The Indian stock markets kicked off the month of June on a mixed note, balancing investor optimism with global uncertainties. As benchmark indices hovered near resistance levels, sector-specific actions, dividend announcements, and upcoming corporate events kept retail and institutional participants engaged.

📊 Market Overview: Stability Amid Caution

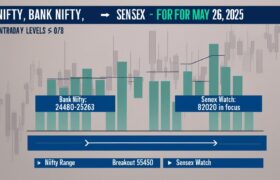

The broader markets showed resilience today, with the Nifty 50 forming a small positive candle, signaling buying interest at lower levels. Despite global cues remaining lukewarm, domestic fundamentals continued to provide a cushion. Nifty traded between 22,400 and 22,800, as per technical charts, with smart intraday recovery playing a key role by session end.

Experts believe that while macroeconomic support remains intact—thanks to healthy GDP figures and improving earnings—the market could remain range-bound in the near term due to global inflationary pressures and central bank policy uncertainties.

💰 Dividend Highlights: Top Companies Reward Shareholders

Several heavyweight companies declared dividends today, reaffirming their commitment to delivering consistent shareholder value. These announcements are significant in reinforcing investor confidence, especially for long-term holders.

Notable Dividend Announcements:

-

Larsen & Toubro (L&T): Declared a final dividend, attracting value investors ahead of ex-dividend trading this week.

-

Tata Motors: Announced a dividend, reinforcing its strong FY25 performance and maintaining shareholder goodwill.

-

Tata Consultancy Services (TCS): Declared a dividend ahead of its ex-date, maintaining its consistent dividend-paying reputation in the IT space.

These dividend moves are likely to attract income-focused investors in the coming weeks.

🔄 Corporate Actions: Splits & Bonuses to Watch

Corporate actions also came into focus today, particularly stock splits that are expected to boost liquidity and attract retail participation.

Upcoming Stock Splits:

-

Coforge Ltd.: Scheduled to trade ex-split this June. The split is designed to make shares more affordable and increase retail participation.

-

Vesuvius India Ltd.: Also announcing a stock split, adding momentum to its already positive stock movement.

Stock splits are usually well-received by the market as they improve liquidity and affordability for small investors, and today’s announcements are no exception.

📈 Sector-Wise Performance: Mixed Trends Across the Board

IT Sector:

TCS and Infosys showed relative strength today, with TCS gaining additional attention due to its dividend. The sector appears stable, backed by strong Q4 earnings and sustained demand in global outsourcing.

Auto Sector:

Tata Motors stood out after its dividend announcement, supporting momentum in the broader auto index. The two-wheeler and commercial vehicle segments also saw mild interest.

Infrastructure:

L&T’s dividend acted as a positive catalyst, helping the sector hold ground despite global headwinds. Continued government infra push is keeping investor interest alive.

🔎 High & Low Volume Stocks

-

High Volume Counters:

-

Reliance Industries and HDFC Bank led the charts in trading activity, driven by FII flows and institutional movements.

-

-

Low Volume Movers:

-

Selective mid-caps remained muted, including lesser-known pharma and textile names that saw reduced activity, possibly due to rotation of funds toward dividend and F&O names.

-

💸 High-Priced Stocks: Who’s Holding Their Ground?

-

Muthoot Finance: Remains one of the more expensive NBFCs, reflecting consistent earnings and business stability.

-

Page Industries: Continues its dominance as one of the highest-priced consumer durable stocks on the exchange, upheld by premium brand perception and stable margins.

📅 Market Outlook for June 3, 2025

Technical indicators hint at a cautious yet constructive start to Tuesday’s trade. With Nifty support pegged at 22,400 and resistance near 22,800, analysts suggest a potential breakout if global markets stabilize.

Key triggers to watch:

-

US Fed commentary

-

Crude oil trends

-

FII/DII flow patterns

Traders are advised to stick to risk-managed strategies with defined stop-loss levels.

🧠 Quote of the Day

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

This timeless quote reminds investors to stay grounded and trust the process. Patience and discipline remain the most valuable assets in volatile environments like today’s market.

🧾 Final Thoughts

The first trading day of June reflected stability amidst external turbulence. With dividend declarations, stock splits, and healthy volumes in bellwether stocks, there’s plenty of opportunity—but caution is warranted. Retail investors should continue focusing on strong fundamentals, while traders can capitalize on short-term moves with proper risk controls.

⚠️ Message for F&O and Intraday Traders

The derivatives market remains choppy. It’s a day for quick scalps over positional plays, especially as June series OI builds up. Stay wary of whipsaws, follow volume, and avoid low-liquidity contracts. Intraday setups on high beta stocks like Reliance, Adani Enterprises, and Bajaj Finance could offer opportunities—but only with a strict stop-loss in place.

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.