IIFL Capital Services Q2 FY26 Results| IIFL Securities Investor Presentation| IIFLCAPS share| IIFL Q2 FY26 highlights| IIFL Capital Financial Performance| IIFL Investor Deck

Company: IIFL Capital Services Ltd (formerly IIFL Securities)

Exchange: NSE: IIFLCAPS | BSE: 542773

Date: 7 November 2025

🏛️ Company Overview

- Founded in 1995 as Probity Research & Services Ltd

- Internet trading launched in 1999, listed in 2005

- Investment from Fairfax Financial (Canada)

- Rebranded to IIFL Capital in 2024

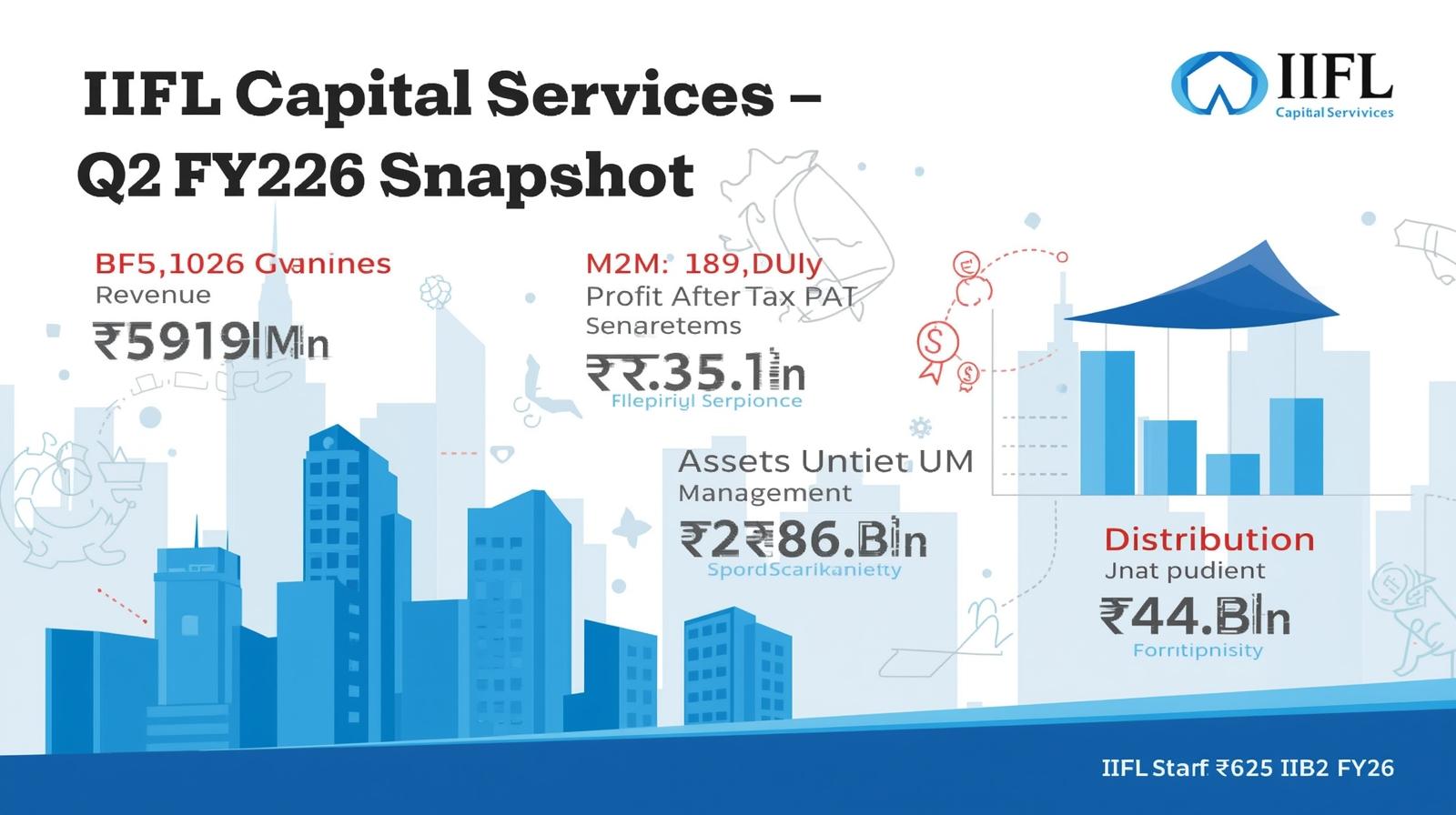

📊 Key Performance Snapshot (Q2 FY26)

| Metric | Value | YoY Change |

|---|---|---|

| Assets under Management & Custody | ₹ 2,486 Bn | +21 % |

| Avg Daily Turnover | ₹ 2,636 Bn | +8 % |

| Operating Revenue | ₹ 5,916 Mn | -4 % QoQ |

| Profit After Tax | ₹ 849 Mn | -59 % |

| Net Worth | ₹ 28.1 Bn | +27 % |

| Distribution AUM | ₹ 444 Bn | +42 % |

| Margin Trading Book | ₹ 15.1 Bn | +44 % |

| Investment Banking Transactions | 14 completed | — |

💼 Business Segments

1. Institutional Equities & Investment Banking

- Teams across Mumbai, Singapore, London, and New York

- 306 stocks under research across 20+ sectors, covering 71% of India’s market cap

- Q2 FY26: 14 deals executed (10 IPOs, 1 rights issue, 1 QIP, 2 PE deals)

- Strong pipeline for the next 4–6 quarters

2. Wealth & Retail Distribution

- 3,500+ external wealth managers, 500+ RMs

- ₹ 444 Bn distribution AUM; diversified across MFs (41%), Debt (33%), PMS/AIF/ETF (26%)

💰 Financial Highlights (Q2 FY26)

| Particulars | Q2 FY26 | Q1 FY26 | QoQ | YoY |

|---|---|---|---|---|

| Total Revenue | ₹ 5,916 Mn | ₹ 6,174 Mn | -4% | -8% |

| PBT | ₹ 1,199 Mn | ₹ 2,258 Mn | -47% | -55% |

| PAT | ₹ 851 Mn | ₹ 1,734 Mn | -51% | -59% |

| Expenses | ₹ 4,275 Mn | ₹ 4,529 Mn | -6% | — |

🧭 Strategic Outlook

- Holistic financial services model – Institutional + Retail + Wealth + Distribution

- Cross-sell opportunities and synergistic intelligence sharing

- Focus on cost efficiency, client engagement, and digital integration

🌱 ESG & Governance

- 50%+ independent board members; woman Chairperson & separate MD

- ISO 14001:2015 certification

- Green energy & water harvesting initiatives

- 25% workforce diversity

- CSR: IIT scholarships for girls, women-led startup support, cultural centre at Tangdhar (J&K)

IIFL Capital Services Q2 FY26 Results| IIFL Securities Investor Presentation| IIFLCAPS share| IIFL Q2 FY26 highlights| IIFL Capital Financial Performance| IIFL Investor Deck

📈 Market Sentiment

The IIFL Capital Services Q2 FY26 Results performance shows temporary margin compression, primarily due to lower retail trading revenue and higher finance costs. However, the company retains robust fundamentals, a strong deal pipeline, and diversified earnings streams — positioning it well for FY26’s capital market upturn.

📢 Join Our Market Community

📱 Stay updated on IPOs, Results & Market News:

- WhatsApp Channel: Join Now

- Telegram: Follow Updates

- Arattai: Connect with Us

Infosys Buyback 2025: Record Date, Price ₹1800, ₹18,000 Crore Offer Details

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

The Tariff Tussle: Decoding the Legal Challenge to Executive Trade Power

Supreme Court| Tariffs| Trade War 2026| Donald Trump| IEEPA| Section 301| US Economy| Import Duties| Constitutional Law| Reciprocal Trade Act…

-

The 2025-26 Market Journey: From All-Time Highs to the “Retail Trap” Panic

Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks|…

-

Indian Stock Market Update Feb 20: Nifty Reclaims 25,550, Sensex Jumps 316 Pts Amid Global Cues

Indian Stock Market Update Feb 20| Nifty 50 today| Sensex closing| Top gainers and losers Market Snapshot: The Bulls Fight…

-

Indian Stock Market Today: Bulls Charge Ahead as Sensex and Nifty Rally on Banking & IT Strength

# Indian Stock Market Today: Sensex and Nifty Close Higher Amid Broad-Based Buying ## Indian Stock Market Report – Updated…

-

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown Trending Keywords: YouTube down, YouTube…

-

Global Market Update 2026: Equities, Commodities, and Indian Rupee Outlook

Comprehensive 2026 global market update covering equities, commodities, bond markets, US Dollar trends, and detailed Indian Rupee outlook with investment themes and risks.