About the Company – Godrej Industries: (Chemicals Division)

Godrej Industries (Chemicals) is one of India’s most respected chemical manufacturers, operating since 1963 under the prestigious Godrej Group. With a focus on green chemistry, it provides eco-friendly solutions in:

-

Oleochemicals

-

Surfactants

-

Specialty chemicals

-

Biotech products

🌱 Key Attributes:

-

Emphasis on renewable, plant-based resources

-

Global presence in over 80 countries

-

Three manufacturing units across Maharashtra and Gujarat

-

A state-of-the-art R&D center in India

-

Serves sectors like home care, agrochemicals, pharmaceuticals, rubber, and more

🧾 Report:

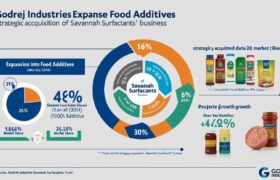

📢 🟢 Major Announcement – Business Acquisition Completed

🔸 Godrej Industries (Chemicals) has completed the acquisition of Savannah Surfactants Limited’s Food Additives Business based in Goa.

🔸 This marks a strategic expansion into the global Food & Beverage ingredients sector.

🔸 Savannah Surfactants’ facility has a manufacturing capacity of 5,200 MTPA, strengthening Godrej’s specialty chemical portfolio.

🔸 This is aligned with Godrej’s sustainable growth strategy, broadening its speciality offerings in line with global market demands.

📈 Effect on Share Market

💡 Expected Market Reactions:

✔️ Positive sentiment likely to boost stock prices of Godrej Industries (500164, GODREJIND) in the short term

✔️ Investors may perceive this acquisition as value-accretive and synergistic

✔️ Enhances Godrej’s positioning in the fast-growing food ingredients segment, opening up new revenue streams

✔️ Increases confidence in management’s strategic execution at the start of FY 2025-26

✔️ May trigger volume-based rally in the mid-term with upcoming quarterly results likely to reflect initial contributions from the acquired business

📌 Retail Traders: Why This Matters

🔹 Strong Fundamental Play – Backed by green chemistry, ESG credentials, and global outreach

🔹 Mid-term Upside Potential – New business integration could push revenue and margins upward

🔹 Diversification Strategy – Company reducing cyclicality risks by expanding beyond traditional chemical segments

🔹 Sustainable Edge – ESG-focused portfolios may now include Godrej due to its cleaner, greener business expansion

🗨️ Pro tip for retail traders:

“Look for accumulation phases in the stock; this acquisition might reflect stronger Q1 FY26 results.”

🟡 “A recipe for growth—Godrej spices up its portfolio with a tasty new acquisition!”

💬 Suggested Chat Prompt for Comments Section:

What do you think—Will Godrej’s entry into the food ingredients space stir up the stock price? Drop your take below! 🍽️📊

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.