Stock Market Report Dec 2 2025| Nifty Prediction Dec 3| Sensex Crash

Date: December 2, 2025 (Tuesday)| Market Sentiment: Bearish / Cautious| Volatility (India VIX): 11.23 (-3.41%)

The Indian equity markets extended their losing streak for the third consecutive session on Tuesday, December 2, 2025. The benchmark Sensex plunged over 500 points, while the Nifty 50 struggled to defend the psychological 26,000 mark, closing just above it at 26,032.

The sell-off was triggered by a “Double Whammy”: The Indian Rupee (INR) hitting a fresh all-time low of 90.02 against the Dollar, and heavy profit-booking in banking heavyweights ahead of the RBI Monetary Policy Committee (MPC) meeting which begins tomorrow.

In this report, we analyze the key drivers of today’s fall, the sector-wise performance, and the trading setup for Wednesday, December 3, 2025.

1. Market Snapshot: The Bears Take Charge

The market opened in the red and remained under pressure throughout the session. Attempts to recover were sold into, indicating a “Sell on Rise” texture.

Index Performance Table (Dec 2, 2025)

| Index | Open | High | Low | Today Close | Change |

| Nifty 50 | 26,088.00 | 26,154.60 | 25,997.85 | 26,032.20 | -143.55 (-0.55%) |

| Sensex | 85,325.50 | 85,553.50 | 85,053.00 | 85,138.27 | -503.63 (-0.59%) |

| Bank Nifty | 59,354.00 | 59,450.00 | 59,100.50 | 59,273.80 | -407.55 (-0.68%) |

| Fin Nifty | 27,650.00 | 27,700.00 | 27,510.00 | 27,565.25 | -249.25 (-0.90%) |

| MidCap Select | 14,110.00 | 14,140.00 | 14,060.00 | 14,080.00 | -30.00 (-0.22%) |

Key Observation: Nifty Financial Services (Fin Nifty) was the biggest drag, falling nearly 1% on its expiry day, weighed down by HDFC Bank and ICICI Bank.

2. Why Did the Market Fall Today? (3 Key Reasons)

A. Rupee Hits Historic Low (90.02)

Currency weakness was the primary mood spoiler. The Indian Rupee breached the 90 per USD mark for the first time in history.

- Impact: A weak rupee spooks foreign investors (FIIs) as it erodes their dollar returns, leading to continued outflows.

B. Pre-RBI Policy Nervousness

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) meeting is scheduled for Dec 3–5.

- Market Fear: While a rate cut is anticipated, traders are trimming positions to avoid volatility during the event. Banks, being the most sensitive to interest rates, faced the brunt of this caution.

C. Profit Booking in Banking Giants

Private banks like HDFC Bank (-1.07%), ICICI Bank (-1.17%), and Axis Bank (-1.05%) witnessed heavy selling. News of a potential reduction in their weightage in upcoming index rebalancing added to the pressure.

3. Top Gainers & Losers

Top 5 Gainers (Nifty 50)

| Stock | Price (₹) | Change (%) | Why it Moved? |

| Asian Paints | 2,850.40 | +3.15% | Value buying after recent correction; crude stability. |

| Dr. Reddy’s | 1,280.50 | +1.30% | Pharma sector acted as a defensive hedge. |

| Maruti Suzuki | 13,050.00 | +0.92% | Continued momentum from strong Nov sales data. |

| Bharti Airtel | 1,595.00 | +0.87% | Tariff hike buzz keeping telecom resilient. |

| SBI Life | 1,840.00 | +0.68% | Insurance stocks showed strength amidst volatility. |

Top 5 Losers (Nifty 50)

| Stock | Price (₹) | Change (%) | Why it Moved? |

| IndiGo | 4,250.00 | -1.62% | Top Loser. Hit by a ₹117 Cr GST penalty notice. |

| ICICI Bank | 1,265.00 | -1.17% | Dragged by FII selling and weak rupee. |

| Reliance | 1,280.00 | -1.14% | Heavyweight pressure; lack of fresh triggers. |

| HDFC Bank | 1,720.00 | -1.07% | Continued underperformance ahead of RBI meet. |

| Axis Bank | 1,130.00 | -1.05% | Banking sector weakness. |

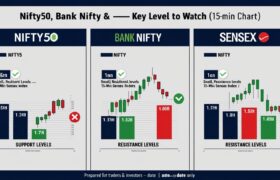

4. Technical Analysis & Prediction for Tomorrow (Dec 3)

Nifty 50 Analysis

- Candle Pattern: The daily chart shows a Small Bearish Candle with shadows on both sides, indicating indecision but with a negative bias.

- Support: 26,000 is the final line of defense. Today’s low was 25,997, which was bought into. If this breaks tomorrow, the index could slide to 25,850.

- Resistance: 26,150 – 26,200. Any bounce to this zone is likely to face selling pressure.

Bank Nifty Analysis

- Trend: The index closed near its day low, which is bearish.

- Outlook: It is stuck in a range of 59,000 – 59,500. A breakdown below 59,000 could trigger a fall toward 58,500.

5. Trading Strategy for Tomorrow (Wednesday, Dec 3)

With the RBI policy meeting starting, volatility will remain high but range-bound.

| Strategy | Entry Trigger | Target (TGT) | Stop Loss (SL) |

| Buy on Support | If Nifty takes support at 26,000 | 26,120 | 25,950 |

| Sell on Rise | If Nifty rejects from 26,150 | 26,050 | 26,210 |

| Breakdown Sell | If Bank Nifty breaks 59,000 (15-min candle) | 58,750 | 59,150 |

Pro Tip: “Avoid aggressive overnight positions. The market is in ‘Wait and Watch’ mode until the RBI Governor’s speech on Thursday/Friday.”

Stock Market Report Dec 2 2025| Nifty Prediction Dec 3| Sensex Crash

📢 Join Our Market Community

📱 Stay updated on IPOs, Results & Market News:

- WhatsApp Channel: Join Now

- Telegram: Follow Updates

- Arattai: Connect with Us

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

Market Snapshot: Bulls Return on Global Cues & Trade Deal Optimism

Indian Stock Market| Nifty 50| Sensex| Bank Nifty| Axis Bank| India-EU FTA| Stock Market News| Market Wrap| Jan 27 2026…

-

India-EU FTA 2026: The “Mother of All Deals” Sealed – In-Depth Analysis

India EU FTA 2026| India EU Trade Deal| Tariff cuts India EU| CBAM India EU agreement| India EU Services Trade…

-

Hindustan Zinc OFS Review 2026: Vedanta to Offload ₹4,500 Cr Stake

Hindustan Zinc OFS Review| Vedanta Limited| HINDZINC| Stock Market News| Dividend Stocks| Silver Rally| Zinc Prices| Offer For Sale| High…

-

Weekly Market Intelligence: 10 Stocks to Watch

Top 10 Stocks| Top 10 Stocks to Watch| Market Analysis As the Indian markets navigate a period of heightened volatility…

-

Lesson 19 – KEY RATIOS |Deep Dive into PE, PB, ROE & DE

Key Ratios| Stock Market Basics| PE Ratio| PB Ratio| ROE| Debt Equity Ratio| Fundamental Analysis| Investing for Beginners Introduction| Part-1/3…