Nifty Slips Below 25,500 as Broader Markets Struggle; Financial Stocks Provide Resilience

The Indian Stock Market witnessed a day of consolidation and mixed movements on 9th July 2025, as major benchmark indices closed in the red with the exception of FIN NIFTY. The day was marked by cautious investor sentiment, lower participation in midcaps, and subtle strength in the financial sector. The Nifty 50 index ended below the psychological 25,500 level while the Midcap index saw notable underperformance.

The trading session began on a flat to slightly positive note, but failed to sustain the early gains due to lack of fresh buying and global uncertainty. The Nifty 50 closed the day at 25,476.10, down 46.40 points or 0.18%, after opening at 25,514.60 and touching an intraday high of 25,548.70. Selling was witnessed across sectors with selective financial counters acting as a silver lining, reflecting the overall sentiment in the Indian Stock Market.

Market analysts suggest that the Indian Stock Market has been experiencing fluctuations due to a mix of domestic economic data and international developments. For instance, any changes in US Federal Reserve policies can directly influence investor sentiment in India. Recent statements from Fed officials hinting at potential interest rate changes have resulted in cautious trading patterns.

📉 Index-Wise Performance Snapshot

✅ NIFTY 50: Slips Below 25,500

-

Current Price: 25,476.10

-

Change: -46.40 pts (-0.18%)

-

Day Range: 25,424.35 – 25,548.70

-

Previous Close: 25,522.50

Nifty’s struggle around the 25,500 zone indicates market hesitation at higher levels, possibly due to global volatility and lack of immediate domestic triggers. Traders are waiting for key macroeconomic data including CPI inflation, IIP numbers, and US Fed commentary before taking directional calls.

Moreover, the technical indicators for the Nifty suggest that the index may face resistance around the 25,500 level. Traders often utilize moving averages to identify potential entry and exit points. The 50-day moving average currently sits just above 25,500, creating a significant psychological barrier for traders.

🏦 BANK NIFTY: Flat to Negative

-

Current Price: 57,213.55

-

Change: -42.75 pts (-0.07%)

-

Day Range: 57,037.90 – 57,290.65

-

Previous Close: 57,256.30

Bank Nifty remained largely rangebound throughout the session. While private banks remained stable, PSU banking stocks showed mild weakness. With quarterly earnings around the corner, investors are selectively positioning themselves in quality names.

Investors are also closely monitoring the earnings season, which can significantly impact stock prices across sectors. For example, if major private banks report stronger than expected results, it could lead to a positive sentiment in the Bank Nifty index, potentially lifting overall market performance.

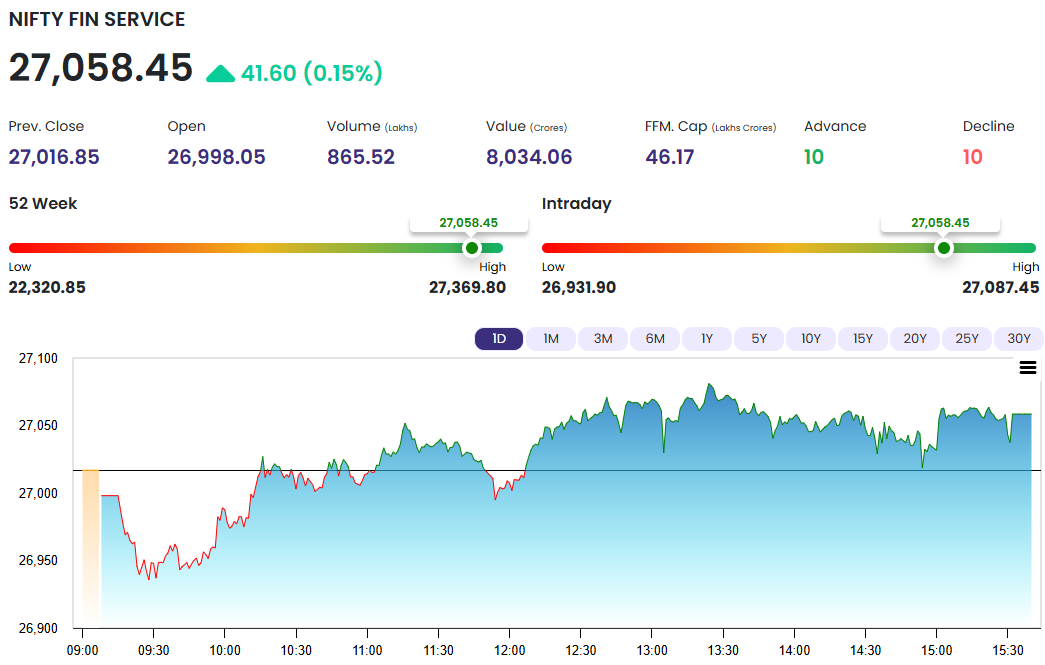

📈 FIN NIFTY: The Lone Gainer

-

Current Price: 27,058.45

-

Change: +41.60 pts (+0.15%)

-

Day Range: 26,931.90 – 27,087.45

-

Previous Close: 27,016.85

FIN NIFTY outperformed other indices as NBFCs, insurance, and asset management companies attracted interest. Renewed focus on financial reforms and expectation of stable earnings from the sector fueled the upside. This shows possible sector rotation by institutional investors.

Furthermore, the Indian Stock Market’s resilience can be attributed to the robust performance of sectors such as technology and pharmaceuticals. Companies in these sectors have reported steady growth, which could offset declines in other areas. The global demand for technology services, especially in a post-pandemic world, has provided a solid foundation for growth.

📉 MIDCAP NIFTY: Most Affected

-

Current Price: 13,291.85

-

Change: -41.60 pts (-0.31%)

-

Day Range: 13,268.40 – 13,399.05

-

Previous Close: 13,333.45

Midcap stocks faced strong selling pressure with the index shedding over 41 points. Weak broader participation, profit booking, and rising volatility impacted investor confidence in the midcap and smallcap space. Defensive sectors were preferred over high-beta midcap counters.

As we look ahead, the upcoming economic indicators, such as GDP growth rates and employment figures, will play a crucial role in shaping market expectations. Analysts believe that a stronger economic outlook could encourage investors to return to the market, potentially reversing the current downward trend.

🧠 Market Quote of the Day

“Volatility is not a risk; it is an opportunity for the wise.”

Let the dips refine your strategy, not shake your confidence.In addition, it is essential for investors to maintain a diversified portfolio. By spreading investments across different asset classes, including equities, bonds, and real estate, one can mitigate risks associated with market volatility. This strategy ensures that even during downturns in the Indian Stock Market, investors have exposure to sectors that could perform well.

🔍 Key Observations:

-

Nifty closed below 25,500 for the first time this week.

-

Midcaps underperformed large-caps, hinting at risk-off sentiment.

-

FIN NIFTY’s positive close may hint at upcoming sector rotation into financials.

-

Volumes were moderate, suggesting a wait-and-watch approach ahead of key macroeconomic data.

Lastly, staying informed about global market trends and geopolitical developments can provide investors with the insights needed to make informed decisions. The interplay between international markets and the Indian Stock Market highlights the importance of a global perspective when investing.

Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.