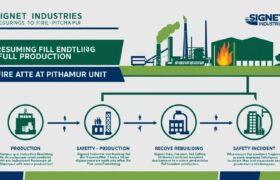

Company Snapshot – Signet Industries Limited

-

Established: 1985

-

CIN: L51900MH1985PLC035202

-

Industry: Diversified Industrial Products (Irrigation, Pipes, Furniture, and More)

-

Certifications: ISO 9001:2015 Certified

-

Website: www.groupsignet.com

-

Head Office: Thane, Maharashtra

-

Production Unit: Pithampur, Madhya Pradesh

📜 Report:

In a significant development, Signet Industries Limited (SIGIND) has officially announced the resumption of full production at its Pithampur facility, Madhya Pradesh, following a fire incident that had temporarily halted operations on April 11, 2025. The company conveyed that the plant is now fully restored and operational at full capacity, showcasing strong recovery and resilience in crisis management.

This rapid turnaround was made possible through the combined efforts of the fire department, local authorities, and Signet’s dedicated workforce, ensuring minimal disruption. This restoration not only reflects operational strength but also rebuilds investor and customer confidence in the company’s risk management and disaster response systems.

For the retail investors and traders, this is a positive signal, especially for short-term movements in stock price due to renewed operational momentum. The announcement might lead to bullish sentiments among traders, expecting a recovery in quarterly revenues.

📌 Report Highlights:

🔹 Resumption of Production:

✅ Full-scale production resumed at the Pithampur facility post-fire.

🔹 Location & Facility Info:

🏭 Plot Nos. 462–465 & 476–478, Industrial Area, Sector-3, Pithampur, District Dhar – M.P.

🔹 Incident Date:

🔥 Fire occurred on April 11, 2025.

🔹 Announcement Date:

📅 Declared on April 14, 2025 via NSE/BSE filings.

🔹 Restoration Status:

🛠️ Entire plant fully restored and operational.

🔹 Acknowledgements:

👏 Appreciation extended to fire officials, employees, and authorities for swift response.

📈 Impact on Share Market

-

🟢 Positive Short-Term Impact Expected:

Reinstating production typically boosts investor confidence. The swift recovery may trigger buying interest, especially from traders who see this as a sign of strong crisis control. -

📊 Potential for Stock Price Rebound:

Since production affects revenue, a quick operational comeback could positively reflect in upcoming earnings, possibly lifting share price. -

🔍 Improved Sentiment & Stability:

Such resilience sends a strong message about the company’s operational reliability, reducing perceived risks.

🧠 How This Helps Retail Traders?

-

💡 Clarity on Operations: Confirms normalcy in business which is vital for stock evaluation.

-

📉 Potential Entry Point: Post-incident dip may reverse, offering short-term gains.

-

🔍 Confidence in Crisis Handling: Shows company’s efficiency in crisis, building investor trust.

-

⏱️ Time-Sensitive Move: Those who act early post-update might benefit from momentum trades.

🗣️ “From Fire to Full Force – SIGIND’s comeback could fire up your portfolio!”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.