Eternal CEO Resignation| Deepinder Goyal Resigns| Albinder Dhindsa New CEO| Eternal Share Price Impact| Blinkit Leadership Change

Critical Dates: Leadership Transition

| Event | Date |

| Announcement Date | January 21, 2026 |

| Effective Date | February 1, 2026 |

| Q3 FY26 Earnings Call | January 21, 2026 |

| Shareholder Approval (Est.) | March 2026 |

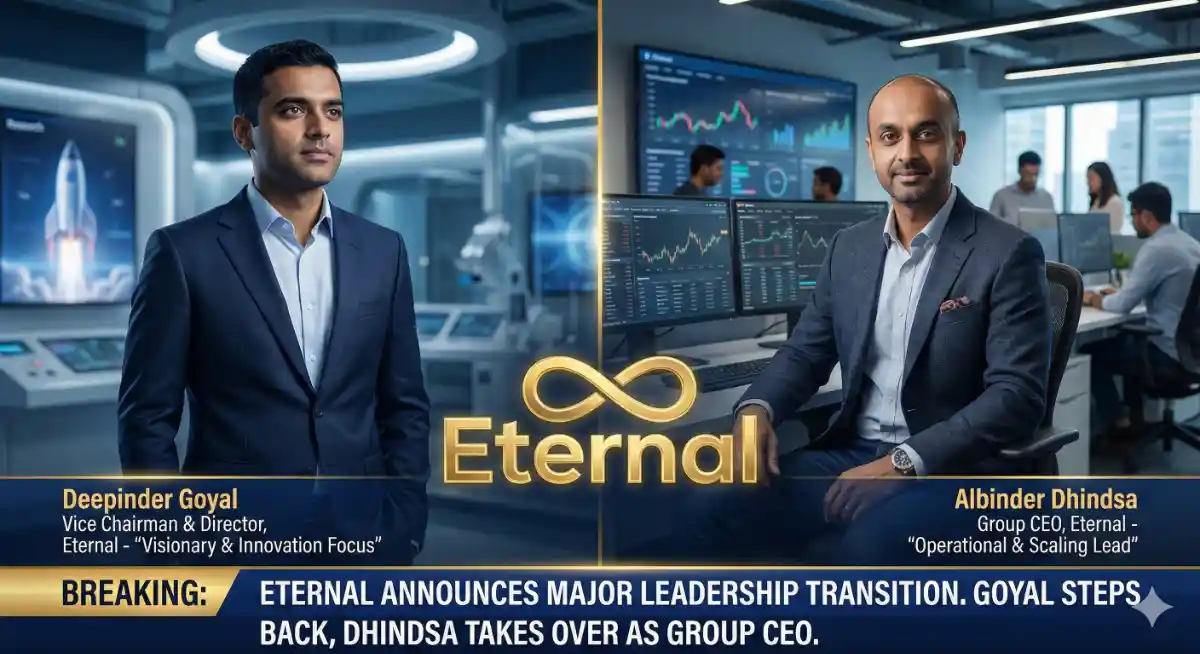

In a move that has sent shockwaves through the Indian corporate landscape, Eternal (formerly Zomato Limited) announced today that its founder, Deepinder Goyal, has resigned as Group CEO.

Effective February 1, 2026, the baton passes to Albinder Dhindsa, the current CEO of Blinkit, who has been instrumental in the group’s recent hyper-growth. This marks the end of an era for the food-tech giant and the beginning of a new chapter focused on scaling its diverse verticals under fresh operational leadership.

The Big Announcement: What Happened?

On January 21, 2026, alongside its Q3 FY26 earnings report (which saw a 73% profit surge), Eternal confirmed the leadership restructure.

Deepinder Goyal is not leaving the company. Instead, he is transitioning to the role of Vice Chairman and Director. In his letter to shareholders, Goyal cited a desire to return to his roots as a “builder” rather than an “operator,” focusing on high-risk, zero-to-one ideas that don’t fit the typical risk profile of a public company CEO.

“I am stepping back to step up. My new role allows me to experiment without the daily pressure of quarterly results, while Albinder drives the ship forward.” — Deepinder Goyal

Deep Dive: The Leadership Shuffle

Deepinder Goyal: The Visionary Returns to the Lab

Goyal’s move mirrors a trend seen in global tech giants—founders stepping away from daily operations to focus on “moonshots.” By moving to the Vice Chairman role, Goyal frees himself from the granular details of managing a mature conglomerate. His focus will shift to:

- Culture & Governance: Ensuring the “Eternal” ethos remains intact across all verticals.

- Innovation: Exploring new verticals that are currently too risky for the public market spotlight.

- Mentorship: guiding the CEOs of Zomato, Blinkit, District, and Hyperpure.

Albinder Dhindsa: The Operator Takes Charge

Albinder Dhindsa’s elevation to Group CEO is a testament to the success of Blinkit. Since its acquisition by Zomato, Blinkit has not only turned profitable but has often outpaced the core food delivery business in growth metrics.

- Proven Track Record: Dhindsa successfully pivoted Grofers to Blinkit, mastering the complex 10-minute delivery model.

- Operational Rigor: Investors view Dhindsa as an execution machine—exactly what Eternal needs as it manages four distinct, capital-intensive businesses.

Strategic Analysis (SWOT)

To understand the implications of this transition, let’s look at the Strengths, Weaknesses, Opportunities, and Threats for Eternal under Dhindsa’s leadership.

Strengths

- Continuity: Dhindsa is already an insider. There is no “culture shock” of bringing in an external CEO.

- Diversified Revenue: With Food (Zomato), Quick Commerce (Blinkit), and Going Out (District), Eternal is no longer dependent on a single revenue stream.

- Strong Balance Sheet: The Q3 results show a company in robust financial health with ₹102 Crore in PAT.

Weaknesses

- Key Person Risk: Deepinder Goyal is the brand. His step-back might make retail investors nervous about the company’s long-term vision.

- Integration Challenges: While Blinkit is integrated, ensuring District and Hyperpure don’t get sidelined under a “Quick Commerce” focused CEO will be a challenge.

Opportunities

- Cross-Selling: Dhindsa is expected to deepen the integration between apps—ordering food, groceries, and event tickets from a unified ecosystem.

- New Geographies: Blinkit’s model is ripe for aggressive expansion into Tier-2 cities, a playbook Dhindsa knows well.

Threats

- Regulatory Scrutiny: As Eternal grows larger, it faces higher scrutiny regarding gig-worker rights and market dominance.

- Competition: Zepto and Swiggy Instamart remain fierce competitors. Any slip in execution during this transition could be costly.

Financial Impact & Market Reaction

The market reaction has been mixed but cautiously optimistic. The stock initially dipped on the headline “Resigns” but recovered as analysts digested the “Vice Chairman” detail.

- Short Term: Volatility is expected. The market hates uncertainty, and a founder stepping down always creates jitters.

- Long Term: This is likely a positive. It mitigates the risk of “Founder Fatigue” and puts a proven scaler in the driver’s seat.

FAQ Section

Q: Is Deepinder Goyal leaving Eternal entirely? A: No. He is resigning as CEO but will remain on the Board as Vice Chairman and Director. He will focus on long-term strategy and new high-risk projects.

Q: When does this change take effect? A: The change is effective from February 1, 2026.

Q: Who is the new CEO of Eternal? A: Albinder Dhindsa, the current CEO of Blinkit, will become the Group CEO of Eternal.

Q: Why did Deepinder Goyal resign? A: He stated he wants to pursue “new, higher-risk ideas” that are better suited for outside the daily operations of a public company.

Q: How did Eternal perform in Q3 FY26? A: Eternal reported a strong quarter with a 73% year-on-year increase in Net Profit (PAT) to ₹102 Crore.

Eternal CEO Resignation| Deepinder Goyal Resigns| Albinder Dhindsa New CEO| Eternal Share Price Impact| Blinkit Leadership Change

Also View:

📢 Join Our Market Community

📱 Stay updated on IPOs, Results & Market News:

- WhatsApp Channel: Join Now

- Telegram: Follow Updates

- Arattai: Connect with Us

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

Market Snapshot: Bulls Return on Global Cues & Trade Deal Optimism

Indian Stock Market| Nifty 50| Sensex| Bank Nifty| Axis Bank| India-EU FTA| Stock Market News| Market Wrap| Jan 27 2026…

-

India-EU FTA 2026: The “Mother of All Deals” Sealed – In-Depth Analysis

India EU FTA 2026| India EU Trade Deal| Tariff cuts India EU| CBAM India EU agreement| India EU Services Trade…

-

Hindustan Zinc OFS Review 2026: Vedanta to Offload ₹4,500 Cr Stake

Hindustan Zinc OFS Review| Vedanta Limited| HINDZINC| Stock Market News| Dividend Stocks| Silver Rally| Zinc Prices| Offer For Sale| High…

-

Weekly Market Intelligence: 10 Stocks to Watch

Top 10 Stocks| Top 10 Stocks to Watch| Market Analysis As the Indian markets navigate a period of heightened volatility…

-

Lesson 19 – KEY RATIOS |Deep Dive into PE, PB, ROE & DE

Key Ratios| Stock Market Basics| PE Ratio| PB Ratio| ROE| Debt Equity Ratio| Fundamental Analysis| Investing for Beginners Introduction| Part-1/3…