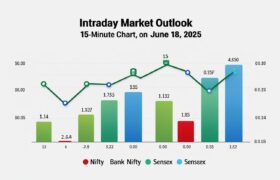

💼 Nifty15minChart, BankNiftyAnalysis, SensexLevels, IntradayTrading, June18Outlook, NiftySupportResistance, BankNiftyStrategy, SensexChartAnalysis

📊 Market Summary at a Glance

As we gear up for the trading session on June 18, 2025, the Indian equity markets are showing signs of range-bound consolidation, as suggested by the 15-minute chart patterns of Nifty 50, Bank Nifty, and Sensex. Traders are advised to proceed with a cautious yet responsive strategy focused on key support-resistance levels and breakout signals.

📌 Nifty 50 – 15-Minute Chart Insights

Current Status: Market in Range-Bound Zone

-

Key Supports:

• 24,670

• 24,550

• 24,465 -

Key Resistances:

• 24,900

• 25,000

-

Technical Outlook:

The Nifty is hovering between 24,465 and 25,000, creating a narrow band of consolidation. This tight range suggests traders should avoid aggressive long or short positions until a confirmed breakout or breakdown is observed. The 24,550–24,670 band is acting as a significant support cluster, while upside movement is getting capped around the 25,000 mark. -

Intraday Strategy Tips:

✅ If Nifty breaks above 25,000 with volume, watch for a momentum move up to 25,200–25,300.

❌ If it breaks down below 24,465, next support lies around 24,250. -

Trader’s Note:

Stay neutral-biased until price action confirms direction. Avoid mid-range entries.

🏦 Bank Nifty – 15-Minute Chart Insights

Volatility Zone Identified: Watch for Breakout!

-

Support Levels:

• 55,400

• 55,147 -

Resistance Levels:

• 56,000

• 56,600

-

Technical Outlook:

Bank Nifty has shown attempts to consolidate near the 55,400–56,000 band. This index remains a key market mover, and with PSU & private banks under watch, a sharp move could be triggered based on macro news or large-cap participation. -

Intraday Strategy Tips:

✅ Watch for a clear breakout above 56,000 for potential long scalps towards 56,400 and 56,600.

❌ Breakdown below 55,147 may attract selling pressure up to 54,800–54,500. -

Retail Trader Takeaway:

Use tight stop-losses and consider option writing strategies if the market remains range-bound. Delta-neutral positions may work best in sideways conditions.

📈 Sensex – 15-Minute Chart Outlook

Flat Momentum but Strong Technical Zones in Play

-

Support Zones:

• 81,500

• 80,500 -

Resistance Zones:

• 82,000

• 82,550

-

Technical Viewpoint:

Sensex mirrors Nifty’s range-bound setup with slightly higher support levels. The 81,500–82,000 region is crucial. A decisive move above 82,550 could spark a fresh uptrend, while a dip below 80,500 could lead to wider correction. -

Intraday Strategy Tips:

✅ Above 82,550 – possible momentum till 83,000.

❌ Below 80,500 – expect intraday dips till 79,800. -

Positional View:

Short-term charts indicate indecisiveness, but bullish bias remains intact above 81,500.

🎯 Trader’s Strategy for June 18, 2025

-

📌 Range Trading with Stop Loss Discipline:

With indices locked in narrow ranges, breakout/breakdown trades are high risk. Stay nimble and avoid over-leveraging. -

📌 Volume-Based Confirmation:

Use volume spikes on 5-minute or 15-minute charts to validate trades near support/resistance. -

📌 Stay Informed:

Be alert to global cues, FII/DII data, and sector rotation, especially in banking and FMCG stocks. -

📌 Tools to Use:

VWAP, Supertrend, and Bollinger Bands work well in range markets to define entry-exit.

📣 Market Sentiment Meter

| Index | Sentiment | Bias |

|---|---|---|

| Nifty 50 | Neutral | Awaiting Breakout |

| Bank Nifty | Slightly Bullish | Above 56,000 Zone |

| Sensex | Neutral | Above 82,000 Key Level |

💬 Final Thoughts

The Indian equity markets are in a pause mode, waiting for triggers. Traders should rely on technical levels, act on confirmation, and avoid premature entries. June 18 could prove to be a consolidation day or a setup for a breakout in the coming sessions.

🧠 Pro Tips for Intraday Traders

-

💡 Patience pays in range-bound markets.

-

💡 Trade light until directional confirmation.

-

💡 Don’t fight the trend – if unclear, stay out.

📌 SEO Meta Description

June 18, 2025 Intraday Market Outlook – Nifty, Bank Nifty & Sensex 15-minute chart analysis with support-resistance levels, trading strategy, and key insights for intraday traders.

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.