🏢 About the Company: DCM Shriram Limited

DCM Shriram Ltd. is a diversified conglomerate with businesses across agri-rural (urea, bioseed, farm solutions), chlor-vinyl (chemicals and PVC), and value-added real estate (Fenesta Windows). It is listed on the NSE and BSE and has a strong presence in north India. Its Fenesta division is well-known in India’s premium UPVC doors and windows segment.

📊 Key Market Data (as of latest available)

-

NSE Symbol: DCMSHRIRAM

-

Industry: Conglomerate (Agri, Chemicals, Real Estate)

-

Market Cap: Mid to Large Cap

-

Turnover (Last 3 FYs):

• FY1: ₹600 Cr

• FY2: ₹547.8 Cr

• FY3: ₹442.3 Cr -

Recent Acquisition Cost: ₹44 Cr

-

New Stake Acquired: 0.53% control in DNV Global Pvt. Ltd.

📄 Detailed Report:

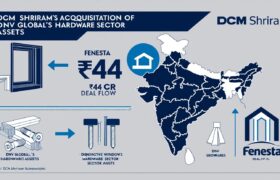

DCM Shriram Limited has announced a strategic acquisition under Regulation 30, acquiring DNV Global Private Limited for a total cash consideration of ₹44 crores. The deal comprises ₹31 crores through fresh equity share subscription and ₹13 crores through buying equity from current promoters. This transaction will be completed in tranches within eight weeks of signing definitive agreements. DNV Global, incorporated in 2013, operates in the “Hardware for Windows & Doors” industry and recorded a turnover of ₹60 crores with ₹3.35 crores in PAT and a net worth of ₹8.09 crores.

The acquisition supports backward integration for Fenesta, DCM’s window and door brand, while also creating a new product line in the hardware vertical. Importantly, this transaction is not a related party deal, executed at arm’s length, and doesn’t require government approvals. DCM Shriram is positioning itself to optimize supply chain operations and expand its product scope in the fast-growing urban infrastructure segment.

🔹 Key Points:

✔ Company: DCM Shriram Limited

✔ Target Entity: DNV Global Private Limited

✔ Acquisition Type: 🆕 New Acquisition

✔ Deal Value: ₹44 Cr (₹31 Cr fresh equity + ₹13 Cr share purchase)

✔ Control Acquired: 0.53%

✔ Industry of Target: 🪟 Hardware for Windows & Doors

✔ Turnover of Target: ₹60 Cr

✔ PAT of Target: ₹3.35 Cr

✔ Net Worth: ₹8.09 Cr

✔ Reason: 🔁 Backward Integration for Fenesta | 🧱 New Hardware Line

✔ Location: 🇮🇳 India

✔ Tranches: Yes, to be completed within 8 weeks

✔ Government Approvals: ❌ Not Required

✔ Related Party: ❌ No

✔ Arm’s Length: ✅ Yes

✔ Date of Report: 🗓️ May 4, 2025

📈 Effect on Share Market

-

🟢 Positive Signal: Investors may view this acquisition as strategic expansion.

-

💼 Strengthens supply chain and product offering in real estate/hardware sector.

-

📉 Minor dilution possible if fresh equity affects ratios, but long-term synergies expected.

-

📊 May improve valuations of Fenesta business in sum-of-parts analysis.

🧑💼 How This Helps Retail Traders

-

🪜 Retail investors benefit from long-term value creation and business diversification.

-

🧠 Insight into management’s proactive strategy can inform buy/hold decisions.

-

🕵️♂️ Signals growth in niche segments like window hardware – often overlooked.

-

📌 This acquisition may uplift future earnings and margins in Fenesta, impacting valuation.

💬 Chat Demo:

User: What’s new with DCM Shriram?

AI: DCM Shriram is acquiring DNV Global Pvt. Ltd. for ₹44 Cr to support Fenesta’s growth in hardware. It’s a strategic backward integration move to improve product offering and profitability.

User: Will it affect the stock?

AI: Likely positively. Investors may reward this synergy-driven acquisition. Keep an eye on volumes and price action post-announcement.

💬 Phrase:

“Ever wondered how a single acquisition can unlock new verticals and boost long-term returns? Here’s how DCM Shriram is doing it smartly – and what it means for YOU.”

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.