Company Overview: SIS Limited

SIS Limited is a leading Indian multinational in essential services with over ₹13,189 Cr annual revenue. It holds:

-

#1 position in Security and Facility Management in India

-

#2 in Cash Logistics

-

Largest security services company in Australia

-

Operates in 300+ offices across 650 districts, employing over 3 lakh people

📊 Key Market Data:

-

NSE Symbol: SIS

-

BSE Code: 540673

-

FY25 Revenue: ₹13,189 Cr (7.6% YoY growth)

-

FY25 EBITDA: ₹604 Cr (3.3% YoY growth)

-

Q4 FY25 Revenue: ₹3,428 Cr (9.3% YoY)

-

Q4 EBITDA: ₹164.8 Cr (10.1% YoY)

-

Operating PAT Q4 FY25: ₹82.5 Cr (52.9% YoY)

-

Net Debt / EBITDA: reduced to 0.71 from 1.52

-

OCF to EBITDA Ratio: 174.8%

📈 Detailed Report:

SIS Limited achieved its highest-ever quarterly revenue and EBITDA in Q4 FY25, with consolidated revenue touching ₹3,427.9 crore and EBITDA at ₹164.8 crore. This represents a 9.3% and 10.1% YoY growth respectively. The company’s strategic execution led to an improved operating PAT of ₹82.5 crore—a 52.9% rise YoY—demonstrating operational efficiency despite a goodwill impairment of ₹305.8 crore.

Segment-wise, Security Solutions (India) posted a 9.6% revenue growth YoY, driven by new wins in mining, BFSI, and education sectors. The International business saw a 7.7% YoY increase, with massive order wins worth AUD 180 million. Facility Management outperformed with 12.9% revenue growth YoY, and EBITDA rising 34.1% YoY.

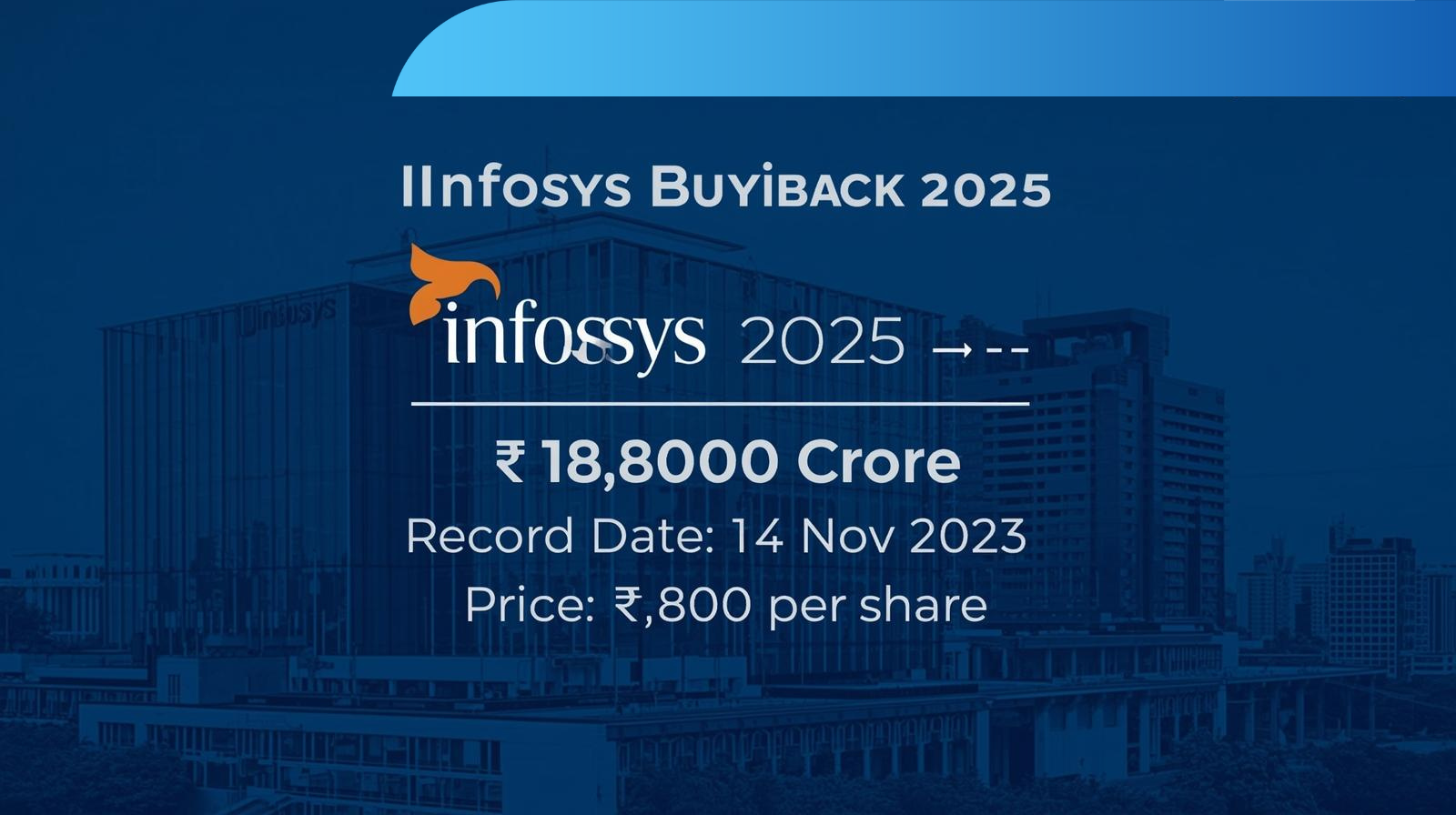

Debt reduction was a key highlight, with net debt dropping by ₹461 crore in Q4 alone, bringing Net Debt/EBITDA to 0.71x—lowest since June 2021. Furthermore, SIS announced its fourth buyback and the IPO filing of its Cash JV (SIS-Prosegur), showing commitment to shareholder value.

📌 Point-wise Summary:

🔹 Record Revenue – Q4 FY25 revenue at ₹3,428 Cr, up 9.3% YoY

🔹 EBITDA Growth – ₹164.8 Cr in Q4, up 10.1% YoY

🔹 Strong PAT – ₹82.5 Cr Operating PAT in Q4 FY25 (up 52.9%)

🔹 Debt Reduction – Net Debt down ₹461 Cr; ND/EBITDA at 0.71

🔹 New Wins – AUD 180 Mn in SIS International; ₹22 Cr/month in India

🔹 Buyback & IPO – Fourth buyback underway, Cash JV IPO filed

🔹 Cash Flow Boost – OCF/EBITDA at 174.8% due to strong collections

🔹 Tax Efficiency – NIL current tax rate aided by 80JJAA benefits

📉 Share Market Impact:

✅ Positive sentiment likely due to record EBITDA and buyback

✅ IPO buzz from Cash JV could increase volume and price action

❌ One-time goodwill impairment may briefly cloud reported PAT

Net View: Bullish trend expected in short to mid-term driven by strong fundamentals, debt reduction, and investor-friendly actions.

🧠 How This Helps Retail Traders:

-

🔹 Shows financial strength: low debt, high EBITDA

-

🔹 Upcoming IPOs and buybacks indicate price support

-

🔹 Segment-specific info helps identify sector exposure

-

🔹 Solid dividend/buyback track record supports long-term holding

💬 Phrase:

“Is SIS on your radar for 2025? Let’s discuss the potential!”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.