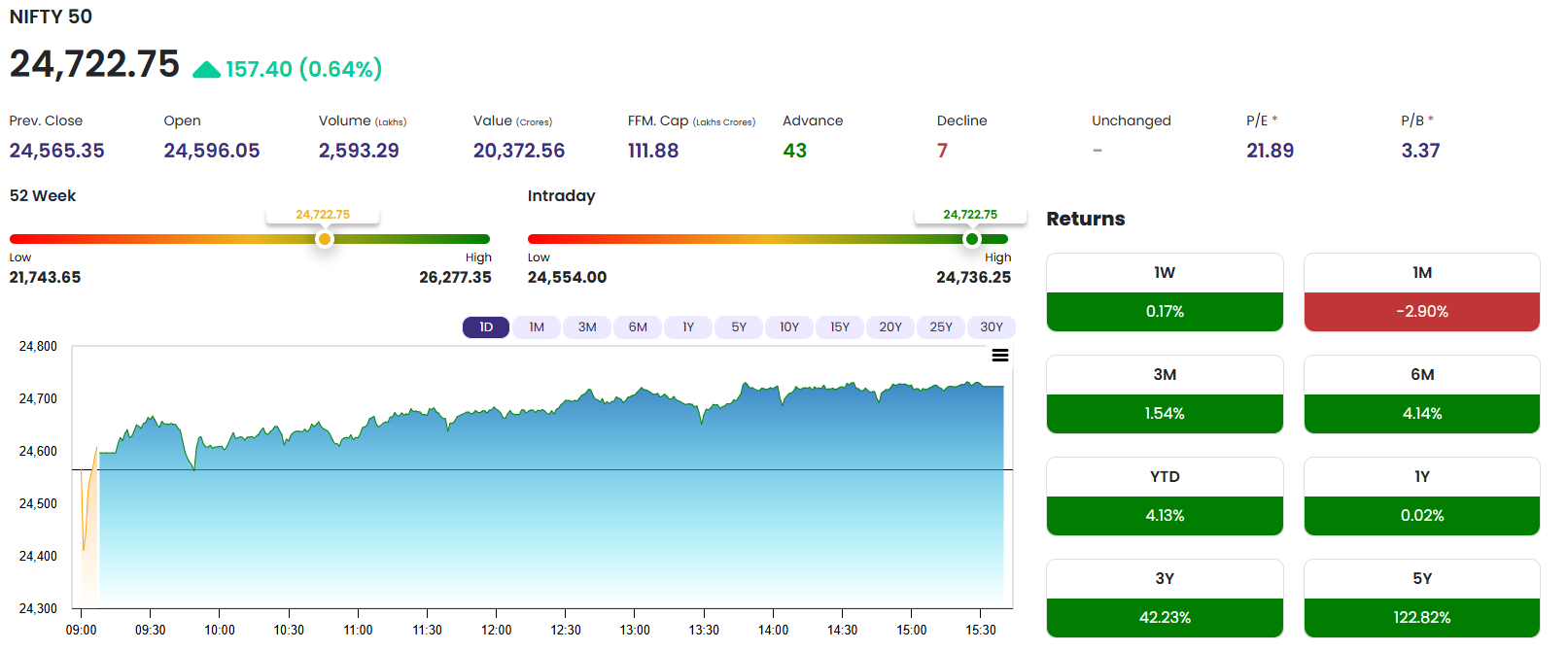

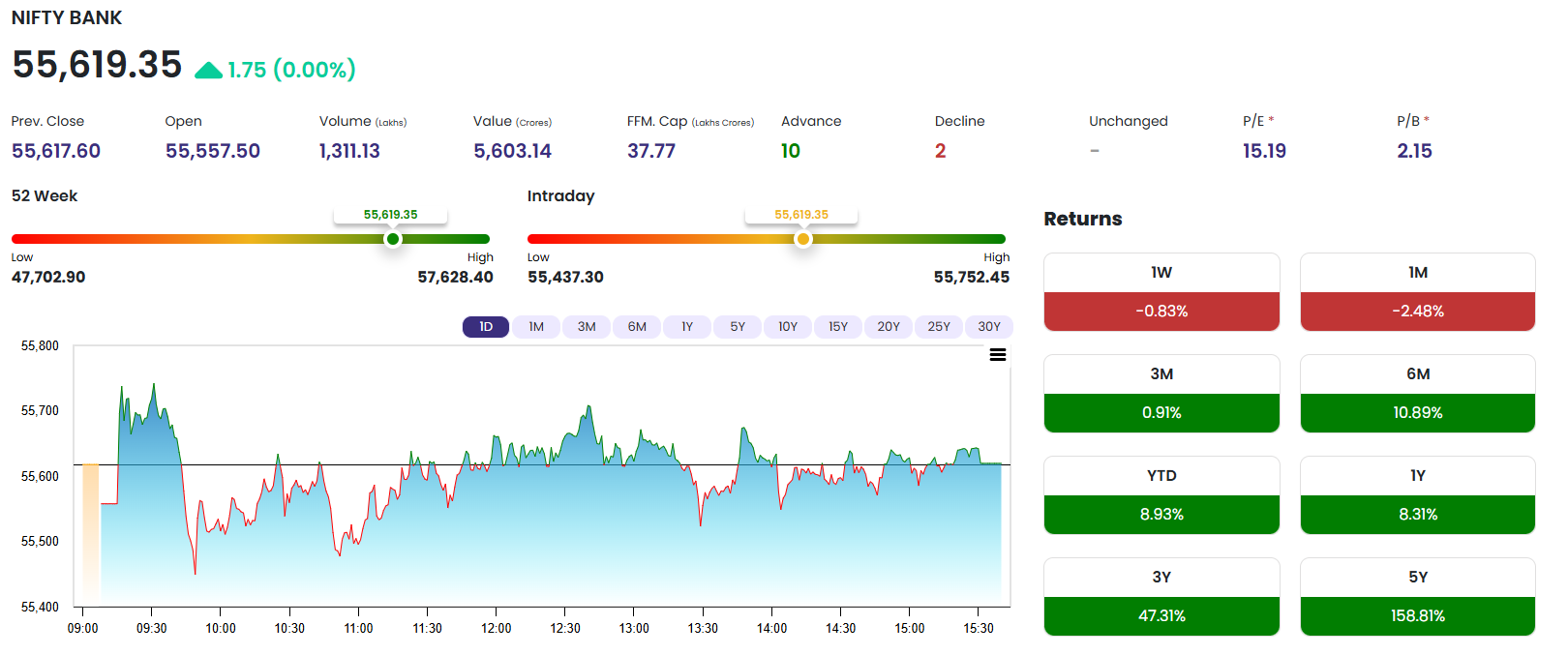

Key Market Indices Snapshot (As of Today)

| Index Name | Current Price | Open | High | Low | Previous Close |

|---|---|---|---|---|---|

| NIFTY | 24,722.75 📊 (+157.40 / +0.64%) | 24,596.05 | 24,736.25 | 24,554.00 | 24,565.35 |

| BANK NIFTY | 55,619.35 🔼 (+1.75%) | 55,557.50 | 55,752.45 | 55,437.30 | 55,617.60 |

| FIN NIFTY | 26,476.60 🔽 (-15.90 / -0.06%) | 26,507.20 | 26,590.10 | 26,412.20 | 26,492.50 |

| MIDCAP NIFTY | 12,861.10 🚀 (+192.85 / +1.52%) | 12,684.65 | 12,870.00 | 12,614.05 | 12,668.25 |

📌 Today’s Market Overview

The Indian stock markets displayed a bullish sentiment on Monday, with the Nifty 50 breaching the 24,700 mark and closing at 24,722.75, gaining over 157 points. The Midcap index was the real star, surging 1.52%, indicating strong participation from retail and institutional investors in broader markets. Bank Nifty also showed strength with a 1.75% uptick, whereas Fin Nifty remained under mild pressure.

This rally was driven by:

-

Strong global cues from US and Asian markets.

-

Robust quarterly earnings from key midcap players.

-

Fresh inflows from domestic mutual funds.

-

Positive FII (Foreign Institutional Investors) sentiment amid easing global bond yields.

🔍 Index-Wise Breakdown & Analysis

✅ NIFTY 50 – Bulls Take Charge

-

Close: 24,722.75 (+0.64%)

-

Support Level: 24,550

-

Resistance Level: 24,750 – 24,800

Nifty opened flat but picked up momentum in the second half, backed by IT, pharma, and auto sectors. The intraday high of 24,736.25 suggests potential for further upside if global sentiment remains supportive. Tomorrow, if it sustains above 24,750, the next target could be 24,900.

BANK NIFTY – Stable Yet Volatile

-

Close: 55,619.35 (+1.75%)

-

Support: 55,400

-

Resistance: 55,800

Banking stocks finally came out of consolidation mode, led by ICICI Bank, HDFC Bank, and PSU banks like SBI. The intraday movement showed good accumulation on dips. Tomorrow, if 55,800 is crossed, short covering may lead to 56,200 levels.

⚖️ FIN NIFTY – Minor Correction

-

Close: 26,476.60 (-0.06%)

-

Support: 26,400

-

Resistance: 26,600

Despite the rally in banking names, the Fin Nifty took a breather, possibly due to profit booking in NBFCs and insurance stocks. A bounce-back from 26,400 levels is expected tomorrow if sentiment stays firm.

📈 MIDCAP NIFTY – On Fire!

-

Close: 12,861.10 (+1.52%)

-

Support: 12,700

-

Resistance: 12,950

This segment continues to outperform the broader market. Stocks from sectors like realty, infra, chemicals, and defense led the rally. This shows rising risk appetite among investors. A breakout above 12,900 could lead to further gains tomorrow.

📊 Sectoral Overview

🏗️ Infra & Capital Goods:

Major outperformers today, with stocks like L&T, Siemens, and ABB India registering strong gains on hopes of government spending and robust order book visibility.

🏘️ Realty & Housing Finance:

Stocks such as Godrej Properties, Prestige Estates, and HDFC Ltd. performed well. Strong housing demand data is boosting sentiment in this space.

💊 Pharma & Healthcare:

Selected pharma counters witnessed accumulation. Defensive buying and export demand are helping the sector bounce back.

🚗 Auto:

Auto stocks were steady, with EV-related counters seeing higher volumes. Tata Motors and Hero MotoCorp gained on global expansion news.

🧪 Chemicals & Specialty Stocks:

Midcap chemical stocks were on fire due to expectations of restocking demand from China and Europe. Watch stocks like Deepak Nitrite and Navin Fluorine.

🌐 Global Market Sentiment

-

US Markets: S&P 500 and NASDAQ futures are mildly positive, suggesting a good handover to Asian markets.

-

Crude Oil: Hovering near $83/barrel, stable after supply adjustments by OPEC+.

-

Dollar Index: Slightly lower, giving support to emerging market currencies.

-

Gold: Trading above $2,030/oz, suggesting some risk aversion still persists globally.

🪙 FIIs & DIIs Activity (Estimated real data may be different or opposite)

-

FIIs: Net buyers of approx ₹1,200 crores today.

-

DIIs: Continued buying worth ₹950 crores.

This twin buying indicates sustained confidence in India’s economic and earnings trajectory.

📅 Market Outlook for Tomorrow (August 5, 2025)

🚀 Nifty Outlook:

-

If Nifty opens above 24,750 and sustains, we may see a rally towards 24,900 and even 25,000 psychological levels.

-

However, profit-booking could emerge near the top, especially ahead of US job data later this week.

📉 Bank Nifty Tomorrow:

-

Momentum is building, and a breakout above 55,800 can push the index towards 56,200.

-

Watch for movement in PSU Banks, which might outperform.

🧮 Midcap Strategy:

-

Stock-specific action likely to continue. Avoid chasing high-beta stocks.

-

Look for dips in fundamentally strong midcaps for positional buys.

💡 Expert Insight & Strategy

“The Indian markets are showing strong resilience and depth. With earnings season underway and inflation moderating, there is room for further upside, especially in mid and small caps. Traders should keep trailing stop-losses as volatility may rise ahead of global economic data.”

— Anuj Mehta, Market Strategist

📌 Key Stocks to Watch Tomorrow

-

L&T, Tata Power, Sun Pharma – Technical breakouts likely.

-

Bank of Baroda, PNB, Union Bank – Watch PSU bank space.

-

Bajaj Finance, LIC Housing – Could see recovery after today’s pause.

-

Adani Ports, DMart, JSW Steel – Showing accumulation patterns.

💬 Trader’s Tip of the Day

“Don’t chase rallies. Identify levels and stick to discipline. Use today’s momentum for identifying high-conviction setups for the week.”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.