Indian Stock Market Daily Report – August 6, 2025

Market Wrap | Indices Performance | Support & Resistance for August 7 | Strategy Ahead

📘 Market Overview: A Mixed Session as Midcaps Crack and Financials Support the Frontline Indices

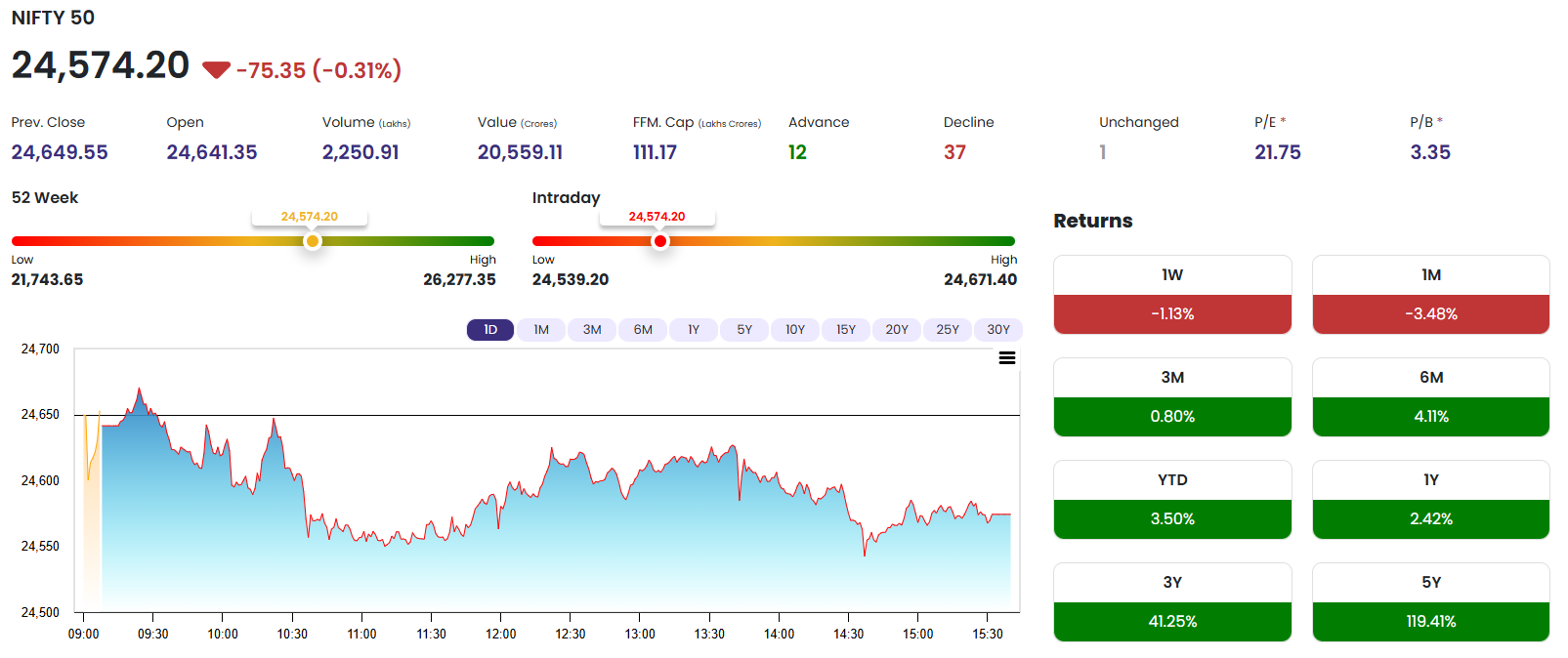

The Indian equity markets witnessed a volatile yet decisive session on August 6, 2025, as investors juggled between global cues, profit-booking at higher levels, and sectoral rotations. The benchmark Nifty 50 ended lower for the day, shedding 75 points (-0.31%) to close at 24,574.20, with selling pressure intensifying during the second half. This pullback came after the index attempted to reclaim the 24,670 zone but faced a stiff resistance amid lack of fresh triggers.

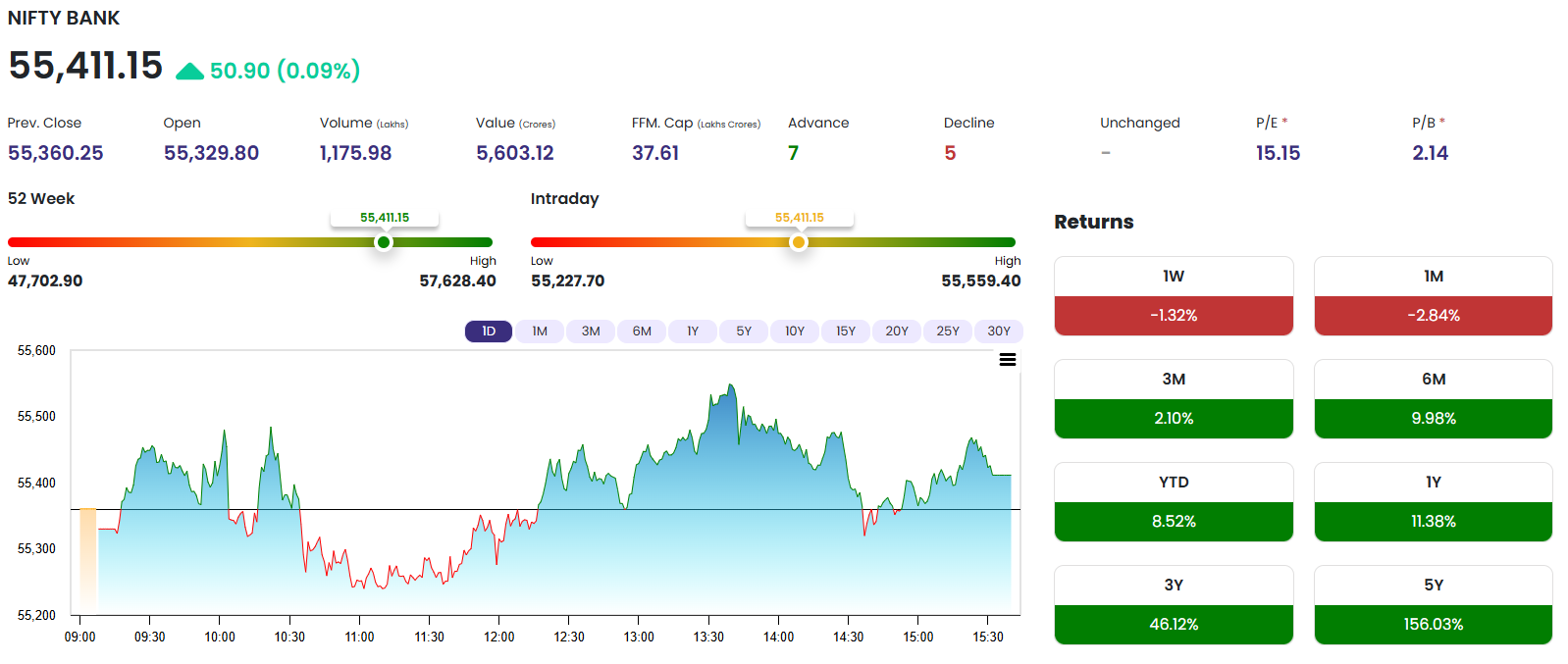

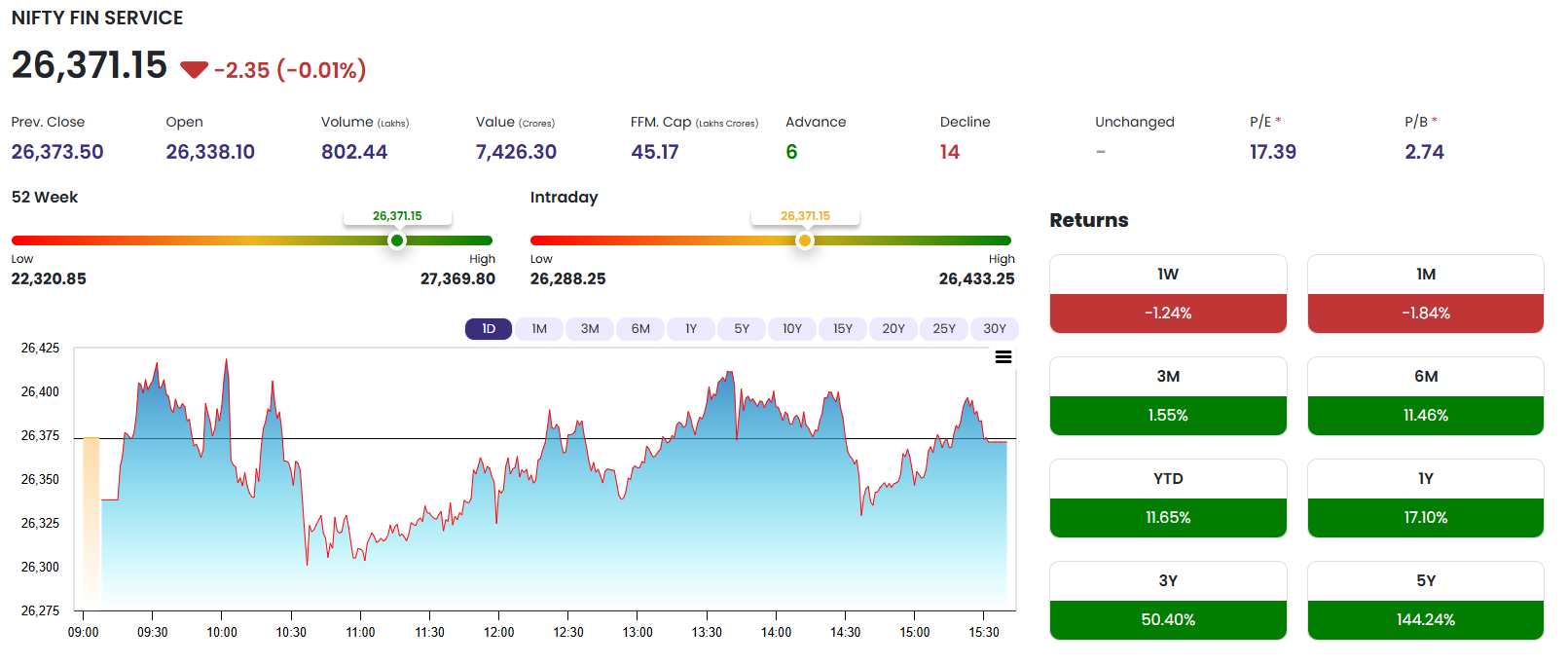

On the other hand, the Bank Nifty held its ground firmly and outperformed all other major indices by closing marginally higher at 55,411.15, gaining 50.90 points (0.09%). The resilience came from heavyweight private banks and select PSU banks showing institutional buying interest. Meanwhile, Fin Nifty hovered in a tight range, reflecting broader consolidation as both NBFCs and insurance counters lacked momentum. It eventually closed flat with a negative bias at 26,371.15 (-0.01%).

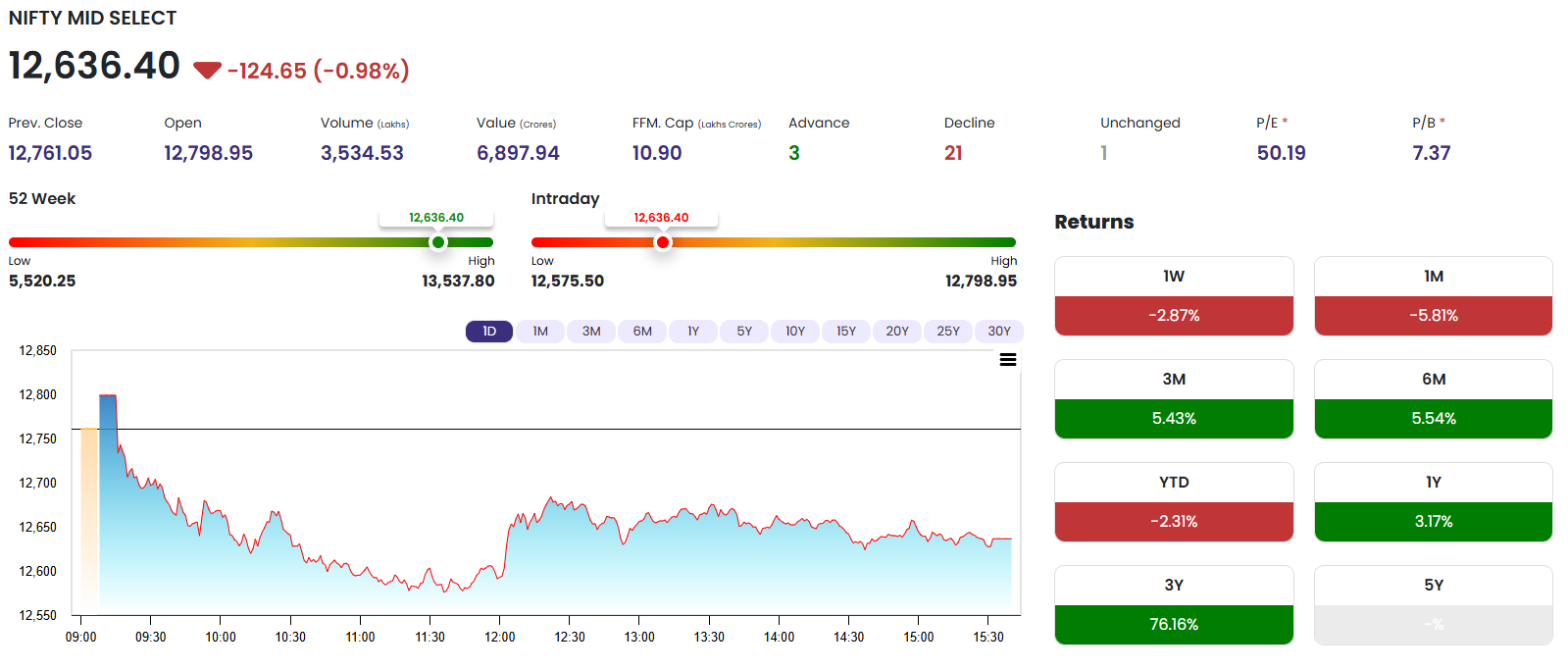

The day’s real pain, however, was seen in the broader market, with Midcap Nifty slipping nearly 125 points (-0.98%) to close at 12,636.40, a clear signal of risk-off sentiment among traders. Investors were seen lightening their positions in mid and small-cap counters, fearing overvaluation and possible FII outflows.

Globally, Asian markets showed mixed signals amid caution ahead of major U.S. earnings and the Fed’s upcoming commentary on inflation. Back home, muted participation by foreign investors, coupled with profit-booking in FMCG, auto, and realty stocks added to the pressure. In contrast, the banking and energy space acted as a cushion.

Technical indicators on key indices suggest caution in the short term, especially for the broader markets. Analysts expect the next 1–2 sessions to be crucial, particularly if Nifty fails to defend its immediate support. From a strategy standpoint, traders are advised to adopt a stock-specific approach while keeping a close watch on midcap volatility.

Support and Resistance for Nifty, Bank Nifty, Fin Nifty & Midcaps – August 7, 2025

🔍 Index-Wise Movement & Technical Breakdown

📉 NIFTY 50 – Weak Close After Early Gains

-

Close: 24,574.20

-

Open: 24,641.35

-

High: 24,671.40

-

Low: 24,539.20

-

Previous Close: 24,649.55

-

Change: -75.35 (-0.31%)

The Nifty 50 failed to sustain early gains, indicating strong resistance at 24,670–24,700. After opening with a minor gap, the index initially tested highs but couldn’t hold ground amid consistent selling in FMCG, IT, and auto sectors. The formation of a red candle on the daily chart, along with a close below the opening price, hints at further weakness unless a swift recovery is seen.

Nifty 50 Falls Below 24,600: Key Technical Indicators

📊 Key Technical Levels for August 7, 2025

-

Support Zones: 24,520 / 24,460 / 24,400

-

Resistance Zones: 24,630 / 24,700 / 24,770

-

Technical View: Bearish below 24,520, bullish only above 24,700

🏦 BANK NIFTY – Holding Strong Amid Broader Weakness

-

Close: 55,411.15

-

Open: 55,329.80

-

High: 55,559.40

-

Low: 55,227.70

-

Previous Close: 55,360.25

-

Change: +50.90 (+0.09%)

Bank Nifty showcased solid resilience in an otherwise tepid market. Led by gains in Axis Bank, Kotak Bank, and select PSU names like SBI and BoB, the index hovered near the upper end of the day’s range. With financials expected to remain in focus due to stable earnings and supportive liquidity conditions, Bank Nifty could lead the market if momentum picks up.

Bank Nifty Defends Support: Bullish Signal Ahead?

📊 Key Technical Levels for August 7, 2025

-

Support Zones: 55,200 / 54,980 / 54,800

-

Resistance Zones: 55,600 / 55,800 / 56,000

-

Technical View: Bullish bias intact above 55,200

💼 FIN NIFTY – Consolidation in Progress

-

Close: 26,371.15

-

Open: 26,338.10

-

High: 26,433.25

-

Low: 26,288.25

-

Previous Close: 26,373.50

-

Change: -2.35 (-0.01%)

Fin Nifty is clearly stuck in a sideways range. The index respected both support and resistance with minimal volatility, suggesting market participants are awaiting fresh triggers. Insurance stocks were weak, while NBFCs offered limited upside. As the index remains range-bound, breakout traders should wait for decisive movement beyond 26,500 or below 26,250.

Fin Nifty in Consolidation: Watch for Breakout

📊 Key Technical Levels for August 7, 2025

-

Support Zones: 26,300 / 26,240 / 26,180

-

Resistance Zones: 26,440 / 26,500 / 26,580

-

Technical View: Range-bound; breakout above 26,500 could trigger rally

📈 MIDCAP NIFTY – Pressure Mounts in the Broader Market

-

Close: 12,636.40

-

Open: 12,798.95

-

High: 12,798.95

-

Low: 12,575.50

-

Previous Close: 12,761.05

-

Change: -124.65 (-0.98%)

The Midcap index witnessed heavy selling after an enthusiastic open. Weakness was broad-based across real estate, auto ancillaries, consumer durables, and capital goods. The index slipped almost 1% and closed near the day’s low, suggesting continued caution from retail and institutional investors alike. Fresh positions in midcaps should be considered only after signs of reversal.

Midcap Nifty Crashes Nearly 1%: Risk-Off Sentiment Rises

📊 Key Technical Levels for August 7, 2025

-

Support Zones: 12,580 / 12,500 / 12,420

-

Resistance Zones: 12,700 / 12,790 / 12,850

-

Technical View: Bearish below 12,600, possible bounce above 12,700

📌 Quick Summary Table – August 6, 2025

| Index | Trend | Support Zones | Resistance Zones |

|---|---|---|---|

| NIFTY 50 | Bearish | 24,520 / 24,460 / 24,400 | 24,630 / 24,700 / 24,770 |

| BANK NIFTY | Bullish | 55,200 / 54,980 / 54,800 | 55,600 / 55,800 / 56,000 |

| FIN NIFTY | Neutral | 26,300 / 26,240 / 26,180 | 26,440 / 26,500 / 26,580 |

| MIDCAP NIFTY | Bearish | 12,580 / 12,500 / 12,420 | 12,700 / 12,790 / 12,850 |

🧠 Market Sentiment & Strategy Ahead

-

Nifty Outlook: Mildly negative unless it crosses above 24,700 with strong volume.

-

Banking Support: Remains key driver of market strength.

-

Midcaps: Avoid aggressive longs till reversal signs emerge.

-

VIX Watch: Keep an eye on volatility index for intraday clues.

For Traders:

Focus on breakout setups in Bank Nifty and large caps with volume support. Keep SLs tight in midcaps. Stay nimble and don’t over leverage.

For Investors:

Use corrections in quality financials and energy to accumulate. Avoid frothy sectors until market stabilizes.

🎯 Key Sectors to Watch Tomorrow

-

Positive Bias: Banks, Oil & Gas, FMCG (selective)

-

Cautious: Realty, Auto, IT, Midcap Pharma

💬 Mr’s Kachhot Closing Thoughts:

“Midcaps got slammed but the real game is still on. Bank Nifty is your best bet for momentum. Nifty will recover only if it can shake off that 24,700 resistance. Play safe, play smart — it’s a market for snipers, not machine gunners.”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.