📄 Details:

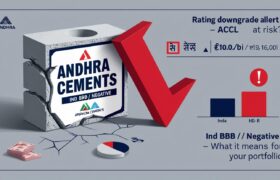

India Ratings and Research, a Fitch Group company, has downgraded the credit rating of Andhra Cements Limited (ACL) from “IND BBB+” to “IND BBB with a Negative Outlook” for its long-term bank facilities and from “IND A2” to “IND A3+” for short-term obligations. The revised rating reflects ongoing operational challenges and financial constraints the company is experiencing. The rating applies to a significant debt portfolio, including term loans and working capital limits across banks like State Bank of India and Yes Bank Ltd, totaling over ₹13,000 million.

ACL is a subsidiary of Sagar Cements Limited, with manufacturing units in Andhra Pradesh and corporate operations based in Hyderabad, Telangana. The company’s cement production under “Durga” and “Visakha” brands has a strong legacy, but current financial stress might impact its debt servicing ability. Despite the downgrade, the rating still indicates moderate safety regarding timely debt servicing, though adverse developments may emerge.

From a retail investor’s viewpoint, this downgrade signals increased risk and potential liquidity pressure. While ACL remains investment-grade, the negative outlook indicates that further deterioration in business or financial profile could lead to more downgrades. This is a crucial point for investors tracking debt-laden cement companies or seeking value in turnaround bets.

📌 Point-wise Report:

🔹 Credit Rating Downgrade:

-

🧾 Downgraded from “IND BBB+” to “IND BBB/Negative” (Long-term)

-

📉 Short-term rating lowered from “IND A2” to “IND A3+”

🔹 Rated Instruments:

-

💰 Term Loans: ₹5819.70 million

-

🏦 Working Capital Limits (Fund-based and Non-fund-based): ₹1300 million+

-

🧮 Proposed Term Loan: ₹1500 million

🔹 Banks Involved:

-

🏛️ State Bank of India

-

🏦 Yes Bank Ltd

🔹 Company Background:

-

🏗️ Andhra Cements is a subsidiary of Sagar Cements Ltd.

-

📍 Operates in Andhra Pradesh and Telangana

-

🧱 Brands: Durga Cement Works and Visakha Cement Works

🔹 Effect on Share Market:

-

📊 Negative sentiment expected due to downgrade

-

💸 Potential dip in share price in short term

-

🔄 Market may see increased volatility around ACL stock

🔹 Impact for Retail Traders:

-

⚠️ Higher credit risk could affect share value

-

🕵️ A red flag for value investors; wait for clearer recovery signs

-

📌 Watch for promoter action or restructuring announcements

🧠 Company Snapshot: Andhra Cements Limited

-

🏢 Headquarters: Hyderabad, Telangana

-

🏭 Manufacturing Units: Durgapuram (Palnadu, AP) & Visakhapatnam (AP)

-

👥 Parent Company: Sagar Cements Ltd

-

🌐 Website: www.andhracements.com

-

📧 Investor Contact: investorcell@andhracements.com

-

📇 CIN: L26942AP1936PLC002379

📈 Key Market Data

-

💼 BSE Scrip Code: 532141

-

🔁 NSE Symbol: ACL

-

🗓️ Credit Rating Date: 8th May 2025

-

🏦 Outstanding Rated Debt: ₹13,269.7 million approx

-

📉 Rating Agency: India Ratings (Fitch Group)

📊 How This Helps Retail Traders

-

📍 Retail traders can reassess exposure to ACL based on creditworthiness

-

🔎 Helps in evaluating company’s financial discipline and risk profile

-

💬 Useful for identifying investment risks in mid-cap cement sector

-

🔁 Encourages research-backed investment decisions

📊 Ratings Table (Summary)

| Instrument Type | Amount (INR mn) | Rating |

|---|---|---|

| Term Loan | 5819.7 | IND BBB / Negative |

| Working Capital (FB) | 350.0 | IND BBB / Negative |

| Working Capital (NFB) | 600.0 | IND BBB / Negative / A3+ |

| Proposed Term Loan | 1500.0 | IND BBB / Negative |

📣 User Phrase

💬 “Will you still bet on Andhra Cements after this rating cut? Let us know in the comments!”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.