Nifty today| Bank Nifty update| Midcap Nifty analysis| Fin Nifty performance| Indian stock market news| Nifty 50 prediction| Bank Nifty outlook| NSE index update| Indian stock market forecast| Nifty support resistance| Midcap rally India| NSE indices today| Indian equity market update| stock market trends India| financial market news India

Market Overview (10 November 2025)

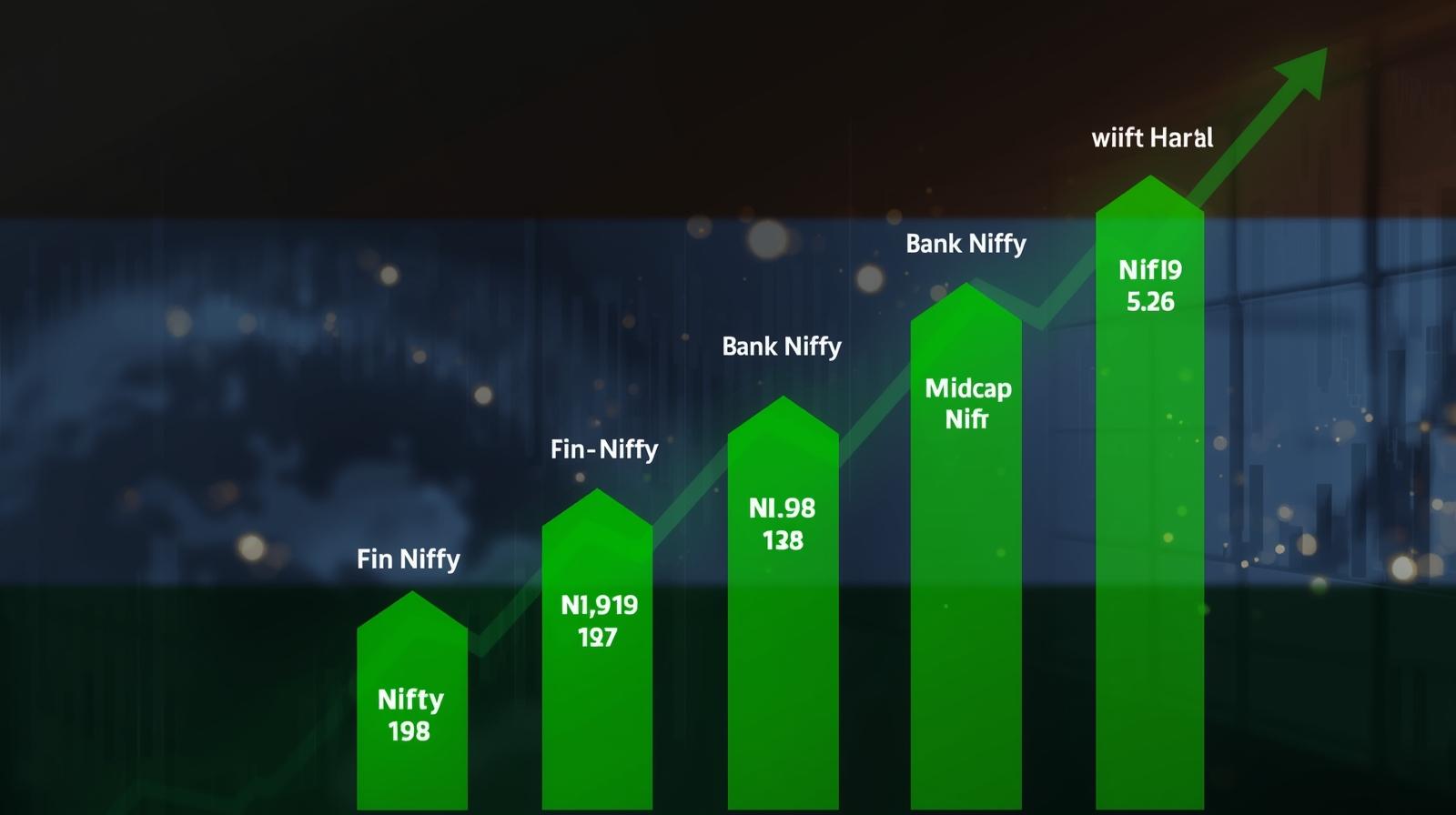

The Indian equity market ended the day on a positive yet cautious note, led by broad-based buying across large-cap and midcap segments. Key benchmark indices — Nifty 50, Bank Nifty, Fin Nifty, and Midcap Nifty — all traded in the green, supported by firm global cues and stable domestic flows.

The Nifty 50 index climbed 82.05 points (+0.32%) to close at 25,574.35, comfortably above the crucial 25,500 mark. The rally was driven mainly by strength in IT, FMCG, and select auto stocks, though the overall breadth remained slightly narrow.

📈 Index Performance Snapshot

| Index | Current Price | Change (Points) | % Change | Open | High | Low | Previous Close |

|---|---|---|---|---|---|---|---|

| NIFTY 50 | 25,574.35 | ▲ 82.05 | +0.32% | 25,503.50 | 25,653.45 | 25,503.50 | 25,492.30 |

| BANK NIFTY | 57,937.55 | ▲ 60.75 | +0.10% | 57,846.20 | 58,097.20 | 57,846.20 | 57,876.80 |

| FIN NIFTY | 27,305.05 | ▲ 66.30 | +0.24% | 27,247.40 | 27,390.50 | 27,222.10 | 27,238.75 |

| MIDCAP NIFTY | 13,527.40 | ▲ 80.65 | +0.60% | 13,473.30 | 13,566.70 | 13,443.50 | 13,446.75 |

🔍 Detailed Market Insights

1️⃣ NIFTY 50: Consolidation Above 25,500

Nifty remained steady throughout the session, supported by gains in IT, Auto, and FMCG.

The index has shown resilience near 25,500 — a key support zone — indicating buyers are active at lower levels.

- Support: 25,480 – 25,500

- Resistance: 25,650 – 25,750

- View: Positive bias; likely to test 25,700–25,750 if momentum sustains.

Lesson 8: The Four Faces of the Stock Market

2️⃣ BANK NIFTY: Sideways with Mild Positivity

Bank Nifty moved within a tight range, reflecting mild profit booking in leading private banks. PSU banks held firm, while major gainers included SBI and ICICI Bank.

- Support: 57,750

- Resistance: 58,150

- View: Range-bound; breakout above 58,100 can trigger upward momentum.

3️⃣ FIN NIFTY: Financials Stable

The Financial Services index moved modestly higher, aided by NBFCs and select insurance majors.

Market experts suggest continued accumulation in quality financials despite valuation concerns.

- Support: 27,200

- Resistance: 27,420

- View: Stable; accumulation visible at lower levels.

4️⃣ MIDCAP NIFTY: Outperformer of the Day

Midcap stocks led the rally with a 0.60% gain, reflecting investor confidence in broader market themes.

Analysts note strong buying in capital goods, industrials, and consumer durables.

- Support: 13,450

- Resistance: 13,600

- View: Bullish; momentum to continue if volume remains strong.

Nifty today| Bank Nifty update| Midcap Nifty analysis| Fin Nifty performance| Indian stock market news| Nifty 50 prediction| Bank Nifty outlook| NSE index update| Indian stock market forecast| Nifty support resistance| Midcap rally India| NSE indices today| Indian equity market update| stock market trends India| financial market news India

🌍 Broader Market & Global Context

- Global equities traded firm, led by gains in Asian and European markets, providing positive cues for domestic sentiment.

- Crude oil remained below $83/barrel, offering comfort to import-heavy sectors.

- The rupee stayed stable near ₹83.10 per dollar, adding further market stability.

- Foreign Institutional Investors (FIIs) were net buyers in recent sessions, indicating renewed interest in Indian equities.

🧮 Fundamental & Valuation Metrics

According to NSE data:

- Nifty 50 P/E ratio: ~23.2

- Nifty 50 P/B ratio: ~3.36

- TTM EPS: ~1,138.38

These metrics suggest valuations remain elevated, though consistent earnings growth could justify the levels.

💬 Analyst View & Breadth Concerns

Despite headline indices making new highs, about 60% of NSE 500 stocks still trade over 20% below their 2024 highs, pointing to narrow market breadth.

Analysts advise focusing on quality midcaps and large financials for near-term positioning while avoiding overleveraged counters.

🧭 Tomorrow’s Market Prediction (11 November 2025)

📉 Short-Term Outlook:

- Nifty likely to open mildly positive if global cues remain steady.

- The index could trade in the 25,500–25,700 zone with 25,480 acting as key intraday support.

- A close above 25,700 may open the path toward 25,800–25,850 in the near term.

💰 Stock Focus for Tomorrow:

- Positive Bias: HDFC Bank, Infosys, Maruti Suzuki, Tata Motors, Larsen & Toubro

- Watchlist for Breakouts: Persistent Systems, Dixon Technologies, GMR Infra

⚙️ Investor Strategy

- Traders: Use dips near support zones (25,500 on Nifty) for long entries with tight stop-losses.

- Investors: Continue selective accumulation in quality midcaps and financials.

- Avoid: Over-trading in volatile small caps and highly leveraged sectors.

📊 Technical Summary

| Index | Bias | Support | Resistance | Outlook |

|---|---|---|---|---|

| Nifty 50 | Bullish | 25,480 | 25,750 | Positive |

| Bank Nifty | Neutral | 57,750 | 58,150 | Range-bound |

| Fin Nifty | Mild Bullish | 27,200 | 27,420 | Stable |

| Midcap Nifty | Strong Bullish | 13,450 | 13,600 | Uptrend |

💡 Key Takeaways

- Midcaps leading the rally — clear outperformance signal.

- Nifty consolidating above 25,500 — indicates strength.

- Banking index stable — no major breakdown visible.

- Broader market participation likely to improve in coming sessions.

📢 Join Our Market Community

📱 Stay updated on IPOs, Results & Market News:

- WhatsApp Channel: Join Now

- Telegram: Follow Updates

- Arattai: Connect with Us

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

The Tariff Tussle: Decoding the Legal Challenge to Executive Trade Power

Supreme Court| Tariffs| Trade War 2026| Donald Trump| IEEPA| Section 301| US Economy| Import Duties| Constitutional Law| Reciprocal Trade Act…

-

The 2025-26 Market Journey: From All-Time Highs to the “Retail Trap” Panic

Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks|…

-

Indian Stock Market Update Feb 20: Nifty Reclaims 25,550, Sensex Jumps 316 Pts Amid Global Cues

Indian Stock Market Update Feb 20| Nifty 50 today| Sensex closing| Top gainers and losers Market Snapshot: The Bulls Fight…

-

Indian Stock Market Today: Bulls Charge Ahead as Sensex and Nifty Rally on Banking & IT Strength

# Indian Stock Market Today: Sensex and Nifty Close Higher Amid Broad-Based Buying ## Indian Stock Market Report – Updated…

-

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown Trending Keywords: YouTube down, YouTube…

-

Global Market Update 2026: Equities, Commodities, and Indian Rupee Outlook

Comprehensive 2026 global market update covering equities, commodities, bond markets, US Dollar trends, and detailed Indian Rupee outlook with investment themes and risks.