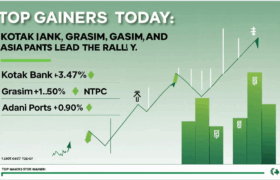

In today’s trading session, the Indian stock market saw a notable uptrend, with several heavyweight and mid-cap stocks marking impressive gains. The day was characterized by strong investor sentiment, robust institutional buying, and sectoral strength across financials, FMCG, and energy. Below is a comprehensive report on the top gainers of the day based on price momentum, percentage gain, and volume action.

📊 Kotak Mahindra Bank: Financial Powerhouse Charges Ahead

-

Current Price: ₹2,224.50

-

Gain: ₹74.70 (📈3.47%)

-

Volume Traded: 75.26 lakh shares

-

Open / High / Low: ₹2,185.00 / ₹2,241.50 / ₹2,176.20

-

Previous Close: ₹2,149.80

Kotak Mahindra Bank led today’s rally, surging by 3.47%, marking one of the highest gains among large-cap stocks. The stock broke past resistance at ₹2,200 with strong volume support, indicating institutional accumulation. The positive sentiment can be attributed to recent banking sector reforms and improved loan growth forecasts.

🏭 Grasim Industries: Cement and Beyond

-

Current Price: ₹2,820.80

-

Gain: ₹41.70 (📈1.50%)

-

Volume Traded: 8.46 lakh shares

-

Open / High / Low: ₹2,780.00 / ₹2,841.30 / ₹2,778.20

-

Previous Close: ₹2,779.10

Grasim continued its upward trend, supported by renewed optimism in the construction and manufacturing sectors. The rise comes after positive updates regarding its expansion in the paints segment and improved operational performance in cement through Ultratech.

🎨 Asian Paints: Bright Colors, Brighter Returns

-

Current Price: ₹2,484.60

-

Gain: ₹41.80 (📈1.71%)

-

Volume Traded: 11.36 lakh shares

-

Open / High / Low: ₹2,440.50 / ₹2,488.00 / ₹2,437.30

-

Previous Close: ₹2,442.80

Asian Paints was among the day’s top gainers, bolstered by a strong rally in the FMCG and discretionary sectors. A consistent performer, the stock benefitted from increased consumer demand, cooling raw material prices, and festival season stocking.

⚡ NTPC: Powering Through

-

Current Price: ₹343.20

-

Gain: ₹5.75 (📈1.70%)

-

Volume Traded: 1.21 crore shares

-

Open / High / Low: ₹338.20 / ₹343.90 / ₹337.00

-

Previous Close: ₹337.45

NTPC’s stock saw a healthy uptick of 1.70%, as the power sector remains a key focus area for policy makers amid rising energy demand. The government’s push for energy transition and increased electricity consumption during peak summer months has aided bullish sentiment.

🏗️ BEL (Bharat Electronics Ltd.): Steady Climb Amidst Defence Sector Buzz

-

Current Price: ₹422

-

Gain: ₹4.90 (📈1.17%)

-

Volume Traded: 1.60 crore shares

-

Open / High / Low: ₹418 / ₹423.35 / ₹416.25

-

Previous Close: ₹417.10

BEL continues to be a favorite among PSU stocks, gaining over 1% today. The movement is aligned with rising investor confidence in India’s defense manufacturing capabilities, backed by increasing export orders and policy support for Make-in-India initiatives.

🚢 Adani Ports: Holding Strong Amid Volatility

-

Current Price: ₹1,448.50

-

Gain: ₹12.90 (📈0.90%)

-

Volume Traded: 8.25 lakh shares

-

Open / High / Low: ₹1,438.00 / ₹1,449.90 / ₹1,430.00

-

Previous Close: ₹1,435.60

Despite broader concerns around the Adani Group’s debt exposure, Adani Ports managed to hold firm with a modest gain. The company’s long-term infrastructure projects and global shipping partnerships continue to attract institutional interest.

🧪 ETERNAL: Small Cap with Consistent Momentum

-

Current Price: ₹263.50

-

Gain: ₹4.95 (📈1.91%)

-

Volume Traded: 1.83 crore shares

-

Open / High / Low: ₹259.65 / ₹264.20 / ₹259.50

-

Previous Close: ₹258.55

ETERNAL, although lesser-known, stood out among the small-cap gainers. With a near 2% rise, the stock appears to be under accumulation, potentially fueled by speculative interest or expected quarterly earnings performance.

📌 Summary of Top Gainers and Market Sentiment

Today’s top gainers showcase a mix of financials, industrials, and consumer-facing sectors. Kotak Bank’s strong upward move indicates revival in financial services sentiment, while Grasim and Asian Paints reflect the strength in manufacturing and consumption.

🗣️ Engagement Quote of the Day

“In every market movement lies a story – today, the bulls roared across finance, power, and paint!”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.