Company Overview

United Breweries Ltd (UBL) stands tall as India’s dominant beer manufacturer, celebrated for its iconic Kingfisher brand. Headquartered in Bangalore and tracing its heritage back to 1915, UBL became the market leader in India’s alcoholic beverage space with a robust portfolio, a wide brewery network, and the strategic leadership of majority owner Heineken N.V.. Currently, Vivek Gupta steers the company as Managing Director and CEO.

UBL owns over 40-50% market share in India’s beer segment, supported by a network of more than 70 breweries and bottling facilities. Its brand portfolio spans across value and premium categories, including Kingfisher Ultra, Heineken, Amstel, and Breezer.

🌾 Recent Strategic Moves & Brewing Challenges

✅ Premiumisation Focus

One of the central pillars of UBL’s growth story is its aggressive push towards premium beer consumption. Brands like Heineken Silver and Kingfisher Ultra witnessed over 40%+ volume growth in FY25-Q4 and Q1 FY26, catering to evolving urban consumers seeking quality and lifestyle upgrades.

❌ Brewery Rationalisation: Mangalore Unit Closure

In a significant operational shift, UBL decided to shut down its Mangalore brewery by June 30, 2025, citing structural rationalisation. The focus will now shift to expanding the Nanjangud facility near Mysuru, aimed at cost optimization and consolidation.

⚠️ Telangana Excise Dispute

A key regulatory challenge surfaced in Telangana, where the company suspended beer supply in January 2025 due to the state government’s failure to implement price revisions and clear pending dues. This led to a 7% intraday fall in UBL’s stock. However, after intense negotiations, beer supply resumed mid-January, leading to a strong rebound in share price.

UBL management has emphasized the need for fair regulatory practices across states, especially in Karnataka and Telangana, where excessive raids, licensing delays, and pricing bottlenecks hamper operations.

📊 Financial Snapshot

FY25 Summary:

- Revenue: ₹4,427 crore (YoY -7.5%)

- Net Profit: ₹97.8 crore (YoY +19.9%)

- EBITDA Margin: Improved on cost efficiencies and premium mix

Q1 FY26 (April-June 2025):

- Net Profit: ₹184 crore (YoY +5.9%)

- Revenue Decline: -7.4% due to sluggish volumes in economy segments

- Premium Volume Growth: 46%+ YoY

Q3 FY25 (Oct-Dec 2024):

- Profit Decline: -25% YoY due to consumer spending pressure

- Severance Charges: One-time hit of ₹2.57 crore

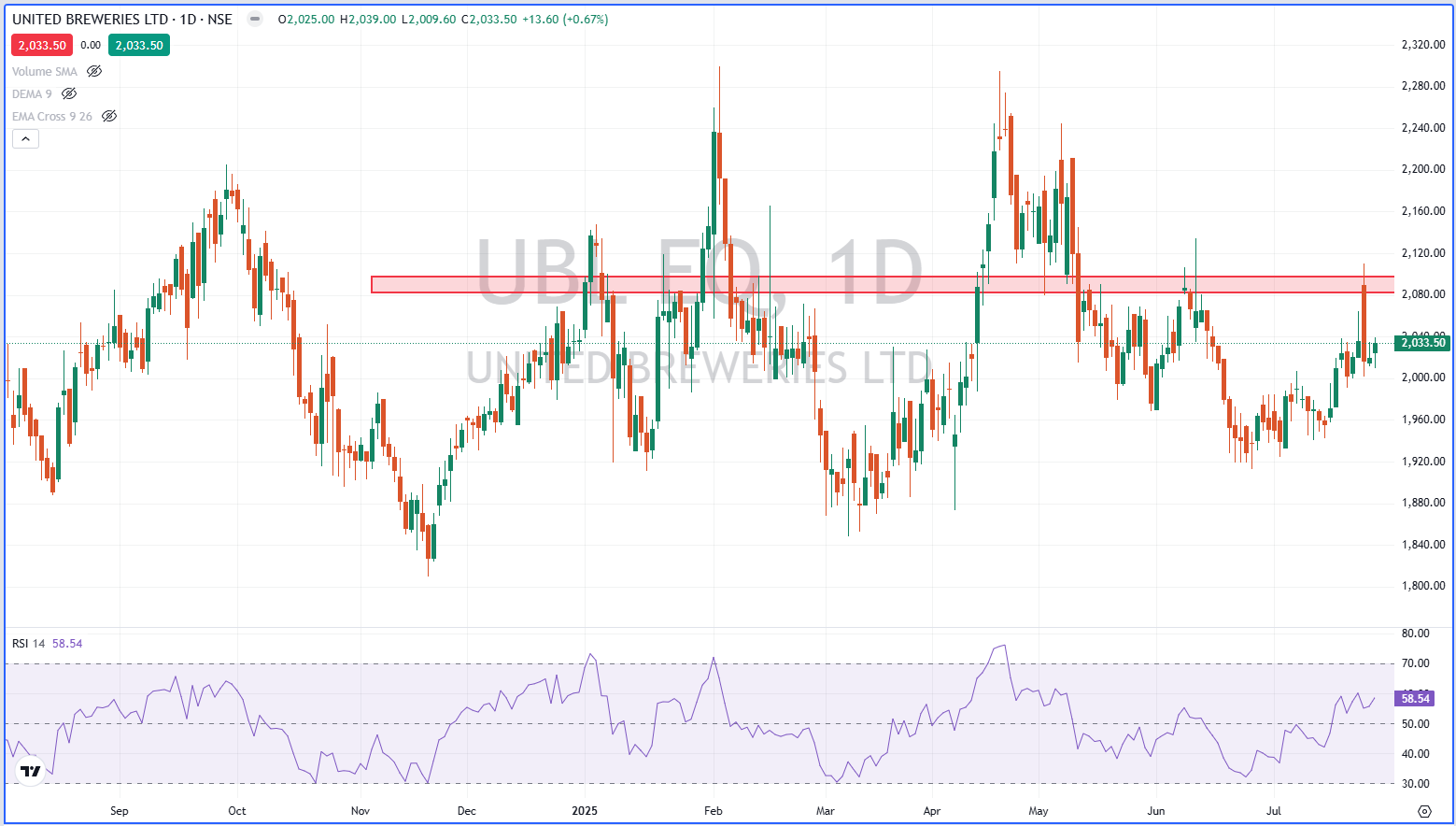

📊 United Breweries Share Price Today

As of July 27, 2025, UBL shares trade near ₹2009.60 – ₹2039.00 range, down from the 52-week high of ₹2,178. Analysts forecast range-bound movement in the near term, with upside dependent on:

- Regulatory clarity in Telangana & Karnataka

- Premium segment volume growth

- Post-Mangalore unit cost optimization impact

Brokerages like ICICI Securities and Jefferies maintain a “Hold” or cautious “Buy” rating with long-term targets between ₹2,000 – ₹2,250.

📊 Technical Indicators

- RSI: 56 (Neutral)

- MACD: Slight positive divergence

- 200-DMA: ₹1,745 acting as support

- Chart Pattern: Sideways consolidation with a possible breakout near ₹1,830

📊 Shareholder Structure

- Heineken N.V.: 61.5%

- Retail & DIIs: ~25%

- FIIs: ~13.5%

🌾 Retail Investors – What to Watch

Retail investors looking at United Breweries must weigh:

- Stability of the beer market vs. regulatory volatility

- Long-term premiumization opportunity

- Dividend stability and parent backing from Heineken

United Breweries remains a low-debt, high-cash consumption play ideal for long-term investors seeking exposure to India’s evolving lifestyle and premium drinking habits.

🔄 Conclusion: A Toast to the Future?

With robust branding, Heineken’s global guidance, and a calibrated premium product strategy, UBL is positioned for growth, albeit through regulatory fog. Retail investors should track Q2 performance, Nanjangud capacity updates, and any policy actions in South Indian states.

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.