Markets End in Red: Indices Witness Broad-Based Decline Amid Global Weakness

The Indian stock market closed in the red today, with all major indices facing selling pressure. Amid cautious investor sentiment and mixed global cues, frontline and sectoral indices declined across the board. Let’s break down how each index performed today with detailed commentary:

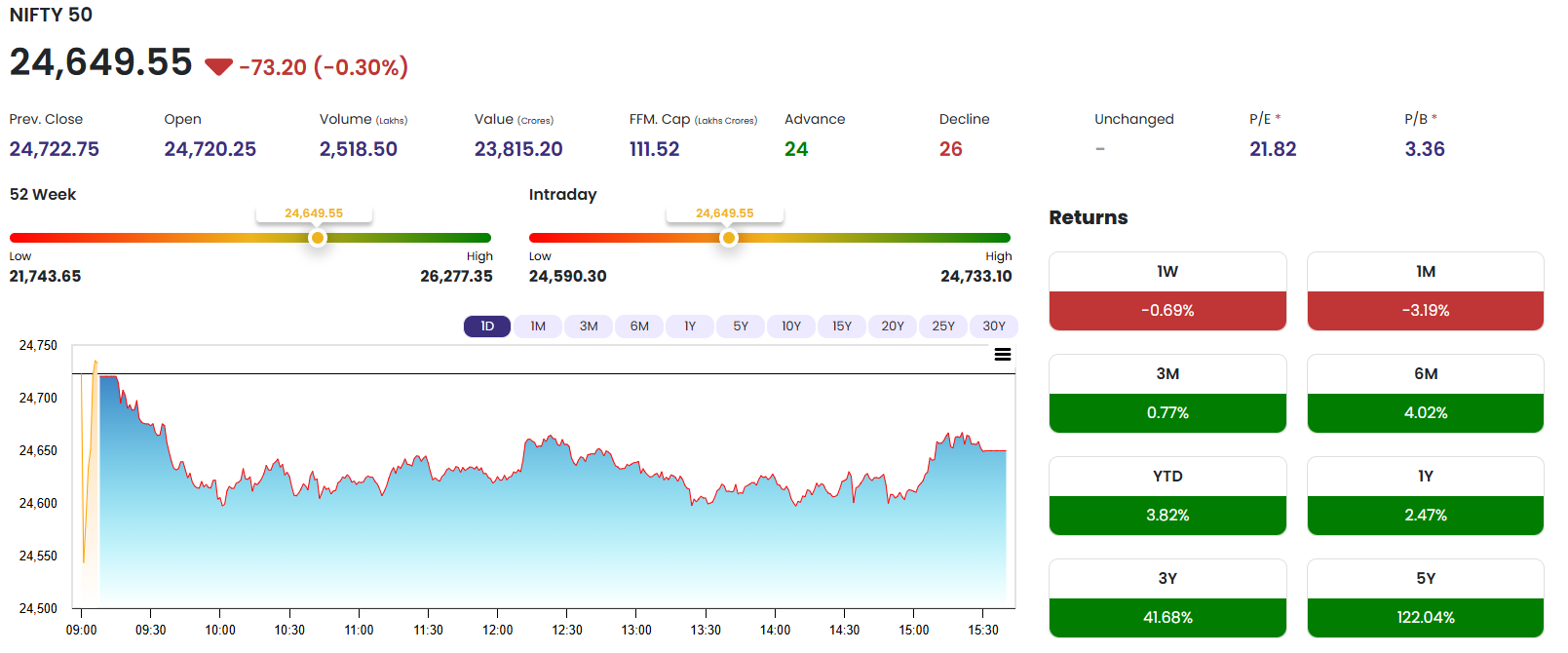

🔹 NIFTY 50 – Down by 73.20 points (-0.30%)

-

Current Price: 24,649.55

-

Open: 24,720.25

-

High / Low: 24,733.10 / 24,590.30

-

Previous Close: 24,722.75

Overview:

The benchmark Nifty 50 witnessed a choppy session and closed lower by 73 points. Despite an optimistic open above the previous close, the index couldn’t sustain gains and slipped into negative territory as selling emerged in heavyweight stocks from banking, IT, and FMCG sectors.

Technical Insight:

The intraday dip towards 24,590 indicates a strong support zone, but the index’s failure to sustain above 24,700 suggests profit booking pressure at higher levels. Traders may now watch 24,500 as an immediate support and 24,800 as resistance in the near term.

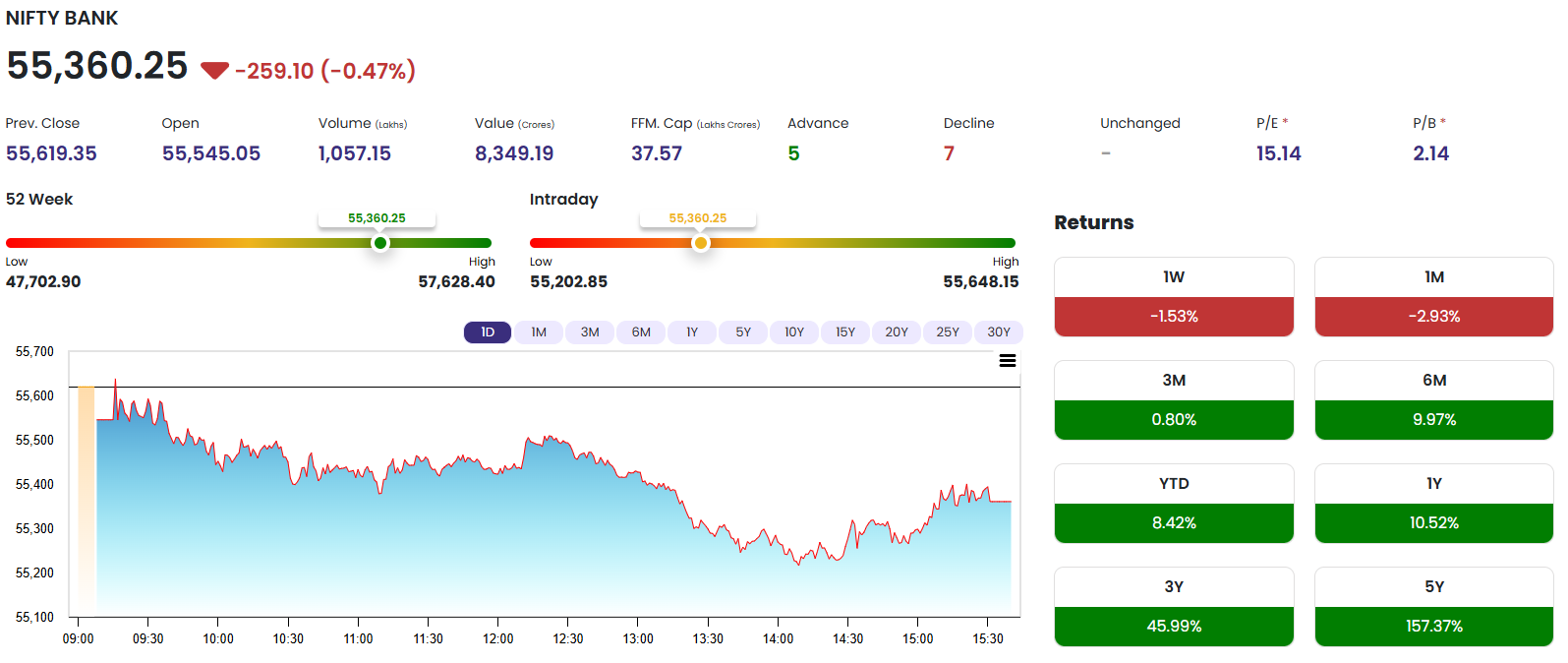

🔹 BANK NIFTY – Down by 259.10 points (-0.47%)

-

Current Price: 55,360.25

NIFTY BANK -

Open: 55,545.05

-

High / Low: 55,648.15 / 55,202.85

-

Previous Close: 55,619.35

Overview:

Bank Nifty underperformed broader markets, declining over 250 points. Private and PSU banking names were largely in the red, with selling in major stocks like HDFC Bank and SBI dragging the index lower.

Key Takeaway:

The banking index has now corrected for the third consecutive session. With financial sector earnings out and RBI commentary awaited, traders may remain cautious. A fall below 55,200 may trigger fresh short-term weakness.

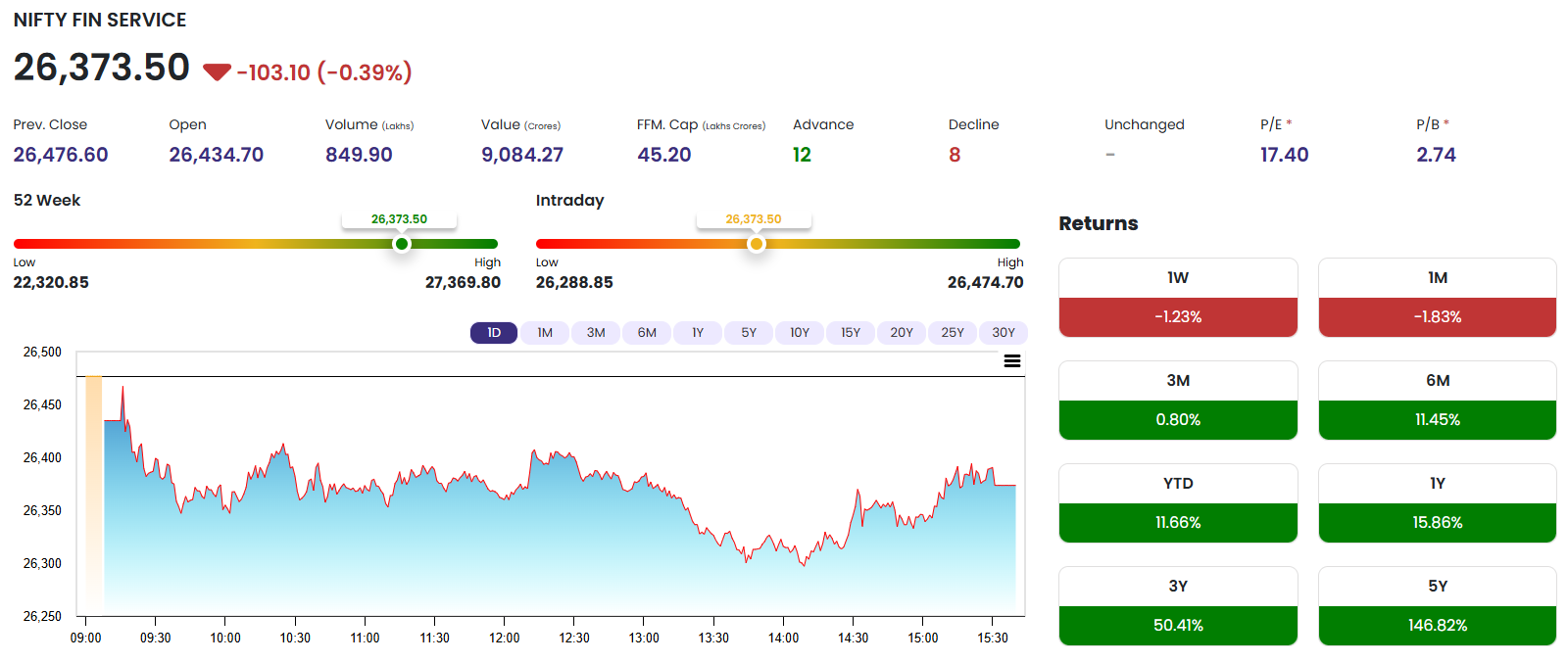

🔹 FIN NIFTY – Down by 103.10 points (-0.39%)

-

Current Price: 26,373.50

-

Open: 26,434.70

-

High / Low: 26,474.70 / 26,288.85

-

Previous Close: 26,476.60

Overview:

Financial services stocks mirrored the pressure seen in banks. FIN NIFTY opened flat and faced resistance at 26,474, eventually closing well below the opening levels. Insurance and NBFC stocks also participated in the decline, indicating sector-wide weakness.

Investor Insight:

The inability to hold above 26,400 despite intraday attempts shows lack of fresh buying. Short-term investors may stay on the sidelines until signs of stability emerge around 26,200.

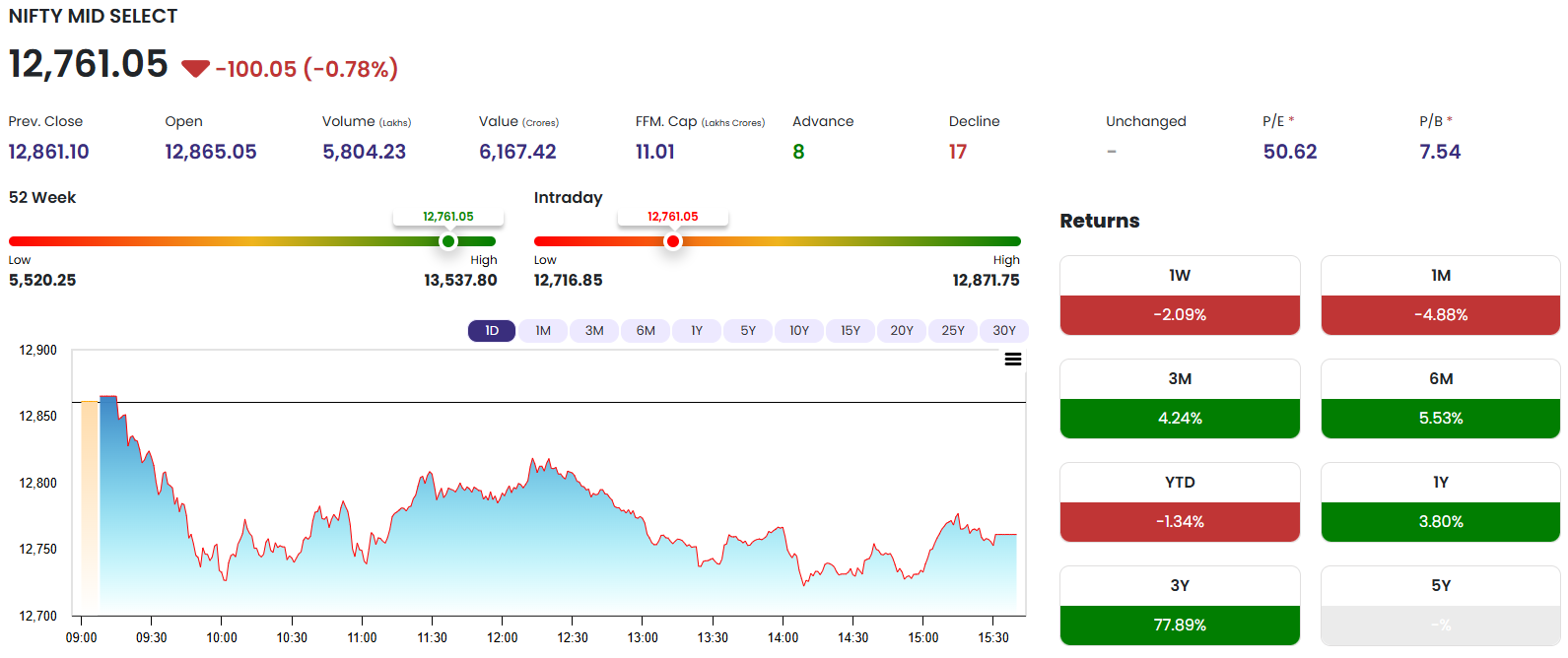

🔹 MIDCAP NIFTY – Down by 100.05 points (-0.78%)

-

Current Price: 12,761.05

NIFTY MID SELECT -

Open: 12,865.05

-

High / Low: 12,871.75 / 12,716.85

-

Previous Close: 12,861.10

Overview:

The midcap index faced the steepest fall of the day, losing nearly 0.80%. Broader market sentiment remained weak as midcap investors rushed to book profits after a strong July rally. Stocks from sectors like realty, media, and auto led the fall.

Market Mood:

With today’s fall, midcap traders are becoming increasingly risk-averse. A drop below 12,700 could invite a deeper correction, while resistance now sits firmly around the 12,900 zone.

📊 Summary Table

| Index | Loss/Gain | Commentary |

|---|---|---|

| NIFTY | -73.20 (-0.30%) | Struggled near resistance; watch 24,500 support. |

| BANK NIFTY | -259.10 (-0.47%) | Banks weigh on sentiment; eyes on 55,200 support. |

| FIN NIFTY | -103.10 (-0.39%) | Broader financials weak; cautious outlook. |

| MIDCAP NIFTY | -100.05 (-0.78%) | Biggest loser today; profit booking evident. |

🧠 Final Take for Traders & Investors

Today’s market action underscores a risk-off sentiment building in the Indian equity space. While the benchmark indices may find support near their current levels, the broader market (especially midcaps) hints at a deeper correction if caution persists.

💬 Quote of the Day:

“Volatility is the price you pay for opportunity in the stock market.”

Keep your strategy nimble. Use tight stop losses, and stay informed on global and domestic triggers.

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.