Best Stocks for Next Week, Stock Market Prediction Next Week| Swing Trading Stocks India| High Momentum Stocks January 2026| Nifty Breakout Stocks

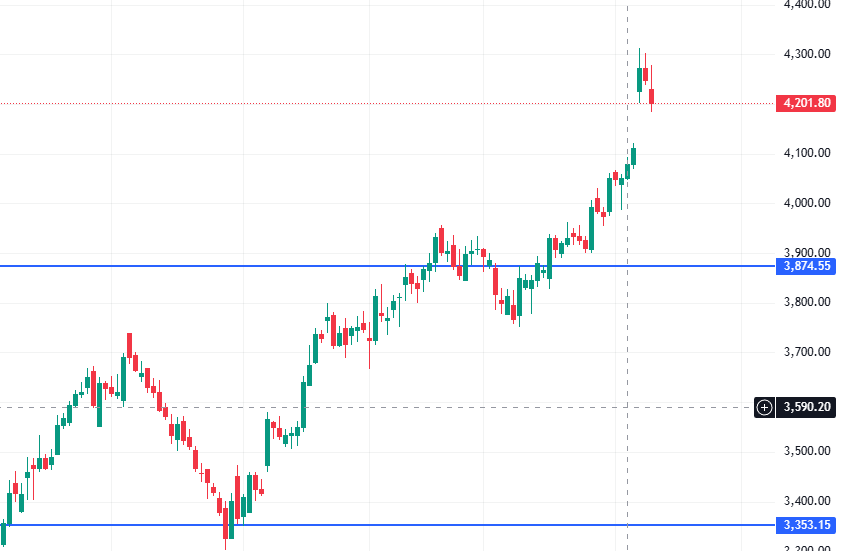

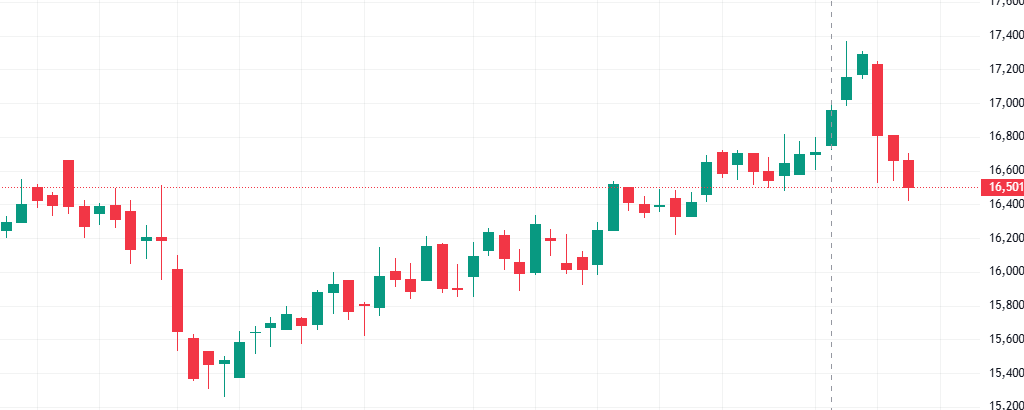

The Indian stock market is gearing up for a decisive week starting January 12, 2026. With the Nifty 50 showing signs of consolidating near all-time highs and budget expectations building up, smart money is moving into specific sectors.

If you are looking for swing trading opportunities, stock selection is critical. We have filtered down 10 high-conviction stocks that are showing strong technical setups (breakouts, reversals) or have received fresh brokerage upgrades this weekend.

Here is your detailed guide to the best stocks for the coming week.

Part 1: Technical Breakout Picks (High Momentum)

These five stocks have generated “Buy” signals on the technical charts (Daily/Weekly timeframes) as of the closing bell on Friday, January 9.

1. Varun Beverages Ltd (VBL)

- Current Market Price (CMP): ₹489

- Target Price: ₹550

- Stop Loss: ₹460

- Potential Upside: ~12%

Deep Dive Analysis: Varun Beverages has been consolidating in a symmetrical triangle pattern for the last five weeks. On Friday, we witnessed a high-volume breakout above the resistance line.

- Technical Setup: The RSI has crossed 60, indicating gathering momentum, and the MACD has given a positive crossover above the zero line.

- Why Buy Now: As a key bottler, VBL often sees pre-summer accumulation starting in January. The chart suggests the start of a fresh impulse wave.

2. IREDA (Indian Renewable Energy Dev. Agency)

- Current Market Price (CMP): ₹136

- Target Price: ₹162

- Stop Loss: ₹135

- Potential Upside: ~11%

Deep Dive Analysis: IREDA has been a retail favorite that faced a steep correction recently. However, the tide is turning.

- Technical Setup: The stock has formed a classic “Double Bottom” reversal pattern near the ₹135 support zone. It successfully closed above its 20-day Moving Average for the first time in a month.

- Why Buy Now: With the upcoming Union Budget expected to focus heavily on Green Energy financing, IREDA is a prime candidate for a “pre-budget rally.”

3. Hindustan Unilever (HUL)

- Current Market Price (CMP): ₹2,372

- Target Price: ₹2,520

- Stop Loss: ₹2,290

- Potential Upside: ~6%

Deep Dive Analysis: For defensive traders, HUL offers a low-risk entry.

- Technical Setup: The stock has broken out of a falling trendline that has suppressed price action since November. The volume on the breakout candle was 2x the 10-day average.

- Why Buy Now: In volatile markets, money rotates back to FMCG giants. HUL provides capital protection with steady upside potential.

4. Tata Power

- Current Market Price (CMP): ₹364

- Target Price: ₹405

- Stop Loss: ₹349

- Potential Upside: ~9%

Deep Dive Analysis: Tata Power is strictly a “Support Play” this week.

- Technical Setup: The stock is trading in a defined range (Rectangle Pattern) between ₹370 and ₹410. It is currently at the bottom of this box (₹370-₹372).

- Why Buy Now: History shows that every time Tata Power hits ₹370, it bounces back toward ₹400. The risk-reward ratio here is excellent (Risking ₹20 to make ₹35).

5. Havells India

- Current Market Price (CMP): ₹1,464

- Target Price: ₹1,560

- Stop Loss: ₹1,375

- Potential Upside: ~8%

Deep Dive Analysis: Havells is showing signs of institutional accumulation.

- Technical Setup: The stock reclaimed its Monthly VWAP (Volume Weighted Average Price) on Friday. A strong bullish candle engulfed the previous three days of price action.

- Why Buy Now: The real estate revival is driving demand for electrical goods. Havells is technically poised to test its previous swing highs.

Also View:

- 45 Weeks. 45 Lessons. From Basics to Advanced – Master Stock Market Investing in Less than 1 Year.

- Lesson 1: What is a Stock Market? Beginner’s Guide to Understanding Shares & Trading

- Lesson 13: Intraday vs Delivery. What trade to do!

- Lesson 14: Short Selling & Margin Trading

- Lesson 15: Settlement System: How Your Trade Becomes Real Money and Shares

- Lesson 16: Introduction: Understanding the Balance Sheet Analysis!

Part 2: Fundamental & News-Driven Picks

These stocks are in focus due to specific news flows, brokerage upgrades, or sectoral tailwinds expected to hit the market this week.

6. Adani Power

- Projected Upside: ~20%

- Catalyst: Brokerage Upgrade

- Analysis: JM Financial initiated coverage this weekend with a ‘Buy’ rating and a target of ₹178. They cited Adani Power’s dominant positioning in the thermal power sector, which is critical as India faces peak power deficits in 2026. The technical chart also shows a breakout from a consolidation phase.

7. Waaree Energies

- Projected Upside: ~38% (Mid-term)

- Catalyst: Solar Sector Boom

- Analysis: Nuvama has issued a ‘Buy’ rating with a massive target of ₹3,691. Waaree is the market leader in solar module manufacturing. With the government likely to announce PLI scheme expansions for solar in the upcoming budget, this stock could see aggressive buying in the grey market and open market alike.

8. Titan Company

- Projected Upside: ~17% (Long-term)

- Catalyst: Valuation Comfort

- Analysis: Motilal Oswal reiterated a ‘Buy’ with a ₹5,000 target. Titan has corrected recently, bringing its valuation to reasonable levels. The wedding season demand in Q4 FY26 is expected to be robust, making this dip a perfect accumulation zone for swing traders.

9. Tata Motors

- Projected Upside: ~18%

- Catalyst: CV Cycle Reversal

- Analysis: InCred Equities believes the Commercial Vehicle (CV) downcycle is over. After 6 quarters of sluggishness, the replacement demand is kicking in. Tata Motors, being the market leader in CVs, stands to benefit the most. The stock is also forming a “Higher Low” structure on the weekly charts.

10. Maruti Suzuki

- Projected Upside: ~15%

- Catalyst: GST Cut Hopes

- Analysis: BNP Paribas named Maruti a top pick for 2026. The auto industry is lobbying hard for a GST cut on entry-level cars. Even rumors of such a cut in the budget could send Maruti soaring. Technically, the stock is hovering near a major support zone, making the downside limited.

Execution Strategy for the Week

To trade these stocks effectively, follow these rules:

- Entry Rule: Do not jump in at the market open (9:15 AM). Wait for the first 15 minutes of the candle to close. If the high of the first 15 minutes is broken, enter the trade.

- Sector Rotation: If the Nifty Auto Index is weak, avoid Maruti and Tata Motors even if individual setups look good. Always trade in the direction of the sector.

- Profit Booking: If a stock hits 5-6% profit, book 50% of your quantity and trail the stop loss to your cost price. This ensures a risk-free trade.

Frequently Asked Questions (FAQ)

Q1. Which is the best stock for high risk and high reward this week? IREDA and Waaree Energies offer the highest volatility. If the momentum catches on, they can deliver 10%+ returns quickly, but they also carry higher risk if the market reverses.

Q2. Are these stocks suitable for long-term investment? Titan, HUL, and Tata Motors are excellent long-term portfolio stocks. The others, like Adani Power and IREDA, are better suited for momentum or swing trading based on current setups.

Q3. What is the stop loss rule for these trades? We have provided specific stop loss levels for the technical picks. Strictly adhere to them. If a stock closes below the stop loss level on a daily candle, exit the trade immediately to preserve capital.

Q4. How does the upcoming budget affect these stocks? The budget (Feb 1) will have a major impact on IREDA, Waaree (Energy), and Maruti (Auto). Expect volatility in these names to increase as we get closer to the end of January.

Q5. Where can I check real-time updates for these stocks? You should track the Nifty sectoral indices (e.g., Nifty Auto, Nifty Energy) to gauge the broader trend affecting these specific stocks.

Disclaimer: I am an AI, not a SEBI registered financial advisor. The targets and stop losses mentioned above are based on technical chart patterns and brokerage reports. The stock market is volatile; please consult your financial advisor before deploying real capital.

Best Stocks for Next Week, Stock Market Prediction Next Week| Swing Trading Stocks India| High Momentum Stocks January 2026| Nifty Breakout Stocks

Also View:

- 45 Weeks. 45 Lessons. From Basics to Advanced – Master Stock Market Investing in Less than 1 Year.

- Lesson 1: What is a Stock Market? Beginner’s Guide to Understanding Shares & Trading

- Lesson 13: Intraday vs Delivery. What trade to do!

- Lesson 14: Short Selling & Margin Trading

- Lesson 15: Settlement System: How Your Trade Becomes Real Money and Shares

- Lesson 16: Introduction: Understanding the Balance Sheet Analysis!

📢 Join Our Market Community

📱 Stay updated on IPOs, Results & Market News:

- WhatsApp Channel: Join Now

- Telegram: Follow Updates

- Arattai: Connect with Us

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

The Tariff Tussle: Decoding the Legal Challenge to Executive Trade Power

Supreme Court| Tariffs| Trade War 2026| Donald Trump| IEEPA| Section 301| US Economy| Import Duties| Constitutional Law| Reciprocal Trade Act…

-

The 2025-26 Market Journey: From All-Time Highs to the “Retail Trap” Panic

Indian Stock Market Performance 2025-26| Nifty 50 Returns FY26| Why is Market Falling Feb 2026| Hold or Sell Indian Stocks|…

-

Indian Stock Market Update Feb 20: Nifty Reclaims 25,550, Sensex Jumps 316 Pts Amid Global Cues

Indian Stock Market Update Feb 20| Nifty 50 today| Sensex closing| Top gainers and losers Market Snapshot: The Bulls Fight…

-

Indian Stock Market Today: Bulls Charge Ahead as Sensex and Nifty Rally on Banking & IT Strength

# Indian Stock Market Today: Sensex and Nifty Close Higher Amid Broad-Based Buying ## Indian Stock Market Report – Updated…

-

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown Trending Keywords: YouTube down, YouTube…

-

Global Market Update 2026: Equities, Commodities, and Indian Rupee Outlook

Comprehensive 2026 global market update covering equities, commodities, bond markets, US Dollar trends, and detailed Indian Rupee outlook with investment themes and risks.