Introduction

The State Bank of India (SBI), the country’s largest lender and a bellwether in the Indian financial sector, has recently revised its home loan interest rates. Effective August 1, 2025, the bank raised the upper limit of its home loan interest rates by 25 basis points, taking the ceiling from 8.45% to 8.70%. This change impacts both new and existing borrowers, particularly those at the higher end of the rate band.

With this revision, SBI continues to play a pivotal role in reflecting broader shifts in monetary policy, inflation outlook, and credit demand. For millions of Indian households aspiring to buy a home or already servicing housing loans, even a marginal increase in interest rates translates into higher EMIs (Equated Monthly Installments) and larger long-term interest burdens.

This report breaks down the current SBI home loan interest rates, the policy context, the impact on borrowers and the housing sector, and what retail investors should watch in the coming quarters.

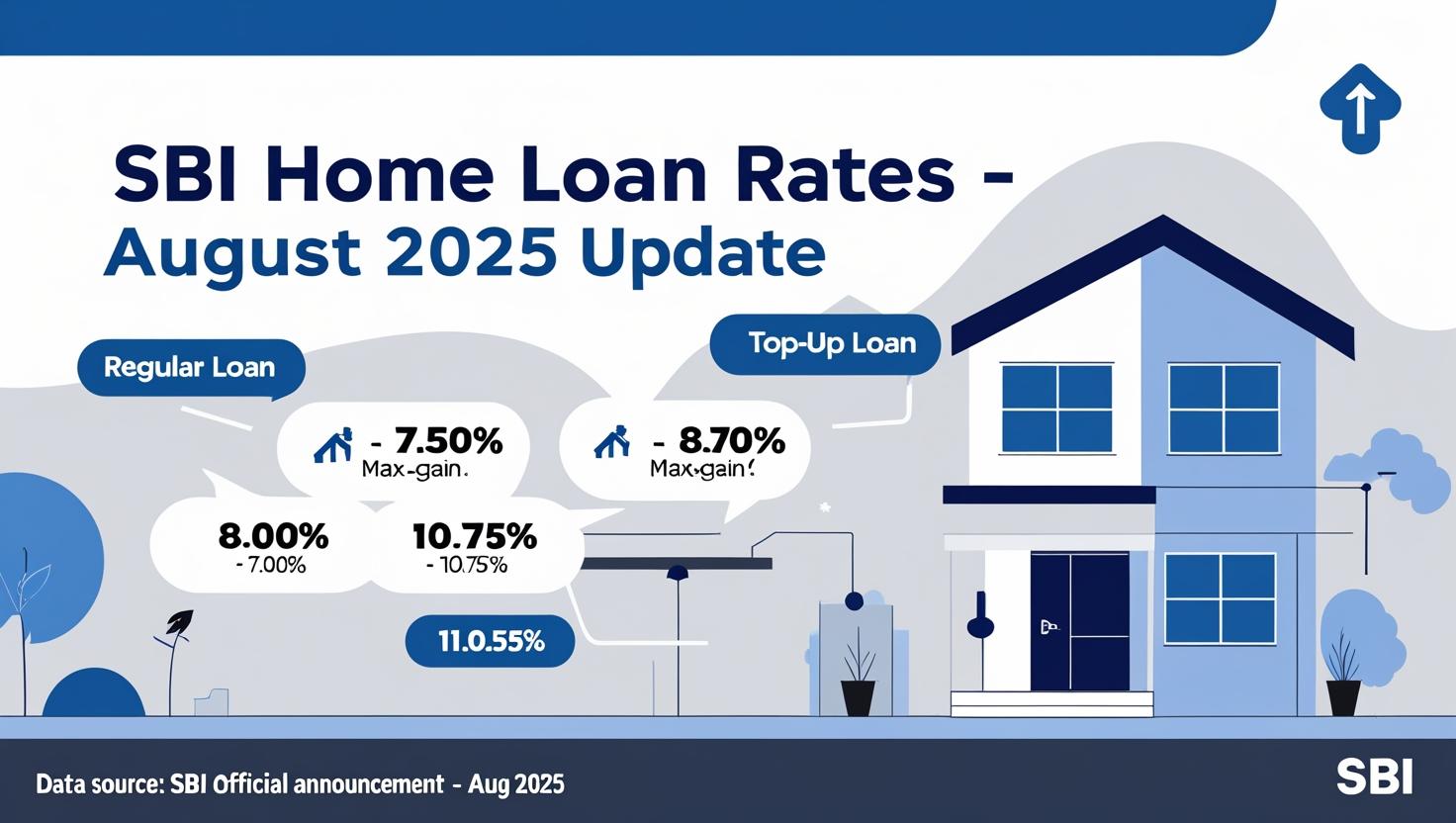

Current SBI Home Loan Interest Rates (August 2025)

SBI offers a wide range of home loan products catering to salaried professionals, self-employed individuals, NRIs, and senior citizens. The revised rates are as follows:

| Loan Type | Interest Rate Range (p.a.) |

|---|---|

| Regular Home Loan (Term Loan) | 7.50% – 8.70% |

| Home Loan – Maxgain (Overdraft) | 7.75% – 8.95% |

| Top-Up Loan (Term Loan) | 8.00% – 10.75% |

| Top-Up Loan (Overdraft) | 8.25% – 9.45% |

| Loan Against Property (P-LAP) | 9.20% – 10.75% |

| Reverse Mortgage Loan | 10.55% |

| YONO Insta Home Top-up Loan | 8.35% |

These rates vary depending on borrower credit score (CIBIL score), loan amount, tenure, and risk profile. The benchmark rate (EBLR) currently stands around 8.15%, and individual borrowers pay a margin above or below this based on their profile.

Why Did SBI Raise Rates in August 2025?

The increase of 25 basis points in the upper band of home loan rates is not an isolated move. It signals broader financial trends.

1. RBI’s Policy Influence

The Reserve Bank of India’s recent decisions on the repo rate have kept monetary policy finely balanced. In June 2025, SBI had actually cut home loan rates by 0.50% following an RBI repo rate reduction. However, with inflationary pressures creeping back, the bank has reversed part of that relief by hiking the ceiling rate.

2. Managing Credit Risk

Rising credit demand and potential risks in the housing market require banks to carefully price loans. By increasing the upper range, SBI ensures borrowers with weaker credit profiles are priced higher, safeguarding the bank’s risk exposure.

3. Competitive Signaling

SBI is the largest home loan lender in India. Its movements act as a bellwether. When SBI hikes rates, private banks like HDFC Bank, ICICI Bank, and Axis Bank often follow suit. This move may therefore signal an upcoming trend of tightening across the industry.

Impact on Borrowers

1. Higher EMIs for Existing Borrowers

For borrowers whose loans are linked to the upper band of the EBLR, the hike directly increases monthly installments. For example:

- Loan Amount: ₹50 lakh

- Tenure: 20 years

- Interest Rate Rise: From 8.45% to 8.70%

The monthly EMI increases by ₹750–₹850, and the total interest burden over the tenure rises by more than ₹2 lakh.

2. Affordability Pressure for New Buyers

New home loan applicants, especially those with moderate credit scores, may face difficulty in securing loans at competitive rates. This can reduce affordability and push some potential homebuyers to delay purchases.

3. Women and Senior Citizen Borrowers

SBI typically offers discounted rates for women borrowers (0.05% lower) and senior citizens in special schemes. These categories remain slightly protected, but the overall upward revision still affects them if they fall into higher-risk bands.

4. NRIs and Self-Employed

For NRI borrowers and self-employed applicants, loan pricing is generally on the higher side due to risk premiums. The upward shift in the ceiling makes their borrowing costlier, potentially impacting overseas demand for Indian residential properties.

Impact on the Housing Sector

1. Short-Term Slowdown in Demand

Historically, higher home loan rates dampen housing demand. Real estate developers, especially in Tier-1 cities, may see a slight slowdown in bookings as EMI costs rise.

2. Affordable Housing Most Sensitive

The affordable housing segment, targeted at first-time buyers, is most affected by even small increases in loan rates. Borrowers in this category are highly price-sensitive, and their eligibility often hinges on EMI affordability.

3. Luxury Housing Less Impacted

Premium and luxury housing demand, typically funded by high-net-worth individuals, remains relatively insulated. Developers in this segment are less likely to feel the immediate pressure of rate hikes.

4. Long-Term Growth Intact

Despite short-term fluctuations, the long-term outlook for India’s housing sector remains strong, driven by urbanization, rising disposable incomes, and government incentives such as PMAY (Pradhan Mantri Awas Yojana).

SBI’s Position vs. Other Banks

- SBI: Now at 7.50% – 8.70% for regular loans.

- HDFC Bank: 7.60% – 8.75%.

- ICICI Bank: 7.60% – 8.90%.

- PNB (Punjab National Bank): 7.55% – 8.85%.

SBI still remains among the most competitive lenders, but its ceiling hike brings it closer to private peers. For borrowers with excellent credit, SBI’s lower bound (7.50%) continues to be attractive.

Retail Investor & Market Perspective

1. Bank Stocks

The rate hike can improve SBI’s Net Interest Margin (NIM), as higher lending rates increase income faster than deposit rate adjustments. This may support SBI’s stock price in the short to medium term.

2. Real Estate Stocks

Listed real estate companies (e.g., DLF, Godrej Properties) may see near-term pressure on demand expectations. Investors should monitor Q2FY26 booking trends.

3. Housing Finance Companies (HFCs)

Companies like LIC Housing Finance and PNB Housing Finance compete with SBI. If they maintain lower rates, they might attract some borrower shift, though SBI’s brand trust and scale give it a dominant edge.

4. Retail Borrowers as Investors

For retail investors servicing SBI home loans, rising EMIs may reduce discretionary spending and retail investments in equity markets. This indirectly influences consumer sentiment.

EMI Calculation Example

To illustrate the impact of the hike:

- Loan: ₹40 lakh

- Tenure: 15 years

- Interest Rate:

- At 8.45%: EMI = ₹39,360

- At 8.70%: EMI = ₹39,880

This is a difference of about ₹520 per month, or ₹93,600 extra over the loan tenure.

Borrower Strategies in the Current Environment

- Check CIBIL Score – A high score (750+) ensures eligibility for rates closer to the lower band.

- Consider Balance Transfers – If another bank offers a lower effective rate, transferring loans may save costs.

- Increase Prepayments – Partial prepayments help reduce tenure and offset rising interest burdens.

- Use Overdraft Linked Products (Maxgain) – These allow borrowers to park surplus funds and reduce interest outgo.

- Negotiate with Bank – Existing customers with good repayment history can negotiate better spreads over the benchmark rate.

Outlook for the Next 6–12 Months

- RBI Policy Watch: If inflation remains under control, RBI may keep the repo rate steady, limiting further hikes.

- SBI Signals: As the largest lender, SBI’s rate changes are often leading indicators. Investors and borrowers must closely track SBI’s stance.

- Housing Demand: Post-festive season 2025 may see a rebound in bookings, especially if income growth sustains.

- Global Factors: US Federal Reserve and global oil price movements could influence India’s inflation and domestic rate environment.

Conclusion

SBI’s decision to raise the upper ceiling of home loan interest rates to 8.70% in August 2025 represents a significant move in India’s retail credit market. While the lower band of 7.50% remains unchanged, the revision impacts borrowers with weaker credit profiles and signals tightening across the sector.

For borrowers, this means higher EMIs, reduced affordability, and the need for careful financial planning. For investors, it indicates potential short-term headwinds for the housing sector but possible margin gains for banks.

Ultimately, SBI’s rate changes are not just a banking decision—they are a macro-economic signal. As India continues its growth journey, home loan rates will remain a critical factor shaping both household finances and the broader real estate ecosystem.