Rupee vs Dollar Forecast 2025| INR vs USD analysis| Why rupee is falling| Indian economy 2026| Currency exchange outlook, ₹90 dollar rate

By Raj Kachhot| Last Updated: December 2, 2025| Sentiment: 🔴 Bearish on INR

The numbers on the screen are flashing red. As of December 2, 2025, the Indian Rupee (INR) is trading at ₹89.87, just inches away from the psychological barrier of ₹90 per USD. For investors, students, and families planning travel, the current Rupee vs Dollar forecast for 2025 looks grim.

But is this truly a currency crash, or is it a calculated correction by the RBI?

While headlines scream panic, the data tells a deeper story. This isn’t just about a strong American economy; it is about intrinsic shifts in the Indian market, massive FII outflows, and a global trade war that is reshaping the value of money in your pocket.

In this deep-dive analysis, we break down why the Rupee is falling, apply the “Basket Test” to see the real damage, and provide an actionable roadmap for 2026.

Part 1: The Current Landscape December 2025

1.1 The Numbers That Matter

Let’s start with the hard data. The currency markets are currently flashing red for the Rupee.

| Metric | Current Level (Dec 2, 2025) | YTD Change (2025) | Status |

| USD/INR Spot | ₹89.87 | ▼ ~4.5% (Depreciation) | Record Low |

| GBP/INR | ₹114.20 | ▼ ~14.0% | Severe Weakness |

| EUR/INR | ₹96.50 | ▼ ~9.0% | Weak |

| 10-Year Bond Yield | 7.15% | ▲ +15 bps | Rising Cost of Debt |

| Forex Reserves | $645 Billion | ▼ -$43 Billion from Peak | Depleting Defense |

1.2 The “Basket Test”: Diagnosing the Patient

A common misconception is that “The Dollar is just strong against everyone.” To verify this, we use the Basket Test. We compare the Rupee not just to the Dollar, but to a basket of other global currencies (Euro, Pound, Yen, and Asian peers).

- The Findings: If this were purely a Dollar strength story, the Rupee would be stable against the Euro and Pound. It isn’t. The Rupee has lost significant value against the British Pound and the Euro this year.

- The Conclusion: This confirms Intrinsic Rupee Weakness. The Indian currency is underperforming its peers, signaling that domestic issues (trade deficits, capital flight) are weighing heavier than global dollar trends.

Part 2: Why is the Rupee Falling? The 4 Pillars

To understand the drop to ₹89.87, we must look at the four pillars currently crushing the currency.

2.1 The FII Exodus (The $14 Billion Hole)

Foreign Institutional Investors (FIIs) are the “hot money” that drives Indian market liquidity. In 2025, they have hit the “Sell” button aggressively.

- What happened? Over $14 Billion has been withdrawn from Indian equities and bonds since January 2025.

- The Mechanics: When an FII sells Reliance or HDFC shares, they get Rupees. They don’t want Rupees; they want to take profits home. So, they immediately sell those Rupees to buy Dollars. This massive selling pressure floods the market with Rupees, driving the price down.

- Why are they leaving? High valuations in the Indian stock market (Nifty PE > 22) and attractive, cheaper alternatives in recovering markets like China and stable yields in US Treasury bonds.

2.2 The US-India Trade Standoff

2025 has been defined by trade tension. The US administration has imposed targeted 50% tariffs on specific Indian exports (textiles, gems, jewelry), citing protectionist policies.

- The Impact: These tariffs reduce Indian exports. Fewer exports mean fewer Dollars coming into the country.

- The Uncertainty: A “Free Trade Agreement” (FTA) has been in the works, but delays are making markets nervous. Until a deal is signed, the “Risk Premium” on the Rupee stays high.

2.3 The “Crawling Peg” & RBI Strategy

The Reserve Bank of India (RBI) is playing a dangerous but calculated game.

- The Shift: For years, the RBI defended the Rupee at specific levels (e.g., ₹83). In late 2025, they shifted the defense line to ₹89.50.

- Why? The IMF recently reclassified India’s exchange regime as a “Crawl-like arrangement.” The RBI realizes that to keep Indian exports competitive against Bangladesh and Vietnam (whose currencies are also weak), the Rupee must be allowed to fall slightly. A too-strong Rupee hurts exporters.

- The Consequence: The market smells blood. Speculators know the RBI is allowing a slide, so they are shorting the Rupee, pushing it down faster than the RBI might like.

2.4 Oil & The Import Bill

India imports 85% of its crude oil.

- Scenario: Even though oil prices have been relatively stable ($75-80/barrel), the weaker Rupee makes every barrel more expensive.

- The Vicious Cycle: We need more Dollars to buy the same amount of oil. This demand for Dollars further weakens the Rupee. It is a classic negative feedback loop.

Part 3: Market Sentiment Analysis

What are the big players thinking right now?

3.1 The Fear Index (Volatility)

The USD/INR Annualized Volatility has spiked from 1.4% in early 2025 to 4.9% in December.

- Interpretation: Complacency is gone. Traders are expecting sharp swings. The market is pricing in a potential “breakout” past ₹90.

3.2 The Speculator’s View

Currency traders are currently “Long USD, Short INR.”

- Short Covering Rallies: Every time the Rupee strengthens slightly (e.g., to ₹89.20), traders rush to buy Dollars again, viewing it as a “discount.” This “buy on dips” mentality makes it very hard for the Rupee to recover meaningfully.

3.3 The Corporate Hedging Panic

Indian importers (who need dollars to pay bills) are panicking. Usually, they hedge (protect) 50% of their exposure.

- Current Sentiment: Importers are now hedging 70-80% of their exposure, fearing the rate will hit ₹91. This rush to buy forward contracts adds even more demand for the Dollar.

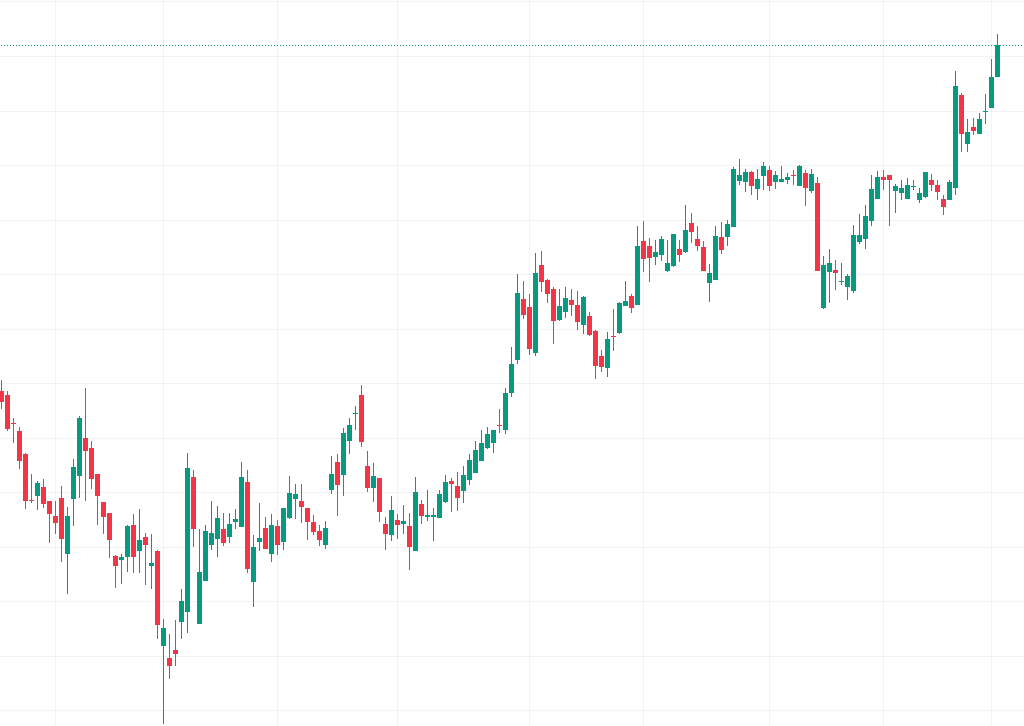

Part 4: Technical Analysis (The Charts)

4.1 The ₹90.00 Psychological Barrier

- Resistance: The ₹89.90 – ₹90.00 zone is a massive “Iron Curtain.” The RBI has huge sell orders placed here. They will likely sell billions of dollars from reserves to defend this line to prevent panic.

- Support: The immediate support is at ₹88.80. If the Rupee strengthens past this, it could go to ₹88.50, but this looks unlikely in December.

4.2 The “Ascending Triangle” Pattern

The daily chart shows a clear “Ascending Triangle” formation.

- The pattern: Higher lows (88.00, 88.50, 89.00) pushing up against a flat resistance (90.00).

- The Implication: In technical analysis, this is a bullish pattern for the Dollar (bearish for Rupee). It usually suggests that once the resistance (90.00) breaks, the price shoots up violently—potentially to ₹91.50 very quickly.

Part 5: Sector-by-Sector Impact

A falling Rupee creates a divided economy. Some cheer, while others weep.

✅ The Winners (Net Exporters)

- IT Services (TCS, Infosys, Wipro): These companies bill clients in USD but pay salaries in INR. A 5% fall in Rupee adds roughly 30-40 basis points to their operating margins. Expect their Q3 earnings to look robust.

- Pharma: India supplies generic drugs to the US. A stronger Dollar boosts their revenue realization.

- Textiles & Apparel: Operating on thin margins, a weaker Rupee helps Indian exporters compete against Bangladesh and Vietnam in the US market.

❌ The Losers (Net Importers)

- Oil Marketing Companies (BPCL, HPCL): They have to pay more Rupees to buy crude. If they can’t pass this cost to consumers (due to political pressure), their profits will collapse.

- Consumer Electronics: Components for phones, laptops, and TVs are imported. Brands like Apple, Samsung, and Xiaomi will likely raise prices by 3-5% in early 2026 to offset the currency hit.

- Aviation: Airlines pay for plane leases and jet fuel in Dollars. A weak Rupee is a nightmare for airline profitability.

Part 6: Personal Finance Impact & Actionable Advice

How does the ₹89.95 rate affect your wallet?

6.1 For International Students (USA/Canada)

- The Pain: If your semester fee is $20,000, it cost you ₹16.6 Lakhs in 2024. Today, it costs ₹18 Lakhs. That is a loss of ₹1.4 Lakhs purely on exchange rates.

- Action Plan:

- Pay Early: If you have funds, do not wait for the rate to drop. The trend is upward.

- Forward Contracts: If you are paying fees in roughly 6 months, ask your bank about a “Forward Contract” to lock in today’s rate for a small fee.

6.2 For Travelers

- The Pain: Your trip to New York or London is now 15% more expensive than last year.

- Action Plan:

- Pre-load Forex Cards: Do not use credit cards for everything (conversion fees + dynamic rates will kill you). Lock in a rate on a Forex card before you fly.

- Choose Destinations Wisely: Consider countries where currencies have also fallen against the dollar (like Japan or Turkey) to get better value than in the US or Europe.

6.3 For Investors

- The Opportunity:

- Diversify: Invest in US-based Mutual Funds or ETFs (like Nasdaq 100 funds). When the Rupee falls, the NAV of these funds goes up in Rupee terms, giving you a natural hedge.

- Stock Picks: Shift focus to export-oriented sectors (IT, Pharma, Specialty Chemicals) and avoid companies with high foreign debt.

6.4 For NRIs Remittance

- The Joy: This is the golden hour. The exchange rate is at a historic high.

- Action Plan: If you have savings in Dollars or Dirhams, remit now. Getting ~₹90 per Dollar is an excellent entry point into Indian fixed deposits or real estate.

Part 7: Future Outlook 2026 Forecast

Where do we go from here?

Scenario A: The Stabilization (40% Probability)

- Condition: India and US sign the trade deal in Q1 2026; RBI intervenes aggressively.

- Forecast: Rupee recovers to ₹88.50.

- Why: Clarity on trade removes the risk premium. FIIs return to buy “cheap” Indian stocks.

Scenario B: The Breakout (60% Probability)

- Condition: Trade talks stall; US tariffs remain; Fed keeps US interest rates high.

- Forecast: Rupee breaches ₹90 and heads toward ₹91.50 – ₹92.00.

- Why: The technical setup (Ascending Triangle) favors this. Once ₹90 breaks, stop-loss orders will trigger, causing a sharp slide.

Expert Consensus

Most global banks (Morgan Stanley, Goldman Sachs) maintain a “Depreciating Bias” for the Rupee. They believe the RBI is comfortable with a slow slide to keep India competitive, meaning we are unlikely to see ₹85 ever again.

Part 8: Frequently Asked Questions (FAQ)

Q1: Will the Rupee ever go back to ₹75?

- Short Answer: Highly unlikely. Economies like India generally have higher inflation than the US. This inflation differential means the currency must depreciate by 2-3% every year to maintain fair value. ₹75 is likely gone forever.

Q2: Is the government doing anything to stop this?

- Answer: Yes. The RBI sells Dollars from its reserves (which are still strong at $645 Billion) to smooth out volatility. However, they are not trying to reverse the trend, only to prevent a crash.

Q3: Should I buy Gold now?

- Answer: Gold is priced in Dollars. When the Rupee falls, domestic Gold prices rise even if global gold prices are flat. Buying Gold is a good hedge against a falling Rupee.

Conclusion: The New Normal

The slide to ₹89.95 is not a momentary blip; it is a structural adjustment. We are entering a new era where a ₹90+ Rupee may become the new normal in 2026.

While this poses challenges for inflation and travelers, it is a necessary pill for the Indian economy to swallow to boost manufacturing exports and reduce the trade deficit.

Key Takeaway: Do not bet on a sharp recovery. Adapt your financial strategy—hedge your expenses, diversify your portfolio, and if you are an NRI, send that money home today.

About the Author

This analysis is based on market data, FII flow reports, and technical charts as of December 2, 2025.

Disclaimer: This post is for informational purposes only and does not constitute financial advice. Please consult a SEBI-registered investment advisor before making financial decisions.

Rupee vs Dollar Forecast 2025| INR vs USD analysis| Why rupee is falling| Indian economy 2026| Currency exchange outlook, ₹90 dollar rate

📢 Join Our Market Community

📱 Stay updated on IPOs, Results & Market News:

- WhatsApp Channel: Join Now

- Telegram: Follow Updates

- Arattai: Connect with Us

📌 Stock Market Disclaimer

- Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.

- The information provided on this platform is for educational and informational purposes only. It should not be considered as investment advice, stock recommendations, or financial guidance.

- ⚠️ Stock Market Investments

- Investing in equities, derivatives, mutual funds, and other financial instruments involves market risks, volatility, and the possibility of capital loss.

- Past performance of stocks or indices is not indicative of future returns.

- Always conduct your own research or consult a SEBI-registered financial advisor before making investment decisions.

- ⚠️ IPO (Initial Public Offerings)

- IPO details, issue size, subscription data, and allotment status shared here are based on publicly available information from company filings, stock exchanges, and merchant bankers.

- Investing in IPOs carries risks including listing volatility, business uncertainties, and sector performance dependency.

- Neither acceptance of applications nor allotment guarantees profits. Investors should evaluate their risk appetite before subscribing.

- ⚠️ GMP (Grey Market Premium)

- Grey Market Premium (GMP) is an unofficial and unregulated indicator of expected IPO listing price.

- GMP data is collected from market observers and informal trading circles; it does not have any legal or SEBI recognition.

- GMP values are highly speculative and may differ significantly from actual listing prices. Investors should not rely solely on GMP while taking investment decisions.

- ✅ General Advisory

- We do not provide any buy/sell/hold recommendations.

- Readers and investors are solely responsible for their investment actions and decisions.

- This platform, its authors, and affiliates are not liable for any direct or indirect financial loss arising from the use of this information.

- 🔒 Always invest responsibly and diversify your portfolio.

Open Demat Account

by Mirae Asset (m,Stock)

-

Rupee vs. Dollar Dec 2025: Crisis, Correction, or the New Normal?

Rupee vs Dollar Forecast 2025| INR vs USD analysis| Why rupee is falling| Indian economy 2026| Currency exchange outlook, ₹90…

-

RBI Policy Preview: The “Rupee vs. Growth” Dilemma – Will They Cut Rates?

RBI MPC Meeting Dec 2025| Repo Rate Cut Prediction| Stocks to Watch RBI Policy Event: RBI Monetary Policy Committee (MPC)…

-

Sensex Falls 500 Pts, Nifty Barely Holds 26,000: Market Report Dec 2 & Tomorrow’s Prediction

Stock Market Report Dec 2 2025| Nifty Prediction Dec 3| Sensex Crash Date: December 2, 2025 (Tuesday)| Market Sentiment: Bearish…

-

Sensex & Nifty Hit Fresh Record Highs But End Flat: Market Report Dec 1 & Tomorrow’s Prediction

Stock Market Report Dec 1 2025, Nifty Ends Flat, Bank Nifty 60000 Rejection Date: December 01, 2025 (Monday)| Market Sentiment:…

-

Lesson 11: Demat & Trading Account — Foundation of Every Investor’s Journey

Demat Account| Trading Account| Bank Account for Investment| Stock Market for Beginners| How to Open Demat Account| Difference Between Demat…

-

Nifty Pauses for Breath on Monthly Expiry: Detailed Report Nov 27 & Tomorrow’s Forecast

Nifty Prediction Nov 28 2025| Stock Market Report Nov 27| Monthly Expiry Analysis Date: November 27, 2025 Market Sentiment: Neutral…