Index Overview: Nifty 50’s Critical Turning Point

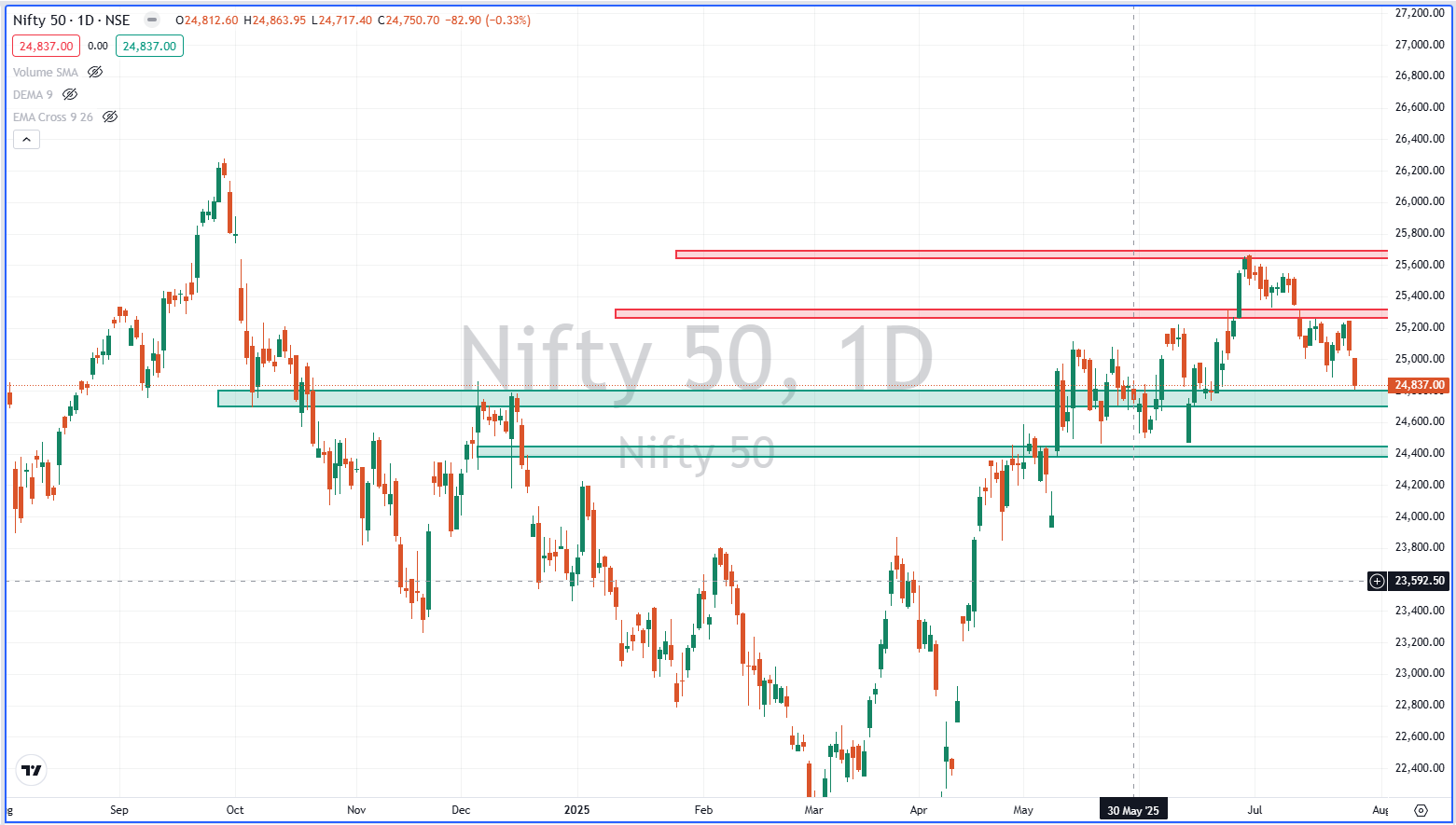

As of 21 July 2025, the Nifty 50 has once again approached a crucial support zone of 24,800, after witnessing consistent rejection from higher levels near 25,550–25,800. This technical level has now become a battleground between bulls and bears. The recent price action and candlestick behavior are hinting at rising selling pressure, with the index entering a short-term consolidation or even a possible downward breakout.

With the broader structure indicating a distribution pattern, it’s essential to analyze the upcoming movement from a support-resistance and price action point of view. Let’s dive deep into what the chart is telling us.

🧭 Key Levels to Watch (Support & Resistance)

| Type | Price Zone | Significance |

|---|---|---|

| 🔻 Resistance 1 | 25,200 – 25,300 | Immediate resistance post rejection |

| 🔻 Resistance 2 | 25,550 – 25,800 | Strong supply zone; recent highs |

| 🟢 Support 1 | 24,800 | Immediate & psychological support |

| 🟢 Support 2 | 24,600 – 24,400 | Historical buying zone; breakdown if breached |

| ⚠️ Breakdown Point | Below 24,400 | Trend reversal & deeper correction likely |

📉 Current Price Structure – Bearish Setup in Progress?

❗ Price Behavior:

-

The index formed multiple red candles, showing rejection at upper resistance.

-

It is trading below short-term moving averages on lower timeframes

-

There’s a visible lower high structure, suggesting a short-term downtrend.

❗ Chart Patterns Noticed:

-

Double Top like formation near 25,800

-

Descending channel formation from July highs

-

Support retest at 24,800 (currently under threat)

These technical factors are increasing the possibility of a breakdown below 24,800, which may trigger further selling pressure, especially from FIIs or short-term institutional traders.

🧠 What This Means for the Market?

If 24,800 fails to hold, it could result in:

-

A quick move toward 24,600, which previously acted as strong support.

-

If 24,600 also cracks, then 24,400 becomes the line of last defense for bulls.

-

On the flip side, any reversal above 25,050 must be accompanied by strong volume and bullish candlestick reversal — else it will be short-lived.

📅 Next Day Movement Projection – 28 July 2025

🔽 Bearish Scenario – Most Likely:

-

A break and close below 24,800 may drag Nifty toward:

-

📍 First Target: 24,600

-

📍 Second Target: 24,400

-

Probability: 65%

Bias: Bearish

Action: Short below 24,800 with SL above 25,000

🔁 Range-Bound Bounce – Neutral Case:

-

If 24,800 holds, expect a sideways bounce up to:

-

📍 Resistance: 25,050 – 25,100

-

Probability: 25%

Bias: Sideways

Action: Avoid fresh positions; consider intraday range trades.

🔼 Bullish Reversal – Least Likely:

-

Only on break above 25,200 with volume, Nifty may aim for:

-

📍 25,500 and eventually 25,800 (very unlikely without news trigger)

-

Probability: 10%

Bias: Reversal

Action: Wait-and-watch; confirm breakout with price action.

🧮 Retail Trader Takeaways

✅ If You’re a Swing Trader:

-

Bearish bias remains intact as long as Nifty stays below 25,000.

-

Shorting opportunities may arise below 24,800 with tight stop-losses.

-

No buying until reversal signal above 25,200 is confirmed.

✅ If You’re a Positional Trader:

-

Monitor 24,600 closely – a breakdown below this would indicate short-term trend reversal.

-

Option writers may look at 24,600 PE & 25,200 CE as sell zones for a range-bound week.

✅ If You’re a Day Trader:

-

Use the 24,800 level as your pivot:

-

Below = Short with 24,600 as first target.

-

Hold above = Scalp longs till 25,050.

-

📊 Broader Market Sentiment – Cooling Off Phase

-

Sectoral indices like Bank Nifty, Nifty IT, and Nifty Midcap are showing mixed signals.

-

FIIs have recently turned mild net sellers.

-

VIX remains stable, indicating no panic yet — but complacency near key support is dangerous.

Unless major positive news or earnings surprise come in, the broader market may enter a consolidation-to-correction mode.

🔍 Volume Analysis

-

Recent down days have shown higher-than-average volumes.

-

This indicates that smart money might be exiting or shorting, especially near resistance.

-

No accumulation patterns visible yet near current support levels.

📈 Indicators Watch

| Indicator | Signal (Assumed) | Interpretation |

|---|---|---|

| RSI (Daily) | ~45–50 | Neutral to Bearish |

| MACD | Bearish Crossover (likely) | Momentum losing upside |

| 20-DMA | Flat/Turning Down | Short-term weakness |

| 50-DMA | Below CMP (rising slowly) | Medium-term support at ~24,600 |

💬 Expert Technical View

“The failure to sustain above 25,300 is a red flag. Until Nifty decisively reclaims 25,200+, any upward move will be sold into. Traders must be cautious and avoid aggressive longs near resistance zones.”

📢 What Should You Do?

“Markets are showing signs of caution and possible reversal. Wait for decisive moves. Let price confirm direction — don’t pre-empt. For now, short trades near resistance with defined SLs are safer than aggressive longs.”

Action Plan:

-

Shorting levels: Below 24,800

-

Long trades: Only above 25,200 with confirmation

-

Avoid: No-trade zones (24,850–25,050) – too much chop expected

-

Options Strategy: Iron Condor (24,600 PE – 25,200 CE) for rangebound expiry play

🧲 Final Thoughts

The Nifty 50 is at a make-or-break juncture. If it holds 24,800, there might be a temporary bounce. But if it breaks down, expect a sharper slide toward 24,400. Given the weak candle patterns and inability to scale 25,300, the market is showing classic signs of short-term fatigue.

Traders should stay light, stay alert, and avoid being caught in no-man’s-land.

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.