Market Overview – July 18, 2025

The Indian stock market witnessed a significant sell-off today, with major indices closing in deep red amid broad-based weakness. Rising concerns over global economic cues, selling pressure in banking and financial stocks, and cautious investor sentiment ahead of key earnings announcements led to a sharp dip across benchmarks.

Here’s how the major indices closed:

| Index Name | Current Price | Change (%) |

|---|---|---|

| NIFTY | 24,968.40 | -143.05 (-0.57%) |

| BANK NIFTY | 56,283.00 | -545.80 (-0.96%) |

| FIN NIFTY | 26,556.15 | -253.30 (-0.94%) |

| MIDCAP NIFTY | 13,171.00 | -93.75 (-0.71%) |

📊 Detailed Index Analysis

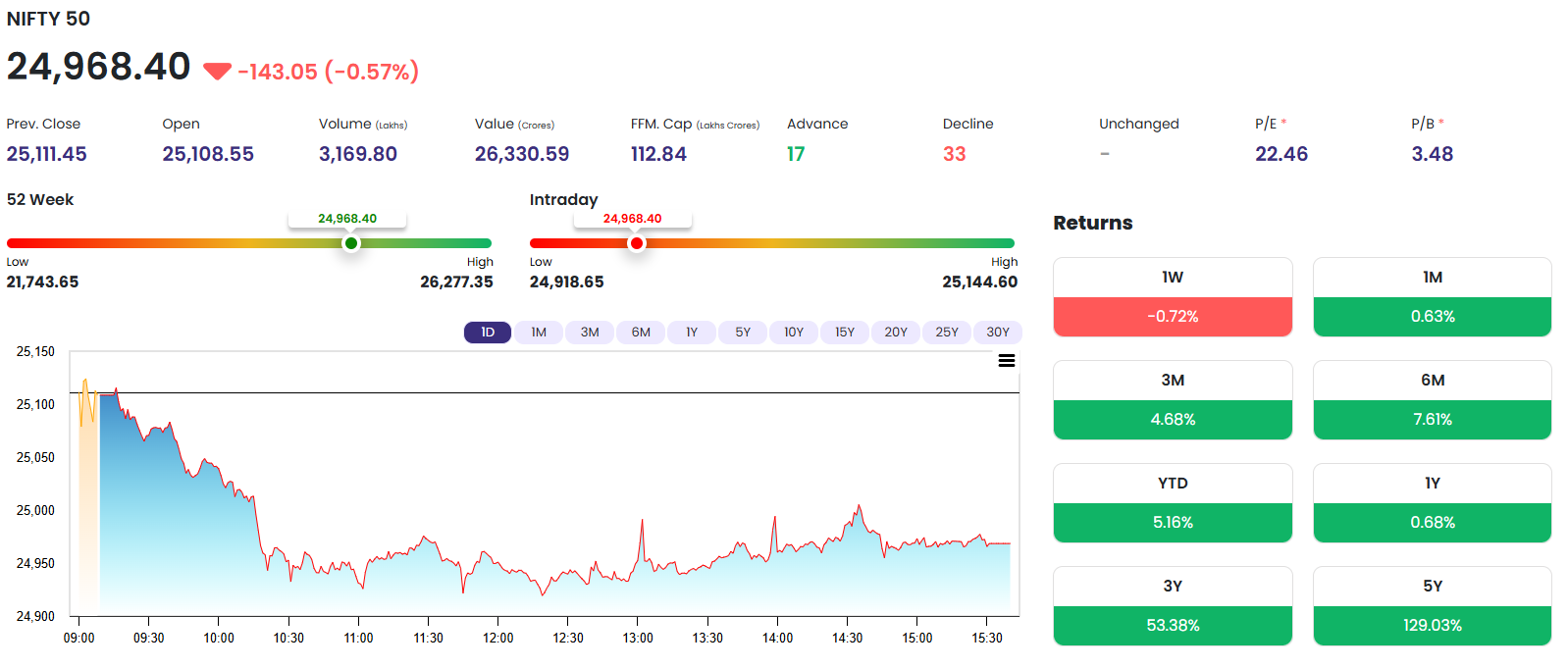

✅ NIFTY 50 Index:

-

Current Price: 24,968.40

-

Open: 25,108.55

-

High / Low: 25,144.60 / 24,918.65

-

Previous Close: 25,111.45

-

Day’s Fall: -143.05 pts (-0.57%)

The NIFTY failed to sustain above 25,100 despite opening in the green. It faced resistance at higher levels and slipped below 25,000. Weakness in heavyweights like Reliance Industries, HDFC Bank, and ICICI Bank dragged the benchmark lower. The breach of key psychological support indicates near-term weakness unless global and domestic cues improve.

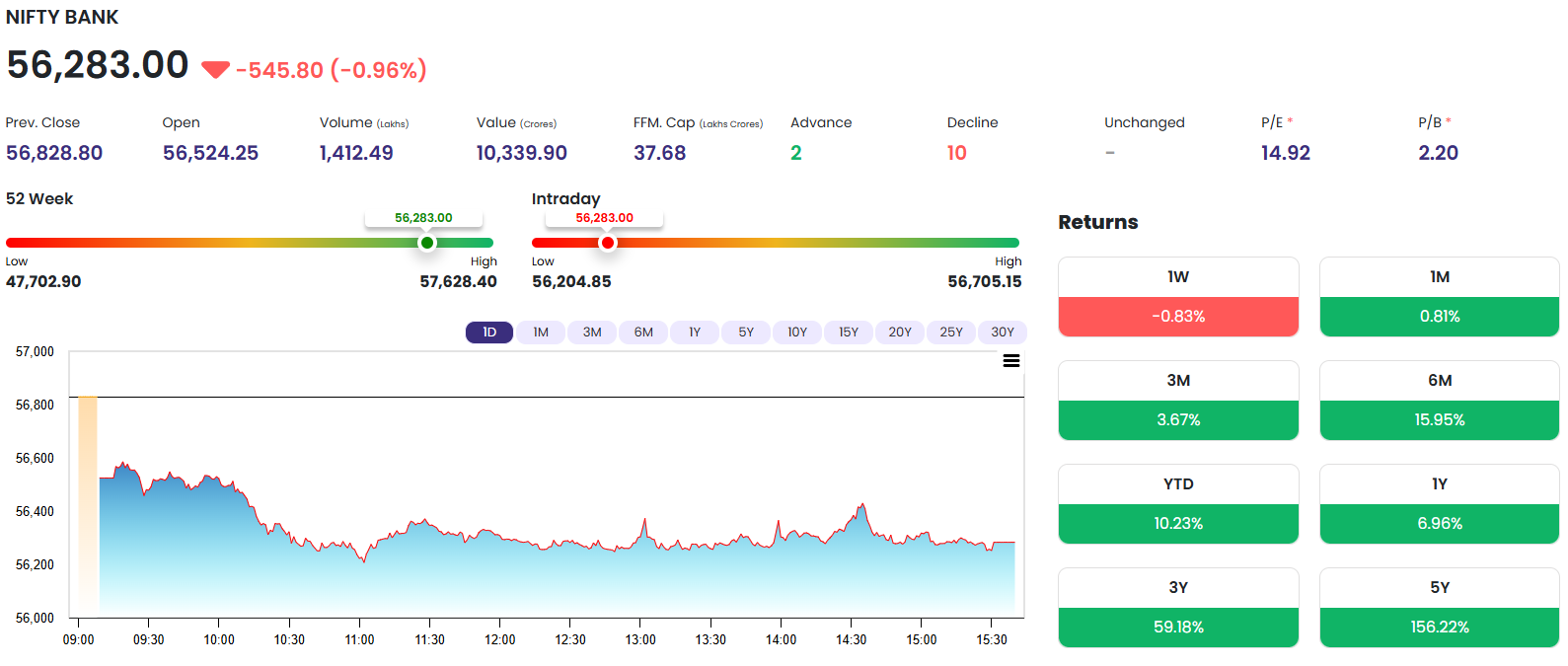

✅ BANK NIFTY Index:

-

Current Price: 56,283.00

-

Open: 56,524.25

-

High / Low: 56,705.15 / 56,204.85

-

Previous Close: 56,828.80

-

Day’s Fall: -545.80 pts (-0.96%)

Banking stocks saw heightened volatility and pressure amid ongoing concerns regarding asset quality and interest margin pressures for Q1 FY26. Private sector lenders led the fall, with HDFC Bank, Axis Bank, and Kotak Mahindra Bank among the top losers. This sell-off reflects institutional profit booking post earnings.

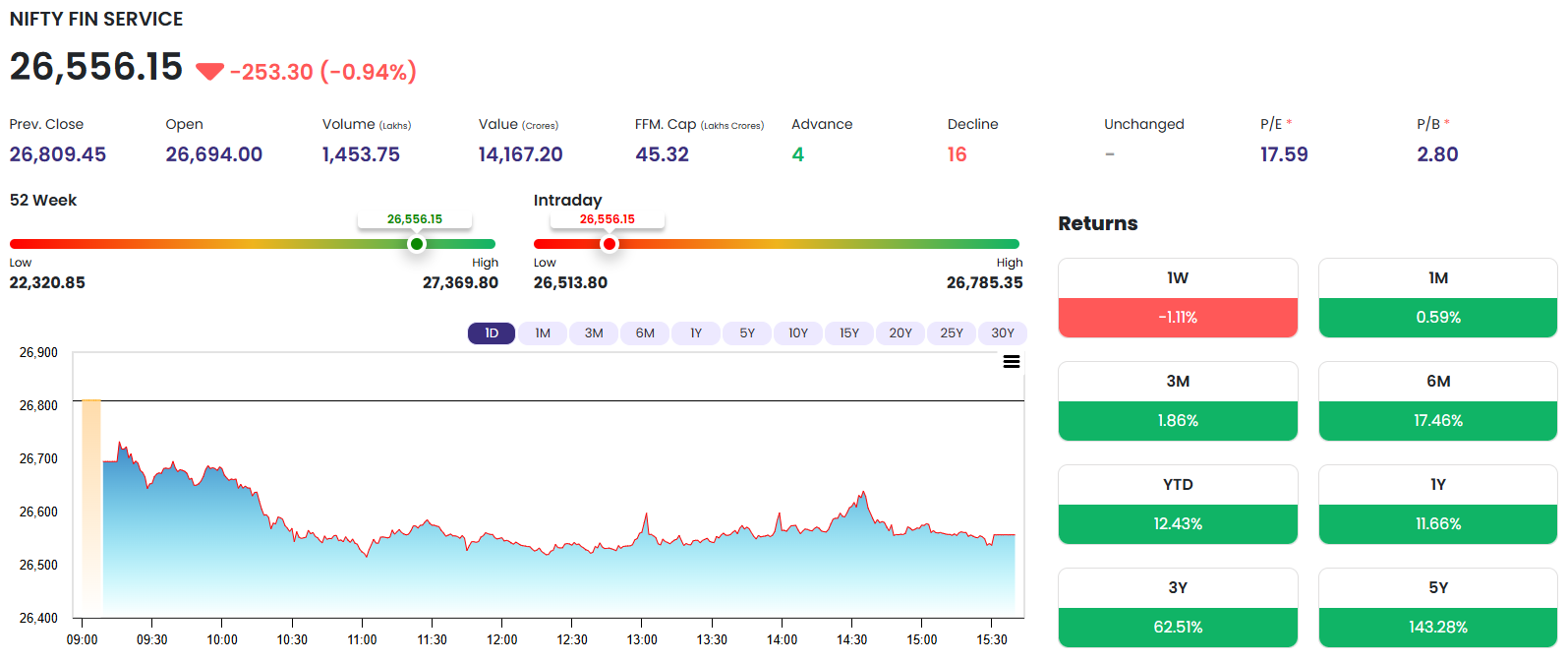

✅ FIN NIFTY Index:

-

Current Price: 26,556.15

-

Open: 26,694.00

-

High / Low: 26,785.35 / 26,513.80

-

Previous Close: 26,809.45

-

Day’s Fall: -253.30 pts (-0.94%)

The FIN NIFTY too mirrored the weakness in the banking sector. Financial services firms, NBFCs, and insurance stocks remained under pressure as market sentiment remained risk-averse. Stronger commentary will be awaited in upcoming earnings for clarity on growth trajectory.

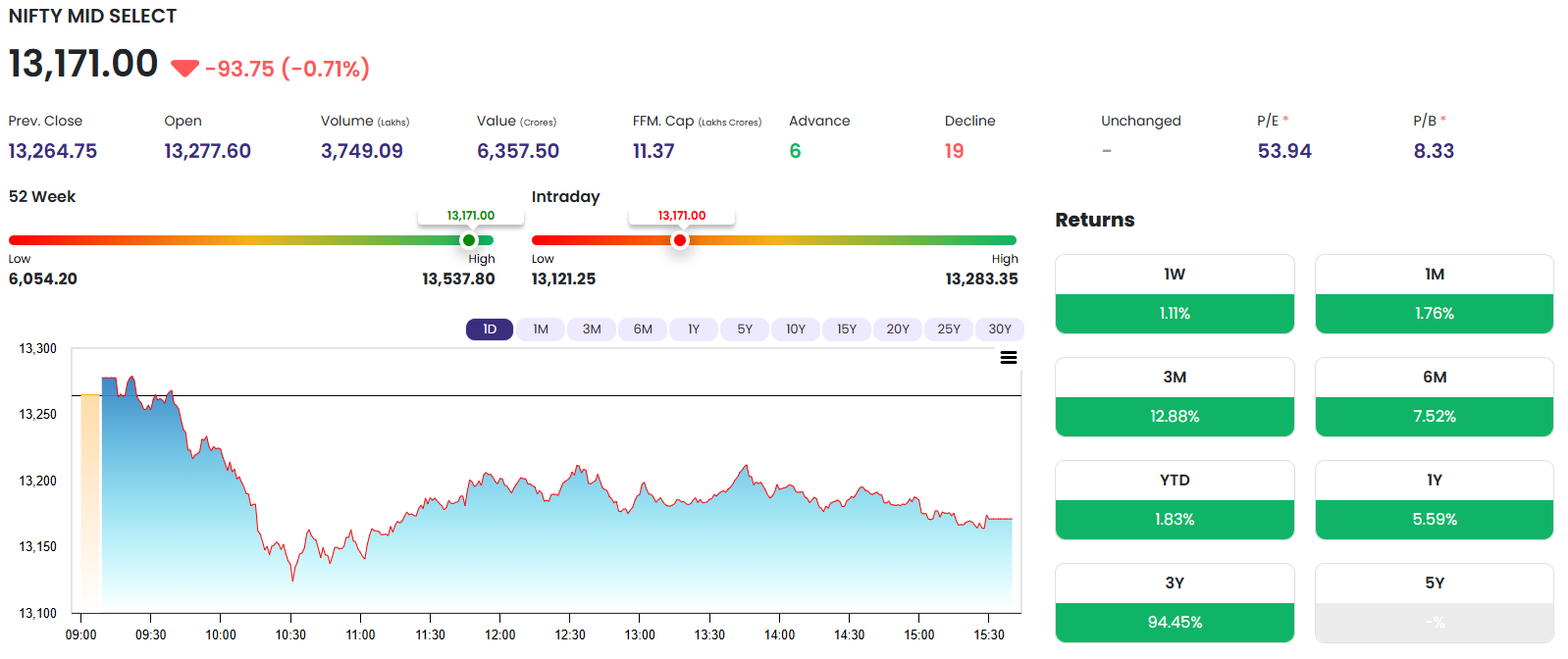

✅ MIDCAP NIFTY Index:

-

Current Price: 13,171.00

-

Open: 13,277.60

-

High / Low: 13,283.35 / 13,121.25

-

Previous Close: 13,264.75

-

Day’s Fall: -93.75 pts (-0.71%)

The midcap segment showed relatively better resilience, although it still ended in the red. Stock-specific action was observed in sectors like capital goods and auto ancillaries, but selling in mid-sized financials and real estate names dragged the broader space.

🔁 Key Reasons for Market Weakness

📍 Global Market Sentiment:

-

US Fed officials signaled prolonged high interest rates.

-

Weak overnight cues from Wall Street carried into Asia and Europe.

📍 Domestic Pressure Points:

-

Mixed Q1 FY26 earnings reports.

-

Investor anxiety over Nifty trading at historically high valuations.

-

Lack of strong institutional buying support.

📍 Sectoral Weakness:

-

Major pressure in banking, financial services, and IT sectors.

-

Select PSU banks also saw correction after previous run-ups.

📈 Share Market Impact & Technical View

-

NIFTY Below 25,000: A technically significant breach that could invite more selling if not reversed quickly.

-

BANK NIFTY Weakness: Below 56,300, signals bearish sentiment for financial space.

-

Support Levels:

-

NIFTY: Next support at 24,800 / 24,650.

-

BANK NIFTY: May test 56,000 or lower if global pressure persists.

-

-

Volatility Index (India VIX): Slightly up, indicating rising fear among traders.

💬 Expert Insights

“The current decline is a healthy correction after a prolonged rally. However, global liquidity tightening remains a concern. Investors should stay stock-specific,” said an equity strategist at a Mumbai-based brokerage.

🏢 Company-Specific Impact

-

Reliance Industries: Saw profit booking post Q1 results.

-

HDFC Bank & Axis Bank: Faced selling despite stable earnings, hinting at investor fatigue.

-

IT Stocks: Underperformed on weak revenue growth outlook amid global tech slowdown.

📣 What Retail Investors Should Do

✅ Short-Term Traders:

Avoid aggressive longs until Nifty reclaims 25,200+ decisively. Focus on intraday volatility opportunities.

✅ Long-Term Investors:

Use dips in quality largecaps and strong midcaps to accumulate. Focus on Q1 FY26 earnings trends before fresh allocation.

✅ Sectors to Watch:

-

Defensive: FMCG, Pharma, and Capital Goods

-

Avoid: Overvalued midcaps and volatile IT/banking names in the near term

Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.