Market Summary – July 21, 2025

The Indian equity markets saw strong upward momentum on Monday, with key indices closing in the green, supported by buying across banking, financial, and midcap counters. Nifty gained over 120 points, while Bank Nifty surged more than 650 points, indicating positive investor sentiment ahead of major earnings this week.

🔹 Index Performance (Closing Basis)

| Index | Close | Change | % Change |

|---|---|---|---|

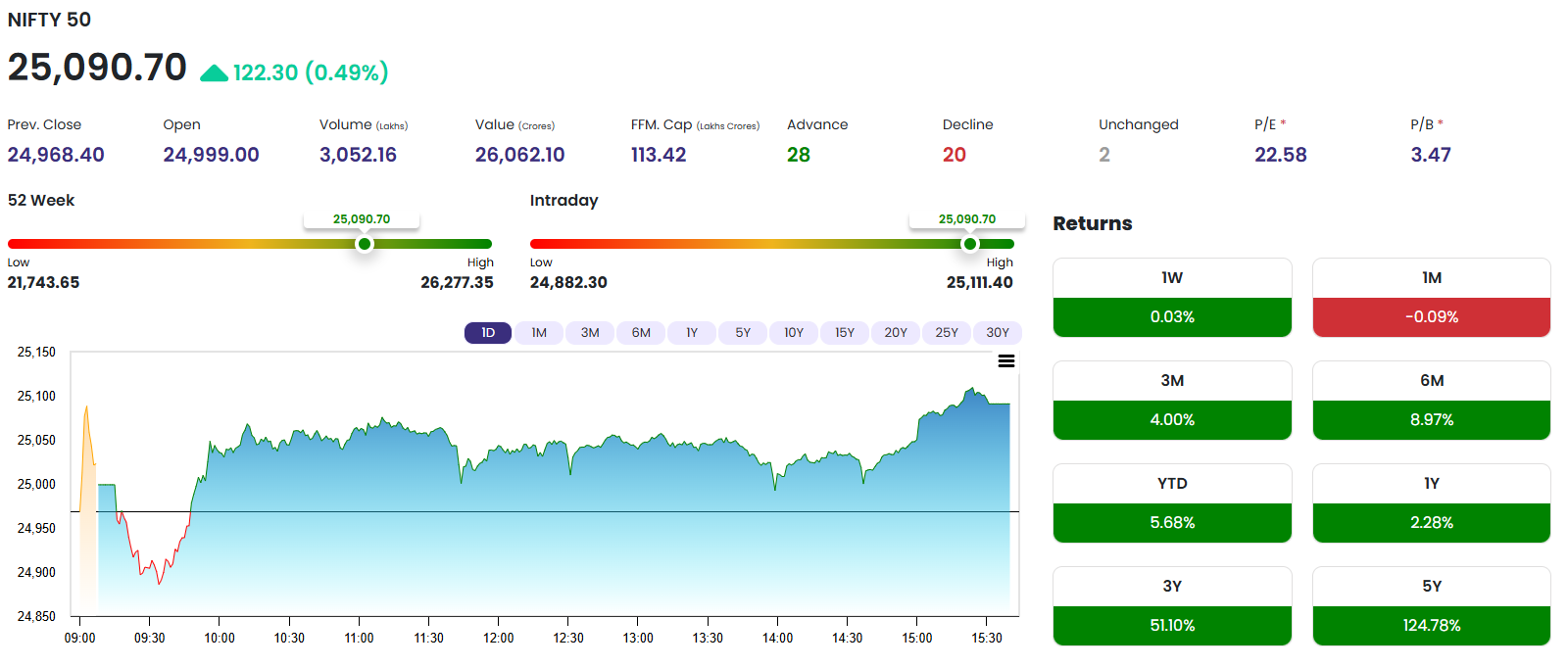

| NIFTY | 25,090.70 | 🔼 122.30 | 🔼 0.49% |

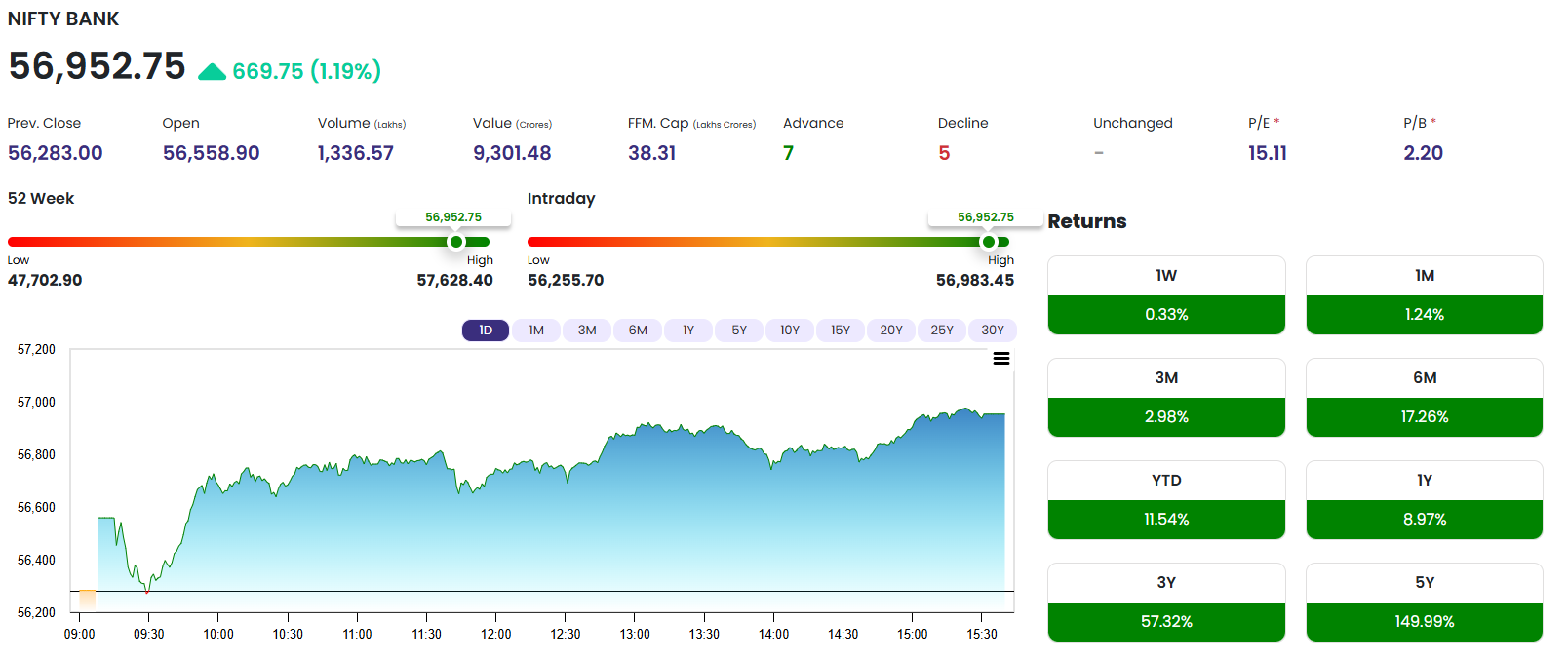

| BANK NIFTY | 56,952.75 | 🔼 669.75 | 🔼 1.19% |

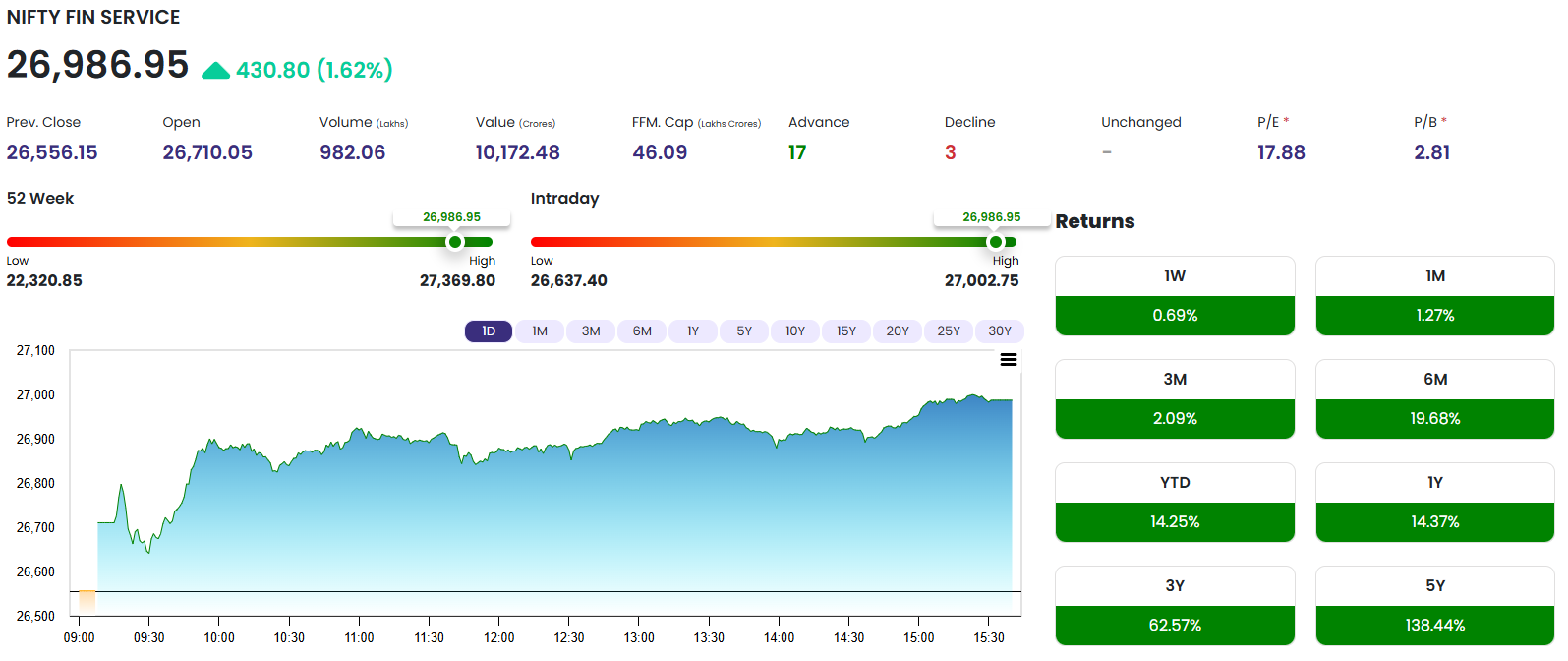

| FIN NIFTY | 26,986.95 | 🔼 430.80 | 🔼 1.62% |

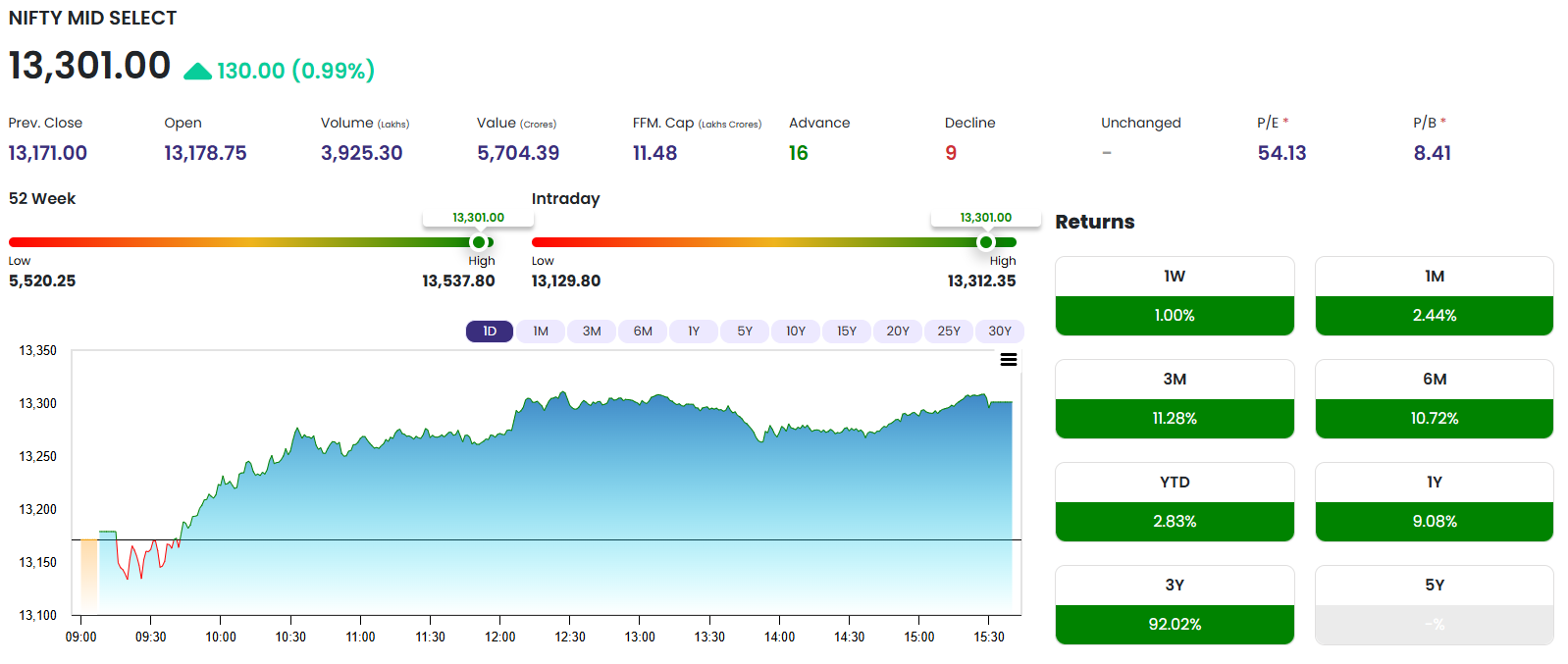

| MIDCAP NIFTY | 13,301.00 | 🔼 130.00 | 🔼 0.99% |

📌 Key Observations:

🔷 Nifty 50

-

Opened at 24,999.00 and hit a high of 25,111.40

-

Low was at 24,882.30

-

Closed at 25,090.70, up 122.30 points

-

Started the day at 56,558.90 and touched a high of 56,983.45

-

Low recorded was 56,255.70

-

Ended the day at 56,952.75 with a solid gain of 669.75 points

-

Sharpest mover with a 1.62% gain

-

Closed at 26,986.95 vs previous close of 26,556.15

-

Shows aggressive buying in NBFC and financials

-

Showed healthy participation with 130 points gain

-

Closed at 13,301.00, indicating broad-based market support

💡 Sectoral & Market Insights

✔️ Banking and Financials led the rally — triggered by strong Q1 results anticipation, lower NPAs, and credit growth.

✔️ Midcaps and broader markets also joined the party — indicating rising investor confidence in second-rung stocks.

✔️ Traders are eyeing upcoming earnings from top corporates like HDFC Bank, Kotak Mahindra Bank, and IT majors.

📊 Technical View

📍 Nifty managed to break above 25,000 – a key psychological resistance. If it sustains above this level, the next target is 25,200.

📍 Bank Nifty broke out above its short-term resistance, targeting the 57,200–57,400 zone.

📍 Fin Nifty looks strongest in momentum — traders are likely to watch 27,200 as next key level.

📍 Midcap Nifty indicates accumulation; any dip may be a buy-on-dips opportunity.

🧠 What Should Retail Traders Do?

🔸 Stay cautiously optimistic — trail your profits if you’re long

🔸 Keep a watch on Q1 earnings and global cues

🔸 Banking & financial stocks remain hot — potential short-term opportunity

🔸 For long-term investors, dips in midcaps and large financials could be a good accumulation zone

📅 Market Impact Ahead

-

Q1 results and global market stability will steer sentiment

-

Any negative surprises from US Fed or crude prices may trigger volatility

-

Institutional activity remains key — keep an eye on FII/DII flow updates

🏢 Quick Snapshot – Index Reference Table

| Index | Open | High | Low | Close | Prev. Close |

|---|---|---|---|---|---|

| NIFTY | 24,999.00 | 25,111.40 | 24,882.30 | 25,090.70 | 24,968.40 |

| BANK NIFTY | 56,558.90 | 56,983.45 | 56,255.70 | 56,952.75 | 56,283.00 |

| FIN NIFTY | 26,710.05 | 27,002.75 | 26,637.40 | 26,986.95 | 26,556.15 |

| MIDCAP NIFTY | 13,178.75 | 13,312.35 | 13,129.80 | 13,301.00 | 13,171.00 |

Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.