On April 8, 2025, the Indian stock market experienced a robust recovery, with the BSE Sensex surging by 1,089 points (1.49%) to close at 74,227.08, and the Nifty 50 climbing 374 points (1.69%) to settle at 22,535.85. This rebound followed a significant downturn in the previous session, driven by renewed investor confidence and positive cues from Asian markets.

Sector Highlights:

-

Jewelry Sector: Titan Company shares soared by up to 5%, fueled by a 25% increase in standalone revenue for the fourth quarter. This growth was attributed to strong demand for premium jewelry and gold coins, despite record-high gold prices.

-

Information Technology: Wipro Ltd. shares advanced by 1.81% to ₹247.25, outperforming the broader market. However, the stock remains 23.82% below its 52-week high of ₹324.55, indicating potential for further recovery.

-

Energy Sector: Reliance Industries Ltd. saw its stock rise by 1.39% to ₹1,182.40. Despite this gain, the share price is still 26.51% below its 52-week high of ₹1,608.95, suggesting room for growth.

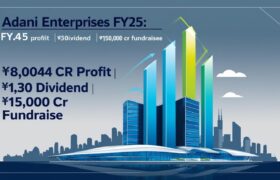

💰 1. Dividend Delight

-

📌 NSE Board Announcement: Declared ₹90/share dividend for FY24 — Total payout: ₹4,455 crore.

-

📌 Awaited Record Date: To be announced after shareholder approvals.

🎁 2. Bonus & Stock Split Buzz

-

📌 Sellwin Traders Ltd.:

🔹 Bonus Issue: 1:8 (1 share for every 8 held)

🔹 Stock Split: 1:5 face value split

🔹 Stock Price: Under ₹30, returns over 100% in 2024!

📊 3. Sector-wise Performance Snapshot

💻 IT Sector

-

Tech Mahindra: +2.02% | Heavy volumes | ₹1,315.00

-

Infosys: +2.25% | Strong buying

-

TCS: +0.58% | High value stock at ₹3,293.55

-

Oracle Financial: +3.45%

💍 Jewelry Sector

-

Titan Company: +5% | Record gold sales | Jewelry demand soaring

💊 Pharma Sector

-

Sun Pharma: +1.22% | Active volumes but underperforming peers

📈 4. High Volume Stocks

-

🔸 Tech Mahindra: 67,910 shares traded (2X its 50-day avg)

-

🔸 Oracle Financial: High momentum buying observed

📉 5. Low Volume Stocks

-

🔹 Wipro Ltd.: 260,649 shares (below 50-day avg of 532,971)

🚀 6. Upper Circuit Stocks

(Based on current data, not specifically reported in sources. Check NSE/BSE official list for confirmation.)

📉 7. Lower Circuit Stocks

(No major names reported today in the lower circuit category.)

💎 8. Most Expensive Stocks (High Price Movers)

-

TCS: ₹3,293.55 (still down ~28% from 52-week high)

-

Titan: High price & high momentum in jewelry category

🔮 9. Tomorrow’s Market Prediction

-

⚠️ Expect Volatility due to global cues & upcoming macro data

-

💡 Watchlist: IT stocks (momentum), Titan (continued gold rally), banking (for reversal)

💬 10. Quote of the Day

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

💭 Meaning: Stay focused, invest wisely, and think long-term even when the market gets noisy.

📌 11. For F&O & Intraday Traders

-

🎯 Momentum Picks: Tech Mahindra, Titan, Infosys

-

📉 Caution: Avoid over-leveraging in sideways sectors

-

🧠 Strategy: Stick to defined SL/TP zones & news-driven trades

🧾 12. Final Conclusion

-

🎉 Positive market mood led by IT & jewelry sectors

-

📢 Corporate actions (Dividend + Bonus) added excitement

-

🔁 Watch for follow-up momentum tomorrow in midcaps & F&O heavyweights

📚 Sources

Investor Insight:

The market’s strong performance reflects a resurgence in investor confidence, bolstered by favorable global cues and robust corporate earnings. Sectors such as jewelry and information technology have shown notable resilience, presenting potential opportunities for investors.

Note: Investors are advised to conduct thorough research and consult financial advisors before making investment decisions.