Company Overview – Adani Enterprises Ltd.

Adani Enterprises Ltd. (AEL) is the flagship entity of the Adani Group, headquartered in Ahmedabad, Gujarat. AEL serves as an incubator for new businesses, having launched verticals like Adani Power, Adani Ports, Adani Green Energy, and Adani Wilmar. It has major interests across infrastructure, energy, airports, logistics, and emerging technologies.

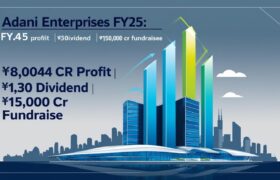

📊 Key Market Data (FY 2024–25):

-

Revenue (Consolidated): ₹1,00,365.08 Cr

-

Net Profit (Consolidated): ₹8,004.99 Cr

-

EPS (Basic & Diluted): ₹60.55

-

Net Worth: ₹56,470.45 Cr

-

Dividend Proposed: ₹1.30 per equity share (130%)

-

Fundraising Approved: Up to ₹15,000 Cr

-

Record Date for Dividend: June 13, 2025

-

Dividend Payment (on or after): June 30, 2025

📋 Key Pooints:

💠 Board Meeting Highlights (1st May 2025):

🔹 Approved audited results for FY 2024–25 (Standalone & Consolidated).

🔹 Declared dividend of ₹1.30 per share (130%) for FY 2024–25.

🔹 Fixed record date for dividend: June 13, 2025.

🔹 Approved re-appointment of Dr. Omkar Goswami as Independent Director.

🔹 Appointed Mr. Ashwin Shah as Secretarial Auditor for FY 2025–30.

🔹 Appointed Mr. Shobhit Dwivedi as Internal Auditor (replacing Mr. Tejas Shah).

🔹 Ceased SMP status of Ms. Sunipa Roy and Mr. Vikram Tandon.

🔹 Scheduled 33rd AGM for June 24, 2025 (VC/AVM mode).

🔹 Approved fundraising up to ₹15,000 Cr via equity or hybrid instruments.

💠 Financial Performance (Consolidated):

📈 Revenue: ₹1,00,365 Cr

💰 Net Profit: ₹8,004.99 Cr

📉 Expenses: ₹93,832 Cr

📊 EBITDA Margin: ~13.06%

💸 EPS: ₹60.55 per share

📦 Segment leaders: Integrated Resources, Airports, Roads, and New Energy

💠 Dividend & Capital Strategy:

🎯 ₹1.30 per equity share dividend declared

📅 Record Date: June 13, 2025 | Payment after: June 30, 2025

📥 Fundraising Plan: ₹15,000 Cr via QIP/Placement/Other methods

💹 Market Impact Outlook:

🔻 Likely Short-Term Effect:

-

Positive sentiment due to strong earnings and dividend payout.

-

Fundraising news may slightly dampen short-term stock prices due to dilution fears.

🔺 Medium to Long-Term Impact:

-

Fundraising suggests strategic expansion — a bullish signal.

-

EPS and Net Profit growth indicate strong fundamentals.

-

Reappointment and auditor changes reflect governance stability.

🧑💼 How This Helps Retail Traders:

✅ Dividend of ₹1.30 offers stable income opportunity.

✅ Strong financials support price appreciation potential.

✅ Fundraising implies growth initiatives — long-term value creation.

✅ Transparent disclosures improve investor confidence.

💬 Chart Snapshot (Profit YoY)

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) | EPS (₹) |

|---|---|---|---|

| 2023 | 98,281 | 3,335 | 27.24 |

| 2024 | 1,00,365 | 8,004.99 | 60.55 |

✨ Phrase:

📢 “Stay ahead with Adani’s bold moves — bookmark for the latest financial insights!”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.