Company Snapshot – Zydus Lifesciences Ltd

| Particulars | Details |

|---|---|

| NSE Symbol | ZYDUSLIFE |

| Current Price (27 July 2025) | ₹973.50 |

| 52-Week Range | ₹795 – ₹1,324 |

| Market Cap | ₹97,850 Cr |

| P/E Ratio | ~21x |

| ROE | 19.5% |

| Promoter Holding | 74.79% |

| Industry | Pharmaceuticals |

🧬 From Cadila to Zydus – A Legacy Reinvented

Founded in 1952 as Cadila Healthcare, Zydus Lifesciences has grown into one of India’s most respected and innovation-driven pharmaceutical conglomerates. With its HQ in Ahmedabad, the company has transformed itself from a domestic generics player to a global life sciences enterprise.

Zydus rebranded in 2022 to better reflect its evolving focus on biosimilars, vaccines, research-based drugs, and global healthcare delivery. Today, its presence spans 50+ countries, and it operates over 30+ manufacturing and R&D facilities.

📈 Stock Momentum – Trending Positively

Zydus Lifesciences is trending on Dalal Street, with the stock climbing ~1.69% on 27 July 2025 to close near ₹976.40. The positive trigger comes from:

-

Fresh USFDA Approvals

-

Product launches

-

Strong FY25 financials

-

Global acquisition spree

The stock is currently 15% up from its 3-month low, making it a standout performer in the Nifty Pharma Index, which has been under pressure.

🏥 What’s Fueling the Trend? – Key Developments

🔹 USFDA Greenlights Celecoxib Capsules

Zydus recently received final approval for Celecoxib capsules in 50mg, 100mg, 200mg, and 400mg variants. This pain management drug sees $122 million annual sales in the U.S. Zydus will likely tap into this through its strong U.S. distribution.

🔹 Oncology Edge – Ibrutinib, Apalutamide Approvals

USFDA also granted tentative approval for Ibrutinib, a blood cancer treatment worth over $2.1 billion globally, and final approval for Apalutamide tablets (for prostate cancer). These reinforce Zydus’ expansion in specialty oncology generics.

🔹 Strategic Biologics Play – CDMO Expansion in US

Zydus has acquired biologics facilities from Agenus Biotech (USA) to establish a Contract Development and Manufacturing (CDMO) base. This allows the firm to scale its biosimilar and monoclonal antibody programs globally.

🔹 Innovation: Semaglutide Delivery Pen

Zydus is working on a multi-strength semaglutide delivery pen, useful for diabetes and obesity patients. This will compete with Novo Nordisk’s Ozempic, combining convenience and cost advantage.

🔹 Legal Spotlight – Patent Clash on Nivolumab

Zydus is legally contesting a Delhi High Court ban on its Nivolumab biosimilar over a dispute with E.R. Squibb. This legal battle has created short-term risk but long-term potential in the high-margin immunotherapy space.

💰 Financials – A Glance at FY25 & Q4 Earnings

📊 Q4 FY25 Highlights (Ended March 2025)

-

Revenue: ₹6,528 Cr (+17% YoY)

-

Net Profit: ₹1,244 Cr (down 1% due to one-time charge)

-

Adjusted Profit: ₹1,390 Cr (+17.6% YoY)

-

EBITDA Margin: 22.9%

-

EPS: ₹44.99

Despite a marginal headline drop in net profit, the core business remains resilient. Adjusted numbers beat analyst estimates, showing operating efficiency and global scale benefits.

🌎 Global Play – Diversification Driving Stability

-

US Market: 47% of revenues

-

India Branded Generics: 29%

-

Emerging Markets (Africa, Brazil, SE Asia): 18%

-

EU & Japan: 6%

The U.S. continues to be the growth engine while Zydus remains one of the top five Indian pharma exporters. The domestic business remains stable, supported by chronic therapy sales and branded generics.

📉 Valuation and Retail Angle

At ₹976, Zydus trades at ~21x FY25 earnings, below the industry P/E average of 26x. It offers strong:

-

EPS Growth

-

Cash Reserves (~₹4,300 Cr)

-

Low Net Debt

-

Decent dividend payout (~₹5.5/share in FY25)

Retail investors find Zydus attractive due to its low volatility (Beta ~0.8) and long-term R&D-driven moat.

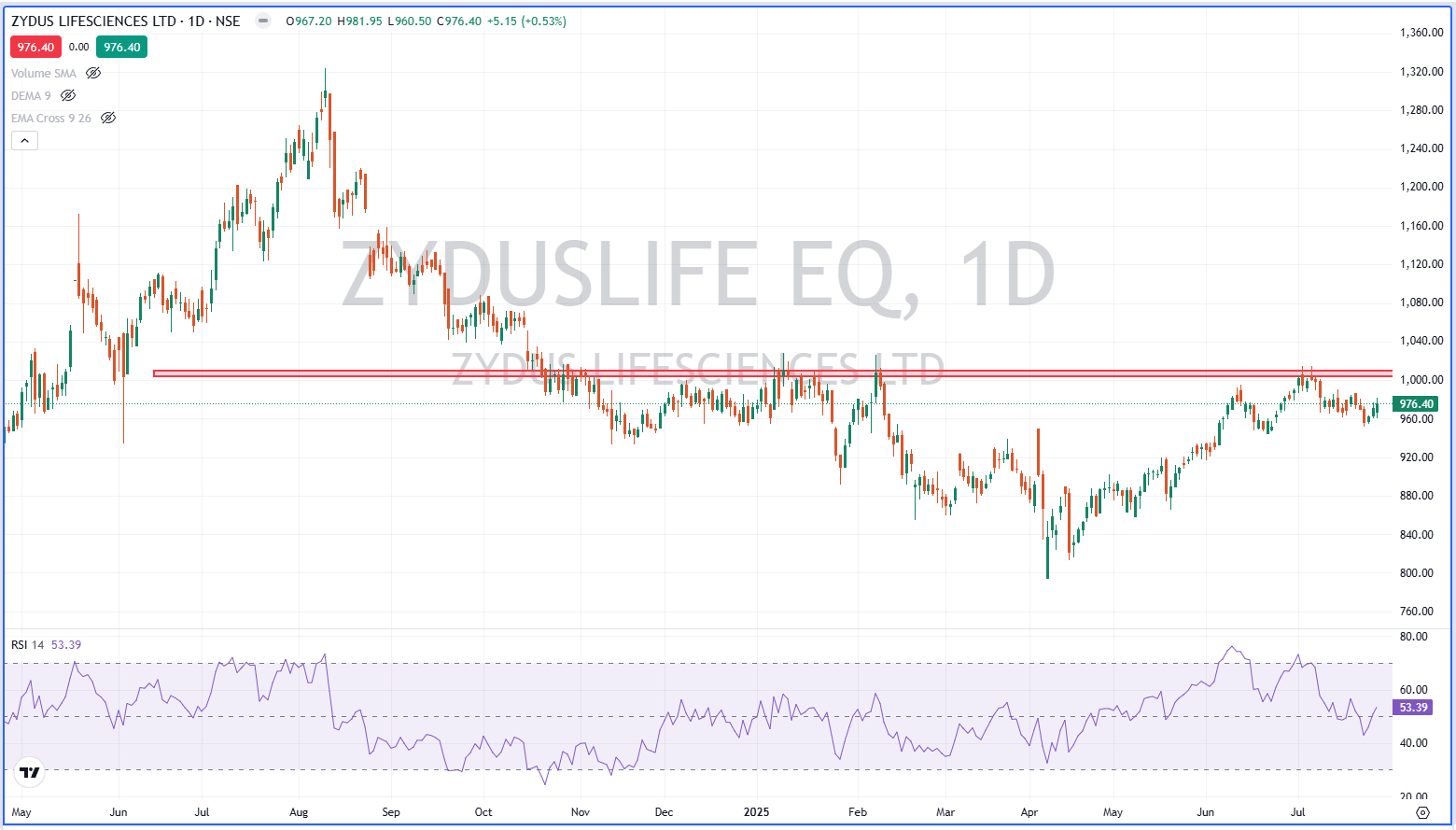

🔍 Technical Chart & Indicators

RSI: 62 (nearing overbought zone)

MACD: Bullish crossover

Support Levels: ₹940 / ₹895

Resistance Zone: ₹1,030 / ₹1,110

Zydus has broken its 20-DMA and 50-DMA levels decisively. Sustaining above ₹980 could pave the way toward ₹1,100 targets in the coming weeks, subject to broader Nifty Pharma trends.

🗣️ Analyst Verdict

| Broker | Rating | Target |

|---|---|---|

| Motilal Oswal | BUY | ₹1,100 |

| Jefferies India | HOLD | ₹1,003 |

| HDFC Securities | BUY | ₹1,080 |

| Sharekhan | HOLD | ₹960 |

Sentiment remains neutral to bullish with upside potential capped by litigation and FDA inspection risks.

🧾 Retail Takeaway – Why It Matters for You

-

✅ Strong global approvals pipeline

-

✅ Attractive long-term story in biosimilars

-

✅ Reasonable valuation with strong cash flows

-

⚠️ Watch legal outcomes for oncology portfolio

-

⚠️ FDA observations (esp. in injectable units)

Zydus Lifesciences is ideal for medium to long-term portfolios, especially for investors looking at low-beta pharma stocks with global optionality.

📌 Conclusion

Zydus Lifesciences has transitioned from a domestic generics brand into a pharma innovator with a global footprint. Its near-term stock movement is being propelled by regulatory approvals, pipeline visibility, and strategic acquisitions.

While litigation over key biosimilars is a short-term hurdle, the long-term growth potential in specialty drugs, CDMO, and global biologics keeps Zydus firmly in the spotlight.

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.