Settlement System In Stock Market| Settlement System| T+1 Settlement| Stock Market Basics| Indian Stock Market Course| Clearing And Settlement| Demat Account| Trading Education

🎯 Learning Outcome

Understand how the T+1 settlement cycle works in India and how trades are completed safely.

🔑 Key Takeaway

Timely settlement ensures liquidity, trust, and stability in the stock market.

1️⃣ Why Settlement System Matters

When beginners place their first trade, they often believe that buying or selling a stock means instant ownership or instant money credit. In reality, a trade is only a promise until it is settled. The settlement system exists to ensure that buyers receive shares and sellers receive money in a secure and organized manner. Without a proper settlement mechanism, markets would collapse due to defaults, delays, and disputes. The settlement system acts as the backbone of trust in the stock market. It ensures that millions of daily transactions are completed smoothly, even when buyers and sellers do not know each other.

Explanation

Trading is agreement; settlement is completion.

Example

You buy a share today, but ownership changes only after settlement.

2️⃣ What Is Settlement in the Stock Market?

Settlement refers to the actual exchange of securities and money after a trade is executed. Once a buyer and seller agree on price through the exchange, the settlement process begins. This process involves brokers, clearing corporations, banks, and depositories. Settlement ensures that the buyer’s demat account is credited with shares and the seller’s bank account receives funds. The system reduces counterparty risk by acting as a neutral intermediary. In India, settlement is standardized and regulated, making it one of the safest systems globally.

Explanation

Settlement = Delivery of shares + Payment of money.

Example

Trade done today → Settlement completes next working day (T+1).

3️⃣ Understanding Trade Date (T) and Settlement Date

The day on which you buy or sell a stock is called the Trade Date, commonly referred to as T-day. Settlement does not happen on the same day. Instead, it follows a fixed timeline. The settlement date is the day on which shares and money are actually exchanged. This gap allows clearing corporations to verify trades, calculate obligations, and manage risk. Understanding the difference between trade date and settlement date is crucial for managing funds, planning withdrawals, and avoiding confusion.

Explanation

T = trade execution

Settlement happens after T.

Example

Buy on Monday (T) → Settlement on Tuesday (T+1).

4️⃣ What Is the T+1 Settlement Cycle?

The T+1 settlement cycle means that a trade executed on day T is settled on the next working day. India moved from T+2 to T+1 to improve liquidity, reduce risk, and align with global best practices. Faster settlement benefits both traders and investors by freeing capital sooner and reducing counterparty exposure. This shift reflects the maturity of Indian market infrastructure and technology. However, faster settlement also demands discipline from traders regarding fund availability and delivery obligations.

Explanation

T+1 = Trade today, settlement tomorrow.

Example

Buy shares on Wednesday → Shares credited on Thursday.

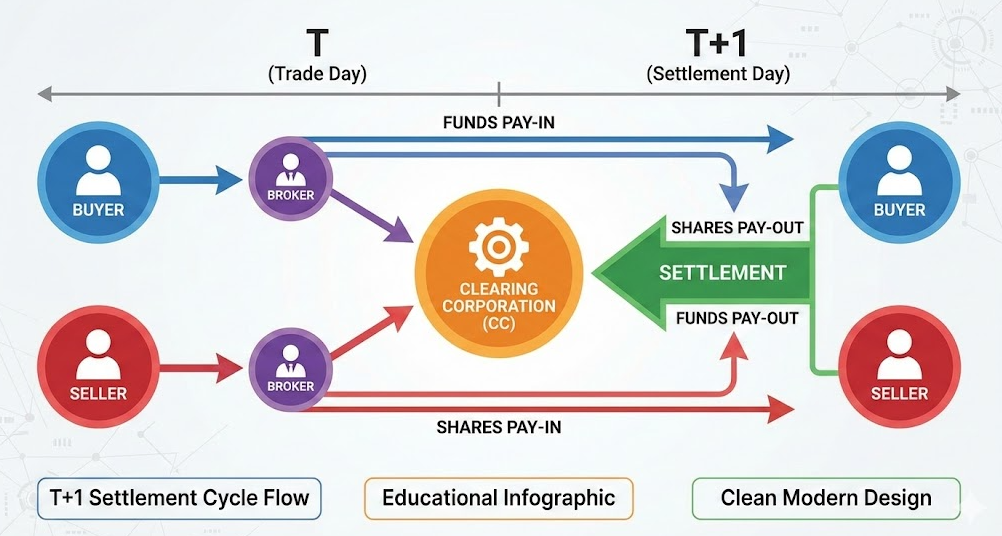

5️⃣ Step-by-Step T+1 Settlement Process

The settlement process follows a structured flow. First, trades are executed on the exchange. Then, the clearing corporation calculates obligations for each broker. Next comes the pay-in, where brokers deliver shares or funds. Finally, pay-out occurs, crediting shares to buyers and money to sellers. Each step is time-bound and automated. This structure minimizes human error and prevents defaults. Understanding this flow helps traders know when funds will be blocked, released, or credited.

Explanation

Trade → Clearing → Pay-in → Pay-out.

Example

Your broker sends funds → Clearing corporation settles → Shares credited.

6️⃣ Role of Clearing Corporation

The clearing corporation is the heart of the settlement system. In India, it acts as the counterparty to every trade, guaranteeing settlement even if one party defaults. This eliminates direct risk between buyers and sellers. The clearing corporation calculates net obligations, manages margins, and ensures timely settlement. Without it, trust in anonymous trading would be impossible. This mechanism is why retail traders can trade confidently without worrying about the other side of the transaction.

Explanation

Clearing corporation = guarantor of trades.

Example

Even if seller defaults, buyer still gets shares.

7️⃣ Role of Depositories

Depositories hold securities in electronic form. In India, shares are stored in demat accounts maintained through depositories. During settlement, depositories facilitate the transfer of shares from seller to buyer. This electronic system has eliminated physical certificates, fraud, and delays. Depositories ensure accuracy, transparency, and speed. For investors, this means safety of holdings and easy access.

Explanation

Depository = electronic locker for shares.

Example

Shares move digitally from seller demat to buyer demat.

8️⃣ Indian Stock Market Case Study 1: Delivery Buy

Let’s consider an Indian investor buying shares for long-term holding. Suppose an investor buys shares of a large Indian company on Monday. The trade is executed immediately, but the shares are credited only after settlement. On Tuesday (T+1), the investor sees shares credited to the demat account. Only after this credit can the investor sell or pledge the shares. This case highlights why understanding settlement dates is essential for planning trades.

Example

Buy on Monday → Shares credited Tuesday → Ownership confirmed.

9️⃣ Indian Stock Market Case Study 2: Selling Shares

Now consider a seller who sells shares from a demat account. The shares are blocked on the trade date. On settlement day, shares are transferred, and money is credited to the seller’s trading account. The seller can withdraw funds only after settlement completion. Many beginners panic when money doesn’t appear instantly. Understanding settlement avoids unnecessary anxiety.

Example

Sell on T → Money credited on T+1.

🔟 Intraday vs Delivery Settlement

Intraday trades are squared off on the same day, so no delivery settlement occurs. However, delivery trades follow the T+1 cycle. Beginners often confuse the two. Intraday trades settle only in cash difference, while delivery trades involve actual share transfer. Knowing this difference helps avoid penalties and confusion.

Example

Intraday: No share movement

Delivery: Shares move via settlement

1️⃣1️⃣ Why Timely Settlement Ensures Liquidity

Liquidity means the ability to convert assets into cash quickly. Faster settlement cycles release funds sooner, allowing traders to reinvest. This improves market efficiency and reduces systemic risk. T+1 settlement has significantly improved liquidity in Indian markets, benefiting retail and institutional participants alike.

Explanation

Faster settlement = faster capital reuse.

Example

Funds received today can be reused tomorrow.

1️⃣2️⃣ Risks If Settlement Fails

Settlement failure can occur due to insufficient funds, technical issues, or delivery shortages. Such failures lead to penalties, auctions, and loss of credibility. The settlement system includes safeguards to minimize such risks, but trader discipline is equally important.

Example

No funds → Trade fails → Penalty applied.

🧠 Practice Questions (Beginner → Advanced)

Section A: Concept Check

- What is settlement in the stock market?

- What does T+1 mean?

- Who guarantees settlement in India?

Section B: Application

- You buy shares on Friday. When will settlement occur?

- Can you sell shares before settlement?

Section C: Thinking

- Why is faster settlement beneficial for the economy?

- What risks increase with delayed settlement?

✍️ Practical Exercise

- Track one delivery trade in your demat account

- Note trade date, settlement date, credit date

- Observe fund blocking and release

✅ Final Conclusion & Expert View

The settlement system is the invisible engine of the stock market. While prices attract attention, settlement ensures trust, safety, and liquidity. Understanding T+1 settlement empowers traders to plan better, avoid confusion, and trade professionally. A strong grasp of settlement mechanics separates informed participants from casual gamblers.

Golden Rule:

A trade is not complete until settlement is complete.

🔜 Next Lesson Preview

Lesson 16: Balance Sheet Reading

Learning Outcome: Assests, Liabilities, Equity

Key Takeaway: Strong balancesheet = stable company

Settlement System In Stock Market| Settlement System| T+1 Settlement| Stock Market Basics| Indian Stock Market Course| Clearing And Settlement| Demat Account| Trading Education

📌 Final Affiliate CTA

Start trading with professional order types, GTT automation and Mini brokerage

👉Open Your mStock Demat Account: Click Here

Course Introduction:

Open Demat Account

by Mirae Asset (m,Stock)

-

Indian Stock Market Today: Bulls Charge Ahead as Sensex and Nifty Rally on Banking & IT Strength

# Indian Stock Market Today: Sensex and Nifty Close Higher Amid Broad-Based Buying ## Indian Stock Market Report – Updated…

-

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown

🚨 YouTube Home Page Error 2026: ‘Something Went Wrong’ – Causes, Fixes & Full Breakdown Trending Keywords: YouTube down, YouTube…

-

Global Market Update 2026: Equities, Commodities, and Indian Rupee Outlook

Comprehensive 2026 global market update covering equities, commodities, bond markets, US Dollar trends, and detailed Indian Rupee outlook with investment themes and risks.

-

Weekly Market Intelligence: 10 Stocks to Watch| Are you holding any!

Top 10 Stocks| Top 10 Stocks to Watch| Market Analysis| BEL| Tata Power| Bajaj Finance| Nifty 50 Outlook| Stock Market…

-

Market Snapshot: Bulls Return on Global Cues & Trade Deal Optimism

Indian Stock Market| Nifty 50| Sensex| Bank Nifty| Axis Bank| India-EU FTA| Stock Market News| Market Wrap| Jan 27 2026…

-

India-EU FTA 2026: The “Mother of All Deals” Sealed – In-Depth Analysis

India EU FTA 2026| India EU Trade Deal| Tariff cuts India EU| CBAM India EU agreement| India EU Services Trade…