Company Overview: JB Chemicals & Pharmaceuticals Ltd

Incorporated: 1976

Headquarters: Vadodara, Gujarat

Industry: Pharmaceuticals

Market Cap (July 27, 2025): ₹26,200 Cr

Stock Symbol: NSE: JBCHEPHARM | BSE: 506943

Promoter Holding (Pre-Deal): 54.43% (KKR majority)

Website: www.jbcpl.com

JB Chemicals & Pharmaceuticals Ltd (JB Pharma), a long-standing player in India’s mid-cap pharma space, has rapidly transformed itself from a formulation-focused entity into a growth-driven, diversified healthcare enterprise. Known for brands like Rantac, Nicardia, Metrogyl, and Cilacar, JB commands strong presence in the cardiac, gastrointestinal, and anti-infective segments.

With a legacy spanning over four decades, JB’s evolving strategy of brand expansion, exports, and capacity upgrades has caught the attention of retail and institutional investors alike—especially with the latest Torrent Pharma acquisition deal shaking up the industry.

📈 Q1 FY25 Financial Performance – Steady and Consistent

JB Chemicals posted strong consolidated results for Q1 FY25, showcasing resilient demand across domestic and export portfolios.

| Financial Metric | Q1 FY25 | Q1 FY24 | YoY Growth |

|---|---|---|---|

| Revenue | ₹1,010 Cr | ₹902 Cr | +12% |

| EBITDA | ₹234 Cr | ₹205 Cr | +14% |

| Net Profit (PAT) | ₹176.83 Cr | ₹157.25 Cr | +12.5% |

| EBITDA Margin | 23.2% | 22.7% | +50 bps |

The results indicate robust brand traction, margin improvements via cost rationalisation, and expansion in export markets, especially regulated geographies like the US and South Africa.

💸 Torrent Pharma’s Big Bet – Rs 18,000 Cr Acquisition

The real headline of 2025 for JB Chemicals is the Torrent Pharma acquisition.

On June 30, 2025, Torrent Pharmaceuticals Ltd signed a definitive agreement to acquire 46.39% stake in JB Chemicals from private equity major KKR for ₹11,917 Cr. Following this, a mandatory open offer for 26% more was announced, bringing the deal size to approx. ₹18,000 Cr.

📌 Valuation Highlights:

-

Deal values JB Chemicals at ₹25,689 Cr.

-

Torrent’s open offer price was set below the market rate, sparking some investor discomfort.

-

Post-deal, Torrent becomes the second-largest domestic pharma player behind Sun Pharma.

This strategic acquisition brings synergy in cardiology, nephrology, and gastro care, with JB’s marketing strength complementing Torrent’s scale and reach.

📊 JB Chemicals Share Price Trend

-

Pre-deal (May 2025): ₹2,120

-

Post-deal reaction (July 2025): Slipped to ₹1,691.80

-

Current Price (July 27, 2025): ₹1705.00

The stock saw short-term volatility due to valuation mismatch and open offer concerns, but analyst targets from Jefferies and Kotak remain bullish, pegging a 1-year target at ₹2,680, citing strong synergy benefits and healthy future EPS growth.

🧪 Product Portfolio & Global Presence

JB Pharma holds dominant shares in India’s prescription market through:

-

Cilacar (Hypertension)

-

Metrogyl (Antibiotic)

-

Nicardia (Cardiac care)

-

Rantac (Gastro)

Exports contribute ~45% of total revenue, with markets across the US, Russia, South Africa, and select CIS countries. The company also holds USFDA and EU-GMP approved facilities.

A recent ANDA approval for Loratadine Tablets USP 10mg in the US marks its continuing pipeline expansion for generic therapy.

🏭 Capacity Expansion and Operational Edge

JB continues to invest in manufacturing and R&D:

-

Panoli Unit Expansion: Dedicated line for povidone-iodine and other antiseptic formulations.

-

Focus on contract manufacturing and branded exports.

With Torrent’s deeper distribution and supply-chain muscle, JB’s existing units could see higher utilization, translating to better operating leverage.

🧑💼 What This Means for Retail Investors

The Torrent acquisition brings long-term positives:

-

Brand Scalability: Torrent’s scale could enhance brand penetration of JB’s leading SKUs.

-

Valuation Catch-up: Post-deal correction offers entry opportunities for patient investors.

-

Dividend Stability: JB has a consistent dividend history and improved cash flows.

However, investors must watch:

-

Regulatory timelines for merger execution.

-

Torrent’s integration plan and open offer progress.

🔎 For long-term investors focused on branded formulations, export-driven growth, and merger arbitrage opportunities, JB Chemicals remains a promising pick under ₹1,800.

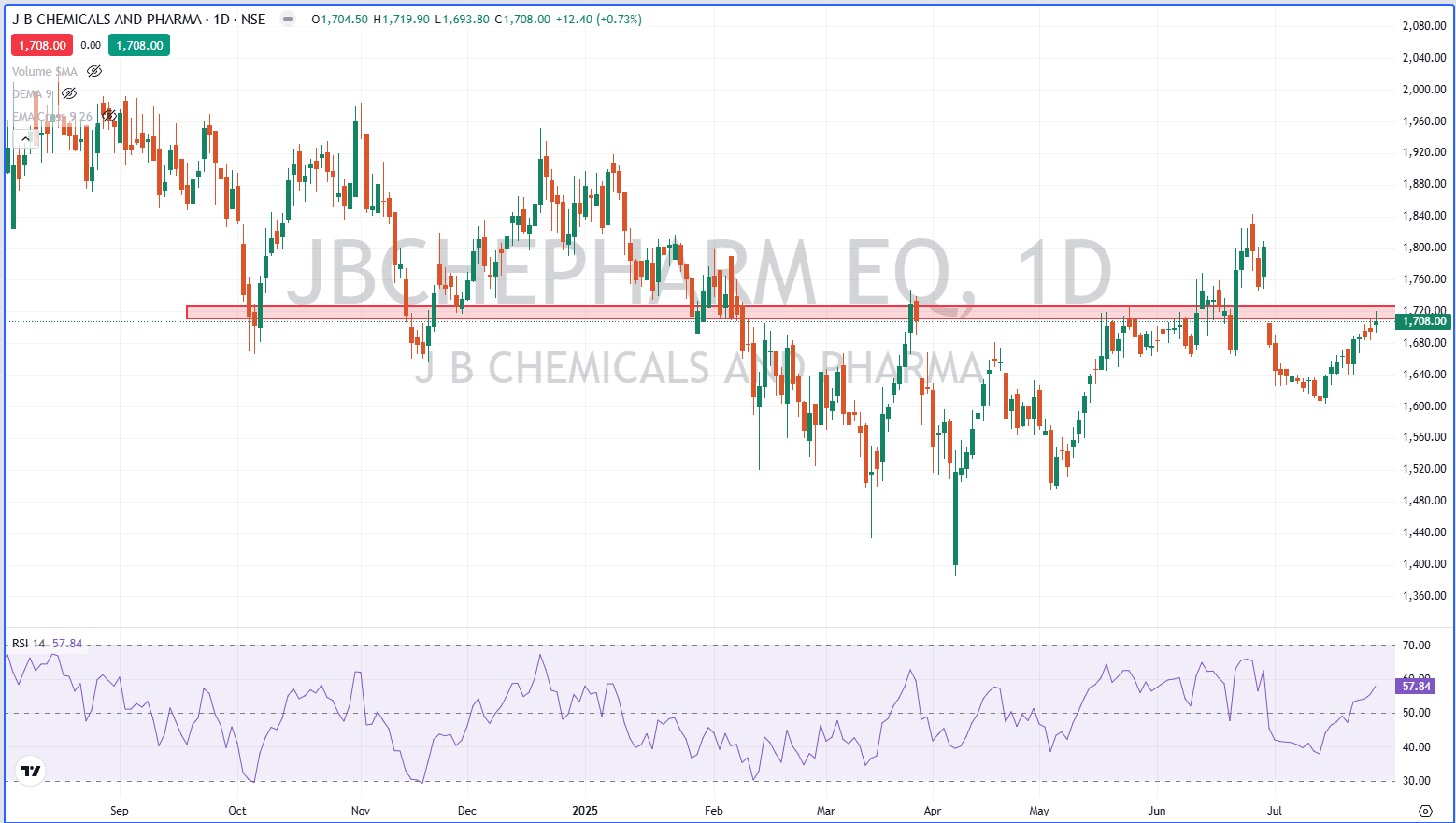

📌 Technical Analysis – Key Levels to Watch

| Indicator | Value |

|---|---|

| 200-Day EMA | ₹1,810 |

| RSI (Daily) | 48 (Neutral) |

| MACD Crossover | Negative bias |

| Support Zones | ₹1,680 / ₹1,620 |

| Resistance Zones | ₹1,780 / ₹1,860 |

📉 After the deal dip, the stock has been consolidating near ₹1,700, with sideways bias on low volumes. A break above ₹1,780 could initiate a new leg up.

🧾 Final Take

JB Chemicals & Pharmaceuticals Ltd stands at a crucial inflection point. With Torrent Pharma’s big acquisition in motion, JB is now part of a broader consolidation wave in Indian pharma. For investors, this is not just a short-term M&A play, but a potential long-term value story, powered by brand strength, synergy realization, and export tailwinds.

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.