Market Overview – Volatility Reigns as Indices Struggle for Direction

On July 22, 2025, the Indian equity markets witnessed a mixed bag of moves, with frontline indices under pressure and midcaps taking a notable hit. While Nifty 50 and Bank Nifty ended in the red, Fin Nifty barely managed to stay afloat, and Midcap Nifty suffered the sharpest drop.

This price action came amidst weak global cues, sectoral rotations, and profit booking in high-beta segments. Traders remained cautious ahead of major earnings announcements and global monetary cues.

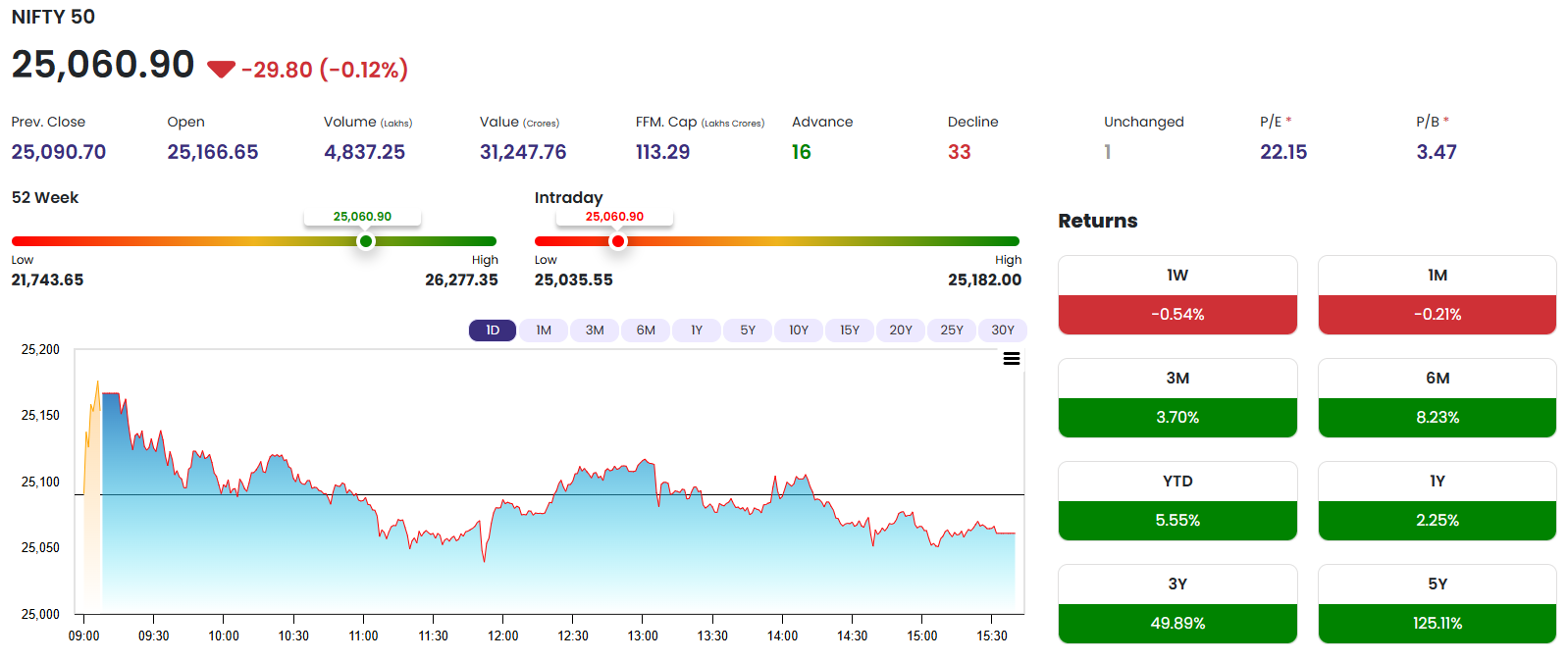

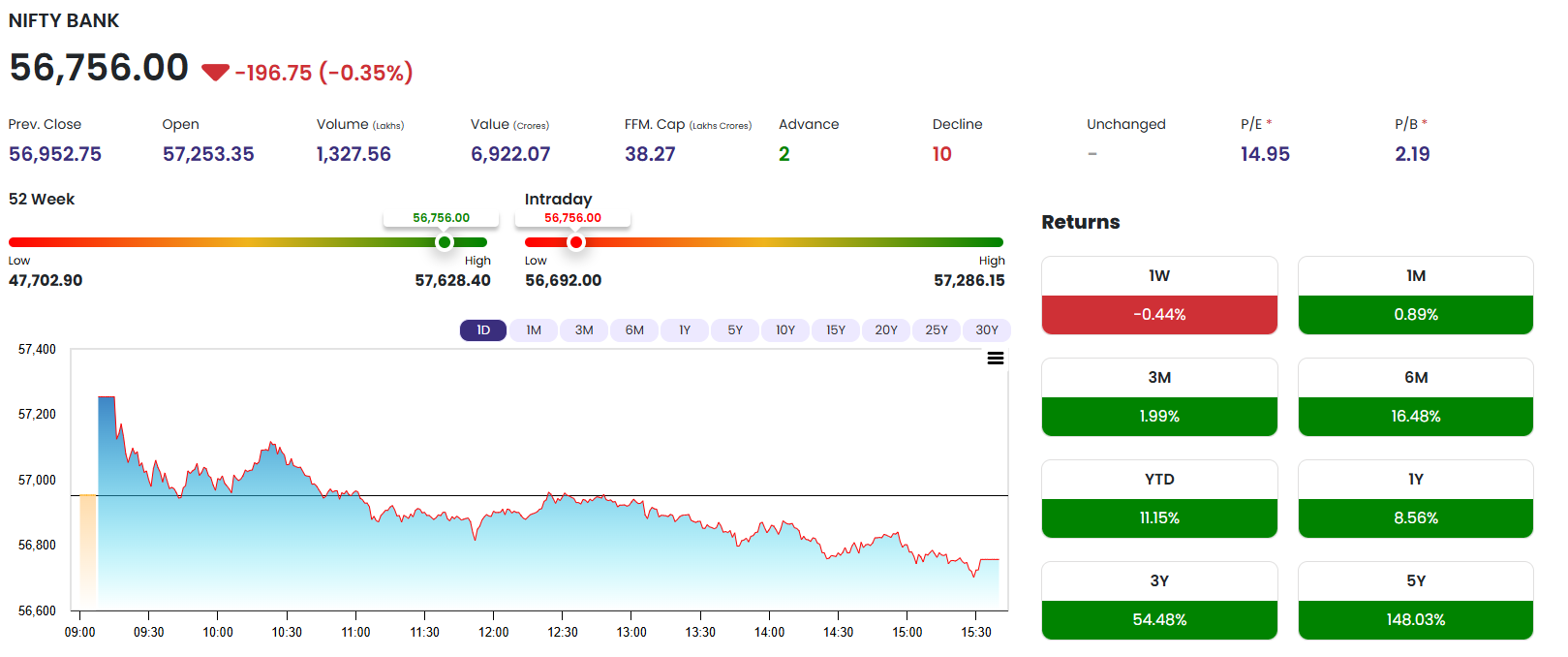

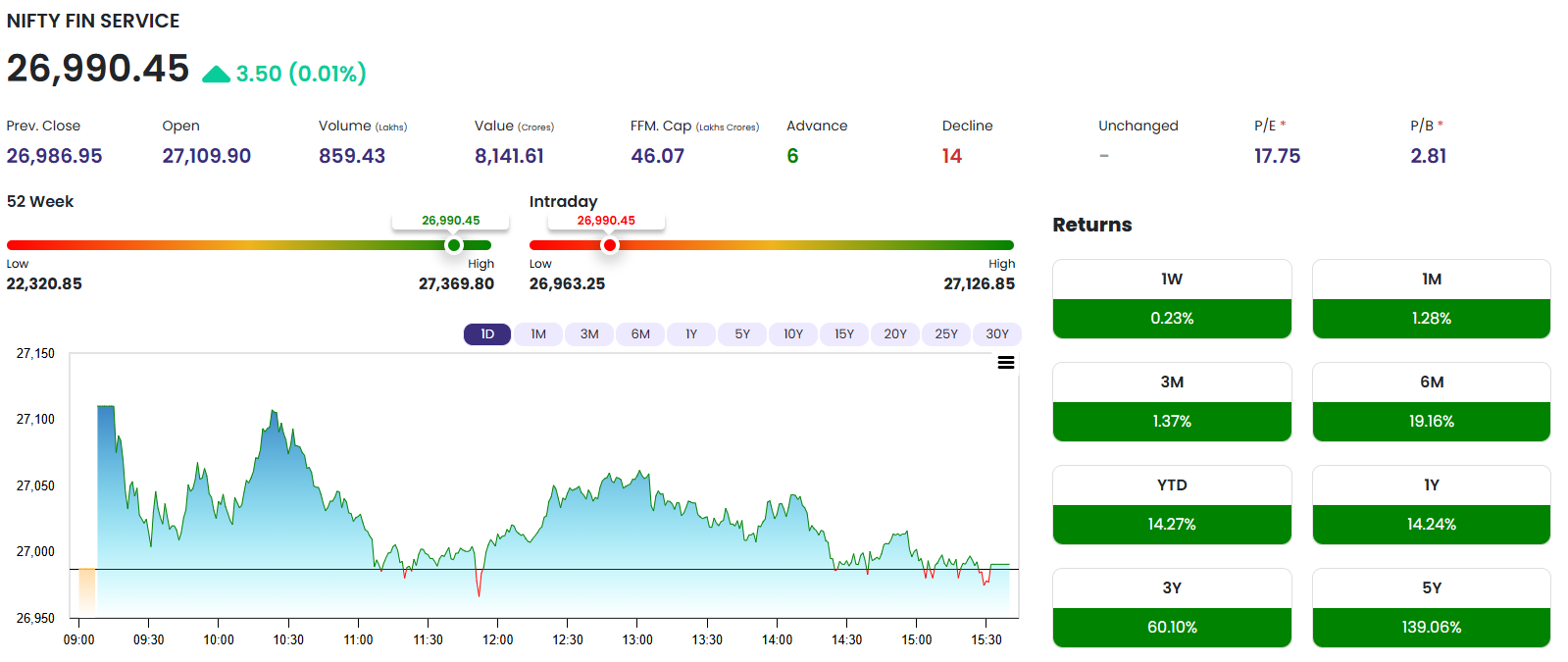

📊 Index Snapshot – July 22, 2025

| 🏷️ Index | 📈 Current | 🔓 Open | 🔼 High | 🔽 Low | 📉 Previous Close | 🔄 Change |

|---|---|---|---|---|---|---|

| NIFTY 50 | ₹25,060.90 | ₹25,166.65 | ₹25,182.00 | ₹25,035.55 | ₹25,090.70 | 🔻 -29.80 (-0.12%) |

| BANK NIFTY | ₹56,756.00 | ₹57,253.35 | ₹57,286.15 | ₹56,692.00 | ₹56,952.75 | 🔻 -196.75 (-0.35%) |

| FIN NIFTY | ₹26,990.45 | ₹27,109.90 | ₹27,126.85 | ₹26,963.25 | ₹26,986.95 | 🔼 +3.50 (0.01%) |

| MIDCAP NIFTY | ₹13,206.60 | ₹13,365.20 | ₹13,366.75 | ₹13,190.15 | ₹13,301.00 | 🔻 -94.40 (-0.71%) |

🔍 Key Market Highlights

🔹 NIFTY 50 – Consolidation with Mild Correction

-

Nifty opened higher at 25,166 but failed to sustain the momentum, slipping into the red.

-

The index moved within a narrow 146-point range.

-

Losses in IT, Pharma, and Metals pulled it lower.

-

However, support around 25,035 held strong, signaling buying interest near dips.

🔹 BANK NIFTY – Bearish Grip Tightens

-

Bank Nifty underperformed with a 0.35% drop, closing at 56,756.

-

Major private and PSU banks witnessed selling pressure.

-

HDFC Bank, ICICI Bank, and SBI saw consistent profit booking.

-

Technical support now lies near 56,500, with resistance at 57,500.

🔹 FIN NIFTY – Flat but Resilient

-

Despite banking drag, Fin Nifty managed a marginal gain of 0.01%.

-

NBFCs and insurance stocks supported the index.

-

Bajaj Finserv, HDFC AMC, and LIC Holdings held steady.

-

It reflects divergence within the financial sector.

🔹 MIDCAP NIFTY – Worst Hit of the Day

-

Midcap index plunged 0.71%, erasing prior gains.

-

Broader market breadth turned negative with mid and small-cap stocks underperforming.

-

High volatility seen in sectors like realty, chemicals, and consumer durables.

-

Caution is advised for retail traders in midcap space due to sharp corrections.

📈 Sectoral View – Who Moved the Market?

| 📦 Sector | 📉 Trend |

|---|---|

| IT | Weak due to US tech stock pressure |

| Banking | Dragged indices lower |

| Auto | Mixed; Hero MotoCorp flat post-dividend |

| Pharma | Profit booking across heavyweights |

| Real Estate | Sharp declines in midcap names |

| FMCG | Relatively stable |

🔔 What’s Driving Market Sentiment?

✅ Domestic Factors:

-

Earnings season in full swing — stock-specific volatility high.

-

Monsoon progress and rural demand being tracked closely.

❌ Global Headwinds:

-

US Fed policy hints towards rate pause but no clear pivot yet.

-

Crude oil prices remain volatile.

-

Global tech stock correction impacting Indian IT sector.

🧮 Technical Levels to Watch (23 July 2025)

| Index | Support | Resistance |

|---|---|---|

| NIFTY 50 | 25,000 – 24,950 | 25,200 – 25,300 |

| BANK NIFTY | 56,500 – 56,300 | 57,500 – 57,700 |

| FIN NIFTY | 26,850 – 26,700 | 27,200 – 27,350 |

| MIDCAP NIFTY | 13,100 – 13,000 | 13,400 – 13,500 |

📌 Retail Traders – What Should You Do?

✅ Focus on sector leaders and avoid speculative midcaps for now.

✅ Use dips in frontline indices for buy-on-support strategy.

⚠️ Stay cautious around volatile counters; maintain strict stop-loss.

🔍 Track upcoming results: Infosys, Kotak Bank, Asian Paints earnings ahead.

📉 Market Impact & Outlook

-

Short-term correction appears healthy after a steep rally in the past weeks.

-

Traders are recalibrating positions ahead of FOMC meeting and Q1 results.

-

Expect range-bound movement with stock-specific opportunities.

-

Midcap space may remain under pressure if institutional selling continues.

🏁 Final Takeaway

The market is clearly in a wait-and-watch mode as global uncertainties and domestic earnings continue to drive direction. While Nifty remains range-bound, the pressure in Bank Nifty and Midcaps hints at deeper profit booking. Traders must adapt with selective positioning and cautious optimism.

🔔 Stay tuned for tomorrow’s key movers and results. Bookmark this page for daily market insights!

💬 What’s your take on today’s fall? Are you holding or booking profits? Let us know in the comments!

Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.