Market Correction Strategy| My Stock Portfolio Journey| Nifty 50 Crash 2026| Portfolio Recovery Tips| Don’t Panic Sell| Editor’s Portfolio Update

Introduction: We Are All Bleeding: But It’s Temporary

The Nifty 50 has taken a brutal hit, falling over 1,000 points from the January 5th high of 26,250 to current levels near 25,150.

I know exactly how you feel right now. You open your Demat account, see red everywhere, and the urge to hit “Sell” is overpowering. But before you make a mistake you can’t undo, I want to share my own portfolio’s reality with you.

I am not just writing this as an analyst; I am writing this as an investor who is in the market with you.

Editor’s Note: My Personal Portfolio Journey

Many of you think that experts or editors somehow avoid losses. We don’t. We just handle them differently.

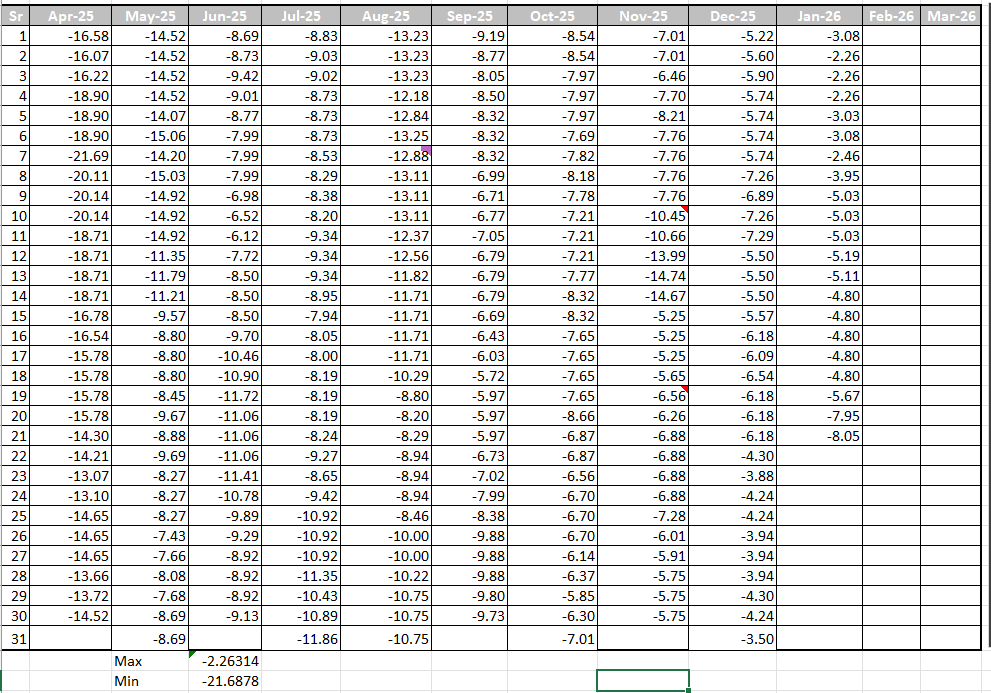

Below is the actual data from my personal portfolio over the last year. Look closely at the volatility I faced:

| Date | My Portfolio Returns | The Reality |

| 01/04/2025 | -16.58% | I was losing significant capital. It was painful. |

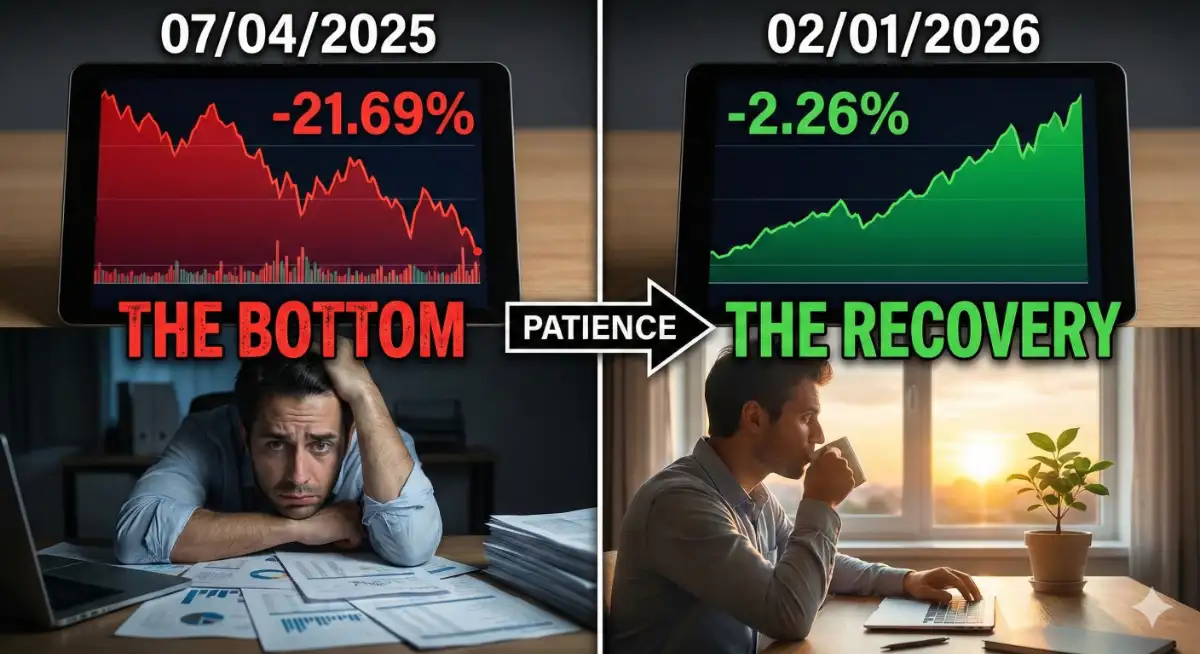

| 07/04/2025 | -21.69% | The Bottom. Within a week, it got worse. If I had panicked and sold here, I would have booked a massive loss. |

| 02/01/2026 | -2.26% | The Recovery. Fast forward 9 months to the start of this year, my portfolio had almost fully recovered. |

| Today | -8.05% | The Current Dip. Yes, I am down again due to the Jan 2026 crash, but -8% is nothing compared to -21%. |

The Lesson I Learned:

If I had sold on April 7th, 2025, because of fear, I would have locked in a 21% loss. By simply doing nothing and trusting my stocks, I saw my portfolio bounce back.

The current drop to -8.05% today is just another cycle. I am not selling. I am following the 10 Golden Rules below—and you should too.

My Strategy: 10 Rules I Follow When Nifty Bleeds

1. Never Sell in This Scenario

This is my #1 rule. If my business (the stock) is good, why should I sell it just because the market mood is bad?

- My Action: I treat these red days as “market noise.” Selling now converts a temporary paper loss into a permanent financial injury.

2. The “Bounce Back” Exit

If you absolutely must sell (for an emergency), never sell on a red candle.

- The Logic: Even in a crash, there is always a “Dead Cat Bounce” or relief rally. If I need to exit, I wait for that one green day where the market jumps up to cover shorts. I never sell at the bottom.

3. No Money? Just Hold.

There have been times when I had zero cash to buy the dip.

- My Mindset: If I can’t buy, I become a “Sleeping Partner.” I stop looking at the app. If the company isn’t going bankrupt, the stock price will eventually reflect its true value.

4. The 6-Month Amnesia

If you bought at the peak (Nifty 26,200) and are stuck:

- The Fix: Just forget the market exists for 6 months.

- Why: As you saw in my data, it took from April to January to recover. Give your portfolio time. Your price will come back.

Managing Leverage (MTF)

5. Don’t Let the Broker Sell Your Stock

If you are holding stocks on Margin (MTF), this is the danger zone.

- My Strategy: I manage my balance aggressively. I ensure there is enough buffer fund in the Demat account so the broker doesn’t trigger an auto-square off at the lowest possible price.

6. The “Survival” Exit

If I am running out of funds to support the margin:

- The Hard Call: I exit half of the MTF stock.

- Why: It is better to cut 50% of the position to save the balance than to lose the whole position to a margin call. This helps manage the balance sheet.

How I Am Buying the Dip (Averaging)

7. The 30-50% Rule

I see people averaging when a stock falls 5%. That is a mistake.

- My Rule: I only average if I have funds AND the stock is down 30% to 50% from my buying price. This makes a real difference to the average price.

8. Stick to the Family

I do not add new stocks to my portfolio during a crash.

- Discipline: I only average the stocks already in my portfolio. I focus on repairing my existing damage rather than looking for new adventures.

9. Don’t Be a Frog

I see investors selling a falling IT stock to buy a rising Pharma stock.

- The Mistake: You sell at the bottom and buy at the top.

- My Advice: Don’t jump. Sit tight. Sector rotation happens; your sector’s turn will come.

10. The 80-10-10 Fund Rule

If you have fresh capital, this is how I am deploying mine right now:

- 80%: Invested now (Fear is high, valuations are lower).

- 10%: Kept in reserve if Nifty falls deeper (e.g., another 500 points).

- 10%: Kept for when the trend turns positive (Green Weekly Candle).

Conclusion: Don’t Panic, Bhai.

All we need to do is not panic. The stock market rewards patience above intelligence.

Look at my table again. -21% became -2%. The current -8% will also turn green. Stay strong, manage your risk, and I will see you on the other side of this correction.

FAQ Section

Q1: Why are you sharing your personal loss data?

Ans: To show you that volatility is normal. If I hid my losses, I wouldn’t be honest. Every investor bleeds; the winners are the ones who hold through the pain.

Q2: Should I stop my SIPs?

Ans: Never. SIPs are the only thing that benefits from a falling market. You are accumulating more units right now.

Q3: Is Nifty 25,150 the bottom?

Ans: No one knows. That is why I use the 80-10-10 rule (Rule #10) to stagger my investments rather than guessing the bottom.

Market Correction Strategy| My Stock Portfolio Journey| Nifty 50 Crash 2026| Portfolio Recovery Tips| Don’t Panic Sell| Editor’s Portfolio Update

Also View:

📢 Join Our Market Community

📱 Stay updated on IPOs, Results & Market News:

- WhatsApp Channel: Join Now

- Telegram: Follow Updates

- Arattai: Connect with Us

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

Market Snapshot: Bulls Return on Global Cues & Trade Deal Optimism

Indian Stock Market| Nifty 50| Sensex| Bank Nifty| Axis Bank| India-EU FTA| Stock Market News| Market Wrap| Jan 27 2026…

-

India-EU FTA 2026: The “Mother of All Deals” Sealed – In-Depth Analysis

India EU FTA 2026| India EU Trade Deal| Tariff cuts India EU| CBAM India EU agreement| India EU Services Trade…

-

Hindustan Zinc OFS Review 2026: Vedanta to Offload ₹4,500 Cr Stake

Hindustan Zinc OFS Review| Vedanta Limited| HINDZINC| Stock Market News| Dividend Stocks| Silver Rally| Zinc Prices| Offer For Sale| High…

-

Weekly Market Intelligence: 10 Stocks to Watch

Top 10 Stocks| Top 10 Stocks to Watch| Market Analysis As the Indian markets navigate a period of heightened volatility…

-

Lesson 19 – KEY RATIOS |Deep Dive into PE, PB, ROE & DE

Key Ratios| Stock Market Basics| PE Ratio| PB Ratio| ROE| Debt Equity Ratio| Fundamental Analysis| Investing for Beginners Introduction| Part-1/3…