Introduction

MapmyIndia, officially listed as CE Info Systems Ltd, has emerged as a flagship Made-in-India deep-tech company revolutionizing digital mapping, GPS navigation, IoT, and geospatial analytics in India. With roots dating back to 1995, the company pioneered digital maps long before Google Maps entered the Indian market. Today, with its flagship Mappls app, MapmyIndia offers India’s most precise, privacy-focused, and India-first mapping solutions—serving not only the consumer but powering over 5,000 enterprises including Apple, Uber, Amazon, and Paytm.

🧭 Company Overview

| Attribute | Details |

|---|---|

| Name | CE Info Systems Ltd (MapmyIndia) |

| Founded | 1995 |

| Promoters | Rakesh Verma, Rashmi Verma |

| HQ | New Delhi, India |

| Listed | NSE & BSE (IPO in Dec 2021) |

| Market Cap | ₹9,900 Cr (Approx as of July 2025) |

| Sector | Geospatial Technology, SaaS, Navigation |

| Products | Mappls App, APIs, IoT Devices, ADAS, Telematics |

MapmyIndia is best known for creating India’s digital twin with 3D maps, satellite imagery, and hyperlocal data. Their maps cover 7.5 million kilometers of roads, 63 million places, and every pin code in India—serving the backbone for industries such as automobile, e-commerce, logistics, banking, and government smart city projects.

📱 What MapmyIndia Offers: B2B & B2C Powerhouse

-

Mappls App (Consumer Facing): Free-to-use app with voice navigation, traffic alerts, RealView (street-level 360°), location tagging, AR search, and pothole/speed camera alerts.

-

Enterprise APIs: Location intelligence tools, routing engines, geo-analytics for delivery optimization, sales-force tracking, logistics, and much more.

-

IoT Solutions: Vehicle tracking, fleet telematics, dashboard cams, and remote vehicle diagnostics.

-

Automotive Integration: Pre-installed GPS systems in cars from Hyundai, Tata, Mahindra, MG, etc., giving it over 90% in-car navigation market share.

-

Mappls KYC & Aadhaar Verification APIs: Key for fintech, logistics, and digital onboarding solutions.

💸 Financial Performance Snapshot (Q3 FY25)

| Metric | Q3 FY25 | YoY Change |

|---|---|---|

| Revenue | ₹114.5 Cr | 🔼 24.5% |

| EBITDA | ₹42 Cr | 🔼 17% |

| PAT | ₹32.3 Cr | 🔼 4% |

| EBITDA Margin | ~36% | Stable |

| Revenue Mix | 99% from B2B | High Margin SaaS/IoT |

MapmyIndia’s consistent margin profile and asset-light tech business has positioned it as a profitable deep-tech company from day one. The company boasts zero debt, high cash reserves, and free cash flow generation—making it a rare tech gem in India’s public markets.

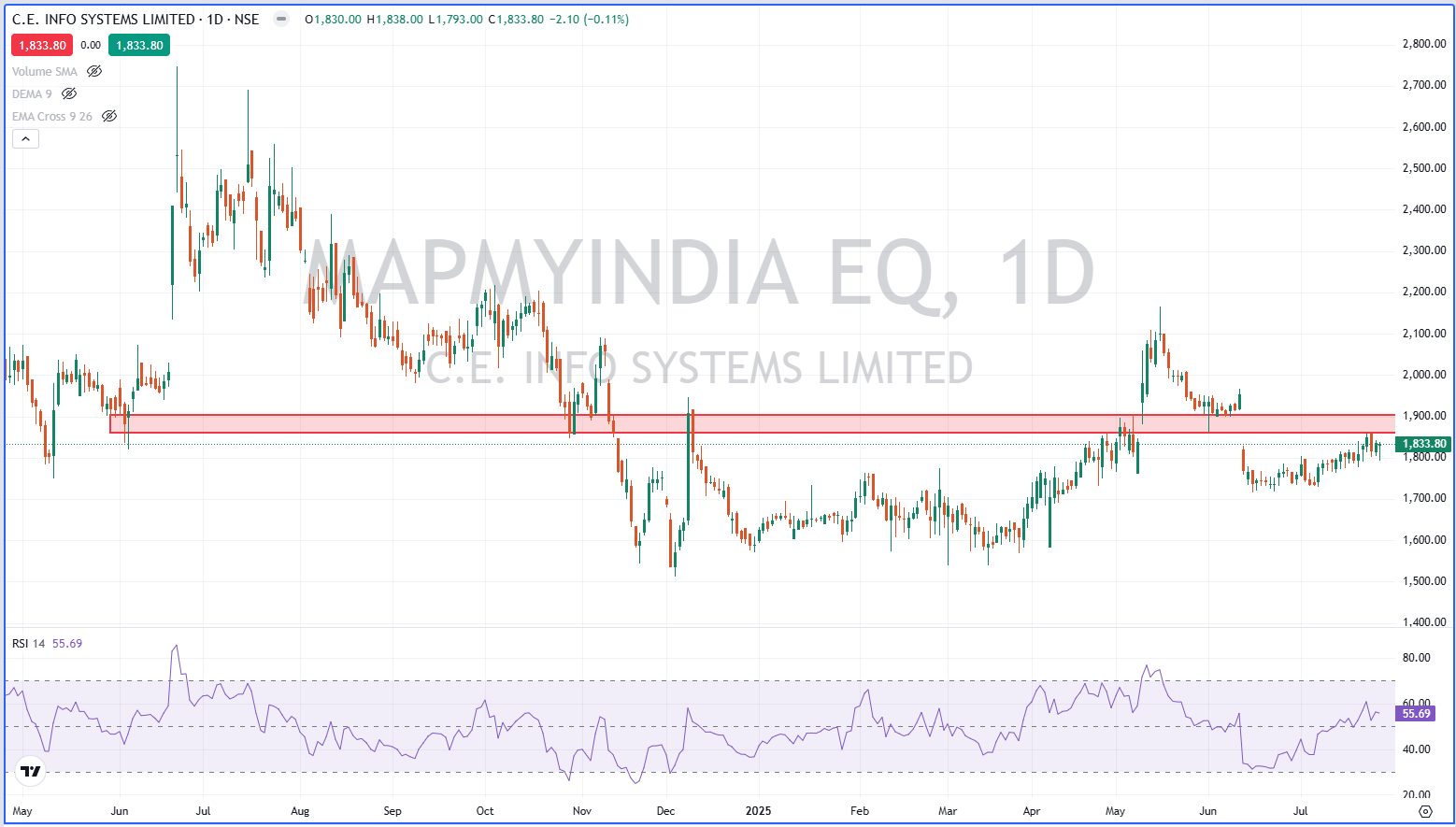

📊 Stock Performance & Technical Levels

Ticker: NSE: MAPMYINDIA | BSE: 543425

CMP (27 July 2025): ₹1,835.50

52-Week Range: ₹1,513 – ₹2,559

P/E Ratio: ~67x

P/B Ratio: ~12.6x

Dividend Yield: Nil

Market Cap: ₹9,900 Cr

🔍 Technical Analysis

-

Support Levels: ₹1,750, ₹1,680

-

Resistance: ₹1,875, ₹1,960

-

RSI: 54 – Neutral Zone

-

MACD: Mild bullish crossover emerging

-

Trend: Range-bound but positive on long-term weekly charts

-

Volume Action: Spike seen post board’s investment reversal

🔄 Recent Controversy & Resolution

In July 2025, MapmyIndia faced minor shareholder unrest after the board approved a ₹35 Cr investment into a new consumer business led by the founder’s son. Retail and institutional investors flagged potential governance issues.

✅ As a result, the board reversed the decision, demonstrating transparency and responsiveness. While this led to a temporary dip in share price, the stock has since rebounded steadily, with many analysts viewing it as a healthy corporate governance signal.

🌐 Market Impact & Ecosystem Influence

-

India’s Digital Push: Under Digital India, smart cities, drone regulations, and 5G—MapmyIndia is a vital enabler with indigenous mapping data.

-

Competition with Google Maps: While Google dominates consumer navigation, MapmyIndia is gaining ground with offline navigation, no-data tracking, privacy-first design, and government partnerships.

-

NavIC Integration: MapmyIndia’s support for ISRO’s NavIC satellite system positions it strategically amid geopolitical shifts and India’s push for digital sovereignty.

🧩 Retail Investor Relevance

Why Retail Should Track MapmyIndia:

✔️ Asset-light, cash-rich, debt-free tech business

✔️ Monopoly-like status in Indian B2B navigation systems

✔️ Exposure to sunrise sectors like EVs, autonomous vehicles, drones

✔️ High operating margins with scalable SaaS/IoT business model

✔️ Regulatory moat via Make-in-India & NavIC compliance

🧠 Analyst View

Brokerages remain cautiously optimistic given the company’s premium valuation, but maintain bullishness for the long-term:

“Despite near-term consolidation, MapmyIndia remains India’s only listed geospatial SaaS play. The platform, data, and deep-tech edge are extremely hard to replicate.” – Domestic Brokerage Report

📈 Conclusion: Small Cap, Big Vision

MapmyIndia is not just a mapping company—it’s a core infrastructure layer for India’s digital economy. From electric vehicle routing to drone corridor mapping, the company is creating invisible highways of data. Investors looking to ride India’s tech boom beyond IT services should keep this stock on their watchlist.

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.