Nifty 50 analysis today| Nifty prediction tomorrow| Bank Nifty levels| Indian stock market analysis| Nifty support and resistance| Sector wise market outlook| Tomorrow market prediction| Stock market closing analysis| Nifty 50 trend

📰 1. Market Summary (Today’s Performance)

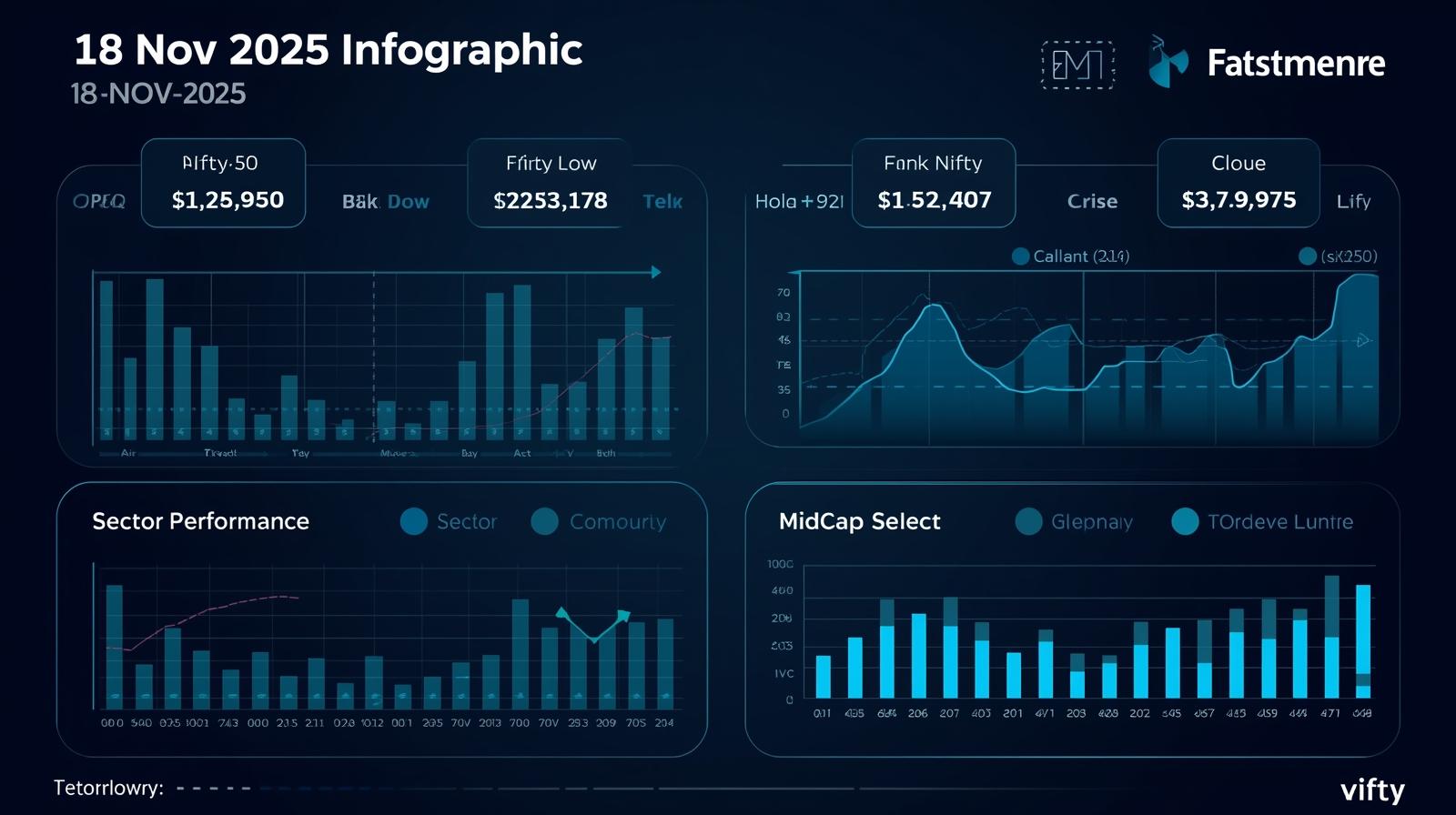

Here is the official closing snapshot of four key indices:

| Index | Previous Close | Open | High | Low | Today’s Close |

|---|---|---|---|---|---|

| Nifty 50 | 26,013.45 | 26,021.80 | 26,029.85 | 25,876.50 | 25,910.05 |

| Bank Nifty | 58,962.70 | 58,990.50 | 59,103.35 | 58,853.20 | 58,965.10 |

| Fin Nifty | 27,646.20 | 27,643.25 | 27,657.25 | 27,499.30 | 27,546.75 |

| MidCap Select | 13,997.45 | 14,003.10 | 14,008.90 | 13,902.65 | 13,917.25 |

🔍 2. Why the Market Moved Today (18 Nov 2025)

The Indian market remained range-bound with a slight negative bias, primarily due to:

✔ Global Pressure

- Weak Asian market cues

- Caution ahead of US inflation & job data

- Lower probability of early US Fed rate cuts

✔ Domestic Drivers

- Strong India earnings sentiment

- Low inflation improving purchasing power

- Financial sector holding strong

- Bank Nifty sustaining above its breakout zone

✔ Short-Term Factors

- Profit-booking after 6-day rally

- Weekly expiry volatility

- Technical resistance at 26,050–26,200 zone for Nifty

⛔ Overall: Market consolidated but did NOT break structure.

📊 3. Nifty 50 Technical Analysis (Today)

Trend:

🔸 Short-term = Sideways to Negative

🔸 Medium-term = Bullish

🔸 Long-term = Strong Bullish

Market Structure:

- Nifty made a lower high compared to intraday movement

- Support is getting respected near 25,880–25,900

- Bears tried to break 25,900 but failed

Our Stock Market Course:

🔮 4. Nifty 50 – Tomorrow Prediction (19 Nov 2025)

🚦 Expected Trend:

Neutral to Mildly Bullish, but movement will depend on global cues.

🧭 Key Levels for Tomorrow

🔵 Support Levels

| Level | Explanation |

|---|---|

| 25,880 | Intraday defended support |

| 25,820 | High liquidity & buying zone |

| 25,760 | Strong positional support |

🔴 Resistance Levels

| Level | Explanation |

|---|---|

| 26,020 | First breakout zone |

| 26,080 | Strong intraday hurdle |

| 26,200 | Next bullish target |

📉 5. Bank Nifty – Tomorrow Prediction

Trend:

Bank Nifty remains stronger than Nifty 50.

Supports:

- 58,700

- 58,450

Resistance:

- 59,200

- 59,450

If Bank Nifty holds above 59,000, expect Nifty 50 to follow with a bounce.

🧩 6. Sector-Wise Market Prediction for Tomorrow

🟩 1. Banking & Financials – Bullish

Reason: Strong credit growth + stable cost of funds.

Stocks to Watch: HDFC Bank, ICICI Bank, SBI, Axis Bank

🟧 2. IT Sector – Weak / Bearish

Due to global uncertainty & US cues.

Stocks to Watch: TCS, Infosys, Wipro (possible dip buying at support)

🟩 3. FMCG – Mildly Positive

Lower inflation improves margin guidance.

Stocks to Watch: HUL, Nestle, ITC

🟥 4. Metals – Under Pressure

China demand concerns + global weakness.

Stocks to Watch: Tata Steel, JSW Steel, Hindalco

🟨 5. Auto Sector – Consolidation

Stable fundamentals but high levels.

Stocks: Maruti, M&M, Tata Motors

🟩 6. Midcaps – Sideways to Positive

MidCap Select holding strong.

Expect stock-specific moves.

🚀 7. Stock-Wise Predictions (Tomorrow)

✔ Bullish Candidates

- ICICI Bank – above 1155 target 1175

- SBI – above 905 target 918

- ITC – above 485 target 490

- Tata Motors – above 1020 target 1045

✔ Weak / Avoid

- TCS – below 3820 weakness continues

- Tata Steel – below 1310 may see selling

- Infosys – under pressure until global cues improve

✔ Midcap Momentum Picks

- Polycab – positive above 6800

- Astral – strong formation above 2450

🏁 9. Final Summary for Traders

- Market is in healthy consolidation, not a trend reversal.

- Nifty holding 25,880 is very important.

- Breakout above 26,080 will open next rally of 150–250 points.

- Bank Nifty will decide tomorrow’s strength.

- Sector leadership remains in Banking + FMCG.

📌 Market Closing Conclusion:

The Indian market closed today on a mildly negative yet stable note, reflecting a healthy phase of consolidation after several days of strong upward momentum. Nifty 50 ended at 25,910.05, slipping slightly below the psychological 26,000 mark, while Bank Nifty managed to maintain resilience with a close near 58,965, reinforcing its role as the primary pillar of market strength. Despite global pressure from weak Asian cues and uncertainty around upcoming US economic data, the domestic market displayed controlled volatility, indicating that investors are not rushing to exit positions.

Broader fundamentals remain intact—lower inflation, improving corporate earnings, and strong financial sector performance continue to support medium- to long-term bullish sentiment. Today’s dip was driven mainly by profit-booking and weekly expiry effects rather than structural weakness. Importantly, Nifty protected its critical support zone near 25,880–25,900, which suggests buyers are active at lower levels.

As the market moves into the next session, traders should watch global cues and US macro announcements closely. A breakout above 26,020–26,080 may trigger a fresh upward leg, while sustaining below 25,880 could invite mild selling. Overall, the trend remains constructive with a cautiously positive outlook for tomorrow.

Indian stock market analysis| Nifty 50 analysis today| Nifty prediction tomorrow| Bank Nifty levels| Nifty support and resistance| Sector wise market outlook| Tomorrow market prediction| Stock market closing analysis| Nifty 50 trend

📢 Join Our Market Community

📱 Stay updated on IPOs, Results & Market News:

- WhatsApp Channel: Join Now

- Telegram: Follow Updates

- Arattai: Connect with Us

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

Iran-Israel War: Unpacking “Operation Lion’s Roar” and its Ripple Effect on Global Markets – A Deep Dive for Indian Investors

Iran-Israel War Market Impact| Operation Lion’s Roar update| Effect of Iran war on Nifty 50| Crude oil price surge 2026|…

-

The Tariff Tussle: Decoding the Legal Challenge to Executive Trade Power

Supreme Court| Tariffs| Trade War 2026| Donald Trump| IEEPA| Section 301| US Economy| Import Duties| Constitutional Law| Reciprocal Trade Act…

-

The 2025-26 Market Journey: From All-Time Highs to the “Retail Trap” Panic

Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks|…

-

Indian Stock Market Update Feb 20: Nifty Reclaims 25,550, Sensex Jumps 316 Pts Amid Global Cues

Indian Stock Market Update Feb 20| Nifty 50 today| Sensex closing| Top gainers and losers Market Snapshot: The Bulls Fight…

-

Indian Stock Market Today: Bulls Charge Ahead as Sensex and Nifty Rally on Banking & IT Strength

# Indian Stock Market Today: Sensex and Nifty Close Higher Amid Broad-Based Buying ## Indian Stock Market Report – Updated…

-

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown Trending Keywords: YouTube down, YouTube…