🏢 About the Company – Tata Steel Limited:

Tata Steel Limited (NSE: TATASTEEL), one of India’s largest and most trusted steel manufacturers, is a flagship company of the Tata Group. Known for its global operations, Tata Steel has a robust presence across Asia and Europe. The company operates in the core steel manufacturing sector and owns several subsidiaries across the globe to expand its strategic reach.

📈 Key Market Data (As of May 13, 2025):

-

Stock Exchange: NSE

-

Symbol: TATASTEEL

-

Current Market Price (CMP): ₹149.60 (indicative, please verify real-time before publishing)

-

Sector: Metals – Ferrous

-

Market Cap: ₹2.01 Lakh Crore (approx.)

-

52-week range: ₹122.62 – ₹184.60

📋 Full Report:

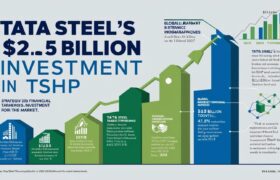

Tata Steel Limited has taken a bold step in reinforcing its global restructuring roadmap by announcing a significant capital infusion of USD 2.5 Billion (₹21,410.95 crore) into its wholly owned subsidiary, T Steel Holdings Pte. Ltd. (TSHP). Incorporated in Singapore, TSHP operates primarily as an investment holding company and is responsible for managing Tata Steel’s indirect overseas subsidiaries. This move marks a strategic realignment in Tata Steel’s international financial structuring, debt management, and operational support, all set to take place in multiple tranches during FY 2025-26.

According to regulatory filings submitted on May 13, 2025, this investment will be made via equity subscription and funded through internal accruals and possibly debt instruments. Notably, this acquisition is a related party transaction, yet Tata Steel has clarified that it is executed at arm’s length and complies fully with all relevant regulatory norms including RBI’s overseas investment guidelines.

The primary purpose of this fund infusion is to repay outstanding debts, support ongoing business operations, and meet restructuring costs within TSHP’s subsidiaries. Despite TSHP being a loss-making entity for FY2024—with a reported loss of ₹10,289.09 crore, the subsidiary maintains a healthy net worth of ₹44,006.70 crore, highlighting its potential as a long-term strategic asset in Tata Steel’s global portfolio.

Given the investment surpasses USD 1 Billion, RBI approval will be mandatory under FEMA (Overseas Investment) Directions, 2022. Tata Steel has already indicated its readiness to obtain such approvals prior to executing the financial tranches.

From a structural standpoint, this acquisition is not a fresh purchase but rather a financial strengthening of an existing entity where Tata Steel already holds 100% equity. This ensures there is no dilution of control but rather an enhanced grip over international operations, especially in high-cost regions.

This development aligns well with Tata Steel’s strategy to streamline its global business models and reduce dependency on external financing. It also hints at the company’s preparation to consolidate operations or even plan future spin-offs or listings of overseas entities.

📊 Summary in Points:

✔ Company: Tata Steel Limited

✔ Announcement Type: New Acquisition Filing (Restructuring)

✔ Target Entity: T Steel Holdings Pte. Ltd., Singapore

✔ Nature of Deal: Equity infusion of USD 2.5 Billion (₹21,410.95 crore)

✔ Ownership: TSHP remains a 100% subsidiary

✔ Purpose:

✦ Repayment of debts

✦ Operational support

✦ Subsidiary restructuring

✔ Method of Payment: Cash

✔ Transaction Nature: Related Party but arm’s length

✔ RBI Approval: Required for investments > USD 1 Billion

✔ Timeframe: FY 2025-26

✔ Loss in FY2024: ₹10,289.09 crore

✔ Net Worth: ₹44,006.70 crore

✔ Stock Symbol: TATASTEEL

✔ Sector: Metals – Ferrous

📉 Effect on Share Market:

This announcement may have mixed reactions in the short term. The large investment in a loss-making subsidiary could trigger investor concerns around cash flows and near-term returns. However, long-term investors and institutional traders may see this as a strong signal of Tata Steel’s intent to clean up balance sheets, reduce external debt dependencies, and strengthen its overseas asset base.

The stock might face short-term volatility but could witness positive re-rating once the first tranche is completed and results in visible debt reduction at the subsidiary level.

🧑💼 How This Helps Retail Traders:

🔹 Long-Term Confidence: Shows Tata Steel’s commitment to sustaining global assets and managing liabilities.

🔹 Signals Future Growth: Potential international restructuring could unlock value.

🔹 Buy-on-Dip Opportunity: Any knee-jerk fall in share price could offer accumulation window for retail investors.

🔹 Clear Regulatory Compliance: Adds confidence in the transparency of the deal.

📊 Chart Concept (for WordPress or Canva AI Image):

Concept:

A dual-layered financial flow chart:

Top Layer:

“Tata Steel Ltd. (India)” with an arrow labeled “USD 2.5 Billion Equity Infusion” pointing to “TSHP (Singapore)”

Bottom Layer:

TSHP with 3 connected boxes labeled:

-

“Debt Repayment”

-

“Business Operations”

-

“Subsidiary Restructuring”

Use brand colors of Tata Group (blue/grey) with a modern, clean layout.

💬 Engaging Phrase for Users:

“Massive moves call for sharp insights – Tata Steel’s latest restructure could be your next market signal!”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.