Home Depot, a leading home improvement retailer, has significantly expanded its footprint in the professional contractor market through strategic acquisitions. Over the past few years, the company has focused on acquiring specialty distributors and wholesale suppliers to enhance its service offerings and grow its addressable market.

These acquisitions not only strengthen Home Depot’s position in the building materials and maintenance, repair, and operations (MRO) sectors but also position it as a go-to partner for professional contractors across the U.S.

1. Home Depot Acquires SRS Distribution – $18.25 Billion

In 2024, Home Depot completed its largest acquisition to date by acquiring SRS Distribution, a leading distributor of specialty building products, for $18.25 billion.

Key Highlights of the Acquisition:

- Branch Network: SRS operates over 760 branches across 47 U.S. states, employing approximately 11,000 people.

- Market Expansion: The acquisition increases Home Depot’s total addressable market by $50 billion, bringing it close to $1 trillion.

- Focus Areas: SRS specializes in products for roofing, landscaping, and pool construction, allowing Home Depot to deepen relationships with professional contractors.

- Strategic Rationale: By acquiring SRS, Home Depot aims to enhance its service offerings for professionals, enabling faster deliveries, specialized product availability, and stronger local support.

Subsequent Move: Following the SRS acquisition, Home Depot’s subsidiary, SRS Distribution, acquired GMS Inc., a distributor of drywall, ceilings, and steel framing, for approximately $5.5 billion. This further strengthens Home Depot’s reach in specialty building products.

Investor Insight: These acquisitions indicate Home Depot’s commitment to professional contractor growth. Retail investors may see long-term revenue stability as the company diversifies beyond retail customers into high-margin professional segments.

2. Home Depot Acquires HD Supply – $8.8 Billion

In December 2020, Home Depot expanded into the MRO sector by acquiring HD Supply Holdings, Inc. for $8.8 billion in an all-cash tender offer at $56 per share.

Key Highlights of the Acquisition:

- Market Position: HD Supply is a leading wholesale distributor of maintenance, repair, and operations products, serving commercial and institutional customers.

- Market Size: The MRO marketplace is estimated at $55 billion, providing significant growth potential for Home Depot.

- Strategic Impact: The acquisition positioned Home Depot as a premier MRO provider, diversifying its revenue stream beyond retail sales.

Investor Insight: The HD Supply deal reflects Home Depot’s focus on long-term recurring revenue from professional clients, reducing reliance on cyclical retail demand.

3. Financial Snapshot and Stock Performance

- Stock Ticker: NYSE: HD

- Current Price: $418.95 (as of latest session)

- Recent Performance: Up 1.78%, reflecting investor confidence in Home Depot’s strategic acquisitions.

Market Impact:

- These acquisitions enhance Home Depot’s position in high-margin professional sectors.

- Expansion into specialty building products and MRO markets provides diversified growth avenues.

- Professional contractor focus is likely to drive repeat business and increased customer loyalty.

4. Strategic Analysis

Home Depot’s acquisition strategy aligns with the following key objectives:

- Market Expansion: By acquiring SRS and HD Supply, Home Depot has increased its market reach into sectors previously underserved by its retail stores.

- Professional Contractor Focus: The company is becoming a full-service partner for professional contractors, offering specialized products and logistics support.

- Revenue Diversification: Diversifying into B2B sales reduces exposure to retail cyclicality and seasonal fluctuations.

- Competitive Edge: Strengthened distribution networks and enhanced product portfolios make Home Depot more competitive against Lowe’s and other regional suppliers.

Retail Trader Tip: Investors should watch Home Depot’s quarterly results for revenue contributions from SRS, HD Supply, and GMS acquisitions. Growing B2B revenue could support long-term stock appreciation.

5. Key Takeaways

- Home Depot’s $18.25B SRS Distribution acquisition is its largest-ever deal, significantly expanding professional contractor services.

- The HD Supply acquisition ($8.8B) diversified Home Depot’s revenue into MRO markets.

- Subsequent acquisition of GMS Inc. ($5.5B) strengthens specialty building product offerings.

- Strategic acquisitions position Home Depot for long-term growth, increased market share, and recurring revenue from professional clients.

References

- Home Depot Acquires SRS Distribution

- Home Depot Subsidiary Acquires GMS Inc.

- Home Depot Completes HD Supply Acquisition

- Barrons: Home Depot to Acquire GMS

- Investopedia: Home Depot Wins Bidding War for GMS

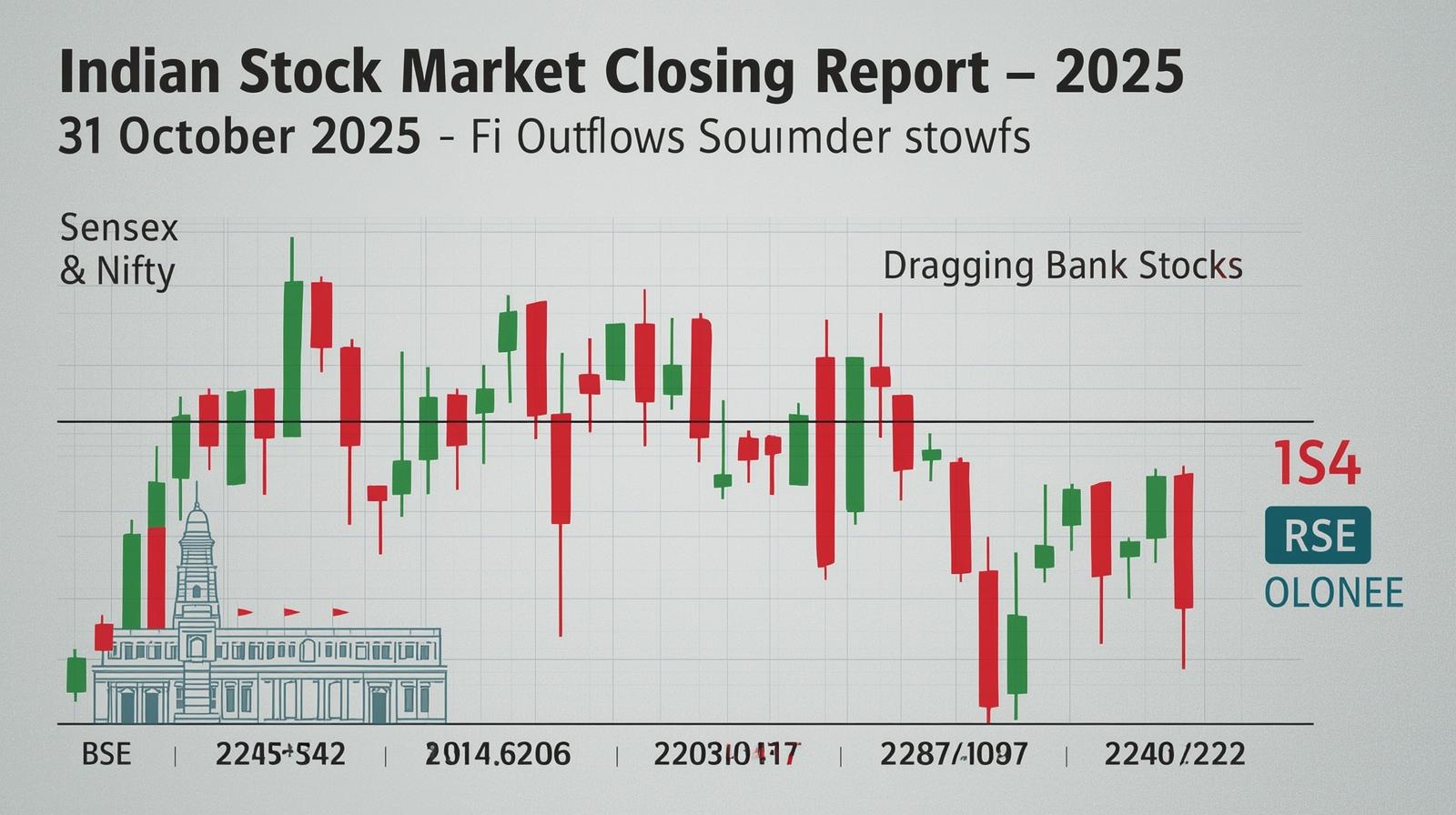

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)