Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks| Retail Investor Strategy 2026

Critical Dates Table: FY 2025-26 Market Milestone

| Event | Date | Market Impact |

| Beginning of FY26 | April 1, 2025 | Nifty at ~23,300 (Bullish Start) |

| All-Time High Peak | Nov 2025 | Sensex touched 85,706 |

| The “Budget Shock” | Feb 1, 2026 | STT Hike on Derivatives (Sharp Sell-off) |

| Current Volatility | Feb 20, 2026 | Nifty ~25,400 (Consolidation Phase) |

The Big Picture: You Are Not Trapped, You Are in a “Correction”

Looking back at the full year starting April 1, 2025, the Indian market has actually delivered a 10-11% return for the Nifty and Sensex. However, because the market saw a massive rally toward the end of 2025 (reaching record highs in November), the recent 5-7% dip in early 2026 feels like a “trap” for those who entered late.

1. The Horizon Reality Check

You must ask yourself: Did you invest for a year, or for a life?

- The 1-Year View: If you invested on April 1, 2025, you are still likely in the green by nearly 10%.

- The 5-Year Vision: Your 5-year plan should not be derailed by a 2-month panic. Real wealth in India is built by participating in the GDP growth story, which is still projected to be a robust 7% for the coming year.

2. The 3-Quarter Earnings Filter

The market is currently punishing “hope,” but rewarding “performance.”

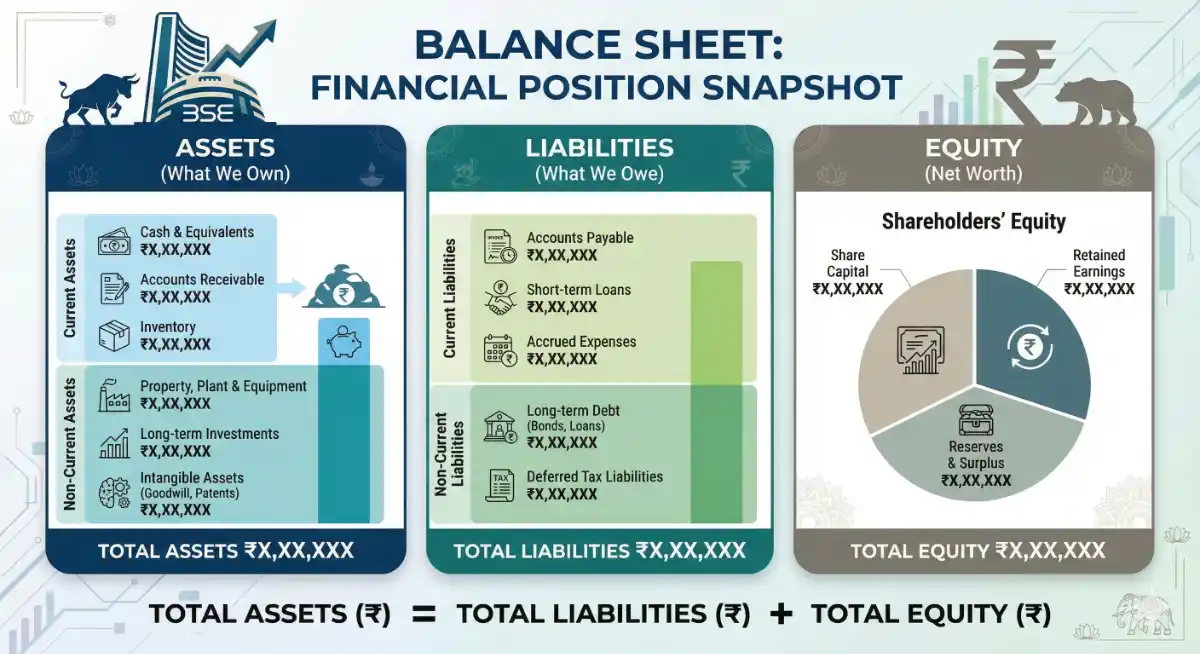

- Check the Results: Have the companies in your portfolio shown a weak balance sheet or declining profits in the last 3 quarters (Q1, Q2, and Q3 of FY26)?

- The IT Sector Example: Many retail investors feel trapped in IT stocks. While the sector is under pressure due to global AI shifts (like the rise of “Claude Cowork”), most top-tier Indian IT firms still have healthy cash reserves and stable margins. If the business model is intact, the price is just noise.

3. Why the “Panic” is Happening Now (The 2026 Triggers)

- Taxation Changes: The hike in STT (Securities Transaction Tax) on Futures and Options in the 2026 Budget has reduced liquidity, making the market more volatile.

- FII Outflows: Foreign investors are pulling money out due to high interest rates in the US, but Domestic Institutional Investors (DIIs) have bought nearly ₹15,700 Cr in a single week to support the market.

- Geopolitical Noise: Small border tensions or global energy price shifts always scare “weak hands” out of the market.

Deep Dive: SWOT Analysis of the Indian Market (Feb 2026)

Business & Financial Analysis

Despite the panic, India’s macroeconomic fundamentals are at their strongest in decades. We received credit rating upgrades from S&P (to BBB) and Morningstar in late 2025.

| Strengths | Weaknesses |

| GDP Growth at 7%+ | Higher STT affecting trading volumes |

| Corporate Debt at 10-year lows | IT sector growth resetting to 2-3% |

| Opportunities | Threats |

| Banking & PSU Sector Rotation | Sustained FII selling (Foreign Outflows) |

| New “Nuclear Energy Mission” Stocks | Global Geopolitical Uncertainty |

Valuation Watch

The P/E ratio of the Nifty 50 has cooled down from a risky 24x in November 2025 to a more comfortable 22x today. This means you are now buying the same quality companies at a 10% cheaper valuation than your neighbor did three months ago.

FAQ Section

Q1: Is the Indian bull run over in 2026?

A: No. A bull market always has “corrections” of 10-15%. This is a healthy shakeout of speculators, while long-term investors continue to hold.

Q2: My portfolio is 10% down. Should I sell?

A: If the company’s fundamentals (sales and profits) are strong over the last 3 quarters, selling now would be “selling at a discount.” Only sell if the business itself is failing.

Q3: Which sectors are leading the recovery?

A: Public Sector Undertakings (PSUs), Banking (especially SBI and HDFC), and Defense stocks have shown the most resilience during the Feb 2026 volatility.

Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks| Retail Investor Strategy 2026

Also View:

- 45 Weeks. 45 Lessons. From Basics to Advanced – Master Stock Market Investing in Less than 1 Year.

- Lesson 1: What is a Stock Market? Beginner’s Guide to Understanding Shares & Trading

- Cash Flow Statement: Why Profits Lie but Cash Never Does

📢 Join Our Market Community

📱 Stay updated on IPOs, Results & Market News:

- WhatsApp Channel: Join Now

- Telegram: Follow Updates

- Arattai: Connect with Us

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.