As we moved deeper into the earnings season, the Indian equity markets displayed a cautious yet resilient tone. While benchmark indices like Nifty 50, Bank Nifty, and Nifty Financial Services moved in narrow ranges, it was the Nifty Select Midcap 50 that led the charge, outperforming the broader indices.

Let’s dive deep into how the day unfolded across these key indices and what retail investors can interpret from the current trend.

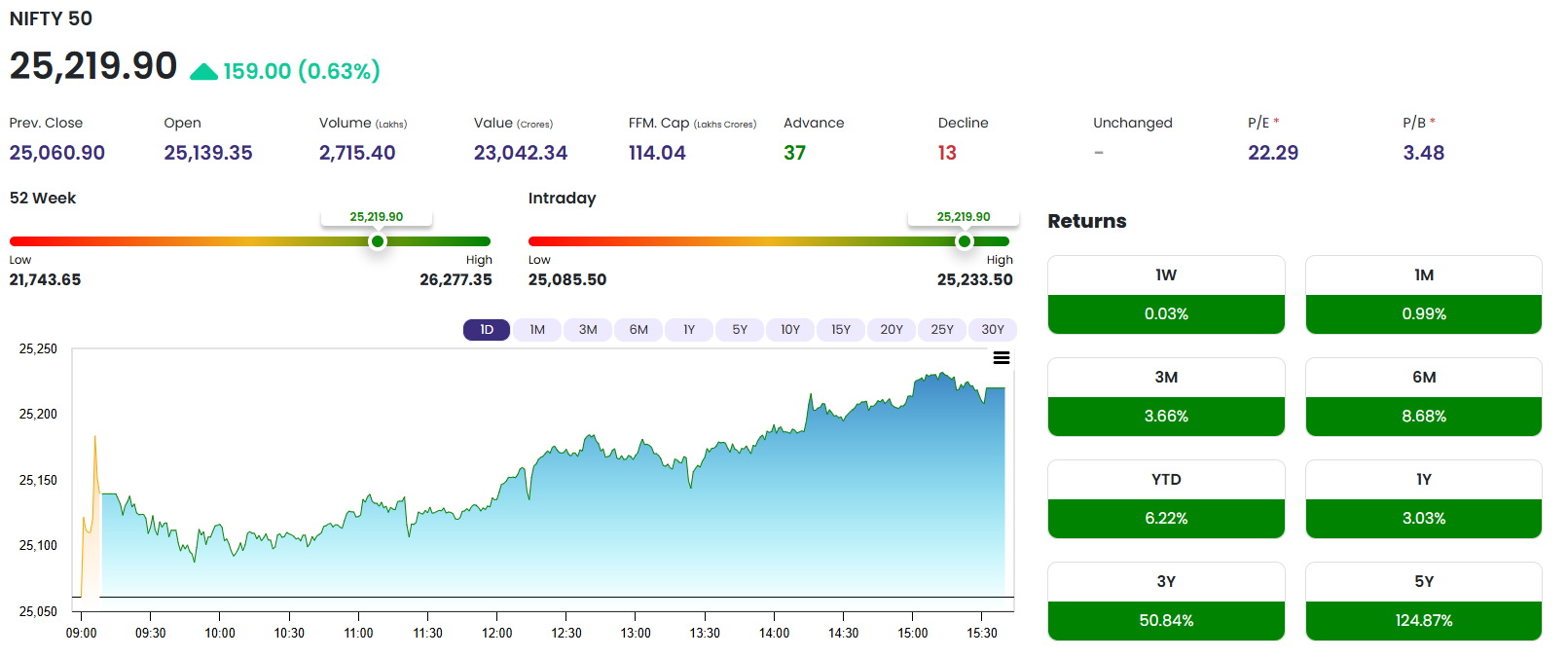

📈 Nifty 50 – Consolidating at Highs | Steady Hands Amid Global Uncertainty

-

Closing: 24,528.15

-

Change: ▲ +28.55 points (+0.12%)

-

Day’s Range: 24,450.50 – 24,573.80

The Nifty 50 index showed strength in its consolidation phase, closing with marginal gains after swinging in a tight range. This pause is not a sign of weakness, but rather a healthy digestion of gains made over the past two weeks.

🔍 Key Movers:

-

Positive contribution from IT heavyweights like TCS and Infosys provided balance as banks remained under pressure.

-

Reliance Industries and L&T lent further support.

-

Q1 results of index constituents are being closely watched, with HUL and Bajaj Finance among the highlights today.

🔄 Market Tone:

The market breadth was neutral, suggesting selective buying. The broader markets (especially midcaps and small caps) saw increased participation, possibly due to profit booking in frontline large-cap stocks.

📊 Technical Snapshot:

-

Support: 24,350

-

Resistance: 24,650

-

Momentum: RSI remains comfortably above 60

-

Trend: Bullish consolidation

A breakout above 24,650 may trigger a new leg of rally toward the psychological mark of 25,000, whereas a dip below 24,350 can result in short-term weakness.

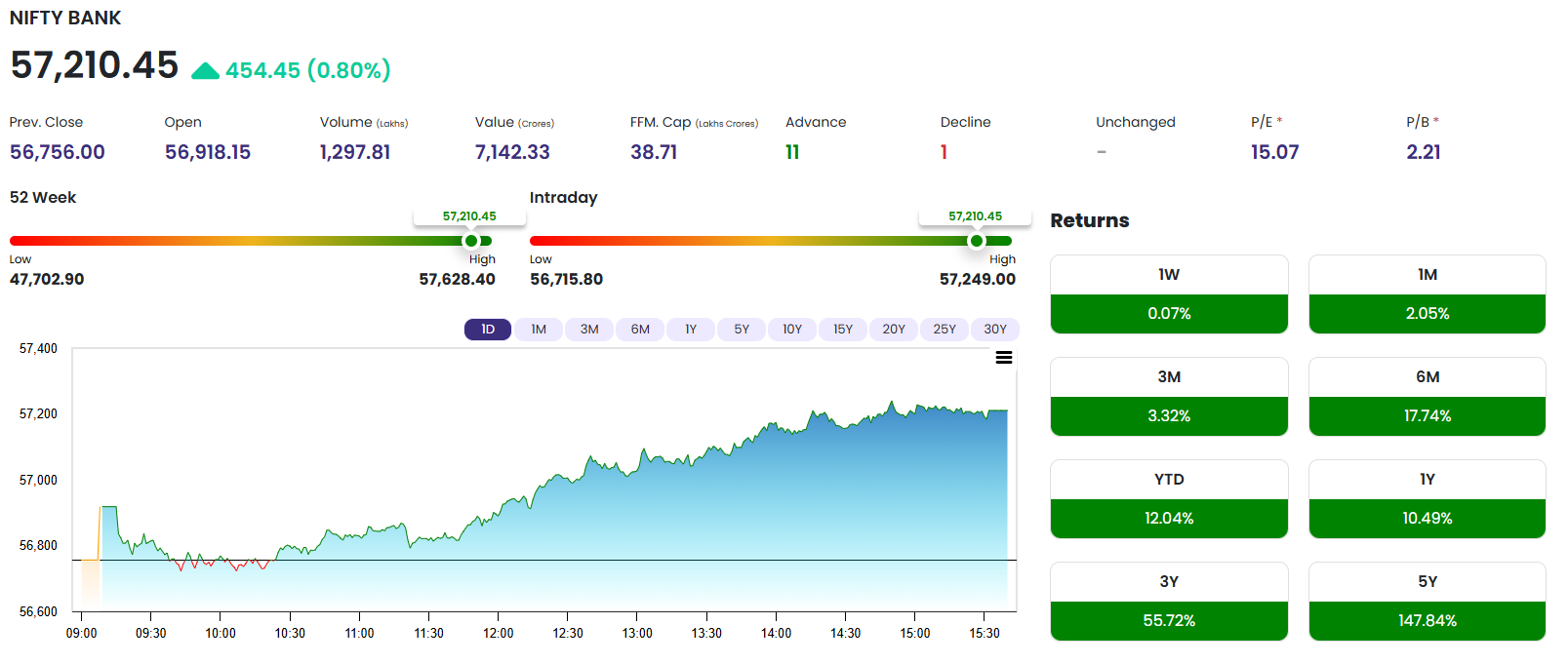

🏦 Bank Nifty – Rangebound with Bearish Undertone | PSU Banks Limit Downside

-

Closing: 53,217.85

-

Change: ▼ -112.75 points (-0.21%)

-

Day’s Range: 52,990.10 – 53,690.40

The Bank Nifty index continued to trade rangebound as mixed cues from private bank earnings kept the index under check. With ICICI Bank, Axis Bank, and Kotak Bank underperforming, it was the PSU banking pack that supported the index.

🏛️ Sector Highlights:

-

ICICI Bank continued to correct post-earnings as margins came under scrutiny.

-

State Bank of India (SBI) and Bank of Baroda showed resilience after strong quarterly numbers.

-

Traders remained cautious ahead of policy clarity and global interest rate direction.

📉 Technical View:

-

Support: 52,800

-

Resistance: 53,800

-

Short-Term Setup: Weak momentum, MACD flattening

-

View: Consolidation with negative bias

Any decisive break below 52,800 could bring sharp selling, while a close above 53,800 would signal bullish breakout potential.

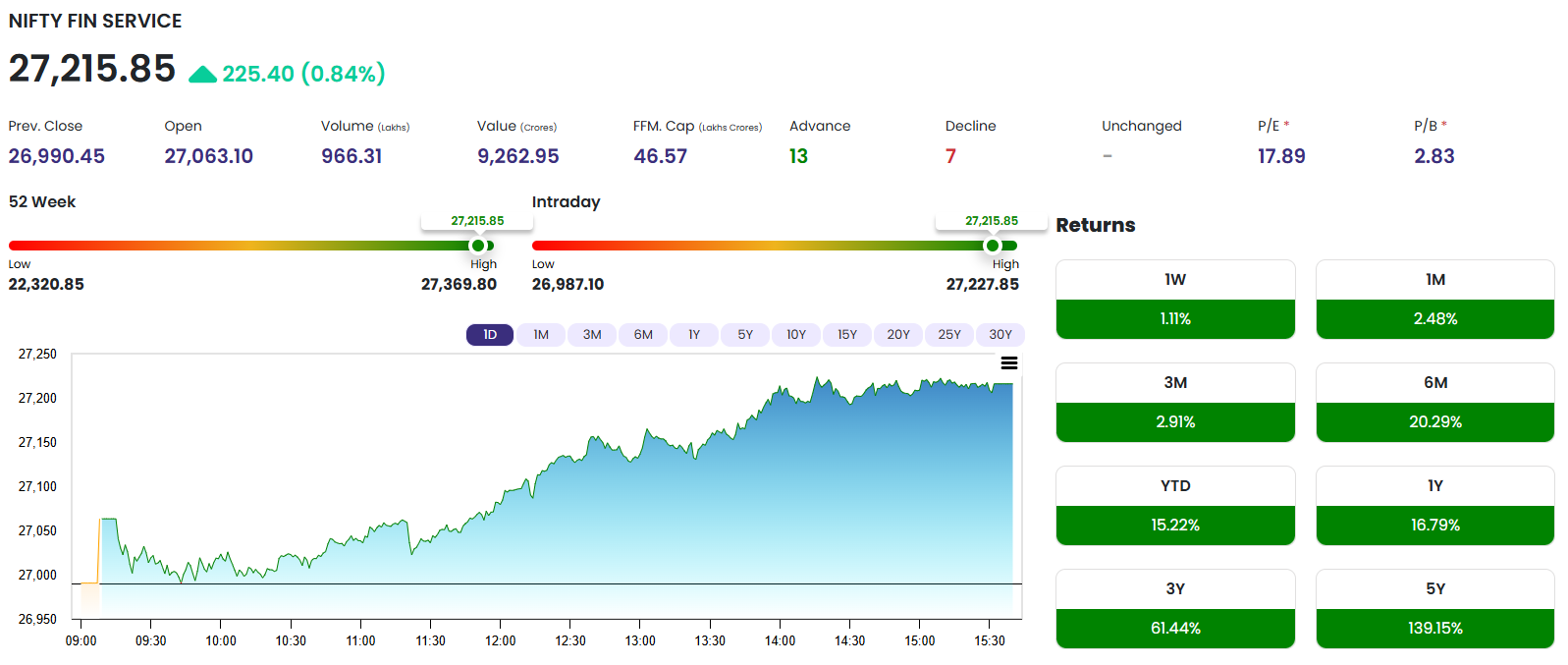

💼 Nifty Financial Services – Consolidation Phase | Insurance Holds, NBFCs Lag

-

Closing: 25,635.10

-

Change: ▼ -44.35 points (-0.17%)

-

Day’s Range: 25,580.65 – 25,777.25

The Nifty Financial Services index, which includes a mix of banks, NBFCs, and insurance firms, moved in tandem with the broader banking trend. However, it showed slightly better relative strength due to buying in select insurance names.

🧾 Movers and Drags:

-

Bajaj Finance remained subdued post-earnings, dragging the index.

-

HDFC AMC and LIC offered support due to fresh buying from mutual funds and retail investors.

-

Insurance stocks such as SBI Life and ICICI Lombard added stability.

📈 Technical View:

-

Support: 25,450

-

Resistance: 25,900

-

Outlook: Sideways

-

A close above 25,900 is needed to resume the uptrend.

Until then, traders can expect more of a time-based consolidation with stock-specific opportunities.

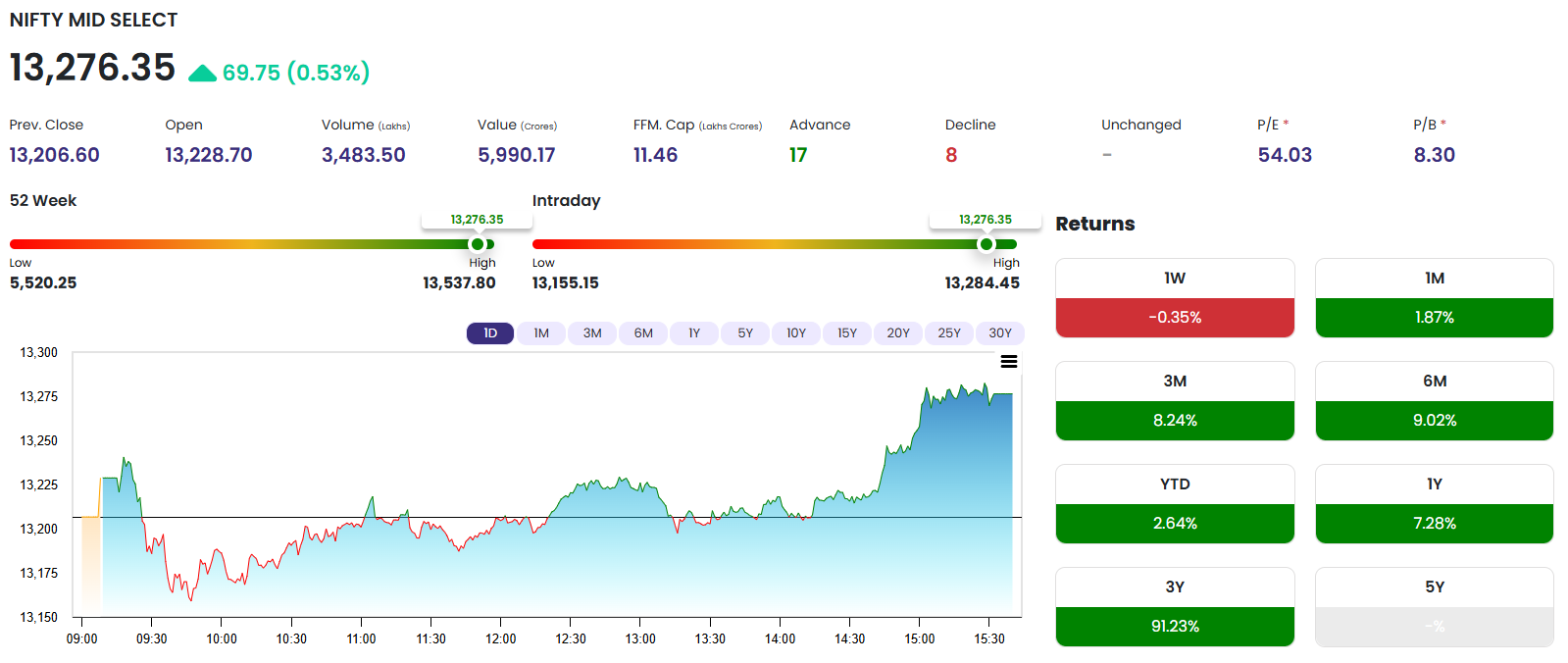

🟢 Nifty Select Midcap 50 – Outperformer of the Day | Midcap Rally Gathers Steam

-

Closing: 14,830.60

-

Change: ▲ +124.45 points (+0.85%)

-

Day’s Range: 14,701.45 – 14,876.90

The real action of the day was in the Nifty MidSelect index, which surged ahead of the frontline indices, reflecting renewed confidence in the broader market. This shift indicates that smart money is rotating into quality midcap names.

💡 Sectoral Participation:

-

Strong action in infra, power finance, and auto ancillary segments.

-

Stocks like PFC, REC, Cummins India, and Trent led the rally.

-

Q1 earnings from several midcap companies beat estimates, triggering bullish sentiments.

🔥 Why Midcaps Now?

-

After a steady rally in large caps, valuation comfort lies in mid and small caps.

-

Higher domestic flows into mutual funds are increasing demand for midcap allocations.

-

Strong management commentary during earnings is boosting confidence.

📈 Technical Setup:

-

Support: 14,650

-

Resistance: 15,000

-

Momentum: RSI trending near 70

-

Signal: Fresh breakout likely if index closes above 15,000

📊 Comparative Performance Snapshot

| Index | Close | Day Change | Performance Outlook |

|---|---|---|---|

| Nifty 50 | 24,528.15 | +0.12% | Consolidation Near Highs |

| Bank Nifty | 53,217.85 | -0.21% | Weak, Waiting for Trigger |

| Nifty Fin Services | 25,635.10 | -0.17% | Sideways to Neutral |

| Nifty MidSelect | 14,830.60 | +0.85% | Strong Outperformance |

🧠 What Should Retail Traders Do?

-

Midcap Exposure: This is the right time to add quality midcaps with strong fundamentals and earnings visibility. Focus on infra, consumption, and specialty finance.

-

Avoid Chasing Banks: Wait for a directional breakout in Bank Nifty before adding long positions. Prefer SBI or Canara Bank over private sector laggards.

-

Earnings Calendar: Stay tuned to results from L&T, Maruti, and Axis Bank later this week – likely to impact index moves.

-

Global Watch: Keep an eye on US Fed commentary this week. Any dovish stance may trigger a global rally.

Stock Market Disclaimer

This post is for me and testing purpose only

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.