Company Overview:

Axis Bank Ltd., India’s third-largest private sector bank, has built a strong presence across retail, corporate, and SME banking. Headquartered in Mumbai, it operates a vast network of 5,200+ branches and has aggressively invested in digital banking platforms. It also has key subsidiaries in asset management, brokerage, and NBFCs, driving growth through a multi-channel ecosystem.

📊 Market Snapshot (As of July 17, 2025):

-

Share Price: ₹1,165.20

-

52-Week Range: ₹933.50 – ₹1318.60

-

Market Cap: ₹3.60 lakh crore

-

P/E Ratio: 14.3

-

Dividend Yield: 0.30%

-

NSE Symbol: AXISBANK

🧾 Axis Bank Q1 FY26 Financial Highlights (Stand alone)

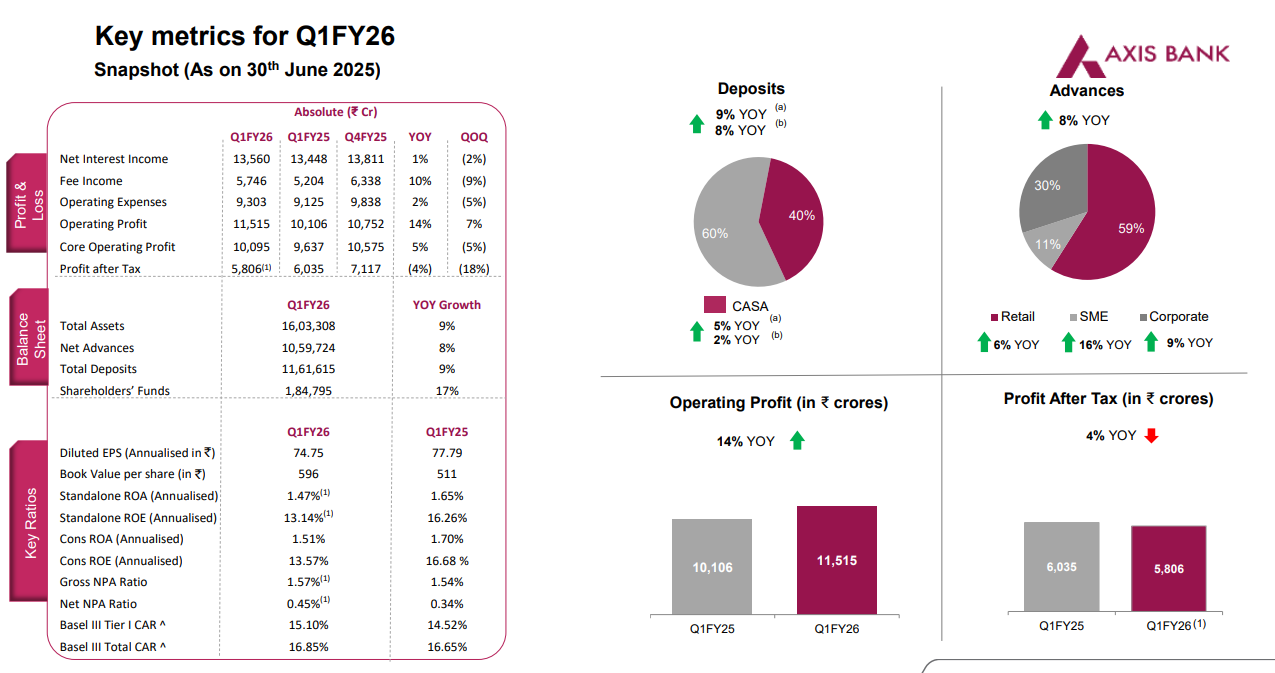

Axis Bank reported a 4% year-on-year drop in net profit to ₹5,806 crore in Q1 FY26, compared to ₹6,035 crore in the same quarter last year. This dip came despite a solid rise in operating profit and revenue. Net Interest Income (NII) grew marginally by 0.8% to ₹13,560 crore, while the Net Interest Margin (NIM) stood at a respectable 3.80%. The decline in profit is largely attributed to a sharp rise in provisions, especially related to technical slippages.

Operating metrics showed positive traction. Operating profit surged 14% YoY to ₹11,515 crore, driven by a 25% rise in non-interest income, which stood at ₹7,258 crore. This was supported by strong fee income and treasury gains. However, provisions nearly doubled to ₹3,948 crore, including ₹821 crore due to technical account reclassifications.

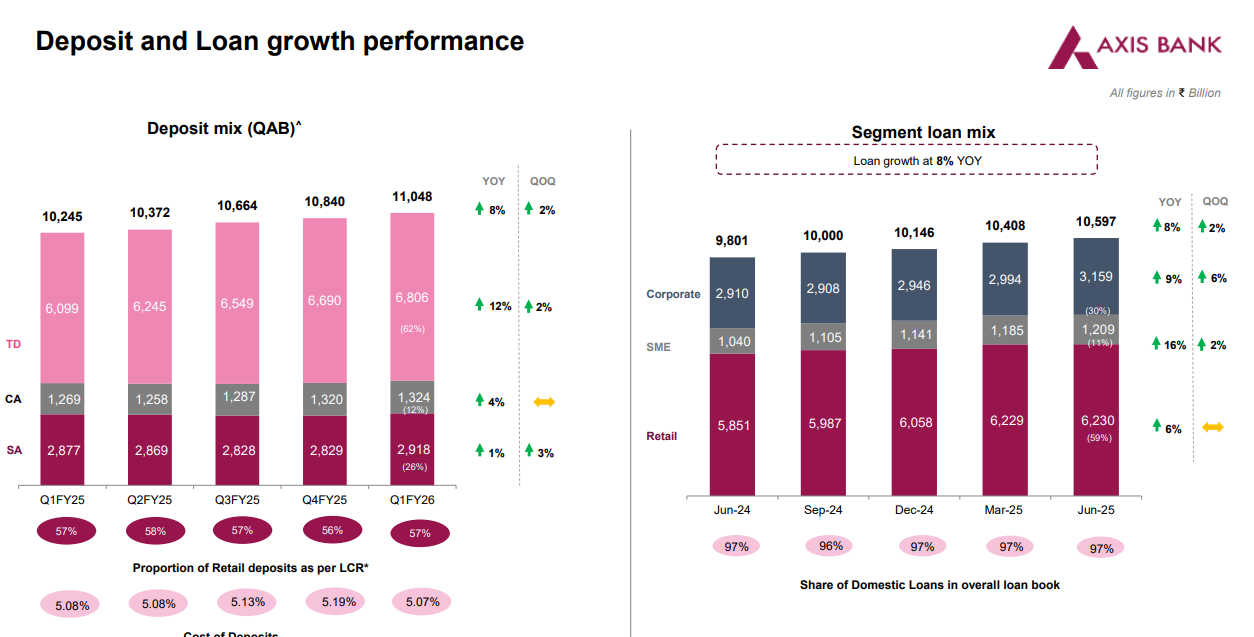

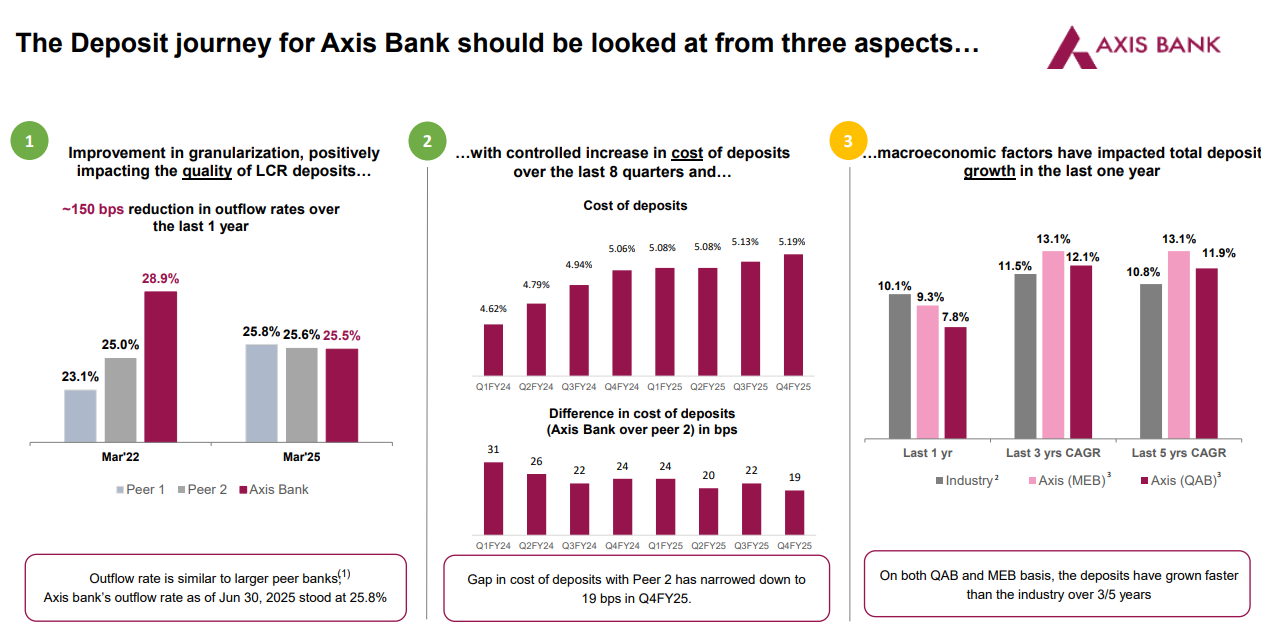

On the asset quality front, the bank saw a slight uptick in stress. Gross NPA rose to 1.57% from 1.28%, while Net NPA increased to 0.45%, both still within manageable levels. Total loan book expanded by 8% YoY to ₹10.6 lakh crore, with notable growth in SME and mid-corporate segments. Deposit base grew 9% YoY to ₹11.62 lakh crore, with CASA ratio at 40%.

The bank also continues to lead in digital banking, with over 97% of individual transactions now done digitally. Axis Mobile and WhatsApp platforms boast 15 million and 32 million monthly users, respectively.

📌 In Point:

🔹 Net Profit: ₹5,806 crore (▼ 4% YoY)

🔹 Net Interest Income (NII): ₹13,560 crore (▲ 0.8%)

🔹 Net Interest Margin (NIM): ~3.80%

🔹 Operating Profit: ₹11,515 crore (▲ 14%)

🔹 Core Operating Profit: ₹10,095 crore (▲ 5%)

🔹 Other Income: ₹7,258 crore (▲ 25%)

• Fee Income: ₹5,746 crore (▲ 10%)

• Treasury Income: ₹1,420 crore (▲ 249%)

🔹 Provisions & Contingencies: ₹3,948 crore (▲ 94%)

• ₹821 crore due to technical slippages

🔹 Gross NPA: 1.57% (vs 1.28% QoQ)

🔹 Net NPA: 0.45% (vs 0.33% QoQ)

🔹 Credit Cost (Annualized): 1.38%

🔹 Total Advances: ₹10.6 lakh crore (▲ 8% YoY)

• Retail: ₹6.23 lakh crore (▲ 6%)

• SME: ▲ 16% | Mid-Corporate: ▲ 24% | Large Corp: ▲ 9%

🔹 Total Deposits: ₹11.62 lakh crore (▲ 9%)

🔹 CASA Ratio: 40%

🔹 Capital Adequacy: CAR at 16.85%, CET-1 at 14.68%

🔹 Digital Share: 97% of individual transactions

🔹 Axis Mobile Users: 15 million | WhatsApp Users: 32 million

🔹 Subsidiary Profits:

• Axis Finance: ₹189 crore (▲ 23%)

• Axis AMC: ₹130 crore (▲ 12%)

• Axis Securities: ₹89 crore (▲ 15%)

📉 Share Market Impact & Analyst Views

The drop in net profit was slightly below market expectations. Following the announcement, Axis Bank shares saw mild intraday volatility, falling ~1.2% before recovering. Analysts like Motilal Oswal and Kotak Institutional Equities retained Neutral ratings, citing caution on asset quality and margin compression.

While strong fee income and digital traction are positives, the street is closely watching credit cost normalization and NIM trends in upcoming quarters.

📈 Strategic Takeaways & Outlook

🔸 Focus shifting towards high RAROC (risk-adjusted return on capital) segments like SME and mid-corporates

🔸 Improving retail loan quality but tighter margins due to base rate movement

🔸 Expanding tech footprint across UPI, cards, and WhatsApp banking

🔸 Margins may come under short-term pressure; however, operating leverage and digital strength position Axis Bank well for medium-term growth

📉 Stock Market Disclaimer

Disclaimer: This post is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy/sell any stock or share. Investing in the stock market involves risk. Past performance is not indicative of future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.