| Debt Equity Ratio| Fundamental Analysis| Investing for Beginners Introduction| Part-1/3…