Indian Stock Market| IPO| IPO Boom| Bearish Market| IPO 2026

Critical Dates: Anticipated IPO Timeline (2026)

Note: Exact dates are subject to SEBI approval. Timelines are based on current DRHP filings and market reports.

| Company | Expected Launch | Est. Issue Size | Est. Valuation |

| Reliance Jio | H1 2026 | ₹55,000 Cr+ | ₹11-12 Lakh Cr |

| NSE India | Q3-Q4 2026 | ₹47,500 Cr | ₹4.75 Lakh Cr |

| Flipkart | Late 2026 | TBD | $60-70 Billion |

| PhonePe | 2026 | TBD | $15 Billion |

| SBI Mutual Fund | 2026 | ₹8,000 Cr+ | ₹80,000 Cr+ |

Introduction: The ₹2.5 Lakh Crore Question

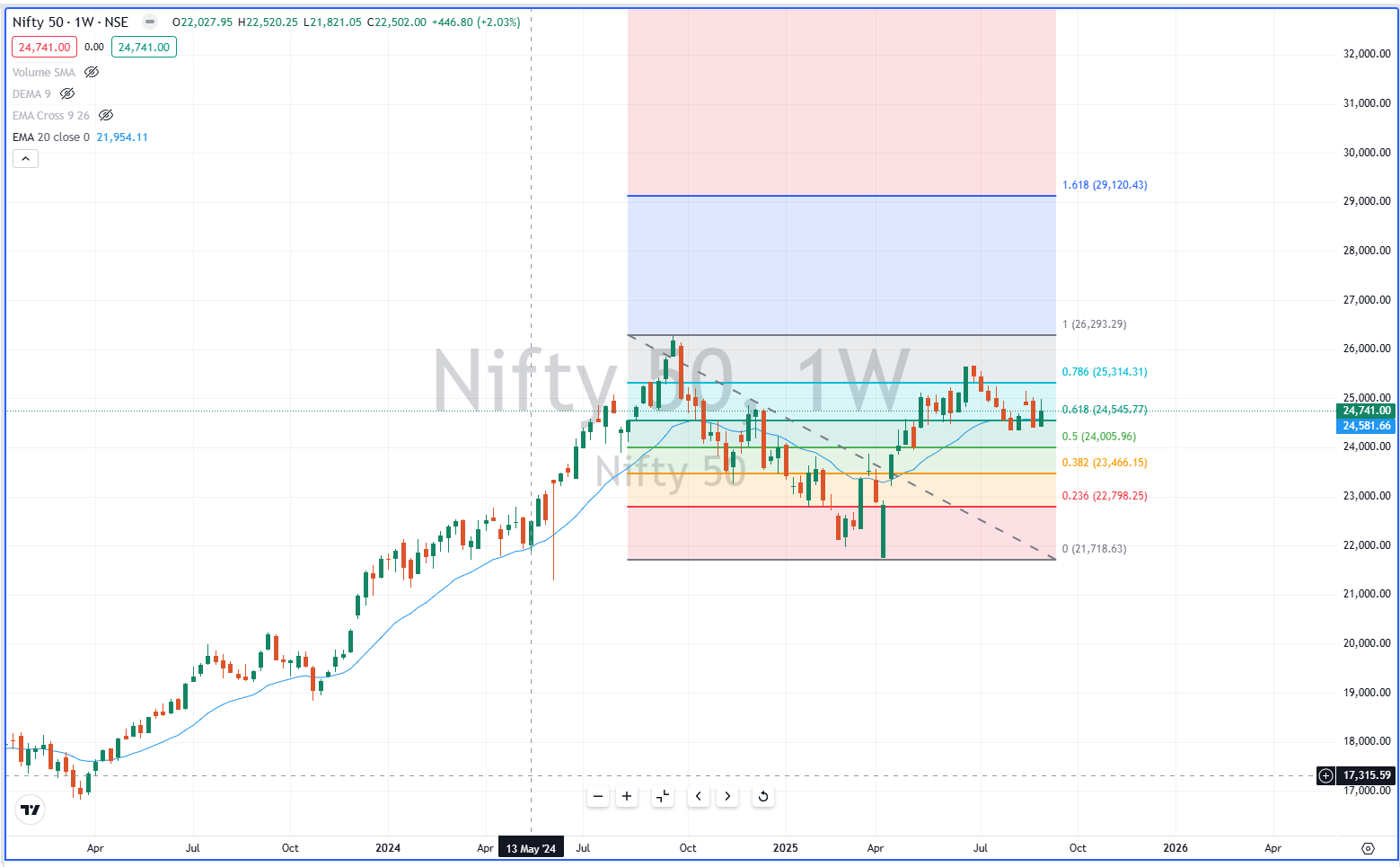

The year 2025 was a paradox for Indian investors. While the Nifty touched life highs, many retail portfolios bled red, with midcaps and smallcaps correcting 50-70% from their peaks. As we transition into 2026, the Indian stock market stands at a critical juncture.

The primary market is gearing up for a historic “Tsunami” of capital raising. Approximately 190 companies are preparing to hit the Dalal Street, aiming to raise a staggering ₹2.5 Lakh Crore.

This creates a unique dilemma: Will 2026 be a Bull Market driven by new listings, or a Bear Market caused by a massive liquidity drain from the secondary sector?

This deep dive analyzes the upcoming IPO pipeline, the “Liquidity Drain Theory,” and what Indian traders must do to survive.

Market Sentiment: Bullish Primary, Bearish Secondary?

The Bull Case: The Primary Market Boom

If you are an IPO investor, 2026 promises to be a golden era. The pipeline is not just crowded; it is premium. Unlike the speculative SME frenzy of the past, 2026 will see the arrival of “The Titans”—mature, profitable, and industry-dominating giants.

- High Institutional Interest: FIIs (Foreign Institutional Investors) are currently net sellers in the secondary market but are aggressively buying into IPO Anchor portions. This suggests they see better value in fresh paper than in listed incumbents.

- Unlisted Market Activity: The Grey Market Premium (GMP) for upcoming giants like NSE and Jio indicates massive pent-up demand.

The Bear Case: The Liquidity Vacuum

For the secondary market (existing stocks), the outlook is cautious to bearish.

- Capital Rotation: When ₹2.5 Lakh Crore is sucked out of the system to subscribe to IPOs, it has to come from somewhere. Retail investors and mutual funds often sell existing holdings to free up cash for these “lottery tickets.”

- FII Selling: Continued selling by FIIs in the cash segment, driven by weak earnings growth and high valuations in the secondary market, remains a concern. The video analysis suggests that unless corporate earnings rebound significantly, FIIs may restrict their inflows strictly to the primary market.

Deep Dive: The Titans of 2026

1. Reliance Jio: The Elephant in the Room

- Focus Keyword: Reliance Jio IPO Review

- Valuation: ₹11 Lakh Crore – ₹12 Lakh Crore ($130B – $170B)

- The Proposition: This is expected to be the largest IPO in Indian history, potentially exceeding ₹55,000 Crore. Jio is no longer just a telecom operator; it is a digital ecosystem.

- Market Impact: A listing of this magnitude will absorb liquidity for months. It could lead to a “re-rating” of the entire telecom sector, including Bharti Airtel. However, during the IPO period, expect the broader market to remain range-bound as funds are locked in ASBA.

2. NSE India: The Monopoly’s Debut

- Status: Awaiting SEBI “No Objection Certificate” (NOC).

- Financials: The NSE is a cash-generating machine with virtually no competition in the derivatives segment. It has set aside ~₹1,300 Crore to settle past regulatory legacy issues, clearing the path for listing.

- Why it Matters: This is arguably the most awaited IPO of the decade. Listing the exchange itself adds a layer of transparency and allows investors to own a piece of India’s financial infrastructure.

3. The Return of the Unicorns: Flipkart & PhonePe

- Flipkart: Walmart-owned Flipkart is shifting its domicile back to India (Reverse Flip). Targeting a valuation of $60-70 Billion, it aims to capitalize on the Quick Commerce boom alongside its traditional e-commerce dominance.

- PhonePe: With a valuation of ~$15 Billion, PhonePe dominates the UPI landscape. Its listing will test the market’s appetite for pure-play fintech, especially after the volatile performance of Paytm.

In-Depth Analysis: The Liquidity Drain Theory

How IPOs Hurt Existing Stocks

The video analysis highlights a critical phenomenon: Capital Rotation.

- The “Sell to Buy” Cycle: Retail investors often operate with limited capital. To apply for a hyped IPO like Jio or NSE, they will liquidate positions in mid-cap and small-cap stocks.

- Pressure on Mutual Funds: Mutual Funds, facing redemption pressure or needing cash to buy into large anchor books, may trim their positions in existing portfolio stocks.

- Result: A temporary but sharp correction in the broader market (Nifty Midcap/Smallcap indices) whenever a mega-IPO opens.

SWOT Analysis for 2026

| Strengths | Weaknesses |

| Strong economic growth (GDP 6-7%) | High valuation of listed mid-caps |

| Mature, profitable companies listing | FIIs selling in secondary market |

| Robust domestic inflows (SIPs) | Global geopolitical fragmentation |

| Opportunities | Threats |

| “Generational Buy” IPOs (Jio, NSE) | Liquidity crunch during mega IPOs |

| Sector rotation into defensive stocks | Regulatory tightening on F&O |

| Quick Commerce & AI sectors | Inflation resurgence impacting margins |

Strategic Advice for Indian Traders

Given the “Bullish Primary / Bearish Secondary” outlook, traders should adapt their strategies:

1. The “Cash is King” Strategy

Do not remain fully invested at all times. Keep 20-30% of your portfolio in liquid cash or liquid bees. You will need this dry powder to:

- Apply for the “Must-Apply” IPOs (Jio, NSE).

- Buy quality existing stocks when they dip due to IPO-induced liquidity crunches.

2. Avoid the “Listing Pop” Trap

In 2025, many IPOs opened high and crashed. In 2026, with huge issue sizes, “listing gains” might be more modest (10-20% rather than 50-100%). Focus on long-term holding for companies like NSE and Jio rather than quick flips.

3. Sector Watch

- Avoid: Sectors with high FII ownership if the selling persists (e.g., private banks might remain sluggish).

- Accumulate: Sectors linked to the IPO themes. For example, a Jio listing might boost interest in 5G infrastructure stocks/ancillaries.

FAQ Section

Q1: Will the Reliance Jio IPO come in 2026?

A: Yes, industry reports and statements from Mukesh Ambani suggest a listing in the first half of 2026, pending final regulatory approvals.

Q2: Is the market bullish or bearish for 2026?

A: The outlook is mixed. The Primary Market (IPOs) is extremely bullish with high activity. The Secondary Market may remain volatile or bearish due to liquidity absorption by these large IPOs and FII selling.

Q3: How much money is expected to be raised via IPOs in 2026?

A: Estimates suggest over ₹2.5 Lakh Crore ($30 Billion+) could be raised by approximately 190 companies.

Q4: Should I sell my stocks to buy IPOs?

A: Avoid selling high-quality, long-term compounders. However, booking profits in underperforming or overvalued mid-caps to create liquidity for high-conviction IPOs like NSE or Jio is a viable strategy.

Q5: What is the estimated valuation of the NSE IPO?

A: The National Stock Exchange is expected to be valued around ₹4.75 Lakh Crore, making it one of the most valuable financial institutions in India.

Indian Stock Market| IPO| IPO Boom| Bearish Market| IPO 2026

Also View:

- Lesson 14: Short Selling & Margin Trading

- Delhivery Launches On-Demand Service in Mumbai & Hyderabad: A Strategic Deep Dive

- Lesson 13: Intraday vs Delivery. What trade to do!

Open Demat Account

by Mirae Asset (m,Stock)

-

The Tariff Tussle: Decoding the Legal Challenge to Executive Trade Power

Supreme Court| Tariffs| Trade War 2026| Donald Trump| IEEPA| Section 301| US Economy| Import Duties| Constitutional Law| Reciprocal Trade Act…

-

The 2025-26 Market Journey: From All-Time Highs to the “Retail Trap” Panic

Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks|…

-

Indian Stock Market Update Feb 20: Nifty Reclaims 25,550, Sensex Jumps 316 Pts Amid Global Cues

Indian Stock Market Update Feb 20| Nifty 50 today| Sensex closing| Top gainers and losers Market Snapshot: The Bulls Fight…

-

Indian Stock Market Today: Bulls Charge Ahead as Sensex and Nifty Rally on Banking & IT Strength

# Indian Stock Market Today: Sensex and Nifty Close Higher Amid Broad-Based Buying ## Indian Stock Market Report – Updated…

-

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown Trending Keywords: YouTube down, YouTube…

-

Global Market Update 2026: Equities, Commodities, and Indian Rupee Outlook

Comprehensive 2026 global market update covering equities, commodities, bond markets, US Dollar trends, and detailed Indian Rupee outlook with investment themes and risks.